- Home

- »

- Medical Devices

- »

-

Wearable Brain Devices Market Size Report, 2024-2030GVR Report cover

![Wearable Brain Devices Market Size, Share & Trends Report]()

Wearable Brain Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Channel Type (32-Channel Type, 12-Channel Type), By Application (Medical Setting, AR/VR Gaming Settings), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-918-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

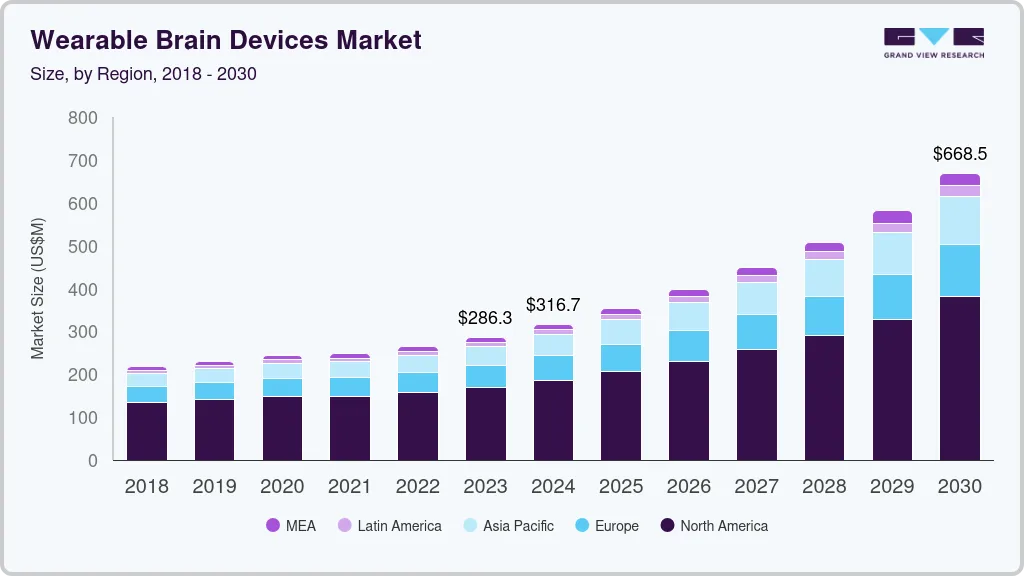

The global wearable brain devices market size was valued at USD 286.3 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 12.9% from 2024 to 2030. The growth of the market is attributed to the growing prevalence of various neurological disorders such as epilepsy, Parkinson’s disease, and Alzheimer’s disease. The rapidly growing geriatric population in the Asia Pacific region, especially in countries such as Japan, India, and China along with quick technological improvements are other key factors bolstering the growth of the market.

Modern technological advancements in portable technologies have made it possible to study the brain, and aid in the treatment of various brain disorders and diseases. According to BMJ Publishing Group Ltd., with the global population of adults aged 60 and up estimated to reach 2 billion by 2050, the burden of brain dysfunction and neurological illnesses, as well as demand for medical resources, is expected to skyrocket over time.

In line with the above, treatment, rehabilitation, and support services for neurological illnesses such as Parkinson's disease, Alzheimer's disease, schizophrenia, depression, and other dementias will be in high demand in the next decades. Moreover, the brain and its functions can now be observed in high resolution due to recent advances in brain imaging technologies. Near-infrared functional spectroscopy, for instance, is a noninvasive imaging technique that uses near-infrared light (wavelength >700 nm) to determine the relative concentration of hemoglobin in the brain using variations in hemoglobin light absorption patterns.

These systems, on the other hand, are unable to distinguish between scattered and absorbed photons. Time-domain (TD)-fNIRS is a new improvement in this method, which estimates photon scattering and absorption in tissues using picosecond light pulses and fast detectors. However, because such systems are expensive, sophisticated, and have a big form factor, they are unlikely to be widely used. To address these issues, a wearable headset based on TD-fNIRS technology was created by a group of manufacturers' researchers.

For instance, in January 2022, Kernel developed the Kernel Flow, a wearable helmet that uses time-domain functional near-infrared spectroscopy to perform brain imaging (TD-fNIRS). Although it showed comparable imaging performance, the system carries a smaller footprint, is cost-effective, and is less sophisticated than benchtop TD-fNIRS systems. As a result, market growth is expected to accelerate in the near future.

According to the WHO, in May 2020, more than 42,48,389 COVID-19 cases and 2,94,046 deaths were reported globally. The COVID-19 pandemic has created a significant challenge for the global healthcare industry further affecting the wearable brain devices market. Restricted access to medical services has led to inadequate care for patients suffering from other diseases. The huge demand for the product is anticipated to exceed stumbling blocks like the medical supply chain's disruption and limited output. During the pandemic, wearable brain devices have proven to be useful for monitoring and detecting neurology-related issues that the coronavirus may induce in individuals.

As a result, participants in the EEG devices market will continue to witness significant growth from hospitals and clinics. According to a study, published in Neuromodulation in February 2021, two COVID-19 patients with pulmonary and mild neurological symptoms (headache and fatigue) had their symptoms reduced without the need for medicines once they were activated every few hours throughout the day. Noninvasive vagus nerve stimulation refers to devices that can be worn on the neck and excite the Vagus nerve in a similar way (nVNS). Thus, this in turn is projected to boost the market growth.

Moreover, prominent players in the industry are aiming at extending their businesses regionally and creating new warehouses in other locations, and are also focusing on running their operations through numerous channels in the worst-affected areas. Companies are using a variety of measures to deal with supply chain disruptions, including rerouting logistics, sourcing from extra partners, and air freight delivery. Local manufacturers have also benefited from the pandemic. These factors are expected to create lucrative opportunities for market growth.

The global market for wearable brain devices is consolidating due to the rising popularity of medical equipment along with the increased research collaboration and agreements between diverse manufacturers. For instance, in November 2021, LOK Corporation and Brain Scientific Inc. established a cooperation to manage and build Brain Scientific's U.S. and global distribution networks. Brain Scientific's flagship products are the NeuroEEG and NeuroCap. This partnership is aimed at helping Brain Scientific scale and speeds its neurological gadgets, which will in turn push the market scale during the study period.

As per preliminary late-breaking evidence presented at the American Stroke Association's International Stroke Conference in February 2020, a wearable, non-invasive magnetic brain stimulation device improves motor function in stroke patients. As a result, these clinical presentations will provide attendees with a better understanding of stroke and brain health in order to aid in the prevention, treatment, and outcomes for the more than 800,000 Americans who suffer from a stroke each year, a number that is expected to grow in the near future supported by factors like increasing cases of obesity, stress, and other chronic diseases.

One of the major factors outlining the growth of the market is the increasing clinical studies on wearable brain devices assessments for various applications. For example, in March 2021, through a clinical trial titled "Transcranial Photobiomodulation for Reducing Autism Symptoms in Children," Brain Scientific Inc., announced a collaboration with JelikaLite, a company that develops Cognilum, a wearable non-invasive photobiomodulation device being developed to improve the well-being of children living with autism.

Cognilum offers brain treatments to children suffering from autism in the clinical trial, while Brain Scientific's NeuroEEG, a wireless EEG device, would measure brain activity. As a result of these actions, the market is likely to expand quickly in the near future. The U.S. dominated the market with the highest shares of 86.70% in 2021. This can be attributed to increasing awareness about the benefits of minimally invasive technologies along with their advancements. In addition, competition among prominent players, related to product innovation, will continue to positively influence market growth. For instance, in November 2019, NextMind introduced a brain-sensing wearable that allowed users to manage their devices in real-time using only their thoughts. This groundbreaking technology is a noninvasive brain-computer interface that instantly translates visual cortex signals into digital commands for any device.

On the other hand, companies are also working on a range of strategic sourcing and diversity programs. For instance, in June 2021, Cybin announced that it will sponsor a Kernel Flow feasibility study to measure ketamine's psychedelic effects on cerebral cortex hemodynamics, all of this will boost wearable brain device market size.

Channel Type Insights

The 32-channel type segment captured the largest market share with around 34.33% in 2021. When compared to the other types of channels, such devices preserve the accuracy required for adequate communication and are extremely portable for daily use. The market is expected to further grow due to many applications of this channel in recording electrical events in the brain to diagnose neurological illnesses and other applications in the brain-computer interface as well. Furthermore, the aspects such as efficiency, the convenience of use, high production, technical advancement, and widespread acceptability by healthcare experts are anticipated to further fuel the expansion of the segment.

Over the projection period, the multichannel segment is expected to register the highest CAGR of 13.25%. When compared to single-channel wearable brain devices, multichannel provides a superior sensor network, avoids data loss, and aids in the detection of significant clinical circumstances. As a result of these reasons, the category is predicted to expand in the near future. Furthermore, technical developments and increased knowledge about the device's safety will boost the growth of the segment in the near future.

Application Insights

In 2021, the medical setting segment dominated the industry with around 64.67% of the revenue share. Medical settings are further segmented into epilepsy, sleep disorders, Parkinson’s disease, traumatic brain injury, Alzheimer’s, and other applications.

The epilepsy segment has witnessed unprecedented adoption of wearable brain devices over time. This is due to rising cases of epilepsy along with an increasing effort taken to increase awareness about the condition. For instance, according to the World Health Organization (WHO), every year, an estimated 5 million people are diagnosed with epilepsy globally. Epilepsy is projected to affect 49 out of every 100 000 people in high-income nations annually. In low- and middle-income countries, this figure can be as high as 139 per 100 000. Efforts from device manufacturers to develop technologically advanced products will continue to contribute to the market growth.

AR/VR gaming settings segment is expected to expand at the highest CAGR of 16.51% during the forecast period. This is due to technological advancements such as enhanced sensor functions, long-term wearability, seamless integration with other electronic components, and increasing awareness regarding the technology among children.

For instance, in March 2022, Interaxon Inc. (Muse), announced the release of its VR Software Development Kit (SDK), as well as a new EEG headband that is compatible with all major VR head-mounted displays (HMDs), based on Interaxon's second-generation sleep headband and EEG meditation, Muse S. Interaxon is aiming at offering strategic collaboration prospects for brain health breakthroughs, leveraging their award-winning biosensing technology in AR and VR applications.

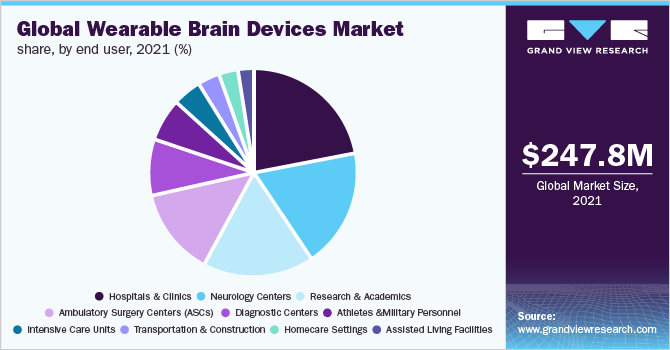

End-User Insights

The hospitals & clinics segment dominated the market with a revenue share of 20.79% in 2021. This segment's growth is mostly attributed to an increase in the number of patients suffering from various chronic diseases, resulting in an increase in surgical procedures. Notably, hospitals receive a substantially higher inflow of patients for neurology treatments than other healthcare settings, owing to the simplicity of managing any crises that may develop during surgical procedures and the availability of a wide range of treatment alternatives. By covering both attended and unattended lab tests, as well as testing performed in hospitals and non-lab settings, this coverage opens the way for new options. During the projected period, new gadgets with improved performance are likely to boost segment growth.

Neurology centers segment is expected to register the highest CAGR of 13.52% during the forecast period. This growth is mostly driven by an increase in neurological disorders such as epilepsy and Parkinson’s disease. These centers offer a wide range of treatments for complex epilepsy patients with the highest level of medical and surgical care. In addition, rising number of neurology centers across developed countries, increased safety, ease of scheduling, focused clinical staff, improved productivity, and growing patient preference for minimally invasive medical procedures and the efficacy of these centers, are some of the major factors that are likely to drive the growth in the forthcoming years.

Regional Insights

North America dominated the market with the highest revenue share of 60.08% in 2021. The surge in demand for minimally invasive procedures is attributable to an increase in the prevalence of Parkinson's disease and epilepsy.

Technological advances are also important contributors to the growth of the region product market. As a result, over the projected period, North America is expected to dominate the total regional market. Furthermore, rising healthcare spending in North America may encourage new and established competitors to enter the market. According to the Centers for Medicaid and Medicare Services, healthcare spending in the U.S. has increased by 9.7% to USD 4.1 trillion in 2020, accounting for around 19.7% of GDP. Asia Pacific is expected to witness the fastest CAGR of 13.97% during the forecast period owing to the availability of mandatory healthcare insurance, technological advancements, and increased healthcare expenditure. Singapore and South Korea are some of the emerging economies in the Asia Pacific region. Increasing awareness regarding the safety of the devices, and growing medical tourism are likely to drive the regional market growth. Other driving factors for the region are affordable devices, an increase in mergers & acquisitions, and government initiatives to improve healthcare services

Key Companies & Market Share Insights

With the surge in demand for wearable brain devices, global manufacturers are speeding up their production processes while also upgrading them through the use of cost-effective solutions. For instance, in January 2021, BioSerenity, Inc., announced that the IceCap EEG and Neuronaute EEG system wearable devices had received FDA 510(k) clearance, allowing physicians to remotely assess and monitor electrical brain activity in people with epilepsy. BioSerenity is dedicated to enhancing patient care by making EEG diagnostics more accessible to the 3.4 million people living with epilepsy in the U.S. alone. Some prominent players in the global wearable brain devices market include:

-

Kernel

-

EMOTIV

-

Neurolief

-

Brain Scientific

-

BioSerenity

-

mBrainTrain

-

Brain Products

-

COGNIONICS, INC.

-

Bitbrain Technologies

-

Dreem

-

BrainCo Inc

-

NextMind

-

Cadwell Industries Inc.

-

Neuroelectrics

-

Others

Wearable Brain Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 316.7 million

Revenue forecast in 2030

USD 668.5 million

Growth Rate

CAGR of 12.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Channel type, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Japan; China; India; Australia; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Kernel; EMOTIV; Neurolief; Brain Scientific; BioSerenity; mBrainTrain; Brain Products; COGNIONICS, INC.; Bitbrain Technologies; Dreem; BrainCo Inc; NextMind; Cadwell Industries Inc.; Neuroelectrics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global wearable brain devices market report based on channel type, application, end user, and region:

-

Channel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

32-Channel Type

-

12-Channel Type

-

14-Channel Type

-

5-Channel Type

-

Multichannels

-

Others (9, 8, etc.)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Setting

-

Epilepsy

-

Sleep Disorders

-

Parkinson’s Disease

-

Traumatic Brain Injury (TBI)

-

Alzheimer’s

-

Other

-

-

AR/VR Gaming Settings

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Neurology Centers

-

Ambulatory Surgery Centers (ASCs)

-

Diagnostic Centers

-

Transportation and Construction

-

Research and Academics

-

Homecare Settings

-

Intensive Care Units

-

Assisted Living Facilities

-

Athletes and Military Personnel

-

Others

-

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Prominent key players operating in the wearable brain devices market include MKernel, EMOTIV, Neurolief, Brain Scientific, BioSerenity, mBrainTrain, Brain Products, COGNIONICS, INC., Bitbrain Technologies, Dreem, BrainCo Inc, NextMind, Cadwell Industries Inc., Neuroelectrics & Others.

b. The global wearable brain devices market size was estimated at USD 247.8 million in 2021 and is expected to reach USD 263.6 million in 2022.

b. The global wearable brain devices market is expected to grow at a compound annual growth rate of 12.33% from 2022 to 2030 to reach USD 668.5 million by 2030.

b. North America dominated the wearable brain devices market in 2021 during the forecast period and is expected to witness a growth rate of 11.69% over the forecast period. This is due high prevalence of various neurological disorders such as Parkinson's disease, and epilepsy along with the rising demand for minimally invasive surgery, the adoption of technologically advanced products are major factor driving the market growth of wearable brain devices in this region.

b. Key factors that are driving the wearable brain devices market growth include increasing clinical studies on wearable brain devices assessments for various applications and the increasing prevalence of chronic diseases. In addition, the rising geriatric population, increasing various initiatives by major key market players such as acquisitions, mergers, and product launches are anticipated to boost the market and are further increasing the growth of the wearable brain devices market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.