- Home

- »

- Medical Devices

- »

-

Wearable Breast Pump Market Size, Industry Report, 2033GVR Report cover

![Wearable Breast Pump Market Size, Share & Trends Report]()

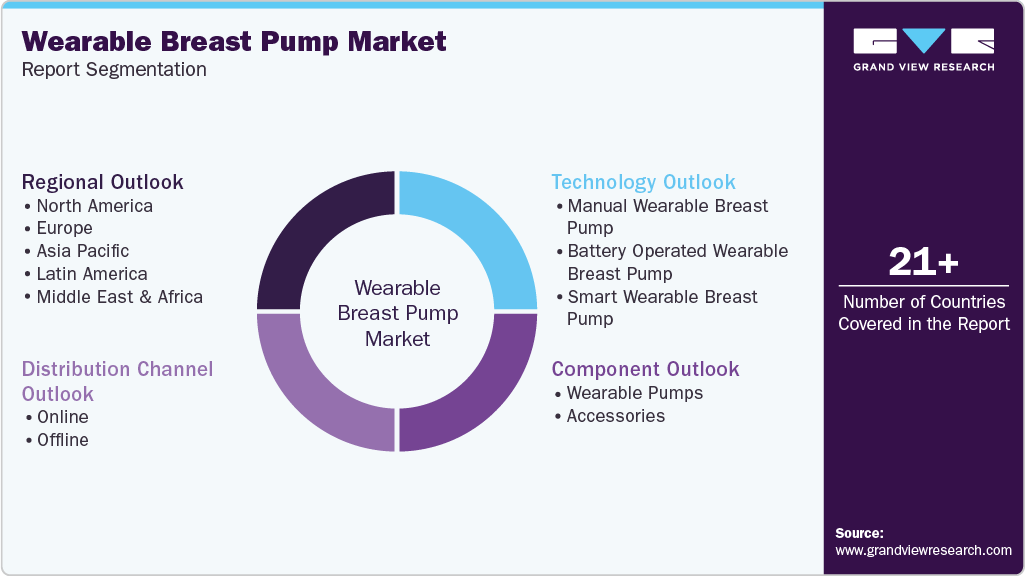

Wearable Breast Pump Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Wearable Pumps, Accessories), By Technology (Manual Wearable Breast Pump, Battery Operated Wearable Breast Pump), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-669-7

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Breast Pump Market Summary

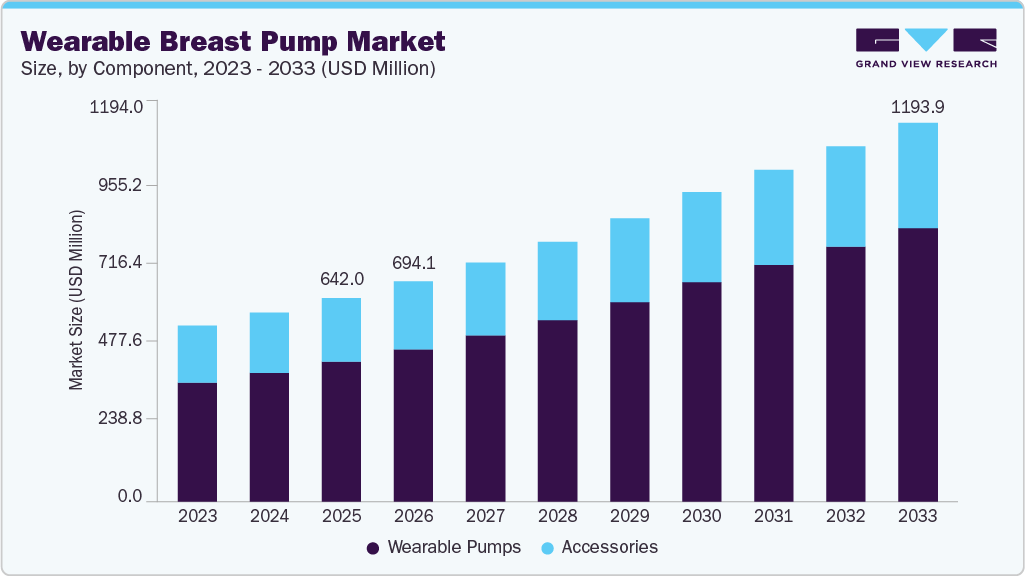

The global wearable breast pump market size was estimated at USD 642.0 million in 2025 and is projected to reach USD 1,193.9 million by 2033, growing at a CAGR of 8.1% from 2026 to 2033. This growth is attributed to the increasing participation of women in the workforce, rising awareness about the benefits of breastfeeding, growing preference for hands-free and discreet pumping solutions, and continuous technological advancements in wearable pump design, including quieter motors, improved suction efficiency, and smart connectivity features.

Key Market Trends & Insights

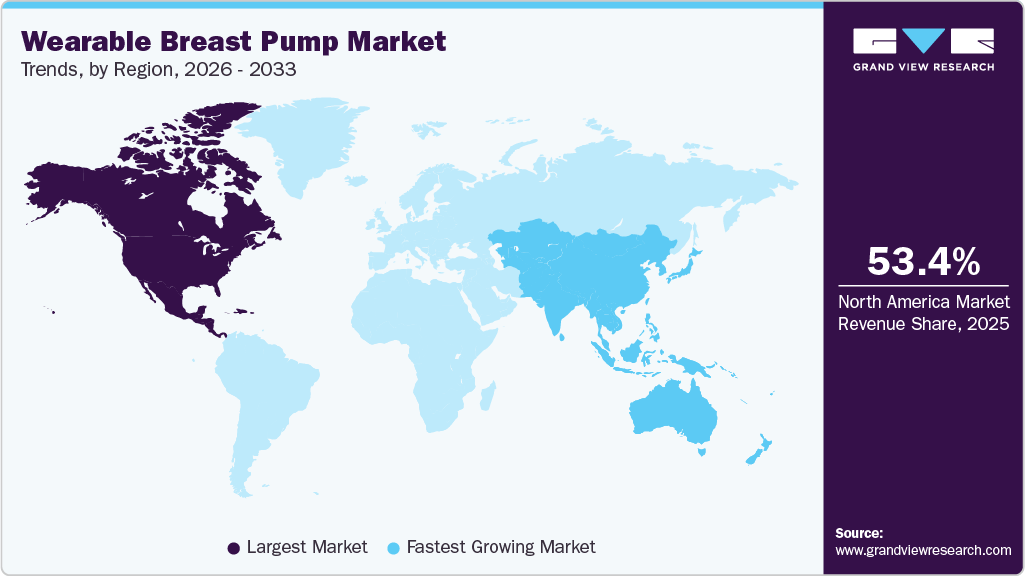

- North America dominated the wearable breast pump market with the largest revenue share of 53.38% in 2025.

- The U.S. dominated the North American wearable breast pump market in 2025, accounting for the largest share of regional revenue.

- By component, the wearable pumps segment led the market with the largest revenue share of in 2025.

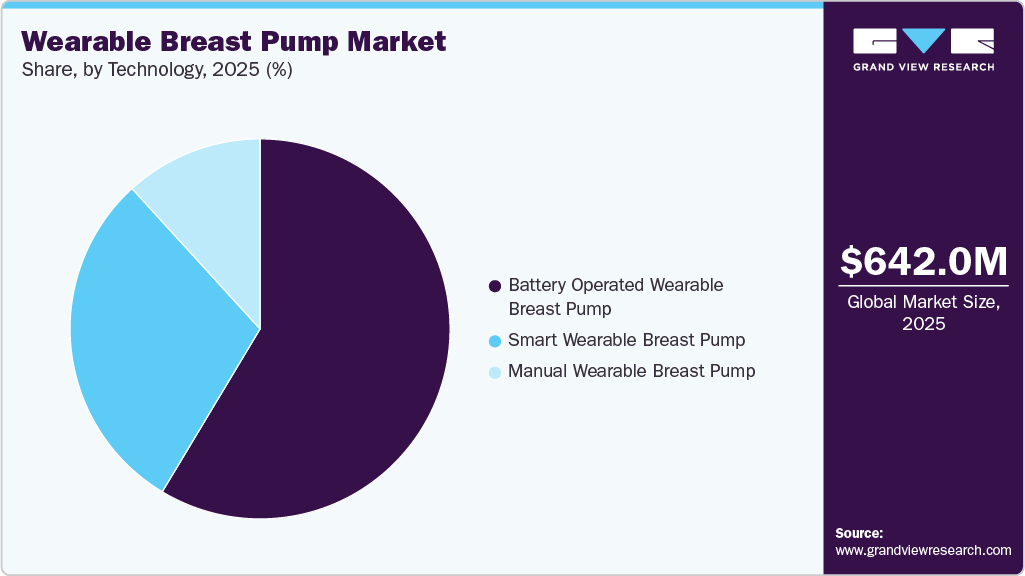

- By technology, the battery operated wearable breast pump segment led the market with the largest revenue share of in 2025.

- By distribution channel, the online segment led the market with the largest revenue share of in 2025.

Market Size & Forecast

- 2025 Market Size: USD 642.0 Million

- 2033 Projected Market Size: USD 1,193.9 Million

- CAGR (2026-2033): 8.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

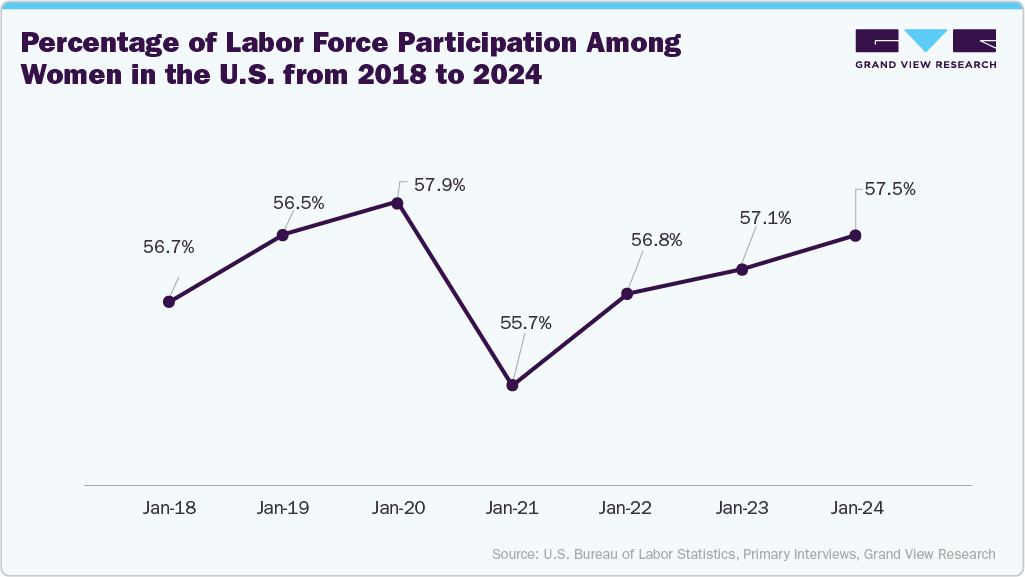

The growing number of working women is driving the wearable breast pump market, as employed mothers seek convenient, hands-free solutions that allow them to express milk while balancing professional and personal responsibilities. Wearable breast pumps offer mobility, discreet use, and time-saving benefits, enabling women to maintain breastfeeding routines without interrupting work. Increasing awareness of the health benefits of breastfeeding, supportive workplace policies, and rising participation of women in the workforce are collectively fueling demand for advanced, portable, and user-friendly breast pump solutions.

U.S. Female Workforce Overview

Category

Dec-24

Nov-25

Dec-25

Women, 16 years & over (Numbers in thousands)

Civilian Noninstitutional Population

138,183

140,676

140,770

Civilian Labor Force

79,034

80,943

80,524

Labor Force Participation Rate (%)

57.2

57.5

57.2

Employed

76,155

77,484

77,348

Employment-Population Ratio (%)

55.1

55.1

54.9

Unemployed

2,879

3,459

3,176

Unemployment Rate (%)

3.6

4.3

3.9

Not in Labor Force

59,149

59,733

60,246

Source: U.S. Department of Labor

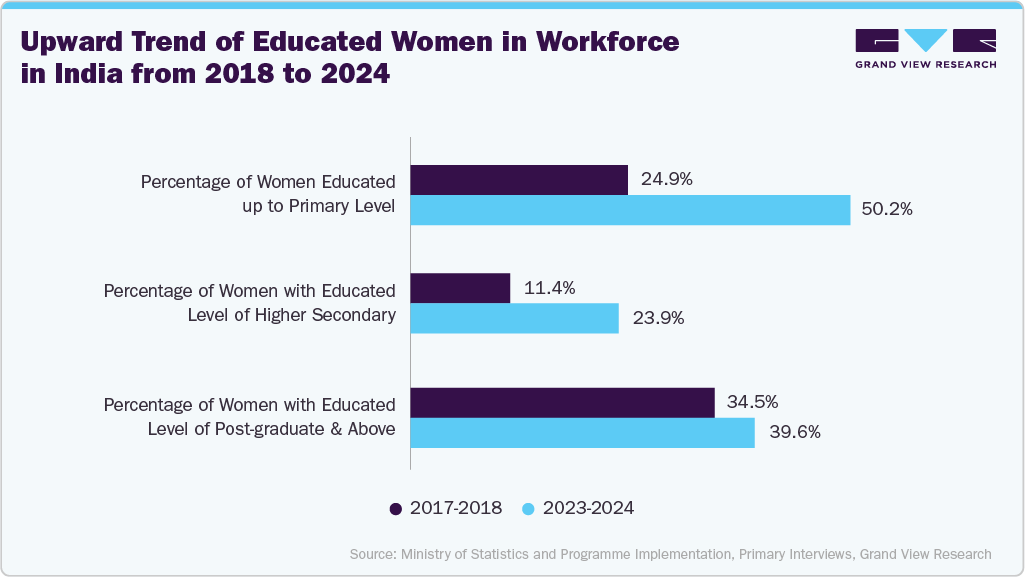

The upward trend of educated women in the workforce is a key driver of the wearable breast pump market. As more educated women pursue professional careers and return to work shortly after childbirth, the need for flexible, time-efficient, and discreet breastfeeding solutions has increased. Wearable breast pumps enable working mothers to express milk hands-free while continuing with professional and personal activities, thereby reducing disruptions to their work schedules. Higher education levels are also associated with greater awareness of the benefits of breastfeeding and a willingness to invest in advanced, technology-enabled products. These factors are accelerating the adoption of wearable breast pumps among career-oriented mothers, supporting sustained market growth.

Breastfeeding initiatives play a significant role in driving the breast pump and breastfeeding support products market by increasing awareness, acceptance, and institutional support for breastfeeding. Government-led programs, public health campaigns, and recommendations from organizations such as the WHO and UNICEF actively promote exclusive breastfeeding and continue breastfeeding after mothers return to work. These initiatives normalize breastfeeding as a public health priority and encourage early adoption of breastfeeding-support solutions, including breast pumps, milk storage products, and lactation accessories. Workplace breastfeeding initiatives further accelerate market growth by creating demand for convenient and efficient pumping solutions. Policies mandating paid maternity leave, lactation breaks, and dedicated nursing rooms, particularly in hospitals, corporate offices, and manufacturing facilities, enable working mothers to continue breastfeeding their children. As a result, employers and healthcare systems are investing in hospital-grade and wearable breast pumps to support employee well-being and retention, thereby directly expanding market

-

Canada Prenatal Nutrition Program (CPNP)

CPNP provides funding to community organizations to support the health of pregnant women, new mothers, and their babies who face risks due to challenges such as poverty, teenage pregnancy, and social or geographic isolation.

-

Providing Urgent Maternal Protections (PUMP) for Nursing Mothers Act

The Providing Urgent Maternal Protections (PUMP) for Nursing Mothers Act, an extension of the Fair Labor Standards Act (FLSA), requires employers across the U.S. to support breastfeeding employees. Under the law, employers must provide reasonable break time to express breast milk for up to one year after childbirth and ensure access to a clean, private space that is not a bathroom. While some employee categories are exempt, the Act applies nationwide, and state or local laws may offer additional protections.

Technological advancements are a key driver of growth in the wearable breast pump market, as they directly address the practical challenges faced by modern mothers, particularly working women. Innovations such as hands-free, in-bra designs allow discreet and mobile pumping, enabling mothers to express milk while working, traveling, or performing daily activities. Improvements in suction technology and anatomically optimized breast shields enhance milk expression efficiency and comfort, increasing user satisfaction and encouraging repeat and long-term use. The integration of quiet motors, long-lasting rechargeable batteries, and leak-proof systems further supports convenient, on-the-go pumping. In addition, smart features such as Bluetooth connectivity and app-based controls allow personalized pumping settings and session tracking, aligning with consumer demand for connected health devices. These technological improvements reduce barriers to breastfeeding, improve convenience and confidence, and expand adoption among a broader user base, thereby driving market growth.

Some Key Technological Advancements

Technological Advancement in Wearable Breast Pumps

Description / Benefit

Example Brand/Model Names

Hands-Free Wearable Design

Allows pumping without holding equipment; fits entirely inside a bra for mobility and multitasking.

Momcozy Breast Pump S9 Pro Single, Philips Hands‑Free/Wearable Single Electric Breast Pump

App Connectivity & Smart Controls

Bluetooth or smartphone app integration to monitor milk volume, suction level, session duration, and receive alerts.

Elvie Stride/Elvie Pump

Custom Suction Modes & Personalization

Multiple pumping patterns like stimulation, expression, and bespoke rhythms improve comfort and output.

Momcozy M9 / Air 1 features customizable modes

Leak-Proof & Self-Sealing Milk Collection

Design that prevents milk from spilling when moving, enabling flexible activity while pumping.

Willow wearable pumps

Improved Comfort Fit & Ergonomics

Designs shaped to natural body contours with multiple flange sizes for better seal and comfort.

Stacy Prime concepts; Medela Motion InBra

Hospital-Grade Suction in Portable Form

High suction strength generally found in larger pumps available in wearable formats.

Momcozy V1 Pro

Source: Company websites, GVR Analysis

Key Expert and User Insights on Wearable Breast Pumps

Person Name

Role / Qualification

What They Said / Contribution

Alicia Betz

Writer, Forbes Vetted, Mom of three, parenting journalist

"I spoke with lactation experts, used feedback from real mom testers and drew upon my own personal experience as someone who pumped through three kids to curate this list of the top wearable breast pump."

Karrie Locher

Certified lactation counselor; postpartum & neonatal nurse; owner of Karing For Postpartum LLC

"Having the option of a wearable pump takes convenience to a new level and may increase the likelihood of meeting those pump sessions they otherwise may not have been able to make work."

Mary Ann Blatz

International board certified lactation consultant

"I have noted that mothers with very large or pendulous breasts have a difficult time keeping the wearable pumps in place. Fit is very important and we’re all different sizes."

Chaunie Brusie

Mom of five

"Elvie changed my life. I had a NICU baby and had to exclusively pump. I was about to give up because it was so hard caring for her alone and my other four kids. Elvie was a game changer, and I will forever sing its praises."

Lauren Scheeler

Mom of four

"It’s easy to use and wash and has a good suction. I wear mine at work all the time and even pumped in Disney with it and walked around. It’s small, so it’s not hard to bring with you places and it comes with a small carrying pack."

Kendra Gallagher

Mom of three, nurse

"It was nice to throw those in and keep doing chores throughout the day. I even put them in when work was busy, and I didn’t get a chance to step away to pump."

Source: GVR Analysis

In August 2025, CMS introduced a new HCPCS Level II code (A4288) specifically for breast pump replacement valves. The dedicated code enables more transparent billing, improves insurance coverage, and removes cost barriers that previously prevented many mothers from replacing worn valve components, which are essential for maintaining proper suction and milk flow. This update aligns valves with other recognized pump parts, supporting better breastfeeding outcomes by ensuring parents can access affordable and timely replacements.

"This decision by CMS is a meaningful win for mothers and families. Valves are small but absolutely essential to the performance of a breast pump, and without them, breastfeeding outcomes can be jeopardized. By establishing a dedicated code, CMS has acknowledged the importance of proper pump maintenance and helped remove a barrier that too often discouraged families from replacing worn valves. This change ensures more parents will have access to the supplies they need to continue breastfeeding with confidence." - Jacqui Penda, CLC, of Symmetrical Health dba Cimilre Breast Pumps

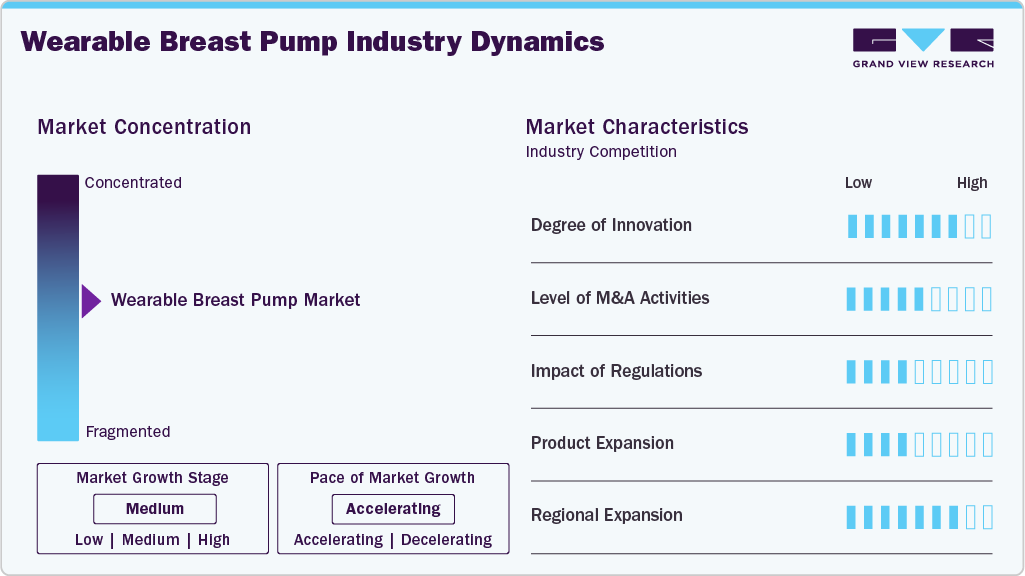

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of the market growth is accelerating. The industry is characterized by a moderate-to-high degree of growth. Key drivers include the rising awareness of breastfeeding benefits, increasing global women's employment rates, improved healthcare infrastructure in emerging economies, and government initiatives to support working mothers. Ongoing advancements in wearable breast pump technology, such as the development of battery-operated pumps and smart pump features, have made breast pumping more convenient and efficient, driving market growth.

Key strategies implemented by players in the industry are new product launches, expansion, acquisitions, partnerships, and other strategies. In November 2023, Pigeon officially unveiled the much-anticipated release of its second-generation GoMini Electric Wearable Breast Pumps, known as the GoMini Plus.

The wearable breast pump market demonstrates a high degree of innovation, driven by the shift from traditional, stationary pumps to hands-free, smart, and lifestyle-oriented devices. Key advancements include compact in-bra designs, quiet motors, customizable suction patterns, and app-based monitoring, all of which significantly enhance user convenience and comfort. For instance, products such as Elvie and Willow integrate Bluetooth connectivity and leak-proof systems, allowing mothers to pump discreetly while working or traveling. These innovations highlight how the market is evolving beyond basic milk expression toward technology-enabled maternal health solutions that prioritize mobility, personalization, and user experience. In January 2023, Willow Innovations, Inc. launched the first breast pump companion app, Willow 3.0, for Apple Watch. The Willow 3.0 pumps have a smartwatch companion app that allows breastfeeding parents to easily track, control, and view their pumping sessions.

Regulations have a significant impact on the wearable breast pump market by shaping how products are designed, tested, approved, and sold. Since wearable breast pumps are classified as medical devices, they must meet stringent safety, efficacy, and quality standards, as outlined in FDA Class II requirements in the U.S. and the Medical Device Regulation in the EU. This involves lengthy approval processes and detailed documentation before products can be introduced to the market. According to Title 21 of the Code of Federal Regulations (CFR), §884.5160, a powered breast pump is identified as an electrically powered suction device used to express milk from the breast. It is classified as a Class II medical device.

Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Major companies acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. In January 2023, International Biomedical announced the acquisition of Ameda, Inc. The company is expected to hire in Operations roles as it consolidates this acquisition and develops new growth initiatives.

The regional expansion strategy adopted by companies in the wearable breast pump market is a smart move to capitalize on emerging opportunities and broaden their market presence. This approach involves establishing a stronger presence in key geographical areas through partnerships, acquisitions, and localized marketing strategies. By tailoring their products and services to meet regional healthcare needs, breast pump firms aim to enhance accessibility and responsiveness, ensuring more comprehensive and effective market penetration.

In January 2024, Annabella announced its seed funding of USD 8.5 million and its entrance into the U.S. breast pump market.Annabella has sold approximately 4,000 breast pumps in Israel since February 2023. This expansion demonstrates Annabella's product excellence, illustrated by its patented, FDA-cleared breast pump, which provides mothers with a product comparable to breastfeeding while emphasizing efficiency and comfort. The seed funding is expected to be utilized to fuel next-generation product development and expand into the US market. Thus, regional expansion serves as a critical factor for industry leaders to tap into diverse markets, address specific healthcare demands, and ultimately drive sustained growth.

Component Insights

Wearable pumps dominated the market in 2025. These devices offer a hands-free, discreet, and portable breastfeeding solution that integrates into the daily lives of working and active mothers. As compared traditional pumps that are bulky or require tethering to power sources, wearable pumps can be worn under clothing and used while performing other tasks, which appeals strongly to women balancing work, family, and mobility. This convenience, coupled with continuous improvements in design, comfort, and user experience, such as quieter operation, better suction, and lighter weight, has made wearable pumps the preferred choice for many new mothers. In addition, increased awareness of breastfeeding benefits, supportive workplace policies, and easier online availability further boost their adoption.

Companies are continuously innovating their products to meet the evolving consumer needs. For instance, in June 2024, Medela launched the Swing Maxi Hands-free, a smart, double-electric breast pump. This compact and portable solution provides flexibility to pump anytime and anywhere. Its lightweight and sleek design makes it ideal for home or on the go. The pump mimics a baby's natural sucking rhythm and features Medela's patented 2-Phase Expression technology for a comfortable and efficient pumping experience.

The accessories segment in the wearable breast pump market is gaining significant growth as demand for supporting products increases alongside core wearable pumps. Items such as milk storage bags, flanges, cleaning tools, charging accessories, nursing bras, and disposable pads are becoming more popular as mothers seek a complete and convenient pumping solution, not just the pump itself. As more women adopt wearable pumps and prioritize comfort, personalization, and hygiene, accessory sales are increasing, with manufacturers also offering replacement parts and subscription-style consumables that generate recurring revenue. This growth reflects a broader trend where consumers value end-to-end breastfeeding support products that enhance usability and fit modern lifestyles.

Distribution Channel Insights

The online distribution channel is expected to hold the dominant share in 2025. It is also expected to grow at the fastest CAGR during the forecast period, offering convenience, a broader product selection, and competitive pricing that attract modern consumers, particularly busy and tech-savvy mothers. Online platforms enable buyers to easily compare features, read reviews, and select from a wide range of brands and models, including the latest smart and wearable designs that may not be available in traditional retail stores. The rapid growth of e-commerce, combined with increasing internet and smartphone penetration across regions, as well as the impact of digital marketing and social media, has all accelerated online sales. In addition, many retailers and brands provide fast doorstep delivery, easy returns, and promotional discounts, making online shopping the preferred channel for purchasing wearable breast pumps, which drives its strong market share and fastest growth.

The offline segment continues to hold a significant share of the wearable breast pump market, as many consumers still value in-person shopping experiences, hands-on product evaluation, and immediate purchase without waiting for delivery. Retail outlets, such as baby specialty stores, pharmacies, maternity shops, and large electronics/department stores, allow mothers and caregivers to see and feel the products, try different pump sizes and accessories, and receive expert advice from sales staff, which builds confidence in their purchase decision. Healthcare professionals and lactation consultants recommend or sell pumps through clinics and hospitals, further supporting offline sales.

Technology Insights

The battery operated wearable breast pump segment dominated the wearable breast pump market in 2025. It offers greater portability, convenience, and ease of use compared with manual options, making pumping easier for busy, working mothers who need flexible solutions throughout the day. These pumps don’t require external power cords. They can be used discreetly anywhere at work, in transit, or at home while also being lighter, smaller, and less tiring to operate than traditional devices, which boosts their appeal and adoption worldwide. Manufacturers continue investing in smaller, more efficient battery-powered designs that cater to users’ desire for hands-free, tech-enabled breastfeeding support, which has helped this segment capture the largest market share.

The smart wearable breast pump segment is expected to grow at the fastest CAGR over the forecast period, due to these devices combining advanced technology with convenience, making them particularly attractive to modern, tech-savvy mothers. Smart pumps include mobile app integration, real-time tracking of milk volume and pumping history, and customizable suction/comfort settings, which enhance the user experience and differentiate them from basic models. As awareness of breastfeeding benefits increases and working mothers seek hands-free, efficient solutions that fit busy lifestyles, demand for these feature-rich, connected devices is rising faster than for traditional pumps. Growing online availability, increasing disposable incomes, and continuous product innovations from leading brands are further accelerating the global adoption of smart wearable breast pumps.

Regional Insights

North America wearable breast pump market accounted for the highest share of 53.38% in 2025. This dominance can be attributed to an increase in various government initiatives. For instance, various awareness campaigns by CDC, WHO and ABM to feed babies with expressed breastmilk using breast pumps are expected to have a positive impact on the market. Moreover, CDC has been encouraging women to feed babies with breast milk. In addition, CDC has also laid guidelines & recommendations regarding the proper storage and preparation of breast milk on their website, which is anticipated to increase awareness regarding the importance of breast milk among women, thereby propelling the market growth.

U.S. Wearable Breast Pump Market Trends

The U.S. wearable breast pump market is growing as more mothers seek portable, hands-free, and convenient breastfeeding solutions that fit busy lifestyles. The market is benefiting from increasing female workforce participation, greater awareness of the benefits of breastfeeding, and supportive healthcare policies, such as insurance coverage under the Affordable Care Act, that make pumps more accessible. Technological innovations, such as smart features and app connectivity, are further boosting demand, especially among tech-savvy consumers. This combination of lifestyle, policy, and tech trends is driving the U.S. market.

Europe Wearable Breast Pump Market Trends

Wearable breast pump market in Europe is growing, driven by increasing female workforce participation and the need for convenient, hands-free breastfeeding solutions that fit busy lifestyles. Rising awareness of the health benefits of breastfeeding, coupled with strong healthcare infrastructure and supportive maternity policies, is encouraging adoption across both urban and semi-urban areas. Technological advancements, such as battery-operated and smart pumps with app connectivity, enhance usability and appeal, while high disposable incomes allow consumers to invest in premium products. In addition, the expansion of online and omnichannel retail ensures easy access to a wide variety of pumps and accessories. As per European Institute for Gender Equality, in 2025, the full-time equivalent employment rate for women in the European Union was 44%, reflecting the proportion of women working hours compared to full-time standards. The average duration of working life for women was 35 years.

The UK wearable breast pump market is growing. In the UK, the growing population of working women is a key driver of the wearable breast pump market. As more women return to work soon after childbirth, the need for efficient ways to maintain breastfeeding increases, boosting demand for electric and wearable pumps that offer convenience and portability. Supportive workplace policies, such as breastfeeding breaks and designated lactation rooms, further encourage the use of wearable breast pumps. This rise in employment among mothers supports the shift toward modern, time-saving pumping solutions, thereby contributing to the growth of the wearable breast pump market.

Wearable breast pump market in Germany is growing due to the increasing participation of women in the workforce and the rise of dual-income households, which drive demand for convenient, hands-free breastfeeding solutions. High awareness of infant health and the benefits of breastfeeding, supported by government campaigns and maternal healthcare programs, encourages the adoption of pumps.

Germany continues to promote breastfeeding as the optimal nutrition for infants and a key factor for maternal and child health. Despite recommendations for exclusive breastfeeding for four to six months, only 40% of infants are exclusively breastfed for four months. To address this, the Federal Ministry of Food and Agriculture (BMEL) has developed the National Strategy for the Promotion of Breastfeeding, which links existing services with new initiatives and fosters collaboration among stakeholders. The strategy focuses on seven key areas: evidence-based guidelines, professional training, healthcare structures, municipal promotion, workplace support, regulation of breast-milk substitutes, and systematic monitoring, with communication efforts promoting societal acceptance. These measures aim to increase breastfeeding initiation and duration, support women according to individual needs, and make Germany a more breastfeeding-friendly country.

Asia Pacific Wearable Breast Pump Market Trends

The wearable breast pump market in Asia Pacific is anticipated to witness the fastest growth during the forecast period, driven by rising awareness of maternal and infant health, increasing participation of women in the workforce, and shifts in urban lifestyle that favor convenient, hands-free pumping solutions. Countries like China, Japan, India, South Korea, and Southeast Asian nations are experiencing strong demand for wearable breast pumps as more working mothers seek flexible and efficient breastfeeding support. Growing e-commerce access and rising disposable incomes are making these products easier to purchase. In addition, government initiatives promoting breastfeeding and improved healthcare infrastructure are further stimulating the adoption of wearable breast pump technologies throughout the region, resulting in a faster growth rate. According to the World Economic Forum, by 2025, 17 out of 19 economies in the region were expected to have a female labor force participation rate of over 40%.

Wearable breast pump market in China held the significant share of Asia Pacific's market in 2025. Due to a combination of a large population base, rising birth awareness, and rapid adoption of modern maternal care products. The country has seen strong demand from working mothers, driven by increasing female workforce participation, urbanization, and busy lifestyles that favor hands-free and portable pumping solutions.

In addition, growing awareness of the benefits of breastfeeding, expanding e-commerce penetration, and the presence of domestic and international brands offering affordable wearable pumps have contributed to wider adoption. Improved healthcare infrastructure and supportive maternal health initiatives have further strengthened China’s leading position within the regional market. In May 2025, Walmart further strengthened its presence in China by launching construction of its largest Sam’s Club in northern China. Scheduled to open in 2026, the 25,000-square-meter mega store likely to operate under an omnichannel model, combining one physical warehouse with 20 digital fulfillment centers to serve premium and diversified consumer demand across the Beijing-Tianjin-Hebei region.

The India wearable breast pump market is experiencing growth, driven by increasing awareness of breastfeeding benefits, rising female workforce participation, and changing urban lifestyles that demand convenient and hands‑free pumping solutions. Urban working mothers are particularly adopting wearable pumps due to their portability, discreet design, and time-saving functionality, which allow breastfeeding while managing professional and domestic responsibilities.

Labour Indicators for Women in India

Indicator (Women)

April-June 2025

July-September 2025

Trend

Female Labour Force Participation Rate (LFPR) - Age 15+

33.40%

33.70%

Increased

Self-Employed Women - Rural Areas

60.70%

62.80%

Notable rise

Regular Wage/Salaried Women - Urban Areas

49.40%

49.80%

Marginal improvement

Source: Ministry of Statistics & Programme Implementation

Middle East & Africa Wearable Breast Pump Market Trends

The Middle East & Africa (MEA) wearable breast pump market is experiencing growth, driven by rising awareness of maternal and child health, increasing participation of women in the workforce, and urbanization in key countries. In the Gulf Cooperation Council (GCC) countries such as Saudi Arabia, UAE, and Kuwait, demand is fueled by affluent urban populations seeking convenient, hands-free breastfeeding solutions that fit busy professional and domestic lifestyles. Technological adoption, including battery-operated and smart wearable pumps, is accelerating due to preferences for portability, discreet design, and efficiency.

Key Wearable Breast Pump Company Insights

Wearable breast pump markettrends are shaping industry leader’s strategies. Heavy investments in research and development for technological innovations reflect a commitment to connected healthcare solutions. Top players are adapting to the shift towards user comfort through technological advancements, and innovative products. Technological advancements in the wearable breast pump market have been continuous, with the emergence of smart and connected devices. These innovative wearable breast pumps enable users to monitor and manage their pumping sessions via mobile apps. The prevalence of Bluetooth connectivity, data tracking capabilities, and customizable features has been on the rise.

Key Wearable Breast Pump Companies:

The following key companies have been profiled for this study on the wearable breast pump market.

- Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.)

- Lansinoh Laboratories, Inc. (Pigeon Corporation)

- Mamapump

- Tommee Tippee (Shanghai Jahwa United Co., Ltd)

- Haakaa

- Ardo medical AG

- KISSBOBO

- Medela

- Willow

- Elvie (Chiaro Technology Limited)

- Freemie

- Uzin Medicare (Spectra Baby)

- LaVie Mom

- Ameda (International Biomedical, Ltd.)

- Annabella-Pump

Recent Developments

-

In October 2025, Medela AG announced the launch of its new Motion InBra Wearable Breast Pump, designed to combine dependable performance with everyday comfort for modern mothers. Engineered to mimic the natural contours of the breast, the pump provides a secure, discreet in-bra fit that supports adequate milk flow while allowing mothers to pump comfortably at home, at work, or on the go. The Motion InBra is scheduled for launch in Europe beginning mid-October, followed by availability in Australia, Canada, and Japan later in 2025, and in the U.S. in early 2026.

“Our Motion InBra is the latest innovation in Medela’s wearable breast pump portfolio, representing our ongoing commitment to turning science into care. Moms told us they wanted a pump they could count on - a wearable, efficient, comfortable, and hassle-free pumping solution that fits naturally into their everyday routines. With Motion InBra, we’ve delivered on that: combining dependable performance and comfort with straightforward, plug-and-play simplicity to give moms confidence and ease in every moment of their breastfeeding journey.” said Thomas Golücke, CEO of Medela

-

In October 2025, Hegen announced the launch of its PCTO Wearable Breast Pump, marking the brand’s entry into the wearable pumping technology market. The launch reflects Hegen’s mission to empower mothers with solutions that support confidence, comfort, and flexibility throughout their breastfeeding journey.

-

In June 2025, Ameda announced that its GLO Wearable Breast Pump received the 2025 Baby Innovation Award for Breast Pump Technology Innovation of the Year, recognizing the product’s breakthrough design, comfort, and performance. Built on Ameda’s hospital-grade legacy, the GLO wearable pump is the first to feature Milk Optimizing Technology, inspired by the suction rhythm and performance standards of multi-user hospital pumps.

“This award recognizes our mission to bring hospital-grade reliability into mom-friendly form factors. GLO delivers power, comfort, and confidence - it truly is the pump we all wish existed sooner.”- said Brian Warren, Senior Product Marketing Manager at Ameda.

Wearable Breast Pump Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 694.1 million

Revenue forecast in 2033

USD 1,193.9 million

Growth rate

CAGR of 8.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Component, technology, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.); Lansinoh Laboratories Inc. (Pigeon Corporation); Mamapump; Tommee Tippee (Shanghai Jahwa United Co., Ltd.); Haakaa; Ardo Medical AG; KISSBOBO; Medela; Willow; Elvie (Chiaro Technology Limited); Freemie; Uzin Medicare (Spectra Baby); LaVie Mom; Ameda (International Biomedical, Ltd.); Annabella-Pump

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Breast Pump Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wearable breast pump market report based on component, technology, distribution channel, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Wearable Pumps

-

Accessories

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual Wearable Breast Pump

-

Battery Operated Wearable Breast Pump

-

Smart Wearable Breast Pump

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the global wearable breast pump market include Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.), Lansinoh Laboratories, Inc. (Pigeon Corporation), Mamapump, Tommee Tippee (Shanghai Jahwa United Co., Ltd), Haakaa, Ardo medical AG, KISSBOBO, Medela, Willow, Elvie (Chiaro Technology Limited), Freemie, Uzin Medicare (Spectra Baby), LaVie Mom, Ameda, Annabella-Pump, Bellababy and Nuliie

b. Key factors that are driving the wearable breast pump market's growth include a worldwide surge in women’s employment rate, growing consumer awareness about wearable breast pumps coupled with development in healthcare infrastructure in emerging economies.

b. The global wearable breast pump market size was estimated at USD 642.40 million in 2025.

b. The global wearable breast pump market is expected to grow at a compound annual growth rate of 8.06% from 2026 to 2033 to reach USD 1,193.95 million by 2033.

b. North America dominated the global wearable breast pump market in 2025. This is attributable to the increasing awareness about the availability of wearable breast pumps, the growing number of employed women, and high disposable income.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.