- Home

- »

- Alcohol & Tobacco

- »

-

Whiskey Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Whiskey Market Size, Share & Trends Report]()

Whiskey Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Malt Whiskey, Wheat Whiskey, Corn Whiskey, Blended Whiskey, Rye Whiskey), By Price Point, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-058-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Whiskey Market Summary

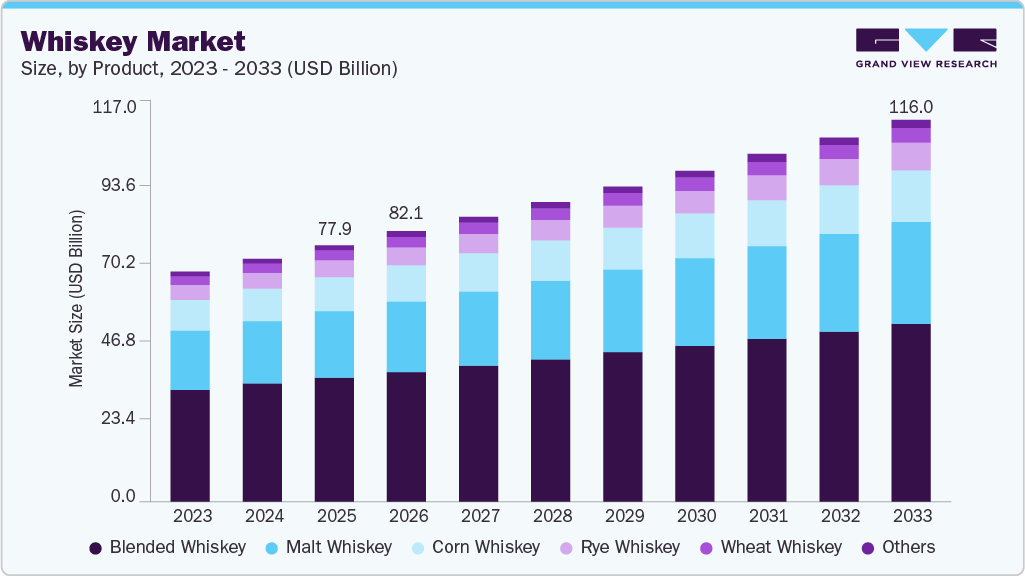

The global whiskey market size was estimated at USD 77.92 billion in 2025 and is projected to reach USD 116.01 billion by 2033, growing at a CAGR of 5.1% from 2026 to 2033. The growth of this market is primarily influenced by aspects such as increased manufacturer focus on product innovation, increasing consumer numbers, and advancements in technologies associated with making, packaging, and delivery.

Key Market Trends & Insights

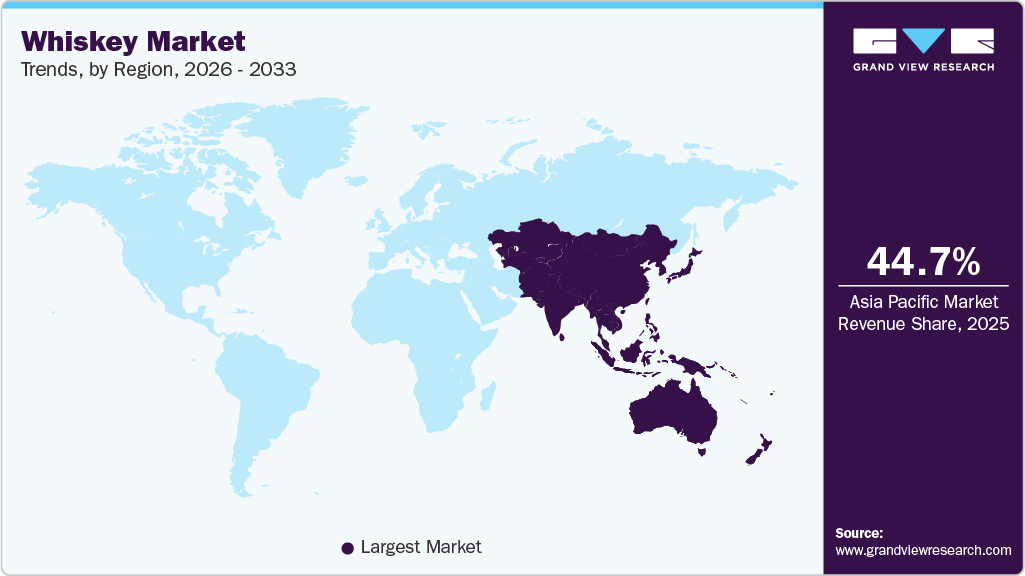

- Asia Pacific dominated the whiskey market in 2025 with a share of 44.69%.

- The Middle East & Africa whiskey market is experiencing a significant CAGR of 5.7% from 2026 to 2033.

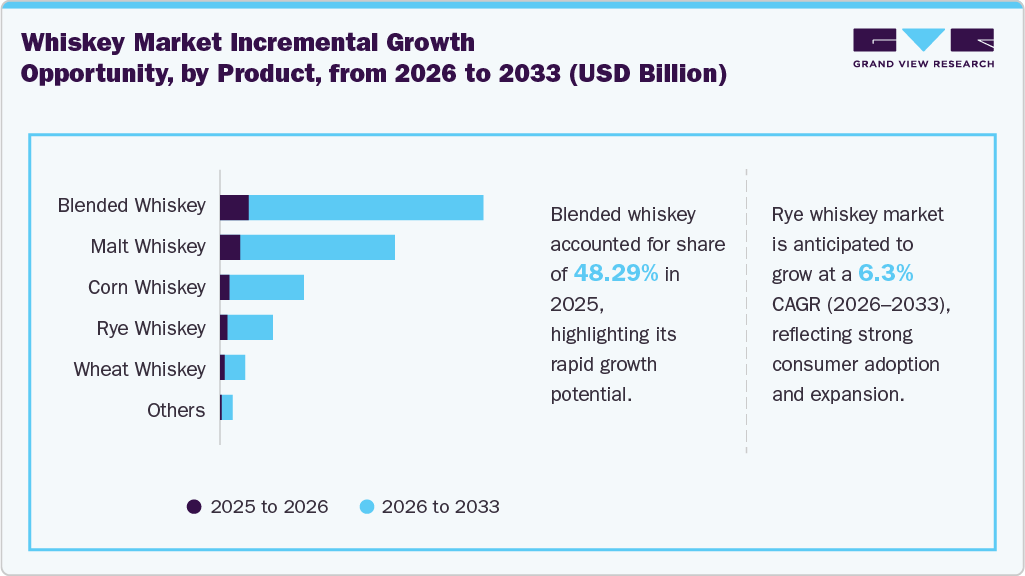

- By product, blended whiskey segment accounted for a share of 48.29% in 2025.

- Rye whiskey market is expected to witness a CAGR of 6.3% from 2026 to 2033.

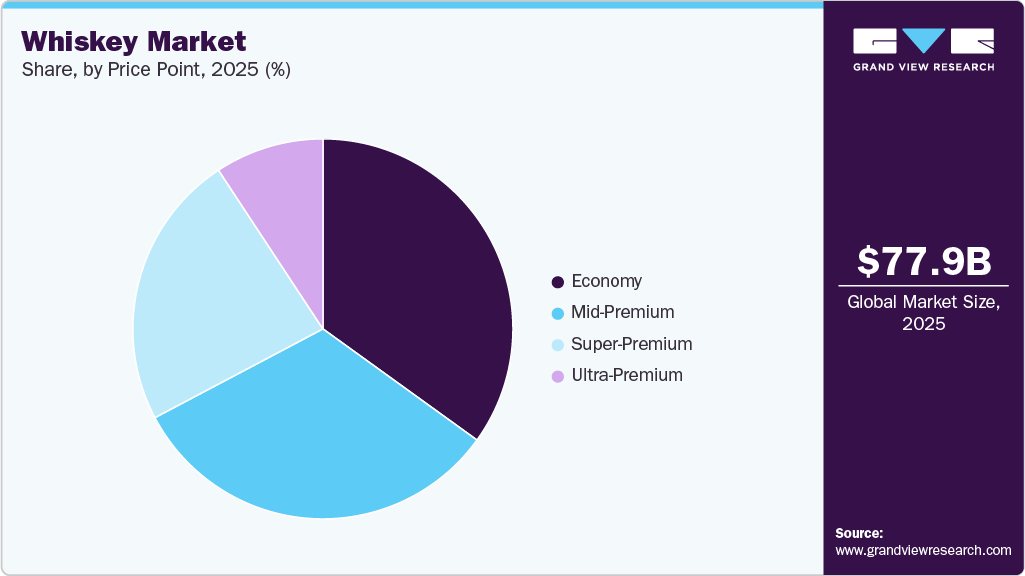

- By price point, the economic whiskey market accounted for a share of 34.95% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 77.92 Billion

- 2033 Projected Market Size: USD 116.01 Billion

- CAGR (2026-2033): 5.1%

- Asia Pacific: Largest market in 2025

A significant rise in demand from commercial buyers such as hotels, bars, liquor-serving lounges, and other leisure and dining destinations is expected to drive the growth of this market. An increase in disposable income levels, ease of availability and accessibility, and the addition of flavor or taste-based innovations in portfolios are contributing to the continuous nature of the growth.In recent years, there has been growing acceptance of whiskey as the preferred alcoholic beverage at social gatherings, family parties, wedding dinners, and other occasions. Multiple types of whiskies are also being used to formulate well-liked cocktails, such as Manhattan, Mint Julep, Sazerac, Boulevardier, Irish Coffee, and others, contributing to the growth in commercial consumption. According to the Distilled Spirits Council of the United States, in 2023, nearly 31 million 9-liter cases of whisky made in America were sold in the U.S.

Advancements in technologies used in manufacturing whiskey products, techniques used for making bottles and packaging, and enhancements in systems utilized for distribution and delivery have generated a surge in growth for this industry. Automation, cost reductions, reduced wastage or spillage, effective inventory management, and inclusion of emerging technologies such as AI have played vital roles in the technology transformation experienced by the market.

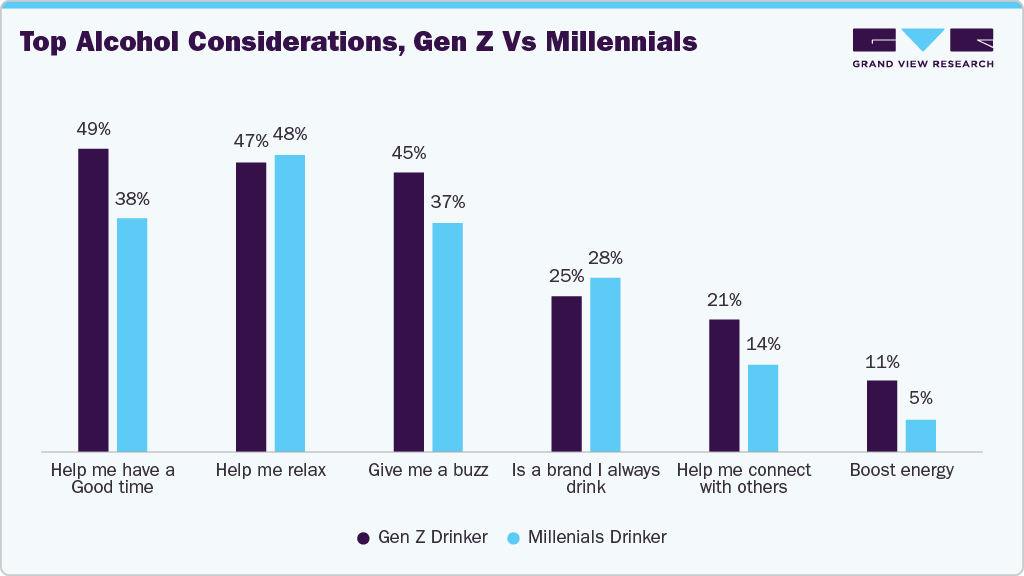

Consumer Insights

Consumer trends in the global whiskey market today are overwhelmingly shaped by premiumization and a deepening appreciation for craftsmanship and authenticity. Across key markets, consumers are increasingly willing to trade up from entry-level spirits to higher-quality, aged, and limited-edition whiskies that offer distinctive flavor profiles and heritage narratives. Premium and super-premium segments now account for a significant share of global whiskey sales, with many drinkers prioritizing “drink better, not more,” experiences that justify higher price points through quality and story-led engagement. This trend is supported by data showing that a substantial portion of market growth is driven by premium offerings and limited-edition releases, which appeal to collectors and enthusiasts alike, particularly in Europe and Asia-Pacific.

Innovation within traditional whiskey production is another key consumer preference trend. Distillers are experimenting with diverse cask finishes, such as wine, sherry, rum, or bespoke wood varieties, to create nuanced and complex flavor experiences that differentiate products in a crowded marketplace. These innovations enable brands to offer fresh expressions while retaining core whiskey identities, attracting both seasoned connoisseurs and curious new drinkers.

Product Insights

Blended whiskey segment held a revenue share of 48.29% in 2025 of the global whiskey industry. Multiple consumers primarily prefer blended whiskey for its affordable price and consistency offered by the products in terms of quality. It features a variety of tastes derived from a blend of grain and malts. An increasing number of young consumers are embracing cocktails and blended whiskies as their preferred choice of alcoholic beverage, and the availability of diverse flavors is adding to the growth opportunities of this market.

Rye whiskey segment is expected to grow at a CAGR of 6.3% from 2026 to 2033, due to rising consumer interest in premium and craft spirits with bold, distinctive flavor profiles. The increasing popularity of classic and craft cocktails, particularly in bars and at-home mixology, is driving demand for rye whiskey because of its spicy and complex taste. Growth is further supported by premiumization trends, with consumers willing to pay more for aged, small-batch, and artisanal rye whiskey products. Expanding distribution through on-trade and off-trade channels, along with growing awareness among younger consumers seeking authentic and heritage-rich spirits, is also contributing to sustained market growth.

Price Point Insights

The economic whisky segment held a revenue share of 34.95% of the global whiskey industry in 2025, reflecting its strong appeal among a wide consumer base seeking affordable and reliable alcoholic beverages. This segment benefits from high consumption volumes, particularly in emerging markets where price sensitivity plays a key role in purchasing decisions. Economy whiskies are commonly used for regular consumption and in mixed drinks, supporting consistent demand across on-trade and off-trade channels. Wide availability, established brand loyalty, and extensive distribution networks further strengthen this segment’s market position, allowing it to maintain a significant share despite growing interest in premium and super-premium whiskey offerings.

The ultra-premium whiskey segment is expected to grow at a CAGR of 5.9% from 2026 to 2033, driven by increasing consumer preference for high-quality, authentic, and aged spirits. Rising disposable incomes and premiumization trends are encouraging consumers to trade up from standard offerings to limited-edition, single-barrel, and craft whiskeys with distinctive flavor profiles. Collectors and enthusiasts are also fueling demand for ultra-premium products as investment assets and luxury gifts. In addition, strong storytelling around heritage, craftsmanship, and origin, combined with elegant packaging and experiential marketing, is enhancing brand value. Expanding availability through specialized retail, duty-free outlets, and high-end on-trade establishments further supports sustained growth of the ultra-premium whiskey segment.

Regional Insights

The North America whiskey market accounted for a revenue share of 30.55% in 2025. This market is mainly influenced by aspects such as the existing whiskey culture in the region, a large share in exports and international whiskey trade, and the presence of multiple tourism-driven businesses in the area that significantly drive demand for premium and blended whiskies. Growing availability facilitated by online distribution also plays a vital role in the growth of this market.

U.S. Whiskey Market Trends

The U.S. whiskey market is expected to grow at a CAGR of 5.3% from 2026 to 2033, owing to the robust manufacturing environment and growing consumption by the diverse population present in the country. The U.S. is home to making multiple whiskies such as bourbon, Tennessee whiskey, rye malt, and others. Increasing consumption facilitated by availability through supermarkets and online portals is expected to add growth opportunities. Many foreign individuals visiting the country for leisure also influence the demand. According to the International Trade Administration, U.S. Department of Commerce, in March 2024, more than 5 million International Visitor Arrivals were recorded in the U.S., which marked a 12.6% increase from March 2023.

Europe Whiskey Market Trends

The Europe whiskey market is expected to grow at a CAGR of 4.8% from 2026 to 2033. This market is primarily driven by cultural and traditional significance associated with the product and increasing consumption of craft spirits and premium whiskies. Craftsmanship traditions in countries such as Scotland and Ireland also contribute to the growth experienced by this market. In addition, the rise in disposable income levels and the availability of global brand products through major supermarkets are expected to fuel the growth of this market during the forecast period.

Whiskey market in Germany held the largest revenue share of the regional whiskey industry in 2025. This is attributed to factors such as the presence of multiple manufacturers in the country, the large number of existing consumers, and increasing demand from commercial buyers such as hospitality industry participants, lounges, bars, and others. According to the Scotch Whiskey Association, Germany exported nearly 59 million bottles of scotch whiskey in 2023.

Asia Pacific Whiskey Market Trends

Asia Pacific whiskey market is expected to grow with a CAGR of 5.0% from 2026 to 2033, driven by the demand for affordable blended whiskies offered by domestic and global brands. Ease of availability through local wine shops, bars, and lounges, and the wide variety of products offered by the major market participants operating in the region have also contributed to the growth of this market. Increasing commercial demand facilitated by established distribution networks and growing urbanization is expected to drive the growth of this market over the forecast period.

The India whiskey market accounted for 70.63% of the Asia Pacific market revenue in 2025, driven by the country’s large consumer base, strong cultural preference for whiskey, and high-volume consumption of affordable and mid-priced brands. Rapid urbanization, a growing middle class, and increasing disposable incomes have supported steady demand across economy and premium segments. The dominance of domestically produced whiskies, supported by extensive distribution networks and competitive pricing, has further strengthened India’s market position. Additionally, evolving consumer tastes, rising interest in premium and craft whiskey offerings, and expansion of modern retail and on-trade channels continue to reinforce India’s leadership within the Asia Pacific whiskey market.

Middle East & Africa Whiskey Market Trends

The Middle East & Africa whiskey market is expected to grow at a CAGR of 5.7% from 2026 to 2033, supported by expanding tourism, a growing hospitality sector, and increasing demand for premium alcoholic beverages in select markets. Growth is driven by rising consumption in duty-free channels, luxury hotels, and upscale bars, particularly in the UAE and South Africa. Additionally, changing lifestyle preferences among expatriate populations, improved retail availability, and growing interest in premium and imported whiskey brands are contributing to steady market expansion across the region.

Central & South America Whiskey Market Trends

The whiskey market in Central & South America is expected to grow at a CAGR of 4.5% from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and evolving consumer preferences toward premium alcoholic beverages. Growing popularity of social drinking, expanding nightlife culture, and higher demand for imported and premium whiskey brands are supporting market growth. In addition, the rise of cocktail culture, particularly in bars and restaurants, is boosting whiskey consumption across key markets such as Brazil, Argentina, and Chile. Improved distribution networks and the expanding presence of international brands are further contributing to steady regional market expansion.

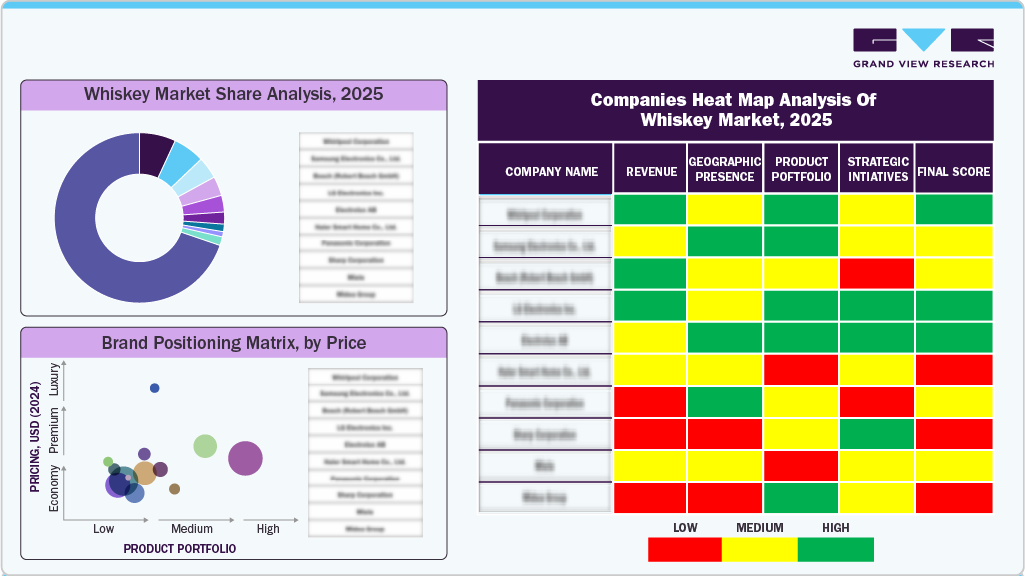

Key Whiskey Company Insights

Some of the key companies in the global whiskey market are Angus Dundee Distillers Plc., Bacardi Limited, Diageo, CAMPARI GROUP and others. To address continuously changing customer requirements and preferences, multiple companies have embraced strategies such as product diversification, effective offline distribution, enhanced digital footprint, improved digital marketing and content delivery.

Key Whiskey Companies:

The following are the leading companies in the whiskey market. These companies collectively hold the largest market share and dictate industry trends.

- Angus Dundee Distillers Plc.

- Allied Blenders and Distillers Pvt. Ltd.

- Bacardi Limited

- Pernod Ricard

- Brown-Forman

- Constellation Brands

- Diageo

- SUNTORY HOLDING LIMITED

- ASAHI GROUP HOLDINGS, LTD

- CAMPARI GROUP

Recent Developments

-

In October 2024, Bacardi Limited, a global alcohol beverage industry participant, invested in future preparations for blended and single malt whiskey production. This included the completion of numerous enhancement projects at its production facilities across Scotland. A state-of-the-art blending and maturation center covering 200 acres is being developed in southeast Glasgow at Poniel, alongside an efficiency, safety, and technology enhancement project at Aultmore Distillery in Speyside and Macduff Distillery.

-

In October 2024, Tomintoul, one of the brands by Angus Dundee Distillers Plc, added two newly developed products to its portfolio. The 15-year Tawny Port Cask Finish and 14 year Pedro Ximénez Sherry Cask Finish is now added to its range of limited edition aged cask finish offerings.

-

In May 2024, CAMPARI GROUP, one of the global red bitter brands, launched its newly designed campaign, We Are Cinema, through the 77th Festival de Cannes. As the reputed film festival's official partner for the third consecutive year, the company introduced this campaign to acknowledge the significant role of human life stories in inspiring artwork and some of the most applauded creations in world cinema.

Whiskey Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 82.12 billion

Revenue forecast in 2033

USD 116.01 billion

Growth rate (Revenue)

CAGR of 5.1% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion, Volume in Million 9-Liter Cases, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price point, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; the Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Angus Dundee Distillers Plc.; Allied Blenders and Distillers Pvt. Ltd.; Bacardi Limited; Pernod Ricard; Brown-Forman; Constellation Brands; Diageo; SUNTORY HOLDING LIMITED; ASAHI GROUP HOLDINGS LTD; CAMPARI GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whiskey Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global whiskey market report based on product, price point, and region.

-

Product Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases, 2021 - 2033)

-

Malt Whiskey

-

Wheat Whiskey

-

Rye Whiskey

-

Corn Whiskey

-

Blended Whiskey

-

Others

-

-

Price Point Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases, 2021 - 2033)

-

Economy

-

Mid-Premium

-

Super-Premium

-

Ultra-Premium

-

-

Regional Outlook (Revenue, USD Million; Volume, Million 9-Liter Cases, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.