- Home

- »

- Beauty & Personal Care

- »

-

Wet Wipes Market Size And Share Analysis Report, 2030GVR Report cover

![Wet Wipes Market Size, Share & Trends Report]()

Wet Wipes Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Household Wipes, Baby Wipes, Intimate Wipes), By Material (Non-Woven, Woven), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-713-5

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wet Wipes Market Summary

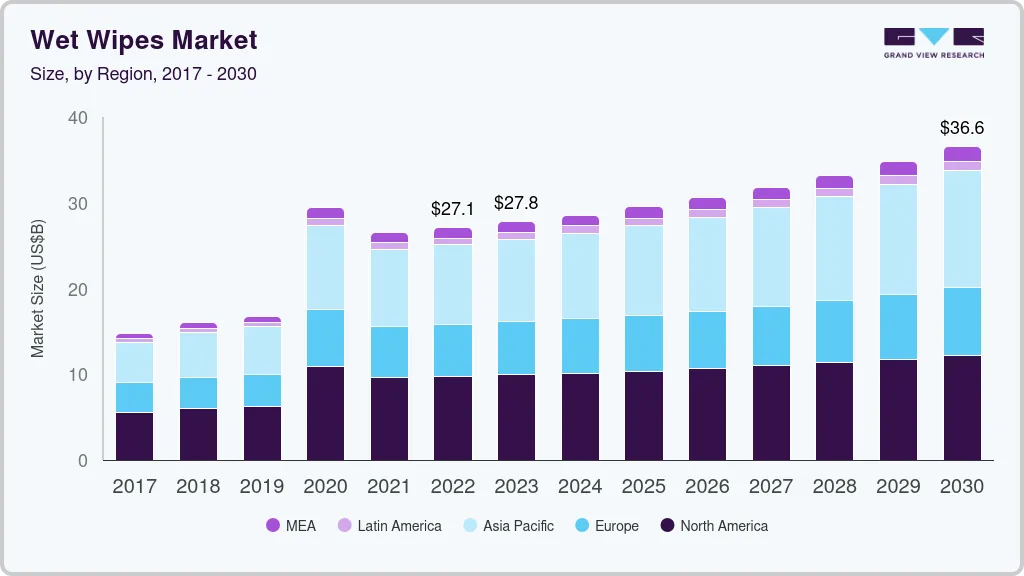

The global wet wipes market size was estimated at USD 27.07 billion in 2022 and is projected to reach USD 36.56 billion by 2030, growing at a CAGR of 3.8% from 2023 to 2030. The increased use of wet wipes to maintain hygiene, particularly when the availability of clean water is limited, drives the market growth.

Key Market Trends & Insights

- The North America region held a significant share of over 36% in 2022.

- The Asia Pacific region is expected to witness the highest CAGR of 5.0% over the forecast period.

- Based on material, the non-woven segment dominated the market with a revenue share of 78.29% in 2022.

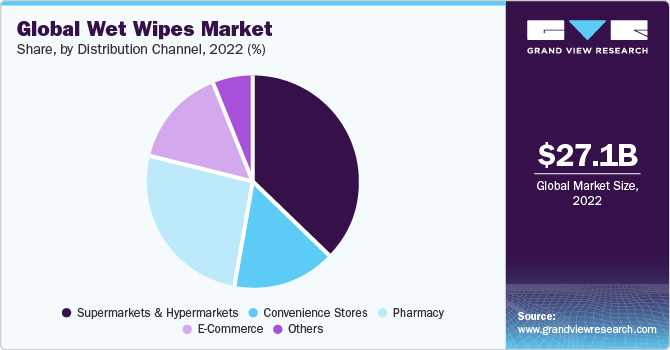

- Based on distribution channel, the supermarkets & hypermarkets accounted for a revenue share of over 38% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 27.07 Billion

- 2030 Projected Market Size: USD 36.56 Billion

- CAGR (2023-2030): 3.8%

- North America: Largest market in 2022

Disinfectant wet wipes are increasingly being used for contamination control, driving product penetration. Cost, convenience, hygiene, performance, ease of use, disposability, and safety are attributes augmenting product adoption. Diverse types of wipes, including intimate, moist, flushable, feminine, and scented, have been developed during the past decade to serve a variety of purposes.

Expansion and new product releases in emerging markets are also important growth drivers. The creation and sale of fragranced wet wipes as well as ecologically friendly or biodegradable wet wipes is a strategy used by businesses to attract more clients. For instance, in May 2021, a baby care company Coterie, introduced a new biodegradable and compostable wipe made entirely of plant-based components. The Coterie Wipes, composed of 99% water and created in collaboration with the Veocel brand, are the most eco-friendly and largest (up to 30% larger) baby wipes available on the U.S. market.

During the COVID-19 pandemic, strong demand for wipes also prompted numerous domestic and international companies to increase their manufacturing capabilities. In March 2020, GoodFibers, a U.S.-based wet wipes manufacturer, increased production to generate up to 225 million wipes each month. Similarly, the need for disinfectant wipes to combat the spread of COVID-19 surged, highlighting the significance of cleaning and sanitizing homes. In the first quarter of 2020, Clorox, a U.S.-based manufacturer of cleaning goods, produced close to 40 million more items, including wipes.

Businesses are increasingly focused on creating innovative, soft, and skin-friendly sanitation and hygiene products to cater to varied consumer needs for hygiene. Furthermore, companies are adding various ingredients to sanitized sheets to nourish and moisturize the skin. For instance, in July 2021, Bausch + Lomb, a leading global eye care company, launched 'Biotrue,' a new range of lubricating eye drops and cleansing wipes. The Biotrue Micellar Eyelid Cleansing Wipes provide instant moisture to help relieve dry, digital-device-weary eyes. The product is pH-balanced, free of preservatives, and inspired by the biology of the eye. The development of such new products has boosted the wet wipes business.

A switch to reusable and biodegradable cosmetic products has also influenced product development. Players such as L'Oréal, Oriflame, and L'Occitane have increased their research and development (R&D) investments to create products that cater to these evolving needs. For instance, L'Occitane’s Shea Butter Cleansing and Refreshing Cloth is soaked in a lotion rich in shea extract, cassia, and orange blossom floral water for a soothing and softening cleansing experience. The towelettes are 100% biodegradable and remove make-up and refresh the face with its gentle, alcohol-free formula.

As more women join the workforce globally, their purchasing power and understanding of personal hygiene are increasing. Manufacturers are introducing intimate, feminine, flushable, and scented wipes to target this consumer group. For instance, in September 2022, Ginni Filaments launched a new manufacturing facility for wet wipes. The company introduced intimate hygiene wipes with the opening of its new facility. These products are intended for women's intimate areas. This product prevents irritation, itching, bad odor, pain, white discharge, and infections in the vaginal area because it maintains the optimal pH range of 3.5 to 4.5 and contains 1.2% lactic acid, which promotes the growth of beneficial bacteria.

Material Insights

Based on material, the non-woven segment dominated the market with a revenue share of 78.29% in 2022. Companies are introducing baby wipes that are produced from exceptionally soft, skin-friendly, and breathable nonwoven spunlace fabric. These products are designed to safeguard the delicate and smooth skin of babies, shielding them from rashes and redness. For instance, in June 2023, Ginni Filaments Ltd., an Indian company, launched 'Adore Baby' ultra-pure water wipes in the baby care segment. These wipes contain 99.9% water, making them the purest and gentlest option with minimal ingredients.

Woven material is expected to grow at a CAGR of about 3.2% in the forecast period. Woven wipes are typically more robust and durable compared to non-woven alternatives. They can withstand more rigorous use without tearing or falling apart, making them a practical choice for various cleaning tasks. These are often reusable, making them an environmentally friendly option. People can wash and reuse them multiple times, reducing the need for disposable products and lowering overall waste.

Product Insights

The household/disinfectant/cleaning wipes segment accounted for a dominant revenue share of approximately 29% in 2022. In the disinfectant/cleaning wet wipes industry, several innovative products have emerged to address manufacturing challenges, enhance product performance, reduce the use of harmful chemicals, and promote environmentally responsible disposal methods. For instance, Sichuan Huanlong New Material Co. Ltd. from China has introduced an antibacterial tissue made from 100% bamboo fiber and essential oils, offering a simple, efficient, and environmentally friendly production process while maintaining mildness and antibacterial properties.

The intimate wipes segment is projected to grow at a CAGR of 5.5% over the forecast period. Market players are launching new products in the intimate care segment which are completely biodegradable. For instance, in September 2021, Lunette, a global manufacturer of menstrual care products, launched Lunette Intimate Wipes which are 100% biodegradable wet wipes and are made up of Nordic plant-based materials. It is anticipated that spending on feminine care products will increase and continue to support the demand in the segment over the forecast period.

Distribution Channel Insights

Based on distribution channel, the supermarkets & hypermarkets accounted for a revenue share of over 38% in 2022. An increasing number of supermarkets offer sustainable wet wipes to cater to the growing consumer demand for eco-friendly products. For instance, Tesco-one of the top supermarkets in the UK-transitioned to biodegradable viscose materials in 2020, eliminating plastic from its own-brand wet wipes. In addition, the retailer made a massive change in March 2022 when it stopped selling baby wipes containing plastic.

The e-commerce channel is expected to grow at a CAGR of about 5.5% over the forecast period. Many brands have been experimenting with online subscription models. For instance, Mypura, a UK-based brand for baby essentials, offers a baby wipes subscription package that enables consumers to save 25% of the purchase price. Both the website and the applications allow parents to create subscriptions with varying quantities and delivery schedules, cancel and stop subscriptions, track deliveries, and initiate one-off deliveries within their subscriptions.

Regional Insights

The North America region held a significant share of over 36% in 2022. Key manufacturers in the market are adopting initiatives such as product launches, sustainable development, biodegradable packaging, and the use of organic ingredients to stay ahead in this market. For instance, in April 2021, beauty brand Busy Co. launched antibacterial and deodorant wet wipes. These wet wipes are made in the U.S., powered by wind energy, 100% clean, and with a zero-waste initiative.

The Asia Pacific region is expected to witness the highest CAGR of 5.0% over the forecast period. The key factor boosting the wet wipes industry is the presence of large-scale manufacturers and raw material providers in the country. In this regard, investments in this market by companies have positively impacted industry growth. For instance, In August 2021, Unicharm Corporation launched “Mamy Poko Premium Baby Wipes” in Taiwan‐Greater China. The new product copes with both environment and safety by using an organic cotton compound sheet that has acquired FSC Certification.

Key Companies & Market Share Insights

The market is a blend of traditional players, innovative newcomers, evolving technologies, and changing consumer demands. A major focus of these companies has been on innovations, expansions, acquisitions, and product launches.

-

For instance, in February 2023, The Honest Company, Inc. launched its Clean Conscious Wipes. These compostable wipes are appropriate for sensitive skin because they have a mild cleaner. In addition, they are created without plastic, quaternary compounds, perfumes, chlorine processing, and parabens.

-

For instance, in May 2022, KCWW announced the expansion of its manufacturing facilities located in Brazil. The expansion includes the construction of a raw material supply network and the installation of advanced technologies. Kimberly-Clark invested USD 120 million in this expansion project. The aim of this expansion is to create an export center and innovative hub for the Latin American region.

Key Wet Wipes Companies:

- The Clorox Company

- KCWW

- Reckitt Benckiser Group PLC

- Unilever

- Johnson & Johnson Consumer Inc.

- TLC International

- WipesPlus

- The Honest Company, Inc.

- Procter & Gamble

- Himalaya Wellness Company

Wet Wipes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.77 billion

Revenue forecast in 2030

USD 36.56 billion

Growth rate

CAGR of 3.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Brazil; South Africa

Key companies profiled

The Clorox Company; KCWW; Reckitt Benckiser Group PLC; Unilever; Johnson & Johnson Consumer Inc.; TLC International; WipesPlus; The Honest Company, Inc.; Procter & Gamble; Himalaya Wellness Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wet Wipes Market Segmentation

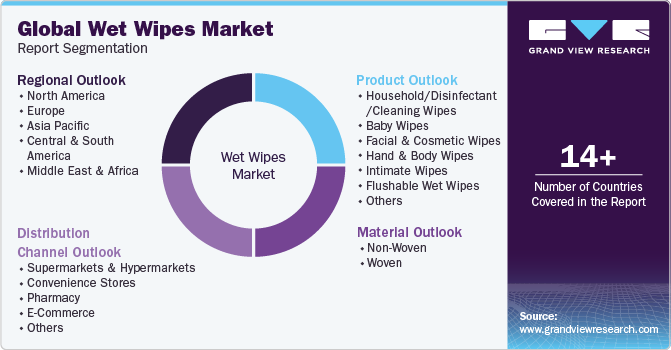

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the wet wipes market based on product, material, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Household/Disinfectant/Cleaning Wipes

-

Baby Wipes

-

Facial & Cosmetic Wipes

-

Hand & Body Wipes

-

Intimate Wipes

-

Flushable Wet Wipes

-

Others

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Non-Woven

-

Woven

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Pharmacy

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wet wipes market was estimated at USD 27.07 billion in 2022 and is expected to reach USD 27.77 billion in 2023.

b. The global wet wipes market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 36.56 billion by 2030.

b. North America region dominated the wet wipes market with a share of around 36% in 2022. Market expansion in the region is driven by heightened hygiene awareness, resulting in the development of diverse wipes like intimate, moist, flushable, feminine, and scented varieties in the past decade.

b. Some key players operating in the wet wipes include The Clorox Company; KCWW; Reckitt Benckiser Group PLC; Unilever; Johnson & Johnson Consumer Inc.; TLC International; WipesPlus; The Honest Company, Inc.; Procter & Gamble; and Himalaya Wellness Company.

b. Key factors that are driving the wet wipes market include cost, convenience, hygiene, performance, ease of use, disposability, safety, and increasing hygiene awareness, leading to the development of diverse wipe types.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.