- Home

- »

- Medical Devices

- »

-

Wellness Tourism Market Size & Trends Analysis Report, 2030GVR Report cover

![Wellness Tourism Market Size, Share & Trends Report]()

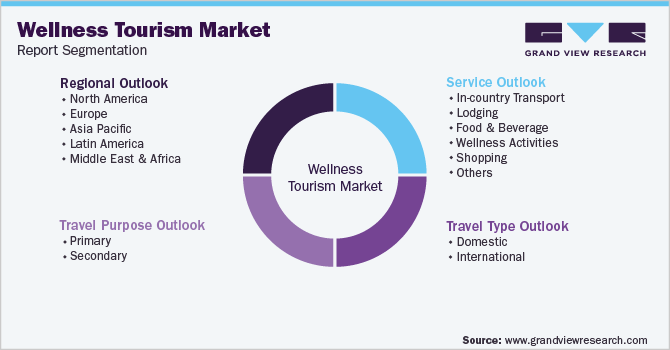

Wellness Tourism Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Lodging, Wellness Activities), By Travel Purpose (Primary, Secondary), By Travel Type (Domestic, International), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-217-4

- Number of Report Pages: 121

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wellness Tourism Market Summary

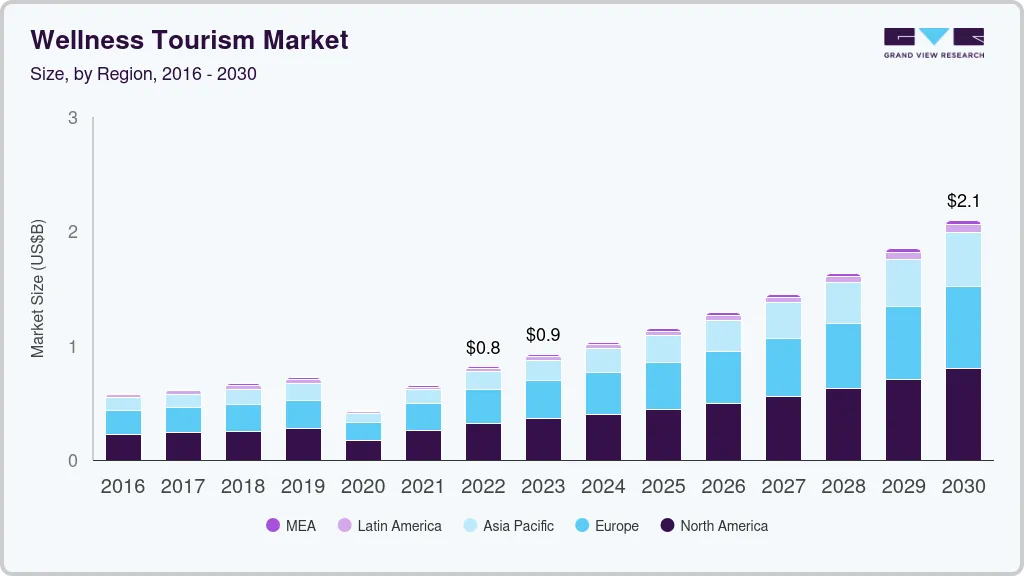

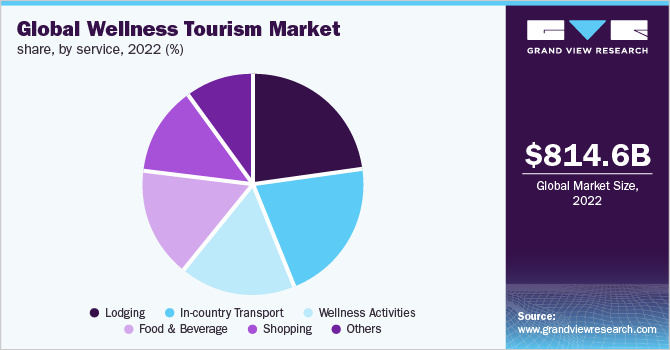

The global wellness tourism market size was estimated at USD 814.6 billion in 2022 and is projected to reach USD 2100 billion by 2030, growing at a CAGR of 12.42% from 2023 to 2030. Wellness tourism refers to tourism activities aimed at improving and enhancing an individual's physical, mental, and spiritual well-being.

Key Market Trends & Insights

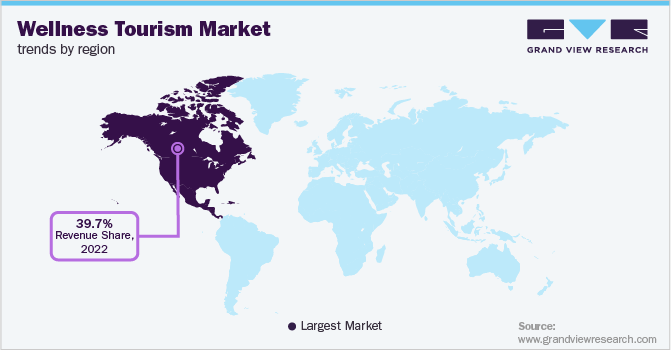

- North America dominated the market with a revenue share of 39.7% in 2022.

- In terms of service, the lodging segment dominated the market with a revenue share of 23.3% in 2022.

- Based on travel purpose, the secondary segment held the maximum market share in 2022.

- On the basis of travel type, domestic segment accounted for a major portion of the global wellness tourism market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 814.6 Billion

- 2030 Projected Market Size: USD 2100 Billion

- CAGR (2023-2030): 12.42%

- North America: Largest market in 2022

Tourists indulge in physical, spiritual, and mental activities by practicing yoga, spas, meditation, and Pilates, and by visiting hot spring resorts. The trend of interacting with the locals of the destination who have visited and experienced different cultures promotes personal well-being.Unlike medical tourism, wellness tourism focuses on the prevention of diseases. It emphasizes a healthy lifestyle and improved quality of life. On the other hand, medical tourism involves treating an already diagnosed condition. Wellness is a precautionary measure to optimize health. The growing number of tourists across the globe has contributed to the requirement for various well-being services. Service providers are focusing on offering spa therapies and other activities to ensure customer satisfaction. In addition, increased expenditure in the tourism sector is expected to have a positive impact on the market.

The COVID-19 pandemic had a profound impact on the market. Restrictions on international travel, stay-at-home orders, and business closures were the primary factors for the decline of the market. Many countries closed their borders to visitors and banned international flights. This resulted in a drastic decline in the number of tourists. According to the Global Wellness Institute (GWI), the number of wellness trips fell by 35.8% in 2020 to 600.8 million globally. The sudden shutdown of economic activities around the world resulted in business closures, job losses, layoffs, and a decline in the purchasing power of consumers. This, coupled with fear of infection, prevented people from traveling to other countries.

However, vaccination drives across the world, relaxation of travel restrictions, and a decrease in the number of COVID-19 cases are anticipated to favor the market growth. According to UNWTO, the number of people traveling abroad reached 900 million in 2022, 63% of the pre-pandemic levels. Furthermore, a gradual rise in the number of business travelers and the opening of spas and resorts with full capacity is likely to bode well for the market.

COVID-19 wellness tourism market impact from 2019 to 2021: 37.1% decrease from 2019 to 2021

Pandemic Impact

Post-COVID Outlook

The COVID-19 pandemic had a profound impact on the market. Restrictions on international travel, stay-at-home orders, and business closures are primary factors for the decline of the market. Many countries closed their borders to visitors and banned international flights. This resulted in a drastic decline in the number of tourists. According to Global Wellness Institute, the number of wellness trips fell by 35.8% in 2020, globally.

According to the UNWTO, international tourist arrival rose by 4% in 2021, equivalent to 15 million international tourist arrivals (overnight visitors), when compared to 2020 (415 million versus 400 million). However, international arrivals are still 72% lower than in the pre-pandemic year of 2019.

The sudden shutdown of economic activities worldwide has resulted in business closures, job losses, layoffs, and a decline in the purchasing power of consumers. This, coupled with fear of infection, prevented people from traveling to other countries.

Vaccination drive across the world, relaxation of travel restrictions, and a decrease in the number of COVID-19 cases are anticipated to favor the market growth. Furthermore, a gradual rise in the number of business travelers and the opening of spas and resorts with full capacity is likely to bode well for the market.

Hectic work schedules and sedentary lifestyles along with the lack of physical activities have resulted in rising cases of various lifestyle-related diseases, such as diabetes, obesity, and high cholesterol levels. According to data published by the WHO, the global burden of diseases will rise to 56% by 2030. Therefore, the rising burden of such diseases is expected to result in a growing demand for health-specific travel.

Service Insights

In terms of service, the lodging segment dominated the market with a revenue share of 23.3% in 2022. The increasing penetration of luxury and high-end hotels & resorts in popular tourist destinations is a major contributor to the growth of the lodging segment. Lodging can be found in a tent, caravan or campervan, hotel, motel, hostel, inn, private home (commercial, such as a bed & breakfast, guest house, or vacation rental), or homestay.

The wellness spa demand is being shaped by the ever-changing needs of its customers. Anti-aging products are getting more popular as clients become more social media savvy. The industry is being driven by rising demand for anti-aging skincare treatments. The demand for such services is also being boosted by increased consumer disposable income, particularly in emerging markets.

The wellness activities segment is expected to witness remarkable growth during the forecast period. This can be attributed to the increasing consumer spending on spas, body massages, meditation, yoga, Ayurveda therapy, and others. Furthermore, the in-country transport and food and beverages segment will have significant growth during the projection period due to the increasing emphasis and demand for self-care during the pandemic.

Travel Purpose Insights

Based on travel purpose, the secondary segment held the maximum market share in 2022 and is expected to continue its dominance during the forecast period. Secondary tourism activities include tourists seeking well-being activities when it is not the primary motivation for the trip. In secondary tourism, spa treatments, body experiences, and mind & health activities are added to leisure or business travel. According to GWI, secondary travel accounted for around 92.0% of wellness tourism trips in 2020. This can be attributed to the rising uptake of wellness services during international business meetings.

The primary segment is expected to witness substantial growth in the coming years. More people are incorporating aspects of health, preventive care, self-fulfillment, and mindfulness into their daily lives across the globe. People nowadays like to maintain a fitness routine and a healthy lifestyle even when they travel, which is boosting segment growth.

According to GWI, primary visitors at the domestic level spend almost 178% more than the average traveler. At the international level, they spend 53% more. Hence, the government is focusing on attracting primary travelers to increase their revenue. This is anticipated to boost segment growth.

Travel Type Insights

On the basis of travel type, the market is bifurcated into domestic and international. The domestic segment accounted for a major portion of the global wellness tourism market in 2022. The segment is estimated to maintain its dominance throughout the forecast period. Rising expenditure recorded by domestic travelers for wellness activities is contributing to segment growth. Furthermore, the COVID-19 pandemic has helped increase the number of domestic visitors, as international borders were closed. As a result, tourists went to destinations within their home countries.

Domestic travelers have less difficulty visiting nearby attractions. Furthermore, due to budgetary constraints, budget-conscious visitors and low and middle-income workers often avoid international travel. This is anticipated to foster the growth of the segment. Domestic and local travel, outdoor activities, and preference for nature-based products are among the key travel trends augmenting the segment's growth.

The international segment is expected to register the fastest CAGR during the forecast period. This is mainly due to increased spending per trip, increased travel to overseas destinations, rising disposable income, and increasing popularity of Southeast Asian countries such as Thailand & Malaysia as tourism destinations offering services at lower prices. Furthermore, increasing spending on social and physical well-being, especially due to concern for a healthy lifestyle, is propelling segment growth.

Regional Insights

North America dominated the market with a revenue share of 39.7% in 2022. This is due to the increasing emphasis on physical and mental health and high disposable income. Active marketing by top players on the importance of physical and mental well-being achieved through yoga, rejuvenation therapy, herbal remedies, meditation, agritourism, and spa therapies at exotic destinations is increasing the number of trips to North America.

Europe is estimated to account for the second most prominent position in the market. The rising need for well-being services owing to increasing cases of stress-related health issues has boosted the market growth in the region. As per Eurostat, 56.0% of people from the European Union had at least one personal tour in 2021. Moreover, Spain was the most popular destination for international tourists in the European Union. Spain has an abundance of thermal springs, which help in soothing aches & pains.

The market in Asia Pacific is estimated to witness lucrative growth due to the growing popularity of various exotic destinations such as China, India, Malaysia, Indonesia, Thailand, and Singapore. In addition, the proliferation of hotel chains with centers offering massages, spa treatments, herbal treatments, and rejuvenation programs is projected to positively impact the market growth in the region. In February 2019, Aman Spa Amanpuri, a wellness center that also provides medical services, opened in Thailand. Also, in July 2018, Evolution Wellness Holdings, a company based in Malaysia, launched a new wellness resort named Fivelements Pte. Ltd. The entry of new players in the market is likely to intensify competition and significantly contribute to the growth of the market in Asia Pacific.

Key Companies & Market Share Insights

The market is highly fragmented in nature. Key players are adopting strategies such as partnerships, mergers, and acquisitions to strengthen their presence in the region. For instance, in May 2022, Hilton announced that it had signed an agreement with CKR Resort to launch the flagship brand Hilton Hyderabad Resort & Spa in Hyderabad. Similarly, OneSpaWorld, a provider of health & well-being services for cruise ships and resorts, announced a partnership with Haymaker Acquisition Corp., an acquisition company, to form a new holding company known as OneSpaWorld Holdings Ltd. in March 2019. Some of the prominent players in the global wellness tourism market include:

-

Hilton

-

Accor

-

Hyatt Corporation

-

Rancho La Puerta, Inc.

-

Marriot International, Inc.

-

Rosewood Hotel Group

-

Niraamaya Wellness Retreat

-

InterContinental Hotels Group

-

Omni Hotels & Resorts

-

Radisson Hospitality

-

Four Seasons Hotels Limited

Wellness Tourism Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 923.6 billion

The revenue forecast in 2030

USD 2.1 trillion

Growth Rate

CAGR of 12.42% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, travel purpose, travel type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Spain; France; Italy; Switzerland; Japan; China; India; Australia; Thailand; South Korea; Malaysia; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Hilton; Marriott International, Inc.; Accor; Hyatt Corporation; Radisson Hospitality; InterContinental Hotels Group; Rancho La Puerta, Inc.; Omni Hotels & Resorts; Niraamaya Wellness Retreat; Four Seasons Hotels Limited

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Wellness Tourism Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wellness tourism market report based on service, travel purpose, travel type, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-country Transport

-

Lodging

-

Food & Beverage

-

Wellness Activities

-

Shopping

-

Others

-

-

Travel Purpose Outlook (Revenue, USD Billion, 2018 - 2030)

-

Primary

-

Secondary

-

-

Travel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Malaysia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wellness tourism market size was estimated at USD 814.6 billion in 2022 and is expected to reach USD 923.6 billion in 2023.

b. The global wellness tourism market is expected to grow at a compound annual growth rate of 12.42% from 2023 to 2030 to reach USD 2.1 trillion by 2030

b. Based on services, the lodging segment dominated the wellness tourism market with a share of 23.27% in 2022. The increasing penetration of luxury and high-end hotels & resorts in popular tourist destinations is a major contributor to the growth of the lodging segment

b. Some of the key companies in the market are Hilton Worldwide; Marriot International; Accor Hotels; Hyatt Hotels; Rosewood Hotels; Radisson Hospitality; InterContinental Group; Rancho La Puerta, Inc.; Omni Hotels & Resorts; and Four Seasons Hotels

b. Key factors that are driving the market growth include the rising number of tourists across the globe has contributed to the demand for various wellness services. In addition, increased expenditure in the tourism sector and growing awareness regarding physical and mental well-being are expected to have a positive impact on wellness tourism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.