- Home

- »

- Next Generation Technologies

- »

-

Wealth Management Software Market Size Report, 2030GVR Report cover

![Wealth Management Software Market Size, Share & Trends Report]()

Wealth Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Advisory Mode, By Deployment, By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-071-2

- Number of Report Pages: 159

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wealth Management Software Market Summary

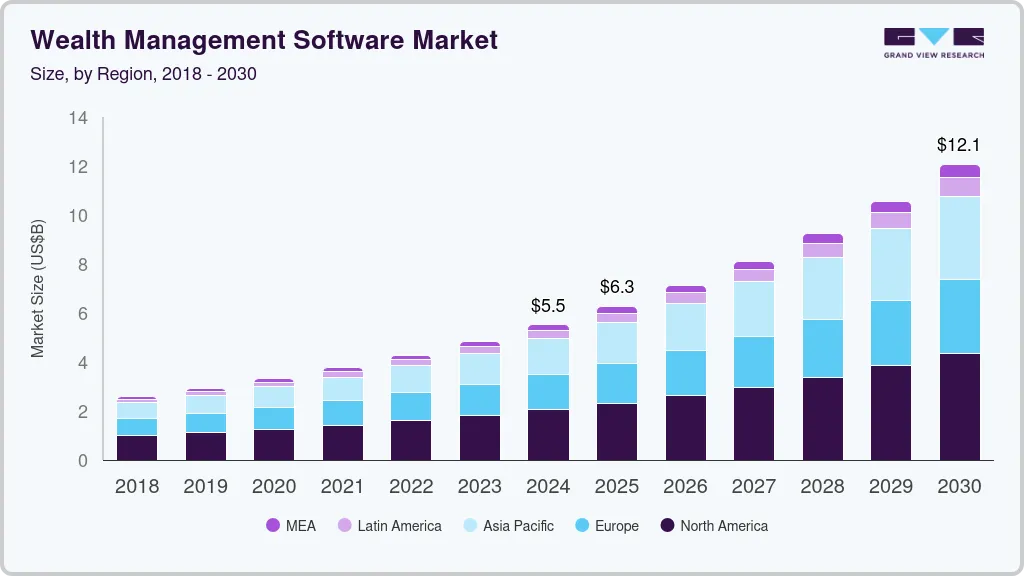

The global wealth management software market size was estimated at USD 5.5 billion in 2024 and is projected to reach USD 12.07 billion by 2030, growing at a CAGR of 14.0% from 2025 to 2030. The market growth can be attributed to the growing adoption of the latest technologies in wealth management advisory.

Key Market Trends & Insights

- North America wealth management software market held the largest share of 37.22% in 2024.

- The U.S. wealth management software market held a dominant position in 2024.

- By advisory mode, the human advisory mode segment accounted for the largest revenue share of 57.31% in 2024.

- By deployment, the cloud segment held the largest market in 2024.

- By application, the portfolio, accounting, & trading management segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.5 Billion

- 2030 Projected Market Size: USD 12.07 Billion

- CAGR (2025-2030): 14.0%

- North America: Largest market in 2024

Advances in financial technology and, subsequently, an entirely new approach being pursued to automate and improve the delivery of financial services are expected to contribute to the growth of the market over the forecast period. As such, the growing adoption of financial technology for wealth management bodes well for the growth of the market.

The increasing need to automate the wealth management process is anticipated to propel the market growth over the forecast period. Wealth management platforms can serve as a cost-effective alternative for users looking forward to automating workflow and managing wealth. Apart from an open architecture, these platforms can also provide omnibus access and help in digitalizing the overall wealth management process. These platforms can also be easily integrated into various wealth administration applications. Wealth managers have realized that affluent clients are focusing aggressively on diversifying their investments, meeting their personal goals, maintaining financial security, and protecting their wealth.

However, a looming lack of adequate knowledge about investment is keeping these affluent clients from fully achieving their financial goals. Hence, wealth managers have started using wealth management solutions to provide their clients with more tailored and holistic investment services. This is emerging among the major factors driving the adoption of wealth management software. The growing preference for digital investment management solutions among High-Net-Worth Individuals (HNWIs) is anticipated to propel the growth of the market. HNWIs are demanding more control and transparency in the way wealth managers manage their wealth. At this juncture, wealth management software can guarantee HNWIs the level of control and transparency they desire in the management of their wealth.

Wealth management solutions can also help HNWIs in strategizing their wealth management plans more effectively using various analytical tools. The adoption of innovative advisor technology is gaining significant traction. Machine Learning (ML) and Artificial Intelligence (AI) capabilities are particularly helping financial advisors in interpreting and analyzing large volumes of data and drafting better investment strategies for their clients. However, continued reliance on conventional asset management processes is challenging the growth of the market. Various other factors, such as lack of awareness about wealth management platforms and inadequate technical expertise among enterprise professionals are expected to restrain the market growth.

Advisory Mode Insights

The human advisory mode segment accounted for the largest revenue share of 57.31% in 2024. Human advisory remains the first preference for several HNWIs across the globe owing to security concerns. Moreover, human advisory services also help in strengthening relationships with the clients and conveying and communicating wealth management strategies and plans to them more efficiently. However, the trends are changing gradually, and clients have started preferring the hybrid advisory model over the human advisory model.

The robo advisory segment is expected to witness moderate growth during the forecast period. Robo advisors tend to be highly accurate, efficient, and more accessible as compared to other modes. Hence, the robo advisory platform is gradually emerging as a cost-effective alternative for several risk & compliance management organizations owing to the various benefits it can offer, such as ease of use, low-cost fee structure, and low to zero account minimums. Various factors, such as the intensifying competition, evolving client requirements, and rapidly changing market dynamics, are also expected to create new growth opportunities for the robo advisory segment.

Deployment Insights

The cloud segment held the largest market in 2024. The segment is estimated to expand further at the fastest CAGR retaining the leading position throughout the forecast period. Several businesses across the globe are preferring cloud-based solutions owing to various benefits they can offer, such as scalability, agility, and easy access to data, among others. The cost-effectiveness and scalability offered by the cloud platform are allowing companies to develop innovative wealth management platforms more efficiently. In addition, financial advisory firms across the globe are also focusing on adopting cloud-based solutions as part of their efforts to reduce operational costs.

On-premise deployment is expected to register a moderate CAGR of 11.6% during the forecast period. Several organizations still prefer on-premise deployment of solutions to ensure a higher level of control over all the systems and data. The on-premise deployment model also allows organizations to have more control over the implementation of software. While on-premise solutions ensure that business data is stored and handled internally, it also necessitates businesses to appoint dedicated, in-house IT staff for support and maintenance purposes.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024 with the largest revenue share. Large enterprises across the globe are focusing on implementing new technical functionalities, and storage and processing technologies. Moreover, computing resources are getting more reliable, cheaper, and widely deployable. Hence, large-scale firms are trying to exploit all the opportunities that are critical to ensure success and growth in the long term. Large enterprises are also focusing on adopting cloud-based wealth management solutions to help in managing the digital assets, accounting operations, and funds of their clients.

The small & medium enterprises segment is expected to grow at the fastest CAGR during the forecast period. The growing demand for wealth monitoring software by SMEs to effectively meet the regulatory requirements and to condense the asset monitoring costs is anticipated to drive the growth of the segment. The growing number of small & medium enterprises in emerging economies is also driving the demand for wealth management solutions.

Application Insights

The portfolio, accounting, & trading management segment dominated the market in 2024. At a time when the demand for portfolio management and trading solutions is increasing; portfolio, accounting, & trading management solutions are allowing trading managers to concentrate on collaborative activities and serve their customers in a better manner. Portfolio, accounting, & trading managers are under severe pressure to effectively handle the data of their existing customers and are hence adopting wealth management solutions aggressively. Wealth managers are also using portfolio, accounting, & trading management platforms to handle the financial data of their clients and effectively support them with the most profitable decision-making.

The financial advice management segment is expected to grow at the fastest CAGR during the forecast period. Several businesses across the globe are focusing on accelerating digitization, increasing operational efficiency, and strengthening client relationships, which is expected to propel the adoption of financial advice & management solutions across various end use industries. Nowadays, several wealth management firms are using wealth management software to manage their multiple clients more effectively. Integrated financial advice & management technology-enabled solutions help financial managers in collaborating with their clients to create investment proposals, identify financial goals, and effectively deliver financial advice.

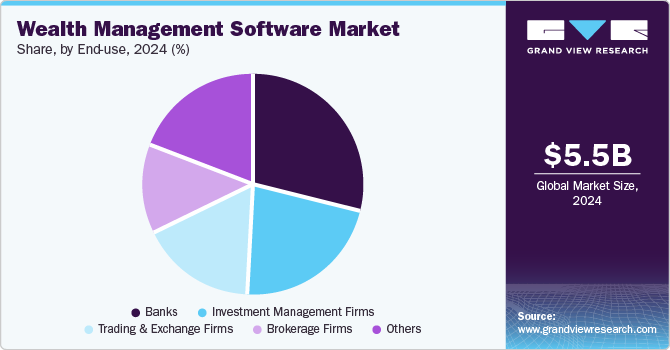

End-use Insights

The banks segment dominated the market in 2024 with the largest revenue share.As the global economy continues to strengthen gradually, banks are anticipated to play a key role in managing the growing assets and wealth of individuals. Moreover, banks are also leveraging wealth management software to ensure a client-centric approach. Numerous wealth management software providers are focusing on providing end-to-end wealth management and processing solutions to cater to the evolving needs of banks, drive efficiency throughout banks’ business, and help banks in operating seamlessly in global markets.

The trading and exchange firms segment is anticipated to grow rapidly during the forecast period.The evolving technological capabilities of wealth management solutions are expected to open new opportunities for the adoption of wealth management software for trading & exchange purposes. Trading & exchange firms are increasingly using wealth management solutions to effectively manage the assets of their clients. Furthermore, the growing digitalization across trading firms is efficiently allowing clients to access their trading accounts and effectively understand the progress of their financial portfolio, thereby creating new growth opportunities for the segment.

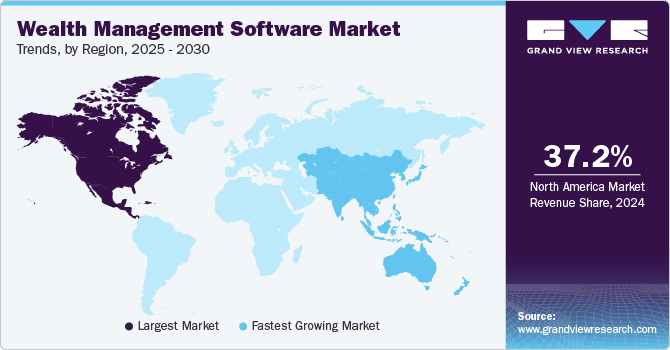

Regional Insights

North America wealth management software market held the largest share of 37.22% in 2024. The number of High-Net-Worth Individuals (HNWIs) in the region is growing continuously. These HNWIs are increasingly subscribing to advanced financial advisory solutions. North America is also home to some of the prominent market players. The increasing digitalization across the financial sector in several North American countries is another factor accentuating the growth of the regional market.

U.S. Wealth Management Software Market Trends

The U.S. wealth management software market held a dominant position in 2024. The adoption of advanced technologies such as artificial intelligence and machine learning is enhancing client engagement and operational efficiency. Regulatory compliance is also a critical factor, encouraging firms to invest in robust software solutions to meet evolving standards. In addition, the rise of robo-advisors and digital wealth management platforms is democratizing access to wealth management services, making them more appealing to younger investors.

Europe Wealth Management Software Market Trends

The Europe wealth management software market was identified as a lucrative region in 2024. The growth of the market is driven by the increasing emphasis on digital transformation and the need for integrated financial solutions. The region’s diverse regulatory landscape necessitates sophisticated software that can adapt to different compliance requirements across countries. Furthermore, the aging population in many European countries is driving demand for wealth preservation and retirement planning tools, thereby driving the market’s growth.

The UK wealth management software market is expected to grow rapidly in the coming years due to the ongoing shift towards digital platforms and an increasing focus on client-centric services. Wealth management firms are increasingly leveraging technology to streamline operations and reduce costs, particularly in response to rising client expectations for personalized services. The growing population of wealth management software clients is driving demand for sophisticated financial solutions that cater to their unique investment needs.

The Germany wealth management software market held a substantial market share in 2024. The country's robust economic environment and high savings rate among individuals drive the demand for comprehensive wealth management solutions. In addition, German firms are increasingly adopting software that supports multi-channel strategies, enabling seamless client interactions across digital and traditional platforms.

Asia Pacific Wealth Management Software Market Trends

The Asia Pacific wealth management software market is anticipated to grow at a CAGR of 15.2% during the forecast period. The region typically holds promising growth opportunities for robo advisors owing to the increasing adoption of digital platforms. The combination of innovative analytics and advanced algorithms is encouraging techno-savvy customers to opt for robo advisory tools to efficiently meet their investment requirements. Furthermore, the increasing number of SMEs in emerging economies, such as China, Japan, and India, is expected to create growth opportunities for the market. In addition, the latest IT infrastructure being adopted by SMEs in the region is expected to drive the demand for digital financial services to enhance their business capabilities.

Japan wealth management software market is expected to grow rapidly in the coming years. In Japan, the aging population is a critical driver for the market, leading to surged demand for retirement planning and wealth preservation strategies. Wealth managers are increasingly utilizing technology-driven solutions to enhance service delivery and client engagement. The cultural shift towards investment among Japanese individuals further supports this trend, as clients seek more personalized approaches to managing their wealth.

Wealth management software market in China held a substantial market share in 2024 owing to the rising affluence of the population and the increasing sophistication of investment strategies. As the middle class expands, more individuals are seeking professional wealth management services, driving demand for innovative software solutions.

Key Wealth Management Software Company Insights

Some of the key companies in the market for wealth management software include Comarch SA, Dorsum Ltd., Fidelity National Information Services, Inc., and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Comarch SA wealth management platform is designed to ensure that both advisors and clients receive an exceptional level of digital wealth services. The company’s wealth management software enables users to provide personalized and relevant wealth services by combining traditional human expertise with an intuitive, multi-module, and cloud-enabled platform.

-

Dorsum Ltd. is a prominent provider of investment software solutions, particularly in the wealth management sector. The company specializes in delivering innovative technology that supports financial institutions in enhancing their wealth management services.

Key Wealth Management Software Companies:

The following are the leading companies in the wealth management software market. These companies collectively hold the largest market share and dictate industry trends.

- Comarch SA

- Dorsum Ltd.

- Fidelity National Information Services, Inc.

- Finantix

- Fiserv, Inc.

- Objectway S.p.A.

- Profile Software

- SEI Investments Company

- SS&C Technologies Holdings, Inc.

- Temenos Headquarters SA

Recent Developments

-

In October 2024, Communify Fincentric announced a next-generation suite designed to enhance client and advisor experiences in wealth management. Developed in the age of AI and built on Communify Fincentric’s deep expertise, this flexible platform delivers innovative solutions that offer exceptional access to information, personalization, and automation for advisors.

Wealth Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.27 billion

Revenue forecast in 2030

USD 12.07 billion

Growth rate

CAGR of 14.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Advisory mode, deployment, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Comarch SA; Dorsum Ltd.; Fidelity National Information Services, Inc.; Finantix; Fiserv, Inc.; Objectway S.p.A.; Profile Software; SEI Investments Company; SS&C Technologies Holdings, Inc.; Temenos Headquarters SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wealth Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wealth management software market report based on advisory mode, deployment, enterprise size, application, end-use, and region:

-

Advisory Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Advisory

-

Robo Advisory

-

Hybrid

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Financial Advice & Management

-

Portfolio, Accounting, & Trading Management

-

Performance Management

-

Risk & Compliance Management

-

Reporting

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Banks

-

Investment Management Firms

-

Trading & Exchange Firms

-

Brokerage Firms

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wealth management software market size was estimated at USD 5.51 billion in 2024 and is expected to reach USD 6.27 billion in 2025.

b. The global wealth management software market is expected to grow at a compound annual growth rate of 14.0% from 2025 to 2030 to reach USD 12.07 billion by 2030.

b. The human advisory mode segment dominated the wealth management software market in 2024 owing to its capacity to provide personalized, relationship-focused services that surpass the capabilities of digital platforms.

b. Some of the key players operating in the wealth management software market include Comarch SA; Dorsum Ltd.; Fidelity National Information Services, Inc.; Finantix; Fiserv, Inc.; Objectway S.p.A.; Profile Software; SEI Investments Company; SS&C Technologies Holdings, Inc.; and Temenos Headquarters SA.

b. The increasing number of High-Net-Worth (HNW) individuals across the globe and the rising demand for efficient solutions to manage their wealth are major driving factors behind the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.