- Home

- »

- Electronic Devices

- »

-

Waveguide Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Waveguide Market Size, Share & Trends Report]()

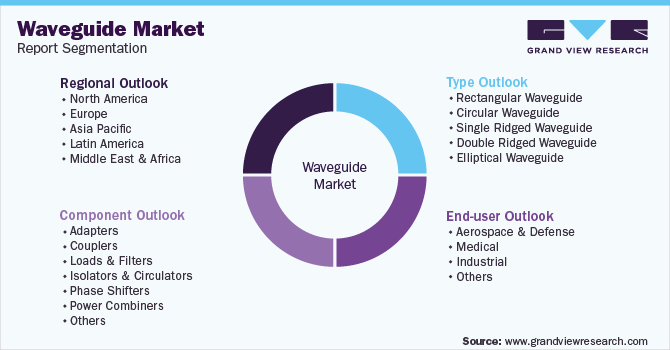

Waveguide Market Size, Share & Trends Analysis Report By Component (Adapters, Couplers, Loads & Filters, Isolators & Circulators, Phase Shifters, Power Combiners), By Type, By End-user, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-018-2

- Number of Pages: 254

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Semiconductors & Electronics

Report Overview

The global waveguide market was valued at USD 1.30 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030. A waveguide is an electromagnetic feed line that is used in radar installations, broadcasting, and microwave communications. A waveguide consists of a cylindrical rectangular metal pipe or tube. In radar, a waveguide transfers RF energy to and fro the antenna, where the impedance must be matched for effective power transmission.

Improvements in radar technologies, which include digital components and software-defined radars, are driving the demand for military radars. Advanced radars that feature Track-While-Scan (TWS) capabilities have helped military agencies achieve additional targets while maintaining a general view of the airspace to support situational attention. TWS radars enable armored fighting vehicles, combat ships, and fighter aircraft to detect the presence of incoming missiles, enemies, and other such threats while tracking a particular target.

Developments in solid-state electronics, like Gallium Nitride (GaN), have led to the introduction of a new group of Advanced Electronically Scanned Array (AESA) radars. AESA radars have better target detection capabilities, including the capability to track multiple targets. They also offer multi-function capabilities and a longer range compared to vacuum-tube-based radars. The capabilities of an AESA radar have led to the increased adoption of these radars, with obsolete klystron and traveling-wave tube (TWT)-based radars being replaced by these new systems.

Countries such as China, Russia, and India are developing new AESA radars for land-based, naval, and aerial platforms. For instance, Russia designed Zhuk Phazotron AE radar, which is used in MiG-35 aircraft, an upgraded variant of the MiG-29. India upgraded its Jaguar fighter aircraft fleet with the new ELM-2052 AESA radars. Thus, the demand for military radars is expected to drive the volume of waveguides needed to be integrated into such systems. This is expected to drive the market’s growth over the forecast period.

The development of next-generation missiles with exclusive technologies is a major threat to strategic platforms and locations of a country, such as military ships and airbases. These new developments include high-speed cruise missiles and nuclear-capable ballistic missiles. Nuclear ballistic missiles can damage lives and cities significantly. Multiple nations are developing progressive weapons capable of destroying high-end air defense systems such as the S-400, Patriot Advanced Capability-3 (PAC-3), and Medium Extended Air Defense System (MEADS).

Countries such as Russia, China, and India have developed hypersonic missiles that are hard for missile shields to intercept. Russia and India have designed the BrahMos missile, which is hard to intercept by previous missile defense shields. All these developments have led to the need for next-generation high-speed air defense radar systems.

COVID-19 Impact

The outbreak of the COVID-19 pandemic took a severe toll on several industries and industry verticals and the Waveguide industry vertical was not an exception to that. The outbreak of the pandemic forced several governments worldwide to impose lockdowns and restrictions on the movement of people and goods as part of the efforts to arrest the spread of coronavirus. As a result, the global demand for waveguides plummeted significantly due to inconsistent operations and expansion activities, especially among the incumbents of the heavy-duty industry.

Having realized that companies are incurring severe losses in the wake of the outbreak of the pandemic, several governments announced economic stimulus packages to invigorate the overall economy and drive the demand for various commodities. The stimulus packages are expected to play a niche, long-term role in stimulating the demand over the forecast period. For example, in November 2020, the government of Canada announced investments worth about USD 134.84 million (CAD 175 million) to facilitate high-speed data connectivity for both individuals and businesses. Plans envisaged connecting about 98% of Canadians to high-speed internet networks by 2026 and all the residents by 2030.

Component Insights

The phase shifters segment dominated the overall market, gaining a market share of 22.4% in 2021 and witnessing a CAGR of 5.6% during the forecast period. These are 2-port waveguide modules that change the phase of an output signal in reply to an external signal. They are made of silver, copper, bronze, brass, or aluminum waveguides and have elliptical, circular, or rectangular cross-sections.

There are two primary types of radio frequency waveguide phase shifters. Digital phase shifters utilize a digital signal that comprises two discrete stages. On the other hand, analog phase shifters utilize an analog signal, mostly voltage, to change a signal’s output phase. For both types of devices, phase shift change is the most important specification to consider. Normally, RF waveguide phase shifters can alter the phase of an input signal from a minimum of 0° to a maximum of 360°. Variable devices use a variable control signal and are operated mainly in digital products.

The adapters segment is anticipated to witness the fastest growth, growing at a CAGR of 7.1% throughout the forecast period. A waveguide adapter is a device that provides an interface between two separate transmission lines so that electromagnetic waves having distinct modes in them can be connected from one line to the other and vice versa.

Microstrip circuits are incredibly popular when designing radio frequency circuits at higher frequencies. The coaxial line can only be used sometimes when higher power needs to be fed at these frequencies. Therefore, the same is accomplished using a waveguide adapter, which links the waveguide with the microstrip circuitry and converts Electromagnetic (EM) wave modes between the waveguide and microstrip.

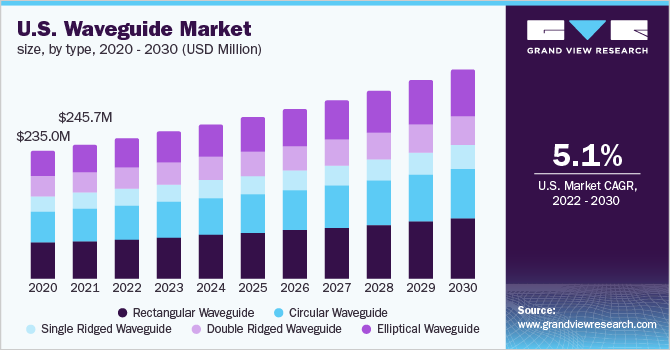

Type Insights

The rectangular waveguide segment dominated the overall market, gaining a market share of 28.0% in 2021 and witnessing a CAGR of 6.1% during the forecast period. This type of waveguide is a rectangular cross-section with a hollow metal tube. The conducting walls of the rectangular waveguide limit the electromagnetic field and thereby guide the electromagnetic wave. Rectangular waveguides are used in almost all microwave applications due to their small size.

The elliptical waveguide is anticipated to witness the fastest growth, growing at a CAGR of 7.0% throughout the forecast period. For almost all microwave antenna feeder systems, an elliptical waveguide is the best option. This waveguide features an elliptical cross-section and is precisely formed from corrugated high-conductivity copper. The corrugated wall provides the waveguide with the necessary flexibility, low weight, and crush strength for ease of handling.

End-user Insights

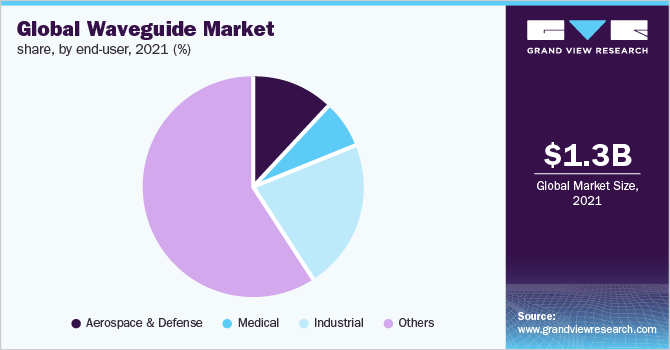

The others segment is expected to dominate in 2021, gaining a market share of 59.3% and witnessing a CAGR of 5.8% throughout the forecast period. Industries such as construction, IT & telecommunication, consumer electronics, manufacturing, and automobile are covered under the others section. The consumer electronics sector is projected to provide promising growth opportunities to the global waveguide industry owing to the ongoing development of high-tech products and the growing demand for HVAC equipment with advanced features.

The growing demand for flexible, highly durable, and high-performance RF systems for efficient signal processing in military applications, such as Electronic Warfare (EW), is expected to support the aerospace and defense segment outlook. Furthermore, increasing investments in digitization initiatives across industries are expected to drive the demand for power transmission and distribution networks.

The industrial segment is anticipated to witness the fastest growth, growing at a CAGR of 6.6% throughout the forecast period. High-frequency connectors connect cables, printed circuit boards, and devices to transmit extremely high frequencies. Connectors in the market range from miniature to large and heavy connectors. Connectors are not only necessary for enabling existing and forthcoming technologies, they must also be able to withstand the ever-increasing transmission rates, adapt to economic and ecological conditions, and continually satisfy the demand for reliability and performance, even in tough conditions.

Regional Insights

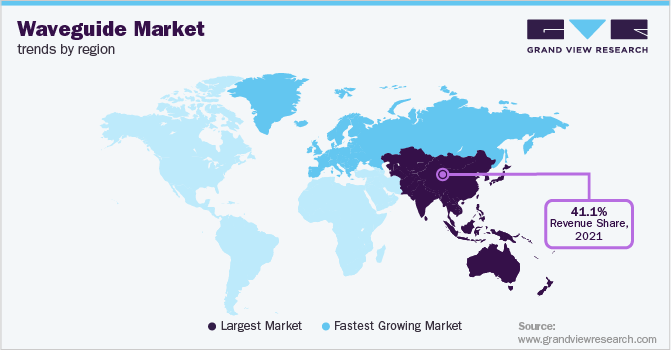

Asia Pacific led the overall market in 2021, with a market share of 41.13%. The advancing manufacturing facilities, favorable government initiatives, growing construction activities, and increasing investments in new infrastructures, among other parameters, are driving the need for waveguide in the Asia Pacific region. For example, in August 2020, the Prime Minister of India inaugurated a unique submarine optical fiber cable to connect the Andaman and Nicobar Islands with the mainland territory. The administration aims to provide internet data transfer at high speed to the residents and propel the local economy.

Europe is anticipated to witness the fastest growth, growing at a CAGR of 6.8% throughout the forecast period. Continuous investments by different global companies to grow data center networks across countries such as the U.K., Germany, Russia, and Spain are likely to expand the European industry landscape. Moreover, the region has observed significant expansion in the development of commercial and residential establishments and a favorable policy framework for digitalizing buildings.

For instance, in June 2018, the European Parliament enforced a new European Electronic Communications Code (EECC) directive, which directed the member countries to modernize their national laws as per the EECC standards. It aspired to promote civil infrastructure cost-sharing to reduce network deployment prices, propel economic digitalization, and improve broadband coverage, among others.

Key Companies & Market Share Insights

The waveguide market is highly fragmented, with several players operating globally, regionally, and locally. The existing players compete on the quality, efficiency, and precision of waveguide components to gain maximum traction from various industries. Some prominent players in the market include Quantic Electronics, Delta Electronics, Inc, Cobham Advanced Electronic Solutions, Ducommun Incorporated, and ETL Systems Ltd. among others. These companies are collaborating with Waveguide organizations and local & regional players to gain a competitive edge over their peers and capture a significant market share.

In March 2021, Quantic Electronics announced the acquisition of Corry Micronics. Corry Micronics's product portfolio included diplexers, RF (Radio Frequency)/microwave filters, low-noise amplifiers, multiplexers, RF switches, power amplifiers, waveguide components, power dividers, couplers, and configurable RF switch matrices. Corry Micronics's RF and microwave components portfolio complemented Quantic Electronics's existing RF portfolio. Some prominent players in the global waveguide market include:

-

Penn Engineering Components Inc.

-

Jupiter Microwave Components Inc.

-

Quantic Electronics

-

Cobham Advanced Electronic Solutions

-

Ducommun Incorporated

-

Smith’s Interconnect

-

DigiLens, Inc.

-

Global Invacom

-

Flann Microwave Ltd.

Waveguide Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.36 billion

Revenue forecast in 2030

USD 2.14 billion

Growth rate

CAGR of 5.8% from 2022 to 2030

Historic year

2017 - 2020

Base year for estimation

2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, Volume in Thousand Units, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany, U.K.; France; China; India; Japan; Mexico; Brazil

Key companies profiled

Penn Engineering Components; Jupiter Microwave Components Inc.; Quantic Electronics; Amphenol RF; Delta Electronics, Inc.; Samtec; Cobham Advanced Electronic Solutions; Ducommun Incorporated; ETL Systems Ltd.; Smiths Interconnect; DigiLens Inc.; Flann Microwave Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waveguide Market Segmentation

This report forecasts volume and revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global waveguide market report based on component, type, end-user, and region:

-

Component Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Adapters

-

Couplers

-

Loads & Filters

-

Isolators & Circulators

-

Phase Shifters

-

Power Combiners

-

Pressure Windows

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Rectangular Waveguide

-

Circular Waveguide

-

Single Ridged Waveguide

-

Double Ridged Waveguide

-

Elliptical Waveguide

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace & Defense

-

Medical

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global waveguide market size was estimated at USD 1,298.7 million in 2021 and is expected to reach USD 1.36 billion in 2022.

b. The global waveguide market is expected to grow at a compound annual growth rate of 5.8% from 2022 to 2030 to reach 2.14 billion by 2030.

b. The phase shifters segment dominated the overall market, gaining a market share of 22.4% in 2021 and witnessing a CAGR of 5.6% during the forecast period. These are 2-port waveguide modules that change the phase of an output signal in reply to an external signal.

b. Some key players operating in the waveguide market include Quantic Electronics, Delta Electronics, Inc, Cobham Advanced Electronic Solutions, Ducommun Incorporated, and ETL Systems Ltd.

b. Key factors that are driving the waveguide market growth include improvements in radar technologies, which include digital components and software-defined radars.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."