- Home

- »

- Drilling & Extraction Equipments

- »

-

Well Intervention Market Size & Share, Industry Report, 2033GVR Report cover

![Well Intervention Market Size, Share & Trends Report]()

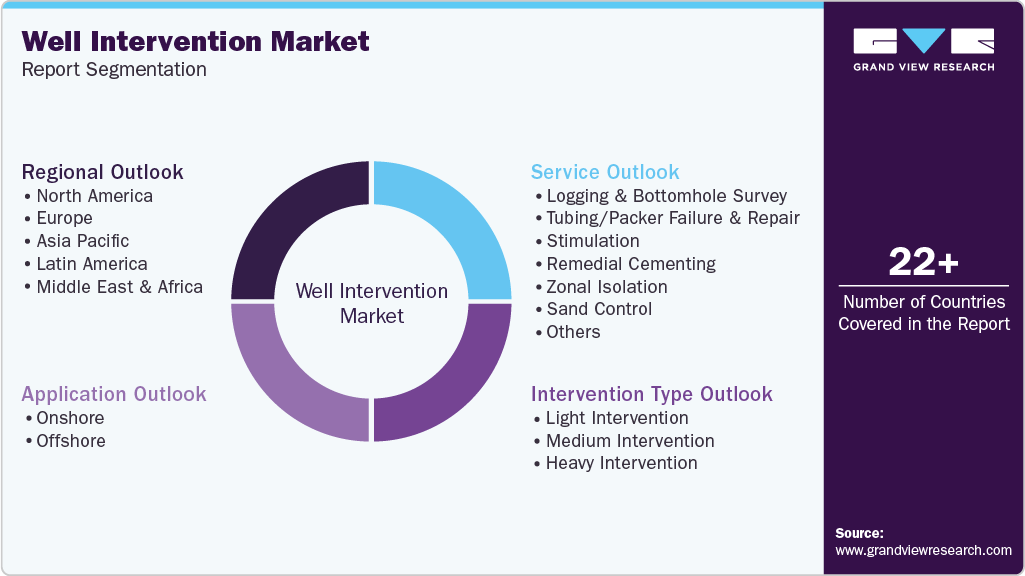

Well Intervention Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Onshore, Offshore), By Intervention Type (Light, Medium, Heavy), By Service (Stimulation, Remedial Cementing, Zonal Isolation, Sand Control), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-914-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Well Intervention Market Summary

The global well intervention market size was estimated at USD 9.79 billion in 2025 and is projected to reach USD 14.23 billion by 2033, growing at a CAGR of 5.0% from 2026 to 2033. The industry is experiencing steady growth driven by the increasing number of mature oil and gas wells, rising focus on production optimization and well-integrity management, and a growing preference for extending the life of existing assets over capital-intensive new drilling.

Key Market Trends & Insights

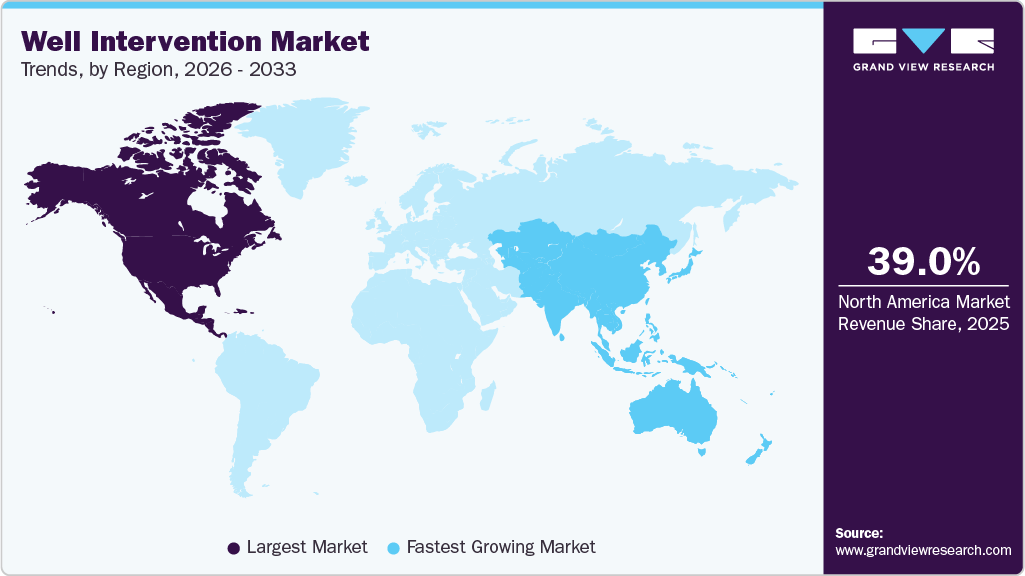

- The North America well intervention market held the largest share of over 39.0% of the global market in 2025.

- The Asia Pacific well intervention market is expected to grow at the fastest CAGR of 6.0% over the forecast period.

- By service, the stimulation segment dominated the market and accounted for a share of over 20.0% in 2025.

- By intervention type, the light intervention segment dominated the market and accounted for a share of over 57.0% in 2025.

- By application, the onshore segment dominated the market and accounted for a share of over 68.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 9.79 Billion

- 2033 Projected Market Size: USD 14.23 Billion

- CAGR (2026-2033): 5.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Sustainability is becoming an increasingly important consideration in the well intervention industry as operators seek to maximize production from existing wells while minimizing environmental impact. By extending the productive life of mature assets, well intervention reduces the need for new drilling, thereby lowering land disturbance, material consumption, and the overall carbon footprint. Operators are also focusing on interventions to improve integrity, reduce methane leakage, and ensure the safe abandonment of depleted wells, in line with tightening environmental regulations. The growing emphasis on regulatory compliance, emissions monitoring, and responsible asset management is positioning intervention as a key enabler of more sustainable upstream oil and gas operations.

Technological advancement is a central growth pillar of the well intervention market, with increasing adoption of digital platforms, real-time downhole monitoring, automation, and advanced intervention tools. Innovations such as data-driven diagnostics, predictive maintenance, and remotely operated intervention systems are improving operational efficiency, reducing non-productive time, and enhancing safety, particularly in offshore and high-pressure, high-temperature environments. The integration of digital analytics with coiled tubing, wireline, and subsea intervention systems is enabling operators to make faster, more informed decisions, supporting higher recovery rates and more cost-effective well lifecycle management.

Drivers, Opportunities & Restraints

The industry is primarily driven by the growing need to sustain production from mature and declining oil and gas wells, as operators prioritize maximizing recovery from existing assets while maintaining capital discipline. Rising intervention activity is further supported by digitalization and efficiency-focused technologies that reduce non-productive time and operating costs. For instance, in August 2025, SLB announced the acquisition of Stimline Digital AS, a specialized well-intervention software provider, strengthening its digital intervention capabilities and underscoring the industry’s focus on data-driven optimization to improve intervention outcomes in complex wells.

The market presents significant opportunities through the growing adoption of advanced digital platforms, automation, and remote intervention technologies, particularly in offshore and subsea environments where cost and safety are critical. Increasing regulatory and operator focus on extending field life in mature basins is creating demand for light well intervention and subsea-based solutions. In late 2025, the UK’s North Sea Transition Authority publicly urged operators to step up well intervention and redevelopment activities to revive shut-in wells and maintain domestic production, underscoring strong policy and operator support for intervention-led asset life extension in mature offshore regions.

Despite favorable fundamentals, the well intervention market faces restraints related to high service costs, project complexity, and sensitivity to upstream capital expenditure cycles. Deepwater and HPHT intervention operations require specialized equipment and skilled personnel, increasing cost pressures for operators. In January 2026, Halliburton reported that while international well intervention and stimulation activity supported stronger margins, slower North American activity reflected cautious operator spending, illustrating how regional capex volatility and cost considerations can temporarily limit intervention demand.

Application Insights

The onshore segment dominated the industry in 2025, accounting for over 68.0% of the market, as continued development of new oilfields and maintenance of existing wells increased demand for intervention services. Global operators are expanding onshore drilling and well-optimization programs to sustain production and enhance recovery from aging assets, which, in turn, drives the application of well-intervention technologies. For instance, in 2025, oilfield services activity in Western Canada surged, with drill rig deployments and intervention work increasing year-on-year as operators prepared over 6,600 wells for drilling and associated well service work, reflecting growth in onshore drilling and intervention efforts across key North American plays.

The offshore segment is expected to grow at the fastest CAGR over the forecast period, supported by expanding offshore drilling and subsea intervention projects in deepwater and ultra-deepwater environments. Investment in offshore production optimization, combined with long-term vessel charters and intervention contracts, is increasing demand for specialized offshore intervention solutions and services. A concrete 2025 example is Halliburton being awarded a multi-year offshore intervention and plug-and-abandonment contract with Petrobras in Brazil, set to begin in the second quarter of 2025, which underscores rising offshore intervention service activity in major offshore basins.

Service Insights

The stimulation segment dominated the industry in 2025, accounting for over 20.0% of the market share, driven by the growing number of well-stimulation campaigns aimed at increasing hydrocarbon flow from the reservoir into the wellbore. Operators continue to rely on acidizing, fracturing, and other stimulation techniques to improve productivity in both onshore and offshore wells. For example, in 2025, Schlumberger completed a deepwater stimulation campaign in the Gulf of Mexico involving three high-pressure wells at water depths exceeding 7,000 feet, successfully optimizing production through advanced acidizing and fracturing techniques, reflecting sustained demand for stimulation services in mature offshore fields.

The re-perforation segment is projected to grow at the fastest CAGR over the forecast period, as it enables operators to establish an efficient flow path between the reservoir and the wellbore, improving production and well performance. Technological advancements and innovative intervention tools are accelerating the adoption of re-perforation services globally. In 2025, Baker Hughes introduced its upgraded “iPerforate” system, a modular perforation technology designed for high-temperature, high-pressure wells, enabling flexible deployment across multiple well types and enhancing operational reliability, underscoring growing market uptake of advanced re-perforation solutions.

Intervention Type Insights

The light intervention segment dominated the well intervention market in 2025, accounting for over 57.0% of the market share, as it enables operators to perform repairs and maintenance without fully shutting in wells, thereby minimizing production losses. Light well intervention techniques, including wireline, coiled tubing, and minor downhole repairs, remain widely adopted for cost-effective and rapid remediation. For example, in 2025, SLB was awarded a multi-year light well intervention contract by Equinor in the North Sea, involving riderless light well intervention (RLWI) services to maintain production in mature offshore fields, highlighting continued reliance on light intervention solutions to enhance operational efficiency.

The heavy intervention segment is expected to grow at the fastest CAGR over the forecast period, as it enables full-scale well repair, replacement of major components, and complete maintenance of downhole equipment. This includes replacing worn-out tubulars, tubing strings, pumps, and other critical components that cannot be addressed during light intervention. In 2025, Halliburton executed a heavy-intervention campaign in the Gulf of Mexico, replacing damaged tubing strings and performing a full well refurbishment on three deepwater wells, demonstrating the growing adoption of heavy intervention for production optimization and well-life extension.

Regional Insights

The North America well intervention market is driven by a large base of mature onshore and offshore wells, particularly in unconventional shale plays and aging conventional assets. High drilling intensity in shale basins, coupled with declining production profiles, has increased demand for coiled tubing, wireline, and remedial intervention services to sustain output and improve recovery. Operators in the region emphasize cost efficiency, rapid deployment, and digital-enabled intervention solutions, supporting steady demand for advanced technologies and integrated service offerings.

U.S. Well Intervention Market Trends

The well intervention market in the U.S. represents the largest and most technologically advanced market globally, supported by extensive shale operations across the Permian, Eagle Ford, Bakken, and Marcellus basins. Frequent well restimulation, workovers, and integrity management activities are critical to maintaining production levels in horizontal and multistage fractured wells. Strong adoption of automation, real-time data analytics, and fit-for-purpose intervention systems continues to enhance operational efficiency and drives sustained investment in intervention services.

Asia Pacific Well Intervention Market Trends

The well intervention market in Asia Pacific is supported by a combination of mature onshore fields, offshore developments, and rising energy demand across countries such as China, India, Australia, Malaysia, and Indonesia. National oil companies play a central role, with an increasing emphasis on production optimization, workovers, and well-integrity management. Growing offshore activity and investments in brownfield redevelopment are driving demand for both conventional and advanced intervention services across the region.

Europe Well Intervention Market Trends

The well intervention market in Europe is primarily driven by offshore activities in the North Sea, where operators focus on extending the life of mature oil and gas fields. High operating costs and stringent regulatory standards encourage the use of advanced, low-risk intervention techniques, including light well intervention and subsea-based solutions. The market is characterized by a strong focus on safety, asset integrity, and maximizing recovery from existing infrastructure rather than new field developments.

Latin America Well Intervention Market Trends

The well intervention market in Latin America is driven by aging oilfields in countries such as Mexico, Brazil, Argentina, and Colombia, where production enhancement and field redevelopment are strategic priorities. Offshore intervention demand is rising, particularly in Brazil’s deepwater and pre-salt developments, while onshore markets focus on workovers and remedial services. Budget sensitivity and operational efficiency remain key considerations, underscoring demand for cost-effective, modular intervention solutions.

Middle East & Africa Well Intervention Market Trends

The well intervention market in the Middle East & Africa is underpinned by a vast inventory of long-producing oil and gas wells and ongoing efforts to maintain high production capacity. National oil companies in the Middle East invest heavily in well integrity, scale management, and production optimization, while Africa’s market is shaped by offshore developments and mature onshore fields. The region places strong emphasis on large-scale intervention programs, advanced technologies, and long-term service contracts to sustain reservoir performance and extend asset life.

Key Well Intervention Company Insights

Some of the key players operating in the global well intervention market include Halliburton Company, Schlumberger Limited, among others.

-

Schlumberger Limited (SLB), founded in 1926, is a leading global oilfield technology and services provider with operations spanning North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. The company offers an extensive portfolio of well-intervention solutions, including wireline, slickline, coiled tubing, well-integrity, and digital-intervention technologies, supporting the full life cycle of oil and gas wells. SLB is widely recognized for its technological leadership, advanced downhole systems, and integration of digital platforms and automation to enhance performance, recovery efficiency, and operational reliability.

-

Halliburton Company, established in 1919, is one of the world’s largest providers of products and services to the energy industry, with a strong global footprint across major upstream oil and gas markets. The company delivers a comprehensive range of well intervention and completion services, including wireline and perforating, coiled tubing, stimulation, and well integrity solutions. Halliburton is known for its deep domain expertise, integrated service model, and focus on improving productivity and asset life through advanced engineering, real-time data analytics, and innovative service delivery.

-

Baker Hughes Company, founded in 1907, is a global energy technology company with operations across North America, Europe, the Middle East, Africa, and the Asia Pacific. The company provides a wide array of well intervention products and services, encompassing coiled tubing, pressure control, well remediation, and intervention tools, serving both onshore and offshore applications. Baker Hughes is recognized for combining equipment manufacturing with service capabilities, leveraging digital solutions, advanced materials, and engineering expertise to optimize well performance, reduce operational risk, and support more efficient and sustainable energy production.

Key Well Intervention Companies:

The following key companies have been profiled for this study on the well intervention market

- Archer (Deepwell AS)

- Baker Hughes Company

- Expro Group

- HALLIBURTON COMPANY

- Helix Energy

- Hunting PLC

- NOV.

- Oceaneering International, Inc.

- SLB

- TechnipFMC plc

- Weatherford

- Welltec A/S

Recent Developments

-

In October 2025, SLB announced the commercial deployment of an enhanced digital well intervention platform integrating real-time downhole data, predictive analytics, and remote operations, enabling operators to optimize intervention timing, reduce non-productive time, and improve well integrity management across mature onshore and offshore assets. This development reinforces SLB’s strategy of combining intervention services with advanced digital technologies to extend well life and lower operating costs.

-

In November 2025, Halliburton launched a next-generation coiled tubing intervention system designed for high-pressure, high-temperature (HPHT) wells, offering improved fatigue resistance, higher pumping efficiency, and enhanced downhole reach. The solution is aimed at complex well environments in deepwater and unconventional plays, supporting operators’ efforts to maximize recovery from technically challenging reservoirs.

-

In December 2025, Baker Hughes expanded its well intervention portfolio with the introduction of a modular intervention and pressure control solution for subsea and offshore applications, enabling faster mobilization and reduced vessel time during intervention campaigns. This advancement supports cost-effective offshore well maintenance and aligns with the growing demand for efficient intervention solutions in mature offshore fields.

Well Intervention Market Report Scope

Report Attribute

Details

Market Definition

The well intervention market size is calculated by multiplying the number of active wells requiring intervention by the average expenditure per well for services and equipment, segmented by type and region. Forecasts are then adjusted using historical growth rates, drilling activity, and technology adoption to estimate future market value.

Market size value in 2026

USD 10.10 billion

Revenue forecast in 2033

USD 14.23 billion

Growth rate

CAGR of 5.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, intervention type, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Norway; France; Netherlands; Russia; China; India; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; UAE; Kuwait

Key companies profiled

Archer (Deepwell AS); Baker Hughes Company; Expro Group; Halliburton Company; Helix Energy; Hunting PLC; NOV.; Oceaneering International, Inc.; SLB; TechnipFMC plc; Weatherford; Welltec A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Well Intervention Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global well intervention market report on the basis of application, intervention type, service, and region.

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Onshore

-

Offshore

-

-

Intervention Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Light Intervention

-

Medium Intervention

-

Heavy Intervention

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Logging and Bottomhole Survey

-

Tubing / Packer Failure and Repair

-

Stimulation

-

Remedial Cementing

-

Zonal Isolation

-

Sand Control

-

Artificial Lift

-

Fishing

-

Re-perforation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Norway

-

UK

-

France

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Malaysia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. By service, the stimulation segment dominated the market, accounting for over 20.0% in 2025.

b. The global well intervention market size was estimated at USD 9.79 billion in 2025 and is expected to reach USD 10.10 billion in 2026

b. The global well intervention market is expected to grow at a compound annual growth rate of 5.0% from 2026 to 2033, reaching USD 14.23 billion by 2033

b. Some of the key players operating in the global well intervention market include Archer (Deepwell AS); Baker Hughes Company; Expro Group; Halliburton Company; Helix Energy; Hunting PLC; NOV.; Oceaneering International, Inc.; SLB; TechnipFMC plc; Weatherford; Welltec A/Sand, and others

b. The well intervention market is primarily driven by the growing number of mature and aging oil and gas wells requiring production optimization, integrity management, and life-extension activities. Increasing focus on maximizing recovery from existing assets, while controlling costs and minimizing downtime, continues to support sustained demand for intervention services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.