- Home

- »

- Electronic & Electrical

- »

-

Water Dispenser Market Size, Share & Growth Report, 2030GVR Report cover

![Water Dispenser Market Size, Share & Trends Report]()

Water Dispenser Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Bottled, Bottle-less), By Application (Residential, Commercial, Industrial), By End-use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-245-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Dispenser Market Summary

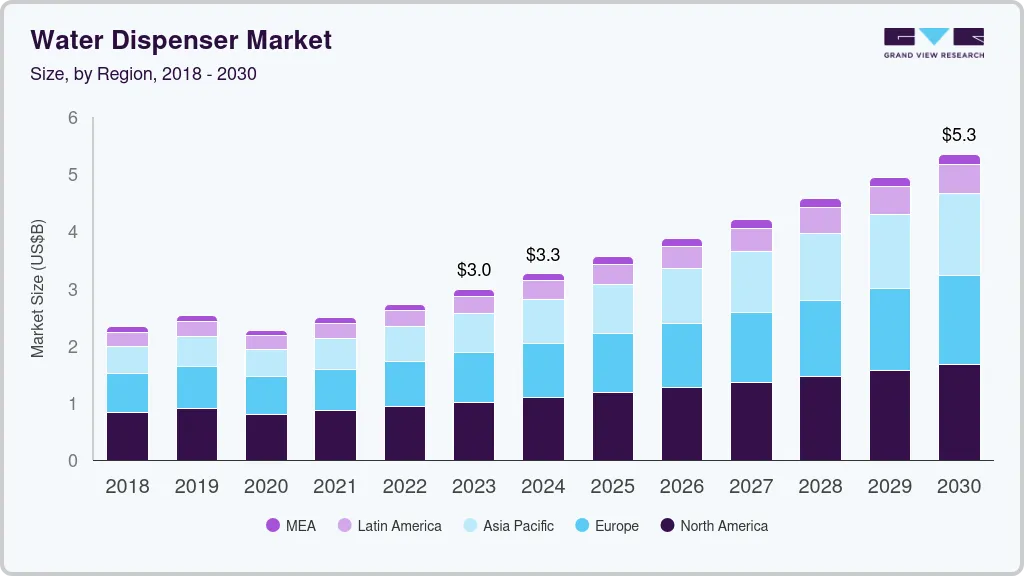

The global water dispenser market size was estimated at USD 2.98 billion in 2023 and is projected to reach USD 5.35 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030. Product demand is being driven by factors such as portability, ease of use and installation, and low maintenance costs.

Key Market Trends & Insights

- North America held the largest share of 38.21% in 2023.

- Asia Pacific is expected to grow at a CAGR of 10.9% from 2024 to 2030.

- By product, the bottled water dispenser market accounted for more than 70.4% of the share in 2023.

- By end-use, the hospitality sector under the commercial application segment is anticipated to grow at a CAGR of 8.7% from 2024 to 2030.

- By distribution channel, the retail store segment held the largest share of 43.17% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.98 Billion

- 2030 Projected Market Size: USD 5.35 Billion

- CAGR (2024-2030): 8.6%

- North America: Largest market in 2023

Drinking water scarcity in several regions necessitates robust sources to meet the rising demand for safe drinking water, resulting in increased product sales and, as a result, market growth. The COVID-19 pandemic has brought about a seismic shift in consumers' attitudes toward wellness and health safety. The infrared sensor dispensing is gaining high traction as direct human contact is reduced. For instance, the Quench Q8 water dispenser operates on touchless sensor-activated dispensing to deliver instant hot and cold water.

The versions which are economical and functional are expected to be highly preferred in the market in recent years. E-commerce platform vendors are actively developing new techniques to increase their sales in the global water technology market. As consumers become more aware of water-borne diseases, players are prioritizing multi-stage filtration, with RO and UV as major techniques, which can be profitable because they are more effective than other methods of water filtration.

Leading manufacturers' promotional campaigns also help to drive the market. Low maintenance requirements, as well as after-sales services provided by manufacturers, help to drive product demand. Furthermore, the availability of a variety of products, such as top load and wall-mounted, with direct plumbing features and simple cleaning processes will drive up demand even further.

On the other hand, frequent product replacement or component replacement, as well as additional expenses during peak summertime, may have a negative impact on market growth. However, rising water pollution levels and increased purchasing power of consumers will support product demand.

Key players are taking the necessary steps to improve the accuracy and overall functionality of the devices. For instance, in 2021, Quench's new product line of touchless hydration solutions, dubbed the Quench Q-series, offers sensor-activated, touchless dispensing for health-conscious businesses and is the first of its kind to be available in the United States and Canada. QuenchWATER+ is produced by all Quench Q-Series options, and it employs a proprietary 5-filter setup to add electrolytes and improve the taste by removing sediments and contaminants. The result is electrolyte water that is crisp, clean, and delicious.

Innovation in the water cooler market, such as those with built-in purification systems, temperature control, and smart features, creates a positive spillover effect, driving interest and adoption of modern water dispensers with similar advanced functionalities.

Market Concentration & Characteristics

In recent years, the water dispenser market has witnessed a considerable degree of innovation. Manufacturers are increasingly incorporating advanced technologies to enhance the functionalities and features of water dispensers. Smart dispensers with IoT connectivity, touchless operation, and energy-efficient mechanisms have gained popularity. Moreover, innovations in water purification systems integrated into dispensers are addressing the growing consumer concern for water quality and safety.

Mergers and acquisitions have played a significant role in shaping the competitive landscape of the water dispenser market. Established companies often engage in strategic acquisitions to expand their product portfolios, gain access to new markets, or consolidate their market presence. These activities contribute to market consolidation and can lead to increased competition among key players.

Regulatory frameworks and standards related to water quality and safety have a profound impact on the water dispenser market. Compliance with health and safety regulations is a critical factor for manufacturers. The increasing emphasis on eco-friendly and energy-efficient products has also led to the development of water dispensers that align with environmental regulations. Adherence to these standards not only ensures product quality but also influences consumer trust and brand reputation.

The water dispenser market faces competition from various product substitutes, particularly reusable water bottles, water coolers, and filtration pitchers. The choice between these alternatives often depends on consumer preferences, convenience, and specific usage scenarios. Manufacturers in the water dispensers market need to differentiate their products by highlighting factors such as efficiency, advanced features, and sustainability to remain competitive in the face of substitute products.

Product Insights

The bottled water dispenser market accounted for more than 70.4% of the share in 2023 and is expected to remain dominant throughout the forecast years. The primary factor driving the segment is the rising demand for bottled water. Furthermore, lower initial costs, as well as ease of installation and low maintenance requirements, are likely to boost product demand.

However, the bottle-less water dispenser market is expected to grow at the fastest rate of 9.5% between 2024 and 2030. Such products do not necessitate the loading and unloading of water bottles on the machine, which is a significant factor driving the segment growth. These products are directly connected to water pipelines and can thus be used continuously without the need for water bottles. These products are mainly used in hotels, restaurants, etc.

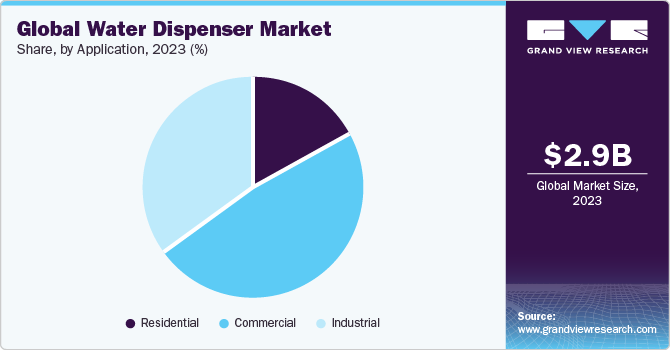

Application Insights

In 2023, the commercial application segment dominated the global market, accounting for the lion's share. The rise in demand for continuously clean water supply in commercial spaces is driving the segment. Furthermore, the lack of direct water sources in several commercial buildings will increase product demand in this segment.

From 2024 to 2030, industrial application is expected to be the fastest-growing segment. The increased use of water purification products in the industrial sector, particularly in developing countries such as China and India, is attributed to the lack of fresh and clean water sources.

End-use Insights

The hospitality sector under the commercial application segment is anticipated to grow at a CAGR of 8.7% from 2024 to 2030. A water dispenser is a great addition for those in the HORECA (hotel, restaurant, and café) industry that are looking to boost their revenue, service value-add, convenience, sustainability, and more. As per a blog by GFS Innovation PTE LTD, in 2020, there has been a surge in demand among Singapore restaurants for still and sparkling water dispensers. Rather than drinking sweetened beverages, it is advised to restrict daily sugar intake to 8 to 11 teaspoons from beverages, juices, and other processed foods. According to the Ministry of Health, the average Singaporean consumes an incredible 12 teaspoons of sugar every day. Switching to water is the best alternative to sweetened drinks due to growing consumer awareness and encouraging a healthy lifestyle. Even though still and sparkling water has no sugar and no calories, they taste just as pleasant and satisfying.

Distribution Channel Insights

The retail store segment held the largest share of 43.17% in 2023. Easy availability of dispensers, assistance with product specifications, and excellent customer services are some of the factors popularizing the sales of water dispensers through the retail channel.

Consumers in the market are preferring purchasing dispensers from online sales channels owing to the availability of a wide range of products, greater discounts, and ease of delivery. These benefits have resulted in the shifting consumer buying preference from offline to online stores and this trend is anticipated to continue during the forecast period. Growth in e-commerce owing to the wider distribution network and product availability generates significant opportunities for market players and this has influenced manufacturers to sell their products through online channels. E-commerce giants like Amazon and Alibaba are some of the major sellers of water dispensers for commercial spaces.

Regional Insights

Due to the growing demand for advanced home appliances in countries such as the United States and Canada, North America is expected to create opportunities for regional markets during the forecast period. North America held the largest share of 38.21% in 2023. Furthermore, the presence of leading manufacturers such as Honeywell, Culligan International Company, and Whirlpool Corp. increases product sales, fueling the regional market growth.

Due to rising demand for water purification sources and appliances in countries such as China and India, Asia Pacific is expected to grow at a CAGR of 10.9% from 2024 to 2030. Consumer appliances in India is expected to grow at a healthy CAGR during the forecast period. The increased purchasing power of consumers in APAC's developing countries will drive up demand even more. Furthermore, many international firms are entering the regional market with technologically advanced products. This is also likely to contribute to market growth in the coming years.

India water dispenser market

The water dispenser market in India is expected to grow at a CAGR of 14.1% during the forecast period, with the demand being driven mainly by the introduction of products with advanced features and technologies by the key water dispenser manufacturers in the country.

Key Companies & Market Share Insights

Manufacturers are driving market growth by innovating products tailored to distinct water dispenser market segments. By developing features and designs that resonate with residential, commercial, or industrial needs, companies can capture specific segment demands. This approach ensures relevance and customer satisfaction, fostering market expansion through targeted innovations in each segment.

Manufacturers involved in the beverage dispenser market often diversify their product offerings to include water dispensers. This diversification strategy expands the market reach of these manufacturers, allowing them to tap into both the beverage and water dispenser markets, fostering overall market growth.

Key players operating in the market account for a considerable market share and have a strong presence across the globe. The market also comprises small-to-midsized players, who offer a selected range of water dispensers and mostly serve regional customers.

The impact of these established players on the market is quite high as most of them have vast distribution networks across the globe to reach out to their large customer base. The key players operating in the market are focusing on strategic initiatives such as product launches, acquisitions, collaborations, participation in events, and expansions to drive revenue growth and reinforce their position in the global market. Some of the recent key developments and strategic initiatives carried out by water dispenser manufacturers have been listed below:

Key Water Dispenser Companies:

The following are the leading companies in the water dispenser market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these water dispenser companies are analyzed to map the supply network.

- Whirlpool Corporation

- Brio Water Technology, Inc.

- Primo Water Corporation

- Honeywell International Inc.

- Culligan International Company

- Clover Co. Ltd.

- Waterlogic Holdings Limited

- Midea Group Co. Ltd.

- A.O. Smith Corporation

- Edgar’s Water

Recent Developments

-

In November 2023, Primo Water Corporation announced that it had reached an agreement with Culligan International to divest a substantial portion of its international operations for a value of up to USD 575 million.

-

In November 2022, Whirlpool Corporation purchased InSinkErator from Emerson. InSinkErator is known for producing food waste disposers and instant hot water dispensers designed for both residential and commercial use.

-

In November 2022, Culligan International and Waterlogic Group Holdings signed a merger agreement to join forces and provide environmentally friendly drinking water solutions and services.

Water Dispenser Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.26 billion

Revenue forecast in 2030

USD 5.35 billion

Growth rate (Revenue)

CAGR of 8.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy’ Spain; India; China; Japan; South Korea; Australia & New Zealand; Brazil; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Whirlpool Corporation, Brio Water Technology, Inc., Primo Water Corporation (formerly Cott Corporation), Honeywell International Inc., Culligan International Company, Clover Co. Ltd., Waterlogic Holdings Limited, Midea Group Co. Ltd., A.O. Smith Corporation, Edgar’s Water

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Dispenser Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global water dispenser market report on the basis of product, application, end use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottled

-

Top Load

- Bottom Load

-

-

Bottle-less

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

- Industrial

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Hospitality

-

Transport Terminal

-

Institutions

-

Corporate Offices

-

Others

-

-

Industrial

-

Food and Beverages

-

Healthcare

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail Stores

-

Non-branded Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global water dispenser market size was estimated at USD 2.48 billion in 2021 and is expected to reach USD 2.72 billion in 2022.

b. The global water dispenser market is expected to grow at a compound annual growth rate of 8.9% from 2022 to 2030 to reach USD 5.34 billion by 2030.

b. North America dominated the water dispenser market with a share of 40.4% in 2021. This is attributable to rising consumer spending capacity and high demand for advanced home appliances in countries such as the U.S. and Canada.

b. Some key players operating in the water dispenser market include Whirlpool Corp.; Clover Co. Ltd.; Oasis International, Inc.; Glacial Home; Primo Water Corp.; Honeywell International, Inc.; and Emerson Electric Co.

b. Key factors that are driving the water dispenser market growth include product features such as portability; easy usage and installation process; and minimal maintenance costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.