- Home

- »

- Healthcare IT

- »

-

Women’s Health App Market Size, Industry Report, 2030GVR Report cover

![Women’s Health App Market Size, Share & Trends Report]()

Women’s Health App Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Fitness & Nutrition, Pregnancy Tracking & Postpartum Care, Menopause), By Modality, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-970-8

- Number of Report Pages: 83

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Women’s Health App Market Summary

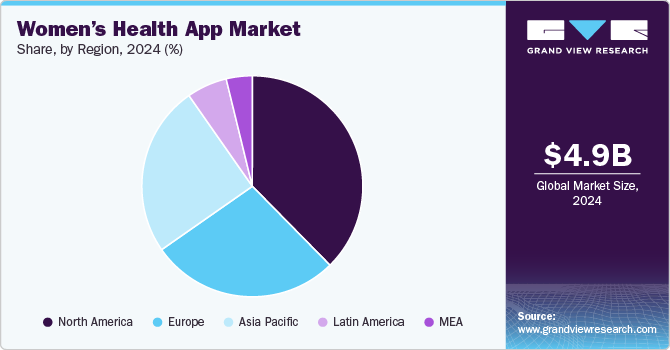

The global women’s health app market size was estimated at USD 4.85 billion in 2024 and is projected to reach USD 12.87 billion by 2030, growing at a CAGR of 17.78% from 2025 to 2030. The rising incidences of women’s health conditions, along with widespread smartphone usage, are anticipated to fuel market expansion.

Key Market Trends & Insights

- North America dominated the women’s health app market with the largest revenue share of 37.66% in 2024.

- The women’s health app market in the U.S. held the largest share in the North America region in 2024.

- Based on type, the menstrual health segment led the market with the largest revenue share of 37.68% in 2024.

- Based on modality, the smartphone segment led the market with the largest revenue share of 68.32% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.85 Billion

- 2030 Projected Market Size: USD 12.87 Billion

- CAGR (2025-2030): 17.78%

- North America: Largest market in 2024

Changes in diet, stress, and consumption of alcohol play significant roles in leading to hormonal disparities in women.

These hormonal imbalances are susceptible to various diseases post-menopause, including osteoarthritis (OA), anemia, obesity, abnormal menstrual cycles, depression, and fibromyalgia. As the aging population and incidence of obesity increase, the prevalence of OA is expected to increase. According to the World Health Organization, in July 2023, approximately 73% of individuals diagnosed with osteoarthritis are over the age of 55, and around 60% of these patients are women.

Anemia continues to affect millions of women around the world. According to the WHO, the prevalence of anemia was 29.9% among females of reproductive age, which is equivalent to nearly half a billion females aged 15-49 years, In December 2023, Hearst UK (The National Magazine Company Ltd.) launched an app for Women’s Health UK, enhancing its Women’s Health Collective membership. This comprehensive app offers exclusive access to expert training plans, wellness advice, and the latest health news, aiming to help women achieve their best health and fitness levels. It features content from leading global experts and top UK writers.

The expected rise in arthritis among women is anticipated to stimulate the market. Developing regular healthy habits and altering daily routines can mitigate the effects of arthritis. In October 2022, the DigiPrevent project, aimed at developing digital tools to prevent rheumatoid arthritis, received funding of USD 3.43 million. This funding, primarily provided by EIT Health, a network created by the European Institute of Innovation and Technology, supports the efforts of researchers at Karolinska Institutet and their partners.

Increasing investments from both government and private sectors are facilitating the uptake of software aimed at enhancing women's welfare. For instance, in January 2024, the World Economic Forum reported that the Global Alliance for Women’s Health had received support from 42 organizations, with a total commitment of USD 55 million to improve global women’s health outcomes.

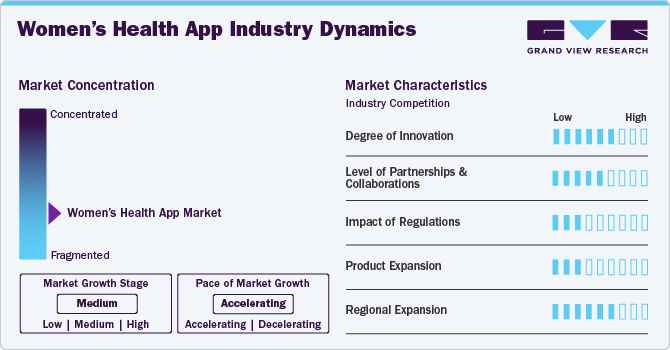

Market Concentration & Characteristics

The degree of innovation is high in the market due to features such as menstrual tracking, fertility monitoring, pregnancy guidance, and mental health support, enhanced by AI and machine learning. These apps focus on personalized care and remote monitoring, reflecting a commitment to improving global women's health outcomes.

To improve their standing in the market, various firms engage in mergers and acquisitions. These endeavors increase their market knowledge, expand their range of products, and improve their capabilities. In May 2024, Keleya and Kinderheldin merged as Keleya and integrated their services, including introducing AI-driven 24/7 midwife support. The merger secures a significant market presence with partnerships across 65 German health insurers, covering 65% of the insured population.

Regulations influence aspects such as data privacy, security, accuracy of information, and overall quality of healthcare services provided through these apps. Regulatory frameworks such as GDPR in Europe and HIPAA in the U.S. set standards for protecting user data and ensuring compliance with healthcare regulations. These regulations enhance consumer trust and drive innovation by encouraging app developers to meet stringent requirements.

In the global market, the presence of product substitutes is medium. While various women’s health apps that cater to specific needs, such as period tracking, pregnancy monitoring, and overall wellness, are available, the level of direct substitutes that offer identical features and functionalities may not be as high as in some other industries.

The increasing awareness about women’s health and the growing demand for personalized healthcare solutions led to a surge in the adoption of women’s health apps worldwide. Companies operating in this market are actively expanding their presence in different regions to cater to the diverse needs of women across the globe. This expansion is driven by factors such as technological advancements, rising investments in digital health solutions, and the emphasis on preventive healthcare measures.

Type Insights

Based on type, the menstrual health segment led the market with the largest revenue share of 37.68% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth is attributed to an increasing awareness among women about the importance of hygiene during menstrual periods. The widespread use of apps for tracking menstrual cycles, combined with the introduction of new products and features by leading companies, is contributing to the expansion of this market segment. In October 2023, Titan Smart Wearables partnered with Elda to innovate in women's healthcare, marking a step towards creating an integrated wellness ecosystem focused on enriching user experiences and empowering health management.

The pregnancy tracking and postpartum care segment is anticipated to grow at a considerable CAGR over the forecast period. The surge in the use of pregnancy-related applications designed to support the health of both the mother and the baby is driving the growth of this segment. In October 2023, the local hospital trust and the University of Leicester launched the Janam app, a free pregnancy guide for South Asian women in Leicestershire, available in six languages. Featuring visual aids such as diagrams and videos, this app aims to empower users with the knowledge to make informed choices about pregnancy, childbirth, and postnatal care.

Modality Insights

Based on modality, the smartphone segment led the market with the largest revenue share of 68.32% in 2024. The smartphone market is growing due to increasing awareness of women's health, demand for accessible healthcare, and the convenience of tracking health metrics. The widespread use of smartphones, advancements in technology such as AI and wearables integration, and the push from COVID-19 towards digital healthcare have all significantly contributed to the popularity and functionality of these apps. In May 2023, Bonatra Healthcare Pvt. Limited acquired women's health and wellness firm MyAva, to widen its holistic healthcare solutions and offer a comprehensive platform for managing chronic conditions. This move is part of Bonatra's plan to launch new IoMT devices, like a smart ring, to enhance its integration of medical and data science with technology.

Other segment is expected to grow at the fastest CAGR over the forecast period. The market is growing with innovation beyond smartphones and tablets, and it includes wearable devices, virtual reality (VR) technology, and telemedicine platforms emerging as key drivers. Wearables such as smartwatches offer convenient health tracking, including menstrual cycles and fertility, while VR technology provides immersive ways to manage pain and improve mental health. Telemedicine platforms enable remote consultations for prenatal care and other health concerns, offering accessible healthcare solutions for women.

Regional Insights

North America dominated the women’s health app market with the largest revenue share of 37.66% in 2024. This is due to the increasing adoption of smartphones and rising government interest in reducing healthcare costs. In addition, the high adoption of technologically advanced products and regulatory reforms for approval and usage of mobile-based applications are contributing to the growth of the market in the region.

U.S. Women’s Health App Market Trends

The women’s health app market in the U.S. held the largest share in the North America region in 2024. Several key factors are driving the market growth in U.S. The increasing awareness and focus on women’s health and wellness have led to a growing demand for digital solutions that cater specifically to women’s needs. The rise of wearable technology and smartphones made it easier for women to track their health metrics, menstrual cycles, fertility, pregnancy, and overall well-being through apps. In addition, the convenience and accessibility of these apps have made them popular among women of all ages. In July 2022, Lisa Health launched Midday, an innovative app designed to assist women through menopause. By integrating AI, sensor tech, and digital therapeutics, Midday offers personalized support highlighting physical and emotional changes during menopause. This app, developed in collaboration with Mayo Clinic, merges Lisa Health's technology with expert medical advice for comprehensive menopause symptom management.

The Canada women’s health app market is expected to grow at the fastest CAGR over the forecast period. The market growth in Canada is driven by several factors. An increased awareness of women's health issues, coupled with the widespread use of smartphones and digital technologies among Canadian women, is fostering a demand for health-focused apps. The COVID-19 pandemic further accelerated this trend by boosting the need for telemedicine and virtual healthcare services. Governmental support for digital health solutions and investments in healthcare technology also play vital roles. Recent data shows a surge in the use of women’s health apps, evidenced by rising download numbers and user engagement across various age demographics, underscoring the critical role these digital tools play in supporting women's health.

Europe Women’s Health App Market Trends

The women’s health app market in Europe is expected to grow at the fastest CAGR over the forecast period, owing to the increasing government investment in IT infrastructure and the growing number of digital startups in the region. Increasing awareness about reproductive health, rising prevalence of OA, and improving internet access are propelling the market in Europe.

The UK women's health app market is governed by GDPR, which ensures the protection of sensitive user data, and the NHS Digital Health Technology Standard that mandates quality and safety standards. These regulations are key drivers in the development and innovation of such apps. Recent trends indicate a significant increase in the usage of women's health apps for tracking menstrual cycles, fertility, pregnancy, and overall well-being among UK females.

The women’s health app market in Germany is growing significantly, driven by strict data privacy laws such as the Federal Data Protection Act and GDPR, which build user trust by ensuring the protection of sensitive health information. In addition, public healthcare institutions actively promote these digital solutions, and the German Federal Joint Committee recognized some apps as eligible for reimbursement, providing a financial incentive for use. Cultural factors contribute, with German women showing a higher preference for using digital tools for health management compared to their European peers. This combination of regulatory support, financial incentives, and cultural openness fostered innovation and adoption in the sector.

The Spain women’s health app market is shaped by specific regulations and trends. Key among these is the data protection laws such as the GDPR, which are critical for apps handling women's sensitive health information. The country is experiencing an increased focus on women's health, fueling the demand for digital health solutions. As awareness around health and wellness grows, there's a notable increase in the development and usage of apps designed for women's health needs, ranging from period tracking to pregnancy support. Recent data indicates a growing reliance on these apps among Spanish women to manage their health care.

Asia Pacific Women’s Health App Market Trends

The women’s health app market in Asia-Pacific is expected to grow at a significant CAGR over the forecast period, due to the high number of smartphone users in China and India, increasing internet penetration, and growing demand for effective healthcare technologies. In addition, increasing government focus on women’s wellness is favoring the market growth. For instance,the Indian government launched the Swasthya Samiksha app that enables the members of the parliament to track maternal and reproductive health data and indicators of their respective constituencies.

The Japan women’s health app market is anticipated to grow at the fastest CAGR over the forecast period. The healthcare sector is strictly controlled, which applies to the market for women's health applications. The Japanese government enforces tight regulations to guarantee the safety and effectiveness of health-oriented technologies, such as apps focusing on women's health. These apps typically undergo extensive evaluation and must gain approval prior to their market release. Moreover, Japan has rigid data privacy regulations, particularly concerning sensitive health data, which additionally influence the creation and functioning of women’s health applications within the nation.

Latin America Women’s Health App Market Trends

The women’s health app market in Latin America is expected to grow at a rapid CAGR during the forecast period. In Latin America, the market is influenced by specific regulations related to data privacy and protection. Countries such as Brazil, Mexico, and Argentina implemented data protection laws that impact how health apps collect, store, and use the personal health information of users. Compliance with these regulations is crucial for companies operating in this sector to ensure the security and confidentiality of sensitive data. In addition, some countries have specific regulations governing telemedicine services, which often intersect with women’s health apps that offer virtual consultations or remote monitoring feature

The Brazil women’s health app market is strictly regulated under the Brazilian General Data Protection Law (LGPD), which mandates strict adherence to data privacy and security practices, essentially for sensitive health information. This compliance is vital for businesses in the sector to maintain user trust. In addition, the country's cultural focus on health, beauty, and wellness significantly influences the demand for digital health solutions tailored to women's needs, from menstrual tracking to mental health support.

MEA Women’s Health App Market Trends

The women’s health app market in MEA was identified as a lucrative region in this industry. In the MEA region, regulatory frameworks are pivotal in driving the market growth. Initiatives by the Saudi Ministry of Health and the Egyptian government aim to boost the adoption of e-health and telemedicine services. Cultural factors, notably gender segregation in countries such as Iran and Saudi Arabia, shape demand for women-centric health apps that offer features such as women-only communities and private consultations with female doctors. In addition, the increasing health awareness among women in the region, acknowledging the role of technology in health management, is fueling the market. Women are leveraging these apps for a range of needs, from tracking menstrual cycles to managing pregnancies and monitoring chronic conditions, enhancing the scope of virtual healthcare.

The Saudi Arabia women’s health app market is anticipated to grow at the fastest CAGR during the forecast period. Saudi society's conservative nature plays a significant role in shaping the market. Due to cultural restrictions on gender interactions, promoting and accessing women's health apps in the country may be challenging. In addition, regulations related to women's data and security are stringent in Saudi Arabia, impacting how women's health apps collect, store, and utilize user data. In April 2024, recent data disclosed by the Communications, Space, and Technology Commission (CST) highlighted remarkable levels of internet accessibility in Saudi Arabia, with 99% of the population now online. The Saudi Internet Report 2023 indicates that each person, on average, uses 44 GB of mobile data every month, showcasing the swift progress in the country's digital infrastructure.

Key Women’s Health App Company Insights

The market is highly fragmented with presence of various software companies. Collaborations for software development, incorporation of latest technologies, new product launch, and regional expansion in emerging markets are some of the key strategies used by companies to gain competitive edge. For instance,in October 2023, Flo introduced Flo for Partners, a feature that helps partners better understand their significant others' menstrual and reproductive health. This update includes push notifications, period and pregnancy information, symptom explanations, supportive tips, and quizzes, enabling partners to offer more informed support during their significant others' cycles.

Key Women’s Health App Companies:

The following are the leading companies in the women’s health app market. These companies collectively hold the largest market share and dictate industry trends.

- Flo Health, Inc.

- Clue

- Glow, Inc.

- Withings

- Google, Inc

- Fitbit, Inc.

- Natural Cycles USA Corp

- Apple Inc.

- Wildflower Health

- HelloBaby, Inc.

- Ovia Health

Recent Developments

-

In January 2024, Femtech Canada announced its network focused to empowering tech firms focused on women’s health, having gathered over 120 Canadian startups and partners. After more than two years in development, the initiative supports health solutions for women, girls, non-binary, trans individuals, and those assigned female at birth.

-

In February 2024, Rosy Wellness expanded its platform to address a wider array of women's health issues for individuals aged 17 to 91. Under the guidance of founder and CEO Lyndsey Harper, Rosy attracted USD 5 million in funding from supporters such as True Wealth Ventures and Portfolia. Notably founded by a physician, the platform introduced new features such as ‘Quickies’ to broaden its reach and offerings in women's health.

-

In January 2023, Mamahood, a femtech app, was launched to support women in the Middle East and North Africa through fertility, pregnancy, and motherhood. It offers health-tracking tools, educational content, and a community platform for support. A key feature is its on-demand live chat, which allows 24/7 access to healthcare advisors for immediate, professional guidance.

-

In March 2024, Dialogue Health Therapeutics, a Canadian virtual health company, enhanced its services by acquiring assets from Koble Care, a digital women's health platform. This acquisition comprises of all of Koble's content, software, and intellectual property. Koble's specialized content will be incorporated into Dialogue’s Integrated Health Platform (IHP), and Koble’s CEO, Swati Matta, will join the Dialogue team as the head of women’s health.

Women’s Health App Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.68 billion

Revenue forecast in 2030

USD 12.87 billion

Growth rate

CAGR of 17.78% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, modality, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; Russia; Iceland; Finland; China; Japan; India; South Korea; Australia; Thailand; Singapore; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait; Israel

Key companies profiled

Flo Health, Inc.; Clue; Apple Inc.; Glow, Inc.; Withings; Google, Inc.; Natural Cycles USA Corp; Wildflower Health; HelloBaby, Inc.; Ovia Health

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

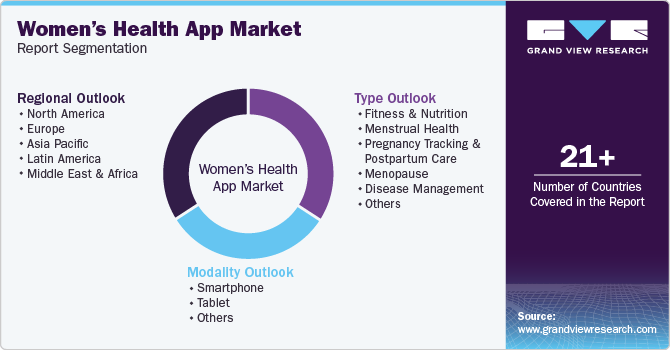

Global Women’s Health App Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women’s health app market report based on:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness & Nutrition

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphone

-

Tablet

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Norway

-

Denmark

-

Sweden

-

Russia

-

Iceland

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

South Arabia

-

UAE

-

Kuwait

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global women's health app market size was estimated at USD 4.85 billion in 2024 and is expected to reach USD 5.68 billion in 2025.

b. The global women's health app market is expected to grow at a compound annual growth rate of 17.78% from 2025 to 2030 to reach USD 12.87 billion by 2030.

b. North America dominated the women’s health app market and accounted for the largest revenue share of 37.66% in 2024. High adoption of mhealth apps, rising awareness about women's health, and strong government support to reduce healthcare cost are propelling the market growth in the region

b. Some key players operating in the women's health app market are Flo Health, Inc.; Clue; Apple Inc.; Glow, Inc.; Withings; Fitbit, Inc.; Natural Cycles; Wildflower Health; HelloBaby, Inc.; and Ovia Health

b. Key factors that are driving the women's health app market growth include increased mobile phone penetration, changes in dietary habits, and rising stress among the working women population.

b. The menstrual health segment dominated the market for women’s health app and accounted for the largest revenue share owing to the increasing demand for period cycle tracking app and new product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.