- Home

- »

- Pharmaceuticals

- »

-

Weight Loss Supplement Market Size, Industry Report, 2030GVR Report cover

![Weight Loss Supplement Market Size, Share & Trends Report]()

Weight Loss Supplement Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Powder, Pills), By Ingredients (Vitamins & Minerals, Natural Etracts/ Botanicals), By End-use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-394-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Weight Loss Supplement Market Summary

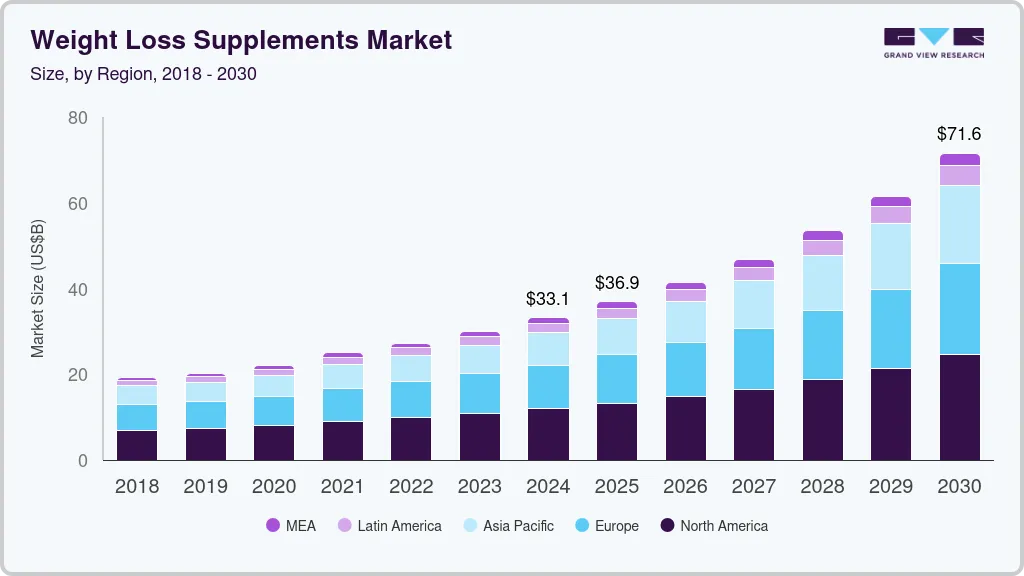

The global weight loss supplement market size was estimated at USD 33.14 billion in 2024 and is projected to reach USD 71.59 billion by 2030, growing at a CAGR of 14.17% from 2025 to 2030. The rising cases of obesity and related health ailments, such as cardiovascular diseases, diabetes, and hypertension, are expected to drive product demand.

Key Market Trends & Insights

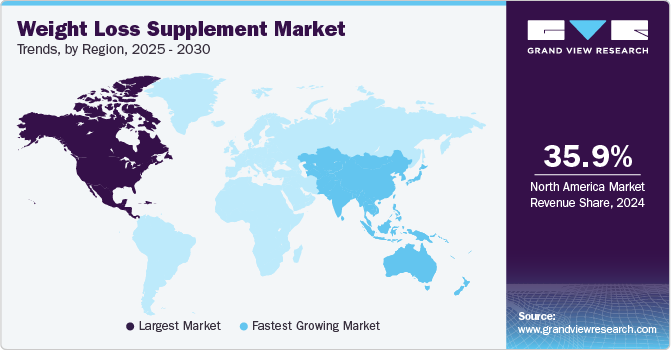

- North America weight loss supplement market accounted for the largest revenue share of 35.97% in 2024.

- The U.S. weight loss supplement market is expected to grow over the forecast period.

- The Asia Pacific weight loss supplement market held the highest CAGR over the forecast period.

- Based on type, the powders segment dominated the market with the largest revenue share of 37.69% in 2024.

- Based on ingredients, the vitamins and minerals segment dominated the market with the largest share of 54.67% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.14 Billion

- 2030 Projected Market Size: USD 71.59 Billion

- CAGR (2025-2030): 14.17%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The prevalence of obesity has been increasing globally, and this trend has contributed to the growth of the market. According to WHO, in 2022, reported that a concerning number of children under the age of 5 experienced overweight issues, totaling 37 million. Additionally, the statistics reveal that over 390 million children and adolescents aged 5 to 19 years faced weight challenges, with 160 million of them struggling with obesity. Moreover, the rise of sedentary lifestyles, coupled with easy access to high-calorie foods, has contributed to a growing prevalence of overweight and obesity, particularly in urban areas. This trend has created a significant market opportunity for weight loss supplements, as consumers seek convenient and effective solutions to manage their weight and improve their overall health. according to a CDC report in 2022, 25% of adults in the U.S. do not meet the recommended activity levels essential for maintaining their health. Across states and territories, estimates of inactivity show a range from 17.7% in Colorado to 49.4% in Puerto Rico. More than 30% of adults were found to be physically inactive, In seven states and one territory.

The campaign's significance becomes evident when considering the broader context of modern health challenges. Factors such as increasing health awareness, sedentary lifestyles, and the pervasive influence of social media have contributed to a rise in obesity rates and related health concerns across the population. For instance, the Weight Matters Campaign, initiated and presented by the Obesity Action Coalition (OAC), serves as a national endeavor aimed at supporting individuals grappling with excess weight in taking proactive steps toward managing their health effectively. This campaign is multifaceted in its approach, encompassing various resources, tools, and educational initiatives designed to empower individuals affected by excess weight to make informed decisions about their well-being. Its influence on the North American weight loss supplement market is profound and multifaceted.

In addition, advancements in research and development have led to the formulation of innovative weight loss supplements with enhanced efficacy and safety profiles. Manufacturers are leveraging scientific breakthroughs and incorporating natural ingredients, such as green tea extract, Garcinia Cambogia, and conjugated linoleic acid, to create products that resonate with health-conscious consumers.

Furthermore, the COVID-19 pandemic has led to various lifestyle changes, including increased stress, altered eating habits, and reduced physical activities. As a result, many individuals have gained weight. This situation has positively influenced the weight loss supplement market, as people seek effective solutions to manage their weight. Weight loss supplements promise quick and convenient results, making them an attractive option for those looking to combat pandemic-related weight gain.

Type Insights

The powders segment dominated the market with the largest revenue share of 37.69% in 2024. The powdered formulation offers larger supplement quantities and extended shelf life, facilitating easily regulated dosages tailored to individual needs, which drives this segment. Its convenient administration and dosage enable rapid and efficient nutrient absorption, enhancing bioavailability compared to alternative formulations. The powder segment in the weight loss supplements market is experiencing notable growth due to the introduction of key players. These companies bring innovative formulations and marketing strategies, expanding consumer awareness and driving demand for powdered supplements, thereby fueling market growth. For instance, In January 2024, Abbott revealed the introduction of its latest brand, PROTALITY, featuring a high-protein nutrition shake powder. This inaugural product within the line aims to cater to the increasing population of adults seeking to achieve weight loss goals while preserving muscle mass and ensuring optimal nutrition.

The pills segment is expected to grow at the fastest CAGR from 2025 to 2030. This growth is driven by the increasing preference for weight loss supplements in pill form, facilitated by their availability in various formats such as chewable tablets, sustained-release pills, and sublingual pills. Clinical trials play a significant role in influencing the market growth of the weight loss supplements market. Positive outcomes from well-designed trials can enhance consumer confidence, drive product adoption, and stimulate market expansion by demonstrating the efficacy and safety of weight loss supplements. For instance, in June 2023, an experimental oral medication developed by Eli Lilly demonstrated a competitive advantage compared to pills manufactured by Novo Nordisk and Pfizer.

Ingredients Insights

The vitamins and minerals segment dominated the market with the largest share of 54.67% in 2024. These supplements, rich in vitamins and minerals, not only aid in weight management but also contribute to overall nutrition and facilitate proper bodily function and metabolism. Many of these products contain antioxidants, which safeguard cells from structural alterations and improve overall health and performance. In addition, they play a role in energy generation and promote the maintenance of a healthy heart, brain, and other bodily functions. As awareness of nutritional deficiencies rises, consumers increasingly seek supplements to address these gaps, driving demand for vitamin-enriched weight loss products and stimulating market expansion. For instance, according to the CDC, half of Americans lack sufficient levels of vitamin A, vitamin C, and magnesium, while over 50 percent of the general population experiences vitamin D deficiency, irrespective of age.

The natural extracts and botanicals segment is expected to grow at a faster CAGR rate from 2025 to 2030. The increasing global interest in organic and vegan supplements, driven by growing environmental awareness, is anticipated to bolster segment growth. Supplements derived from natural extracts and botanicals, including caffeine, green tea extract, Garcinia Cambogia, licorice root, ginseng, and green coffee bean extract, are popular. Furthermore, the demand for traditional remedies is opening avenues for innovative products from local players entering the market.

Distribution Channel Insights

The offline segment dominated the market with a share of 70.57% in 2024. The increasing accessibility of weight loss supplements in retail pharmacies, drug stores, health & beauty stores, and department stores is fueling growth in this segment. Furthermore, health & beauty stores and department stores are taking proactive measures to raise awareness about maintaining good health, which is anticipated to have a positive influence on segment expansion. Additionally, offline stores are consistently enhancing overall customer engagement and shopping experiences. Many health stores and department stores have implemented point-of-sale terminals to expedite the checkout process.

The online distribution channel segment is expected to record the fastest CAGR from 2025 to 2030. Online retailers are providing attractive discounts on product prices, thereby stimulating sales through digital channels. Moreover, online platforms are formulating and executing various strategies to rival offline competitors. The convenience offered by online distribution channels is favorably influencing segment expansion. In addition, with the increasing prevalence of e-commerce, there is a gradual transition toward online distribution channels for supplements. The increase in self-directed consumers is also a significant driver of segment growth.

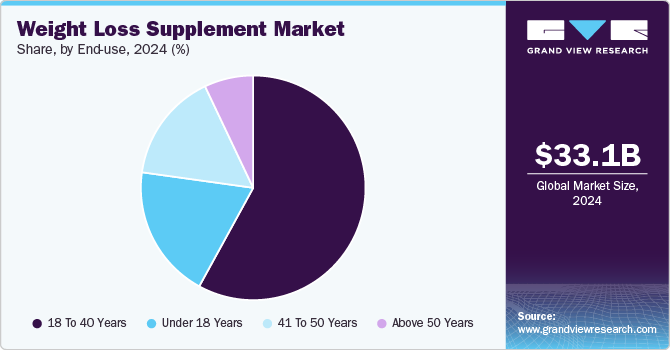

End-use Insights

The 18 to 40 years segment held the larger revenue share of 57.98% in 2024. The increasing demand to uphold a healthy body weight and achieve an ideal physique is anticipated to propel the growth of this segment. The upward trend in disposable income and growing engagement in physical fitness pursuits are projected to have a favorable influence on segment expansion.

The increasing understanding of the advantages and mechanisms of weight loss supplements is forecasted to propel the segment forward. According to estimates from the National Institutes of Health in 2021, around 15% of U.S. adults have reported consuming weight-loss dietary supplements at some point in their lives, with a higher consumption rate observed among female adults compared to males. The rising desire for appetite suppressants, fat burners, and craving reducers is fueling growth within the segment.

The under 18 years segment is expected to grow at a significant CAGR from 2025 to 2030. The increasing awareness among consumers within this age demographic regarding the benefits of the product is poised to propel the segment forward. In addition, the rise in disposable income within this segment is anticipated to contribute positively to its growth.

Regional Insights

North America weight loss supplement market accounted for the largest revenue share of 35.97% in 2024 for the weight loss supplement market, driven by various factors including increasing health consciousness, rising disposable incomes, and the prevalence of sedentary lifestyles. In addition, advancements in product formulations and marketing strategies have bolstered consumer engagement, while the convenience of online platforms has expanded accessibility.

Alongside traditional supplements, emerging pharmaceutical interventions like the experimental drug retatrutide are generating significant interest. In a clinical trial presented at the American Diabetes Association's annual meeting in San Diego, retatrutide demonstrated promising results, with participants achieving an average weight loss of approximately 24% of their body weight, equivalent to around 58 pounds. Such breakthroughs underscore the growing momentum and potential for innovative approaches to combat obesity and promote healthier lifestyles across North America.

U.S. Weight Loss Supplements Market Trends

The U.S. weight loss supplement market is expected to grow over the forecast period, driven by factors such as increasing health consciousness, rising obesity rates, and a growing focus on wellness. In this evolving landscape, startups such as Noom are playing a pivotal role in shaping consumer behavior and preferences. Noom, known for its innovative approach to weight management through personalized coaching and behavior tracking, is expanding its offerings to include a new program called Noom Med. This program represents a significant development as it integrates the use of anti-obesity medications, such as Wegovy, into Noom's comprehensive weight loss solutions. This expansion not only diversifies Noom's service offerings but also underscores the growing integration of pharmaceutical interventions within the broader landscape of weight management solutions in the U.S. market.

Europe Weight Loss Supplement Market Trends

The Europe weight loss supplement market is projected to grow significantly due to rising health concerns, increasing awareness, and consumer preference for natural products. Key growth factors include higher demand for personalized nutrition, technological advancements, and the prevalence of obesity in the region. For instance, in 2019, the European health interview survey revealed significant variations in the proportion of overweight and obese adults across different countries in the European Union (EU).

The weight loss supplement market in the UK held a significant share in 2024. The UK market is witnessing significant growth, aligning with the increasing prevalence of obesity. This highlights the public's need for effective solutions to combat this health issue. For instance, in the Health Survey for England 2021, it was found that 25.9% of adults in England are obese, while 37.9% are overweight, indicating a growing concern for public health and the need for effective weight management solutions.

France weight loss supplement market is experiencing growth, mirroring the rise in obesity rates. In 2020, overweight and obesity affected nearly half of the adult population in France. Among them, 47% were classified as overweight, with 17% specifically struggling with obesity. This highlights the growing concern for public health in the country.

The weight loss supplement market in Germany is flourishing due to a combination of factors such as a health-conscious population, advanced healthcare infrastructure, and the availability of high-quality products. A 2022 report by NIH revealed that over 53% of adult Germans grapple with overweight issues, with men experiencing it more frequently than women. Both sexes faced an obesity prevalence of 19%. Notably, the occurrence of overweight and obesity tends to rise with age in both genders.

Asia Pacific Weight Loss Supplement Market Trends

The Asia Pacific weight loss supplement market held the highest CAGR over the forecast period. largely driven by factors such as increasing health consciousness, rising obesity rates, and a growing preference for natural and herbal products. With a population that is becoming more health-aware and proactive in managing their weight, the demand for effective weight loss supplements has surged. Several factors contribute to the market's expansion in this region. Firstly, the rising prevalence of obesity and lifestyle-related diseases has led consumers to seek alternative solutions to maintain a healthy weight. Secondly, the growing middle class with disposable income is more inclined to invest in self-care and wellness products.

The China weight loss supplement market is experiencing significant growth, driven by factors such as increasing health consciousness, a rising middle class, and the growing prevalence of obesity and lifestyle-related diseases. As more Chinese citizens become aware of the importance of maintaining a healthy weight and adopting healthier lifestyles, the demand for effective weight loss supplements has risen. In a study conducted in August 2023, it was found that among the participants, 34.8% were classified as overweight, while 14.1% were identified as obese in China. Notably, the prevalence of overweight and obesity was higher in males than in females across the overall study population.

Japan weight loss supplement market is witnessing notable growth. Manufacturers and retailers in Japan are responding to these trends by introducing new, high-quality weight loss supplements that cater to the diverse preferences of Japanese consumers. As the market continues to evolve, it is expected that the growth of the weight loss supplement industry in Japan will remain robust, offering ample opportunities for businesses and investors in this sector.

MEA Weight Loss Supplement Market Trends

The weight loss supplement market in MEA has experienced considerable growth in recent years, driven by several factors. Rising health consciousness among consumers, increasing obesity rates, and growing disposable incomes have contributed to the expansion of this market. Additionally, the influence of Western lifestyles and dietary habits has fueled the demand for weight loss products in the region. Moreover, advancements in product formulations, marketing strategies, and distribution channels have further propelled market growth. With consumers increasingly prioritizing health and wellness, the weight loss supplement market in the Middle East and Africa is poised for continued expansion in the coming years.

Saudi Arabia weight loss supplement market has experienced steady growth in recent years, paralleling the rising prevalence of obesity in the country. With lifestyle changes and dietary habits shifting, the demand for weight management solutions has increased significantly. A recent study published by the National Institutes of Health in March 2023 reported a significant finding from a comprehensive survey conducted across all regions of Saudi Arabia (KSA). The survey revealed that obesity prevalence in the country stands at 24.7%.

The weight loss supplement market in Kuwait is experiencing notable growth, driven by factors such as increasing health consciousness, rising obesity rates, and a growing preference for natural and herbal products. As the population in Kuwait becomes more health-aware and proactive in managing their weight, the demand for effective weight loss supplements is on the rise.

Key Weight Loss Supplement Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve the availability of their products, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Weight Loss Supplement Companies:

The following are the leading companies in the weight loss supplement market. These companies collectively hold the largest market share and dictate industry trends.

- Glanbia PLC

- GlaxoSmithKline PLC

- Herbalife Nutrition Ltd.

- Abbott

- Nestle

- Amway Corp.

- Ajinomoto Co. Inc.

- NutriSport Pharmacal, Inc.

- GNC Holdings, LLC

- LifeVantage Corporation

Recent Developments

-

In March 2024, Novo Nordisk disclosed that the U.S. FDA granted further approval for Wegovy. This approval extends its indication to include the reduction of major cardiovascular events, such as heart attack, or stroke, in adults diagnosed with known heart disease who are either obese or overweight. This recommendation is in conjunction with a reduced calorie diet and increased physical activity.

-

In January 2024, Abbott, a U.S. introduced its latest offering, the PROTALITY brand. This new line features a high-protein nutrition shake, designed to cater to the increasing demographic of adults seeking to manage weight loss while preserving muscle mass and ensuring optimal nutrition.

-

In January 2024, GNC, a U.S. based company, unveiled its latest product, GNC Total Lean GlucaTrim, a multi-action weight loss supplement. Engineered with an innovative formula, it aids in weight and inch reduction while preserving lean muscle mass and promoting healthy blood sugar and insulin levels.

-

In February 2024, Herbalife unveiled its latest innovation, the Herbalife GLP-1 Nutrition Companion, introducing a new series of food and supplement product combinations. These offerings, available in both Classic and Vegan options, are now accessible in the U.S. and Puerto Rico, offering consumers a diverse array of flavors to choose from.

Weight Loss Supplement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.91 billion

Revenue forecast in 2030

USD 71.59 billion

Growth rate

CAGR of 14.17% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, ingredients, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Glanbia PLC; GlaxoSmithKline PLC; Herbalife Nutrition Ltd. Abbott;NutriSport Pharmacal, Inc.; Nestle; GNC Holdings, LLC; Amway Corp.; LifeVantage Corporation; Ajinomoto Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Weight Loss Supplement Market Report Segmentation

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Softgels

-

Pills

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins & Minerals

-

Amino Acids

-

Natural Extracts/ Botanicals

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Under 18 years

-

18 To 40 Years

-

41 To 50 Years

-

Above 50 Years

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline Channel

-

Online Channel

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global weight loss supplement market size was estimated at USD 33.14 billion in 2024 and is expected to reach USD 36.91 billion in 2025.

b. The global weight loss supplements market is expected to grow at a compound annual growth rate of 14.17% from 2025 to 2030 to reach USD 71.59 billion by 2030.

b. The vitamins & minerals segment dominated the weight loss supplements market with a share of 54.67% in 2024.

b. Some key players operating in the weight loss supplement market include Glanbia PLC, GlaxoSmithKline PLC, Herbalife Nutrition Ltd, Abbott, NutriSport Pharmacal, Inc, Amway Corporation, and Nestle

b. Key factors that are driving the weight loss supplements market are rapidly rising global obesity levels and the increasing prevalence of obesity-related disorders such as diabetes, hypertension, and cardiovascular diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.