- Home

- »

- Advanced Interior Materials

- »

-

Wood And Laminate Flooring Market, Industry Report, 2030GVR Report cover

![Wood And Laminate Flooring Market Size, Share & Trends Report]()

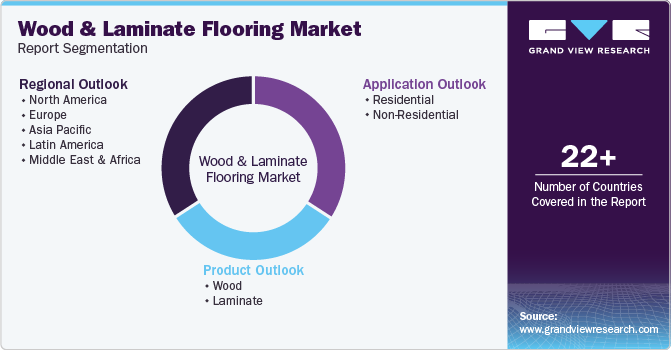

Wood And Laminate Flooring Market Size, Share & Trends Analysis Report By Product (Wood, Laminate), By Application (Residential, Non-Residential), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-430-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Wood And Laminate Flooring Market Trends

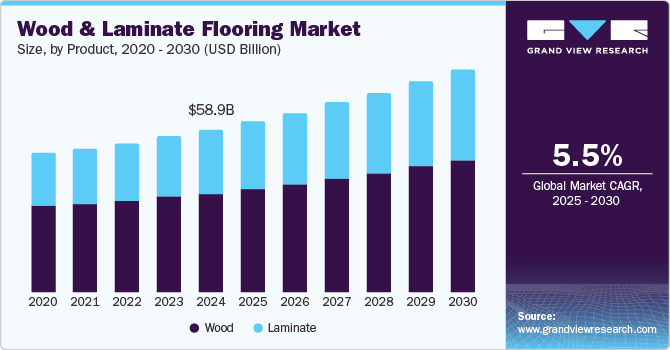

The global wood and laminate flooring market size was estimated at USD 58.96 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. In new constructions and renovations, consumers increasingly seek flooring solutions that offer aesthetic appeal and durability. This trend is particularly pronounced in developed nations, where single-family homes are becoming the norm, especially in colder climates that favor wood flooring for its warmth and inviting ambiance. As homeownership trends shift, the demand for high-quality and visually appealing flooring options is expected to rise.

The commercial construction sector is another significant contributor to wood and laminate flooring demand. With increased investments in hotels, office spaces, and retail environments, flooring choices that balance durability with aesthetic qualities are in high demand. Laminate flooring, known for its cost-effectiveness and ease of maintenance, is especially favored in commercial settings. This trend underscores the evolving preferences of businesses seeking functional yet visually compelling environments that enhance customer experiences and employee productivity.

Technological advancements are critical in augmenting the wood and laminate flooring market. Innovations in design and manufacturing processes have significantly improved the quality and appearance of laminate flooring, making it an attractive alternative to traditional hardwood. Moreover, advancements in engineered wood technologies offer a broader range of product choices, appealing to consumers who are increasingly interested in obtaining realistic wood aesthetics at competitive price points. These innovations cater to consumer preferences and position manufacturers favorably in a highly competitive landscape.

Sustainability trends are reshaping consumer attitudes toward flooring materials, driving demand for sustainably sourced wood and recycled laminates. As environmental awareness grows, consumers are leaning toward flooring solutions that reflect their values, aligning with a broader push for responsible consumption. This sustainable focus enhances market growth potential, facilitating an environment where companies can differentiate themselves by committing to eco-friendly practices. Consequently, the wood and laminate flooring market is poised for continued expansion as it adapts to evolving consumer preferences driven by aesthetics, sustainability, and technological advancements.

Product Insights

Wood flooring led the market with a revenue share of 60.2% in 2024. Consumers are increasingly drawn to wood flooring for its natural beauty and warmth, which enhance interior aesthetics. The heightened focus on sustainability has driven demand for responsibly sourced wood products. Furthermore, urbanization and construction activities favor wood flooring for its durability and resilience in both residential and commercial applications.

Laminate flooring is expected to grow at the fastest CAGR of 6.0% over the forecast period, driven by laminate flooring’s affordability, ease of installation, and low maintenance, appealing to cost-conscious consumers in both residential and commercial markets. Technological advancements enable laminate products to closely resemble natural wood and stone, while the DIY trend further enhances demand for this versatile flooring solution.

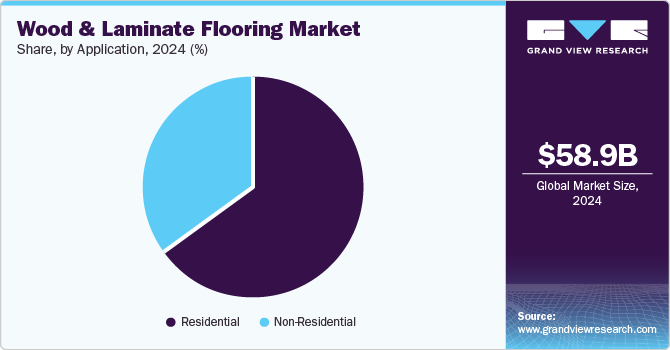

Application Insights

The residential segment dominated the market and accounted for a share of 65.1% in 2024. Urbanization and population growth have spurred increased residential construction, with homeowners prioritizing aesthetically appealing and durable flooring options. Rising disposable incomes facilitate investments in quality materials, while the trend toward sustainability boosts demand for eco-friendly wood products, and the popularity of renovations enhances interest in modern flooring solutions.

The non-residential segment is projected to grow at the fastest CAGR of 65.1% over the forecast period. Growth in commercial construction is a key driver of demand, as businesses require durable and aesthetically appealing flooring solutions for offices, retail spaces, and hospitality venues. The preference for low-maintenance, resilient options and the trend toward sustainable materials further influence developers’ choices, significantly impacting demand in this segment.

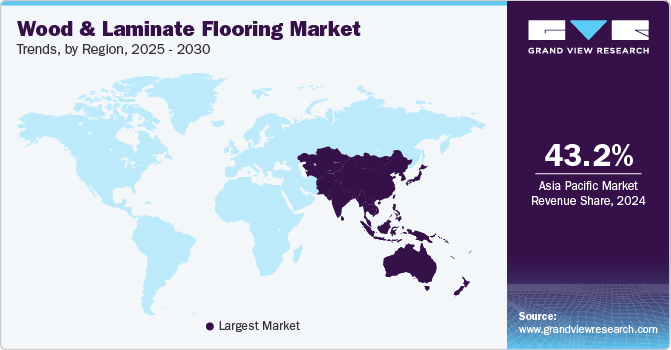

Regional Insights

North America wood and laminate flooring market is expected to register significant growth in the forecast period. North America’s thriving construction industry and growing consumer interest in home improvement projects bolster demand for hardwood flooring in residential settings. The robust commercial sector seeks durable and visually appealing options, while rising disposable incomes empower consumers to invest in quality flooring that enhances their living spaces.

U.S. Wood And Laminate Flooring Market Trends

The wood and laminate flooring market in the U.S. dominated the Asia Pacific wood and laminate flooring market in 2024. The country features a vibrant residential sector, with homeowners emphasizing aesthetics and durability. The expansion of new construction and renovation projects drives demand for wood and laminate products. Furthermore, commercial spaces are increasingly utilizing these flooring solutions due to their cost-effectiveness and minimal maintenance requirements.

Asia Pacific Wood And Laminate Flooring Market Trends

Asia Pacific wood and laminate flooring market dominated the global market with a revenue share of 43.2% in 2024, propelled by rapid urbanization and heightened construction activities. As populations shift to urban areas, the demand for housing and commercial infrastructure intensifies, further increasing the need for versatile flooring solutions. Moreover, rising disposable incomes enable consumers to allocate more funds towards home improvements.

The wood and laminate flooring market in China dominated the Asia Pacific wood and laminate flooring market with a revenue share of 34.0% in 2024, aided by substantial investments in commercial construction and urban development. The demand for cost-effective, aesthetically pleasing flooring solutions is particularly strong in urban settings. Furthermore, advancements in manufacturing technologies have enhanced product quality, positioning laminate flooring as a desirable choice for residential and commercial applications.

Europe Wood And Laminate Flooring Market Trends

Europe wood and laminate flooring market held substantial market share in 2024 as sustainability and eco-friendly materials gain prominence. Consumers favor flooring solutions that comply with green building practices, influenced by stringent environmental regulations. Furthermore, increased investments in construction and home renovations elevate demand for stylish, durable flooring options.

The wood and laminate flooring market in Germany is expected to grow rapidly in the forecast period. Germany’s commitment to sustainable construction practices and superior product offerings drives strong demand for eco-friendly flooring options, particularly wood and laminate. The market thrives on innovative design trends and technological advancements in flooring materials, addressing consumer preferences for durability and aesthetic appeal.

Key Wood And Laminate Flooring Company Insights

Some key companies operating in the market include AHF, LLC.; MOHAWK INDUSTRIES, INC.; Beaulieu International Group; and Kährs;; among others. Strategic initiatives encompass investments in sustainable materials, advancements in durability technology, expansion into emerging markets, and enhancing e-commerce to improve customer accessibility and distribution efficiency.

-

AHF, LLC specializes in solid and engineered hardwood flooring crafted from premium American hardwoods. The company also provides a diverse selection of flooring solutions, including luxury vinyl tile, laminate, and commercial-grade vinyl, emphasizing innovation and design excellence.

-

Kährs, a Swedish manufacturer of wood and laminate flooring, is recognized for its commitment to sustainability and quality. The company provides a diverse selection of engineered wood and laminate options, prioritizing durability, aesthetic appeal, and eco-friendly production methods.

Key Wood And Laminate Flooring Companies:

The following are the leading companies in the wood and laminate flooring market. These companies collectively hold the largest market share and dictate industry trends.

- AHF, LLC.

- MOHAWK INDUSTRIES, INC.

- Beaulieu International Group

- Kährs

- Boral

- DAIKEN Corporation

- Shaw Industries Group, Inc., a Berkshire Hathaway Company

- Tarkett

- Barlinek S.A.

- British Hardwoods

Recent Developments

-

In September 2024, Beaulieu International Group announced the appointment of Jean-Baptiste De Ruyck as CEO, succeeding Pol Deturck, to lead the company toward sustainable growth and strategic opportunities.

-

In May 2024, Beaulieu International Group debuted its Experience Center during Flanders Flooring Days, showcasing an extensive range of flooring solutions and encouraging visitors to engage with innovative products.

-

In April 2024, Kährs launched the Duramen Collection, a sustainable, 3-strip engineered wood flooring line showcasing heartwood beauty, combining elegance with environmental responsibility, certified by the Nordic Swan Ecolabel.

-

In April 2024, Tarkett launched the Collective Pursuit™ non-PVC flooring collection, offering high performance comparable to luxury vinyl tile, demonstrating the company’s commitment to sustainability and market demands.

-

In January 2024, Shaw Floors announced its 2024 Phase I introductions, featuring innovative soft and hard surface collections that catered to diverse customer needs, offering performance, affordability, and unique visual styles.

Wood And Laminate Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 61.89 billion

Revenue forecast in 2030

USD 80.78 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million square meters, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

AHF, LLC.; MOHAWK INDUSTRIES, INC.; Beaulieu International Group; Kährs; Boral; DAIKEN Corporation; Shaw Industries Group, Inc., a Berkshire Hathaway Company; Tarkett; Barlinek S.A.; British Hardwoods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood And Laminate Flooring Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood and laminate flooring market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Wood

-

Laminate

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Italy

-

Spain

-

Russia

-

Romania

-

CZ

-

Portugal

-

Ukraine

-

Slovakia

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Philippines

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Qatar

-

South Africa

-

Morocco

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."