- Home

- »

- Advanced Interior Materials

- »

-

Wood Chipper Machines Market Size, Industry Report, 2030GVR Report cover

![Wood Chipper Machines Market Size, Share & Trends Report]()

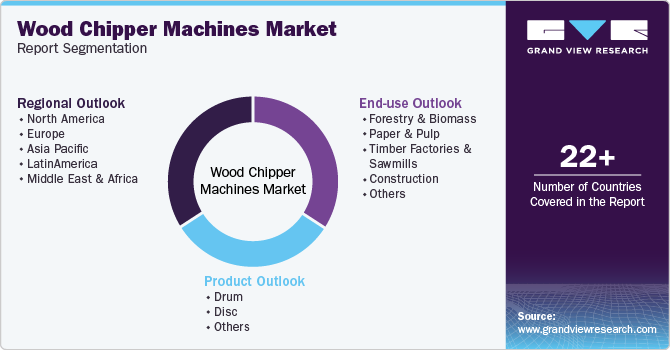

Wood Chipper Machines Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Drum, Disc), By End-use (Paper & Pulp, Forestry & Biomass, Timber Factories & Sawmills), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-056-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wood Chipper Machines Market Summary

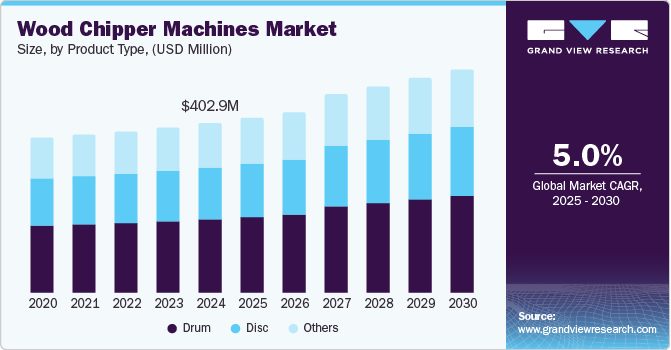

The global wood chipper machines market size was valued at USD 402.9 million in 2024 and is projected to reach USD 529.9 million by 2030, growing at a CAGR of 5.0% from 2025 to 2030. This growth is attributed to the increasing demand for wood in industries such as furniture, construction, and paper, and pulp is boosting the need for efficient wood processing equipment.

Key Market Trends & Insights

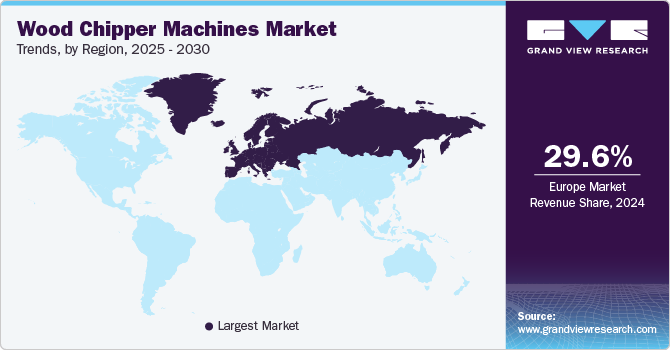

- The wood chipper machines market in Europe dominated the global market and accounted for the largest revenue share of 29.6% in 2024.

- The wood chipper machines market in the Asia Pacific is expected to grow at a CAGR of 6.1% over the forecast period.

- By product type, the drum product segment dominated the market and accounted for the largest revenue share of 43.2% in 2024.

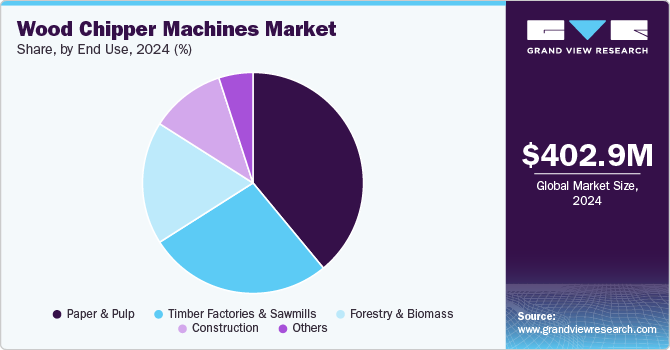

- By end use, the paper and pulp segment led the market and accounted for the largest revenue share of 39.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 402.9 Million

- 2030 Projected Market Size: USD 529.9 Million

- CAGR (2025-2030): 5.0%

- Europe: Largest market in 2024

In addition, rapid urbanization and infrastructure development generate significant opportunities for wood chipper machines to clear land. Furthermore, the rising popularity of eco-friendly practices and organic mulch usage in landscaping further fuels market demand, alongside technological advancements enhancing machine efficiency and performance.Wood chipper machines are essential devices that transform large pieces of wood into smaller chips or mulch, primarily utilized in landscaping, gardening, and forestry. The market is experiencing significant growth, driven by various factors. One major contributor is the expansion of the forestry and timber industry, where the rising global demand for timber and pulp necessitates efficient processing equipment.

Furthermore, the trend toward sustainable green waste management practices is propelling market growth. Municipalities and businesses are increasingly investing in woodchippers to manage organic waste responsibly, thereby reducing landfill dependency. Cities like San Francisco have implemented comprehensive green waste recycling programs that incorporate wood chippers to process yard debris, aligning with their zero-waste initiatives.

Moreover, opportunities for market expansion also arise from the growing interest in DIY and home improvement projects. The COVID-19 pandemic prompted many homeowners to undertake renovations, leading to heightened demand for wood chippers to efficiently handle garden waste. Furthermore, rising construction and demolition activities generate significant wood waste, creating a robust market opportunity. Urban redevelopment projects often produce large amounts of wood from demolished structures that require processing into usable chips for landscaping or biomass energy.

Product Type Insights

The drum product segment dominated the market and accounted for the largest revenue share of 43.2% in 2024, owing to its ability to maintain consistent knife velocity, which results in the production of uniform wood chips. In addition, their design allows for higher processing capacity, making them ideal for industries that require large quantities of chips quickly. Furthermore, their low maintenance costs and long operational life contribute to their appeal among users, further driving demand in various sectors.

The disc segment is expected to grow at a CAGR of 5.0% over the forecast period, driven by its energy efficiency and innovative design. These machines are engineered to consume less fuel while effectively processing wood waste, making them an attractive option for environmentally conscious users. Furthermore, the integration of discharge and comminuting systems into a single unit enhances usability and reduces operational complexity. Moreover, as industries increasingly focus on sustainable practices and waste reduction, the demand for disc wood chippers is expected to grow, supporting their market expansion.

End Use Insights

The paper and pulp segment led the market and accounted for the largest revenue share of 39.2% in 2024. This growth is attributed to the increasing demand for wood chips in paper production. Wood chippers are essential for converting logs into uniform chips, which facilitate the efficient absorption of cooking chemicals during pulp processing. In addition, as global consumption of paper products rises, manufacturers require more wood chips, thereby boosting the demand for wood chippers. Moreover, this trend is further supported by advancements in technology that enhance chip quality and processing efficiency.

The forestry and biomass segment is expected to grow at a CAGR of 5.5% from 2025 to 2030, owing to heightened awareness of sustainable practices and biomass energy production. Wood chippers play a crucial role in harvesting forest biomass and converting tree residues into usable chips for energy generation and other applications. In addition, as governments and industries increasingly focus on renewable energy sources, the demand for wood chipper machines to facilitate biomass processing is growing.

Regional Insights

The wood chipper machines market in Europe dominated the global market and accounted for the largest revenue share of 29.6% in 2024. This growth is attributed to a strong emphasis on sustainability and environmental regulations. Countries in the region are increasingly adopting policies that promote the use of wood chippers for efficient waste management and biomass energy production. In addition, the growing demand for wood chips in various industries, including construction and landscaping, further supports market expansion. Furthermore, technological advancements in wood chipper designs enhance processing efficiency, making them more appealing to businesses focused on eco-friendly practices.

Germany Wood Chippers Machines Market Trends

The Germany wood chipper machines market dominated the European market and accounted for the largest revenue share in 2024, driven by the country’s commitment to renewable energy and sustainable forestry practices. The government encourages the use of wood chippers for processing wood waste into biomass fuel, aligning with its environmental goals. Furthermore, the robust construction industry and increasing urbanization create a demand for efficient waste management solutions, leading to higher adoption rates of wood chippers in both residential and commercial applications.

Asia Pacific Wood Chippers Machines Market Trends

The wood chipper machines market in the Asia Pacific is expected to grow at a CAGR of 6.1% over the forecast period, owing to infrastructure development and urbanization. Countries like India and Australia are investing heavily in construction projects, which generate significant amounts of wood waste that require efficient processing. Furthermore, the increasing awareness of sustainable practices among consumers and industries also drives demand for wood chippers as effective solutions for managing green waste and promoting recycling initiatives.

China wood chipper machines market dominated the Asia Pacific market and is expected to grow rapidly due to its booming construction sector and rising demand for timber products. The government's initiatives to promote sustainable forestry practices further drive the need for efficient wood processing equipment. Furthermore, as urban areas continue to grow, there is a heightened focus on managing tree debris and landscaping needs, which positions wood chippers as essential tools for both residential and commercial use.

North America Wood Chippers Machines Market Trends

The wood chipper machines market in North America is expected to grow significantly over the forecast period, driven by the increasing demand for efficient wood processing solutions in various industries. In addition, the construction sector is expanding rapidly, leading to a rise in wood waste that requires effective management. Furthermore, the paper and pulp industry relies heavily on wood chippers for producing wood chips, further boosting market demand. Moreover, the presence of major manufacturers and advancements in technology also contribute to the region's market expansion, making wood chippers more accessible and efficient.

The growth of the U.S. wood chipper machines market is particularly driven by the robust, thriving construction and paper industries. Furthermore, the increasing popularity of electric wood chippers, which offer eco-friendly options for waste management, is driving consumer interest. Moreover, government initiatives promoting sustainable practices and renewable energy sources enhance the adoption of wood chippers across various sectors. As urbanization continues to rise, the need for effective landscaping and tree maintenance solutions further supports the market's growth in the U.S.

Key Wood Chipper Machines Company Insights

Some of the Key players in the global wood chipper machines industry include Terex, Morbark, Bandit, and others. These companies are adopting several strategies to enhance their competitive edge. These include expanding their geographical presence through strategic partnerships and collaborations. In addition, companies are also enhancing customer engagement by offering after-sales support and extended warranties, thereby building brand loyalty. Furthermore, sustainability initiatives are being integrated into product offerings to align with growing environmental concerns among consumers.

-

MTD Products produces a range of wood chippers designed for residential and commercial use, focusing on efficiency and ease of operation. The company operates within the landscaping and gardening segment, providing solutions that help users manage yard waste effectively. Its product lineup includes various models powered by gasoline and electric engines, catering to customer needs for wood processing and waste management.

-

J.P. Carlton manufactures a variety of wood chippers, including disc and drum models, designed for heavy-duty applications in forestry and biomass sectors. The company operates within the commercial and industrial segments, offering robust solutions for wood processing that meet the demands of professionals in landscaping, construction, and waste management.

Key Wood Chipper Machines Companies:

The following are the leading companies in the wood chipper machines market. These companies collectively hold the largest market share and dictate industry trends.

- Terex

- Morbark

- Bandit Industries

- Vermeer

- MTD Products

- Peterson

- J.P. Carlton

- ECHO Bear Cat

- MTD Products

- Zenoah

- Weifang Fred Machinery

- China Foma (Group)

- Rivim

Recent Developments

-

In November 2024, Terex showcased its leading environmental brands at IFAT 2024, featuring Terex Ecotec, CBI, Terex Recycling Systems, ZenRobotics, and Green-Tec. The event highlighted innovative recycling and waste management solutions, including the TDS 815 slow-speed shredder and the CBI Magnum Force 5400B horizontal grinder, which can serve as effective wood chipper machines. Terex emphasized its commitment to sustainability and customer engagement, demonstrating advanced technologies that enhance waste processing efficiency and support environmental goals.

-

In November 2023, Bandit Industries announced the launch of the HM6420 hammermill horizontal grinder, designed as an efficient solution for grinding applications that may include contaminants. This powerful machine features a 1,200-horsepower Caterpillar engine and a robust 50” diameter hammermill, capable of processing large volumes of material. The HM6420 enhances Bandit's lineup of wood chipper machines, offering advanced features such as a quick-change pocket system for hammers and a proportional feed system that optimizes output and product quality.

Wood Chipper Machines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 415.0 million

Revenue forecast in 2030

USD 529.9 million

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product Type, end use, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, Italy, UK, France, China, India, Japan, Australia, Brazil, Argentina, Saudi Arabia, and South Africa.

Key companies profiled

Terex; Morbark; Bandit Industries; Vermeer; MTD Products; Peterson; J.P. Carlton; ECHO Bear Cat; MTD Products; Zenoah; Weifang Fred Machinery; China Foma (Group); Rivim.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood Chipper Machines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global wood chipper machines market report based on product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drum

-

Disc

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Forestry & Biomass

-

Paper & Pulp

-

Timber Factories & Sawmills

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.