- Home

- »

- Next Generation Technologies

- »

-

Workload Scheduling & Automation Market Report, 2020-2027GVR Report cover

![Workload Scheduling & Automation Market Size, Share & Trends Report]()

Workload Scheduling & Automation Market (2020 - 2027) Size, Share & Trends Analysis Report By Deployment (Cloud, On Premise), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-930-2

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global workload scheduling and automation market size was valued at USD 2.22 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2020 to 2027. The growth can be attributed to the continued digitalization, growing preference for virtual and cloud-based resources, and generation of large volumes of data due to increasing internet penetration. Workload scheduling and automation is playing a crucial role as enterprises are adopting IT automation solutions to enhance their efficiency and competitiveness. The growing demand for cloud computing, enterprise mobility, big data analytics, DevOps, and micro-services architecture is also expected to drive the demand for workload scheduling and automation solutions over the forecast period.

Workload scheduling and automation helps in automating, monitoring, and controlling workflows or jobs in an organizational IT environment. It also helps in executing the background IT jobs efficiently and streamlining the IT infrastructure with the business objectives to optimize the organizational performance and reduce the total cost of ownership. Vendors in the market are offering integrated batch and workload automation solution suites designed to help companies in developing their batch operations with administrative automated scheduling and monitoring functions. When it comes to the delivery of solutions under a managed services model, vendors are helping enterprises in fostering their business agility by combining batch scheduling processes across varied IT environments and platforms.

The IT systems landscape across various industries and industry verticals is evolving continuously in line with the emerging trends and data center operations and workload processing is getting increasingly infeasible. The incumbent legacy practices are providing for a limited set of jobs and need significant manual intervention. Moreover, the growing interconnection between different processes and the necessity to optimize these processes has triggered the need for upscaling workload scheduling and automation capabilities. As a result numerous organizations are opting for automated workload scheduling to overcome the abovementioned shortcomings. This is evident from the industry research survey conducted in 2018, which revealed that around 64% of the respondents identified IT workload operations as the most automated function in the industry.

At present, application developers are working in a dynamic IT environment and are dealing with a myriad of business applications and operating systems. Managing batch activity in such heterogeneous environments needs manual scripting, which is time-consuming and also prone to error. The need for automation to eliminate the manual scripting process is driving the demand for workload scheduling and automation solutions. However, many companies do not have a steady internal workload process and are hence face challenges in offloading their processes to a software solution. This is emerging as a prime challenge while adopting workload scheduling and automation solutions.

The challenge of scheduling enterprise IT workloads finds its roots in the variety of platforms, on which, the jobs must run. Various systems store jobs in databases on their mainframe. Data is stored by the ERP system in SQL Server and Oracle databases while messaging systems store data in Microsoft Exchange and Lotus Notes. Cognos data and Teradata warehouses offer reports via Crystal Reports and Microstrategy. In order to tackle this data diversity, enterprises are finding new ways to integrate these varied data sources and depositories of information. The continued integration of the latest technologies, such as artificial intelligence and machine learning, with workload automation solutions, is expected to drive the market growth over the forecast period.

In December 2019, the World Health Organization (WHO) declared the outbreak of COVID-19 as a pandemic. The subsequent lockdowns in various parts of the world have drastically impacted the production, demand, and supply of goods and services across the world. While supply chains and different markets have been totally disrupted, enterprises and governments are confronting financial challenges. At this juncture, IT resources enabled by cloud technology would play a crucial role in improving access to data services and enhancing the connectivity between people and businesses globally. In the wake of the pandemic, technology-driven companies are looking forward to operating work environments remotely leveraging cloud-enabled workload automation and scheduling solutions.

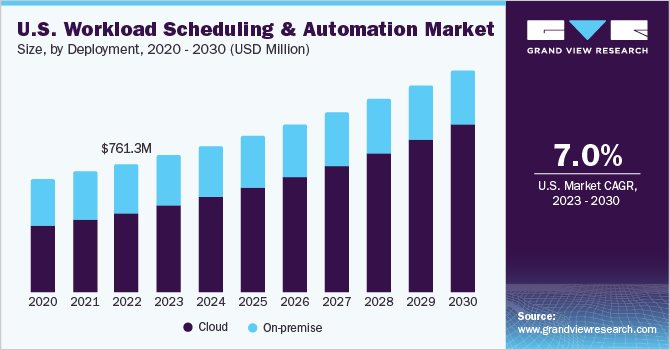

Deployment Insights

The cloud segment accounted for a major revenue share of around 55% in 2019. Cloud-based solutions are emerging as a new norm owing to the increasing demand for solutions that can potentially help the developers and operators on the go. The latest trends have revealed that Workload Automation (WLA) is often used in virtualized and cloud environments. Advances in technology are encouraging enterprises to deploy WLA cloud solutions to ease workload processing and accommodate various other applications across the cloud environment. The Future of Cloud Report: 2018 has revealed that almost 27% of the industry experts foresee around 95% of the workloads being run on the cloud over the next five years.

Cloud-based workload scheduling and automation solutions not only integrate, monitor, and operate workload but also provide analyses and predictions for the future. They help organizations in tackling problems that can arise in the future and managing assets. These solutions can enhance workload scheduling without the need for any human intervention. On the other hand, sophisticated scheduling, automating, and analytical capabilities of these solutions can help organizations in increasing employee efficiency, thereby driving the demand for workload scheduling and automation software.

Enterprise Size Insights

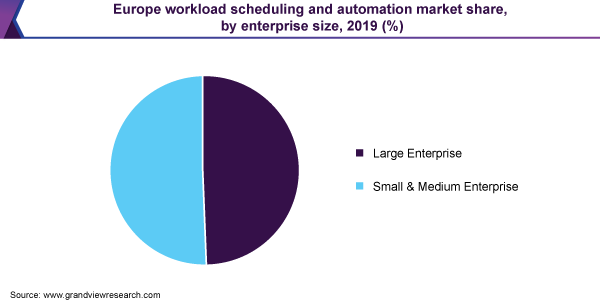

The large enterprise segment accounted for the largest market share of over 53% in 2019. Large enterprises have taken a lead in adopting workload scheduling and automation solutions and are deploying these solutions to centralize the execution, enhance IT operational efficiency, and increase IT productivity. Large enterprises are also adopting cloud-based services to effectively manage costs. The availability of free, open-source, and customizable WLA cloud solutions also bodes well for the growth of the segment.

The adoption of workload scheduling and automation software is gaining traction among small and medium enterprises that are looking for economical alternatives to manage their workloads. Startups are particularly adopting cloud-based services to operate their workloads, thereby driving the demand for cloud-based workload automation solutions. According to the Logic Monitor Survey, 83% of the enterprise workloads would be handled on the cloud by 2020. Workload scheduling and automation solutions would be instrumental in centralizing control over business processes and cloud computing systems.

End-use Insights

The retail segment held the largest market share of around 25% in 2019 owing to the increasing adoption of WLA solutions by retailers for in-house operations, such as logistics and inventory management. Services, such as managing online payments, payment gateways, digital wallets, and exemplary customer experience, would particularly require complex, automated workflow structures, thereby encouraging the adoption of WLA solutions in the retail industry. Based on end-use, the market is segmented into BFSI, IT and telecom, retail, healthcare, government, and public sector, and manufacturing.

Workload scheduling and automation solutions help in eliminating time-intensive manual intervention in processes and reducing the subsequent errors that can potentially lead to poor user experience. Given the continued digital transformation of the BFSI industry, WLA is playing a crucial role in automating various processes that are repeated each day during business hours. The growing list of daily processes as a result of the rapidly-changing needs of customers is expected to drive the adoption of automation and scheduling solutions for workload processes. Various industry estimates suggest that automation solutions would be performing around 25% of the work across the banking functions, thereby freeing employees to focus on higher-value tasks and projects.

Regional Insights

North America accounted for a major share of over 40% in 2019 owing to the early adoption of workload scheduling and automation solutions by enterprises in the region. North America is also home to several vendors, such as Oracle Corporation, Cisco Systems, and IBM Corporation, among others, which are offering several innovative IT workload automation solutions. Moreover, various industry participants estimate that North America will maintain a substantial share of cloud-based workloads throughout 2020 and experience steady growth over forecast period. The increasing IT infrastructure; the growing preference for entirely-automated, cloud-based operations; and the rising number of technology startups are expected to drive the growth of the North America regional market.

On the other hand, the deployment of cloud technology in various European nations is also encouraging small and medium enterprises to adopt workload scheduling and automation solutions rapidly. While enterprises in the region are under pressure to reduce IT infrastructure costs, the outsourcing industry in the region is also trying aggressively to find alternative ways to control spending. Asia Pacific is anticipated to emerge as the fastest-growing regional market over the forecast period as the region is home to several providers of IT services and solutions.

Key Companies & Market Share Insights

The market is consolidated in nature with niche players occupying a substantial market share. IBM Corporation; VMware, Inc.; Cisco Systems Inc.; and Oracle Corporation are some of the major players. The key players continue to consolidate their market position through acquisition and mergers, and strategic partnerships and agreements aimed at securing their market position in the long run. For instance, in July 2019, HCL Technologies Ltd. acquired some of IBM Corp.’s products for security, commerce, marketing, and digital solutions. Along with the acquisition, the company also introduced the HCL software division to operate an enterprise software product business that offers some popular products, such as Workload Automation 9.5, Informix 14.10, and Domino 10.

In October 2018, Tidal Workload Automation, provider of enterprise-class workload automation for multi-cloud and hybrid environments and a member of Oracle PartnerNetwork (OPN), announced that its Tidal platform has been made available on Oracle Cloud Marketplace. The initiative was aimed at offering enterprise-class automation capabilities to Oracle Cloud customers willing to automate and orchestrate their mission-critical workloads. In July 2017, IBM Corp. announced the IBM Watson-based services platform to augment human intelligence and leverage cognitive technologies for service provider operations. The IBM Services Platform along with Watson’s cognitive abilities will help in predicting issues and proactively directing automation to enhance quality and help the IT staff in making faster and data-driven decisions. Some of the prominent players in the workload scheduling & automation market include:

-

ASG Technologies Group, Inc.

-

BMC Software, Inc.

-

CA Technologies (Broadcom Inc.)

-

Cisco Systems, Inc.

-

HCL Technologies Limited

-

Hitachi Vantara Corporation.

-

IBM Corporation

-

Oracle Corporation

-

Stonebranch Inc.

-

VMWare Inc.

Workload Scheduling & Automation Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.34 billion

Revenue forecast in 2027

USD 3.65 billion

Growth Rate

CAGR of 6.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends.

Segments covered

Deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

IBM Corporation; VMWare Inc.; BMC Software; Oracle Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global workload scheduling and automation market report on the basis of deployment, enterprise size, end-use, and region:

-

Deployment Outlook (Revenue, USD Million, 2016 - 2027)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2016 - 2027)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

BFSI

-

IT & Telecommunication

-

Retail

-

Healthcare

-

Government & Public Sector

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global workload scheduling & automation market size was estimated at USD 2.22 billion in 2019 and is expected to reach USD 2.34 billion in 2020.

b. The global workload scheduling & automation market is expected to witness a compound annual growth rate of 6.5% from 2020 to 2027 to reach USD 3.64 billion by 2027.

b. Large enterprise segment accounted for the largest market share of over 55% in 2019. The growth can be attributed to the large scale deployment of these solutions to centralize the execution process, enhance IT operational efficiency, and increase IT productivity. Moreover, the availability of free, open-source, and customizable WLA cloud solutions will also boost the growth of the segment.

b. Some key players operating in the workload scheduling & automation are IBM Corporation, VMware, Inc., Cisco Systems Inc., and, Oracle Corporation. Some of the other players in the market include ASG Technologies Group, Inc., BMC Software, Inc., CA Technologies (Broadcom Inc.), HCL Technologies Limited, Hitachi Vantara Corporation, and Stonebranch Inc.

b. Key factors that are driving the market growth are the continued digitalization, growing preference for virtual and cloud-based resources, increasing penetration of the internet, and the large volumes of data being generated as a result. Moreover, the growing demand for cloud computing, enterprise mobility, big data analytics, DevOps, and micro-services architecture is also expected to drive the demand for workload scheduling and automation solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.