- Home

- »

- Pharmaceuticals

- »

-

Women's Health Therapeutics Market Size Report, 2030GVR Report cover

![Women's Health Therapeutics Market Size, Share & Trends Report]()

Women's Health Therapeutics Market Size, Share & Trends Analysis Report By Application (Hormonal Infertility, Contraceptives), By Age, By Drug (ACTONEL), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-414-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The global women’s health therapeutics market size was valued at USD 43.1 billion in 2023 and is expected to expand at a CAGR of 4.0% from 2024 to 2030. The market growth is attributed to the increasing awareness of women's health issues, advancements in medical technology, and a growing geriatric population. In addition, the market growth is also driven by the rising incidences of conditions such as menopause, polycystic ovary syndrome (PCOS), and breast cancer, which are fueling demand for targeted therapies. Furthermore, the shift towards personalized medicine and innovative reproductive health solutions further enhances the market landscape, while favorable government policies promote women's health initiatives globally.

Women's health therapeutics encompasses a range of medical treatments specifically designed to address health issues unique to women, including reproductive health, menopause, and hormonal disorders. The market is experiencing significant growth driven by increasing awareness of women's health, technological advancements, and a focus on personalized medicine.

The women's health therapeutics market is witnessing a surge in innovative contraceptive methods and targeted therapies for conditions such as endometriosis and polycystic ovary syndrome (PCOS). Recent advancements include non-hormonal options such as the vaginal capsule OUI, which creates an impenetrable barrier in cervical mucus, and Phexxi, a vaginal gel that maintains an acidic environment to hinder sperm motility. These innovations address the growing demand for safer, more effective contraceptive alternatives, especially as many women seek to avoid hormonal side effects.

In addition, there are opportunities to develop therapies for unmet needs in reproductive health, such as treatments for infertility and sexually transmitted infections. Furthermore, governments worldwide are increasingly supporting these developments; for instance, the U.S. National Institutes of Health (NIH) funds research to enhance women's health solutions. As the market evolves, the focus on personalized and user-friendly contraceptive technologies is expected to expand access and improve health outcomes globally.

Application Insights

Contraceptives dominated the market and accounted for the largest revenue share of 35.8% in 2023 attributed to increasing awareness about family planning and the availability of advanced contraceptive methods. In addition, the approval and launch of innovative products, such as the FDA-approved non-prescription contraceptive pill Opill in 2023, further contribute to market expansion. Furthermore, supportive reimbursement policies by governments and private organizations are further boosting the use of contraceptives globally.

The endometriosis and uterine fibroids segment is expected to grow at a CAGR of 7.6% over the forecast period. The rising prevalence of these conditions drives this growth, and increased awareness and diagnosis rates fuel demand for targeted therapies. In addition, advancements in medical technology, such as developing novel treatments, enable more effective management of endometriosis and uterine fibroids, contributing to the market expansion. Moreover, government initiatives to promote women's health and introduce new therapeutic products, such as Orilissa for endometriosis, further drive market growth in this application area.

Age Insights

50 years and above segment led the market and accounted for the largest revenue share in 2023. The increasing prevalence of menopausal and postmenopausal health issues drives this growth. As women enter this age group, they often experience conditions such as osteoporosis, hormonal imbalances, and increased risks of chronic diseases. This demographic shift is compounded by a growing awareness of women's health issues, leading to higher demand for effective treatments. In addition, advancements in hormone replacement therapies and personalized medicine are improving treatment options tailored to the exclusive needs of older women.

For younger women, particularly those in their reproductive years, the growth of the women's health therapeutics market is driven by increasing awareness of reproductive health issues, including polycystic ovary syndrome (PCOS) and infertility. Increased access to information and healthcare services empowers younger women to pursue timely diagnoses and treatments. Furthermore, innovations in contraceptive methods and fertility treatments are meeting the demands of this age group. Moreover, the growing trend towards preventive care and government initiatives to improve women's health education fosters a supportive environment for adopting therapeutics across various age segments.

Drug Insights

Prolia led the market and accounted for the largest revenue share of 16.3% in 2023. This growth is attributed to its effectiveness in treating and preventing osteoporosis in postmenopausal women. Prolia works by inhibiting RANK ligand, a protein crucial for bone resorption, thus reducing bone loss and fracture risk. Its biannual injection schedule enhances patient compliance, making it a preferred choice among healthcare providers. Furthermore, supportive government initiatives and favorable compensation policies in regions such as North America boost its market presence, contributing to Prolia's rapid growth trajectory.

Minastrin 24 Fe is expected to grow significantly over the forecast period, owing to its dual benefits as a contraceptive and a treatment for menstrual disorders. Its formulation includes a combination of ethinyl estradiol and norethindrone acetate, which effectively regulates menstrual cycles while preventing pregnancy. In addition, the increasing awareness of reproductive health issues and the demand for convenient contraceptive options are key drivers behind its growth. Furthermore, the availability of Minastrin 24 Fe through various distribution channels, including retail pharmacies and online platforms, enhances accessibility for women seeking reliable contraceptive solutions, thereby driving the market's growth.

Distribution Channel Insights

Hospital pharmacies dominated the market and accounted for the largest revenue share of 47.7% in 2023 attributed to the increasing prevalence of women's health disorders, such as endometriosis, polycystic ovary syndrome (PCOS), and osteoporosis. Hospital pharmacies are crucial in providing specialized medications and therapies tailored to women's unique health needs. In addition, the rising demand for effective treatments, coupled with advancements in medical research, enhances the capacity of hospital pharmacies to offer comprehensive care. Furthermore, the established infrastructure and access to healthcare professionals within hospitals facilitate immediate medication availability, further supporting the growth of this segment.

Online pharmacies are expected to grow at a CAGR of 4.6% over the forecast period, owing to the growing trend of digital healthcare and increased consumer preference for convenience. In addition, the growth of e-commerce platforms allows women to access various health products and medications from the comfort of their homes. This accessibility mainly benefits sensitive health issues, encouraging more women to seek necessary treatments without stigma. Furthermore, integrating telemedicine services enhances patient engagement and follow-up care, driving further growth in online pharmacy sales within the market.

Regional Insights

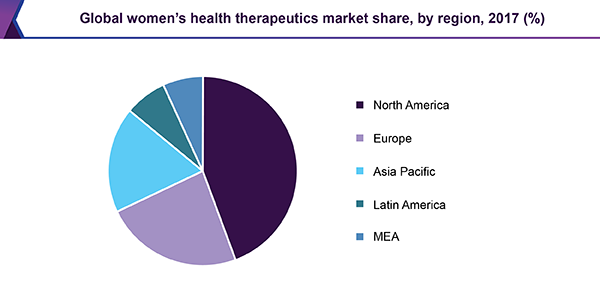

North America women’s health therapeutics market dominated the global market and accounted for the largest revenue share in 2023 attributed to the increased awareness of women's health issues, strong healthcare expenditure, and the availability of advanced treatments. In addition, the high adoption rate of women's health products, significant spending on female health, and the rising prevalence of diseases such as breast cancer further boost the market growth in the region.

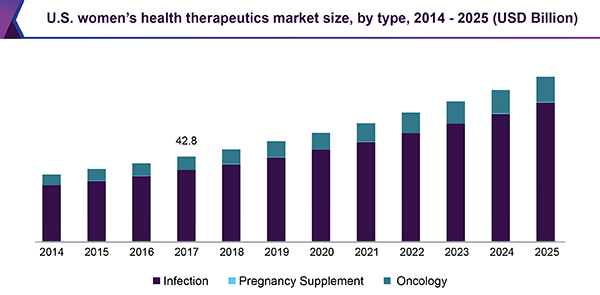

U.S. Women's Health Therapeutics Market Trends

Women's health therapeutics market in the U.S. is expected to grow substantially over the forecast period, owing to the increasing prevalence of conditions such as osteoporosis, breast cancer, and menopause. The high adoption rate of women's health products and substantial spending on female health contribute to the country's market dominance. Furthermore, the presence of key players, such as Pfizer Inc. and Merck & Co., Inc., and their focus on strategic collaborations and product launches further drive the market's expansion in the U.S.

Asia Pacific Women's Health Therapeutics Market Trends

The Asia Pacific women's health therapeutics market is expected to grow significantly, owing to the convenience of online platforms for buying medicines and the growing trend of digital healthcare. In addition, the increasing prevalence of e-commerce and the emphasis on telemedicine contribute to expanding online pharmacies in the region. Furthermore, the rising awareness of women's health issues and the increasing willingness to spend on healthcare drive the market's growth in Asia Pacific.

China Women's Health Therapeutics Market Trends

Women's health therapeutics market in China is driven by the growing prevalence of conditions such as polycystic ovary syndrome (PCOS), endometriosis, and breast cancer. The increasing awareness of women's health issues and the rising disposable incomes of women in the country contribute to the market's growth. Furthermore, the government's focus on improving healthcare infrastructure and promoting the development of women's health therapeutics further supports the market's expansion in China.

Europe Women's Health Therapeutics Market Trends

Europe women's health therapeutics market registered a significant revenue share in 2023. This growth is driven by the growing awareness of women's health issues and the improved healthcare infrastructure in countries such as Germany, the UK, and France. In addition, the increasing prevalence of diseases such as breast cancer and the rising demand for effective treatments contribute to the market's growth in Europe. Furthermore, the presence of key players, such as Bayer AG and GlaxoSmithKline plc, and their focus on product launches and strategic collaborations further drive the market's expansion in the region.

Key Companies & Market Share Insights

Some key women's health therapeutics market companies include Pfizer, Inc., Cipla Inc., Orchid Pharma, and others. Key players in the market adopt strategies such as strategic partnerships and acquisitions, continuous product innovation, and geographic expansion to enhance market presence. These companies prioritize regulatory compliance and conduct extensive clinical trials to ensure safety and efficacy, ultimately addressing the evolving healthcare needs of women globally.

-

Bayer AG manufactures contraceptives, treatments for heavy menstrual bleeding, menopause management solutions, and therapies for gynecologic conditions such as endometriosis and acne.

-

Cipla Inc. manufactures various products, including antibiotics, respiratory medications, and treatments for chronic conditions. The company develops therapies that address specific women’s health challenges.

Key Women's Health Therapeutics Companies:

The following are the leading companies in the women's health therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Pfizer, Inc.

- Cipla Inc.

- Orchid Pharma.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical

- F. Hoffmann-La Roche Ltd.

- AbbVie

- Axena Health

Recent Developments

-

In June 2024, Orchid Pharma partnered with Cipla to launch Cefepime-Enmetazobactam, a breakthrough antibiotic combination approved for treating complicated Urinary Tract infections (cUTI), Ventilator-Associated Pneumonia (VAP), and Hospital-Acquired Pneumonia (HAP). This collaboration ensured widespread distribution of this treatment across India. In addition, the partnership combined Orchid's drug development capabilities with Cipla's distribution network, ensuring that this life-saving medication reaches healthcare providers efficiently.

Women's Health Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.5 billion

Revenue forecast in 2030

USD 56.8 billion

Growth Rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion/Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, age, drug, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, South Africa, UAE, Kuwait, Saudi Arabia

Key companies profiled

Bayer AG; Pfizer, Inc.; Cipla Inc.; Orchid Pharma.; Sun Pharmaceutical Industries Ltd.; Teva Pharmaceutical; F. Hoffmann-La Roche Ltd.; AbbVie; Axena Health

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women's Health Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women's health therapeutics market report based on application, age, drug, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Infertility

-

Contraceptives

-

Postmenopausal Osteoporosis

-

Endometriosis & Uterine Fibroids

-

Menopause

-

Polycystic Ovary Syndrome (PCOS)

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

50 Years & Above

-

Others

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

ACTONEL

-

YAZ, Yasmin, Yasminelle

-

FORTEO

-

Minastrin 24 Fe

-

Mirena

-

NuvaRing

-

ORTHO TRI-CY LO

-

Premarin

-

Prolia

-

Reclast/Aclasta

-

XGEVA

-

Zometa

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."