- Home

- »

- Healthcare IT

- »

-

Workplace Stress Management Market Size Report, 2030GVR Report cover

![Workplace Stress Management Market Size, Share & Trends Report]()

Workplace Stress Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Stress Assessment, Yoga & Meditation, Resilience Training), By End-use, By Delivery Mode, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-784-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Workplace Stress Management Market Summary

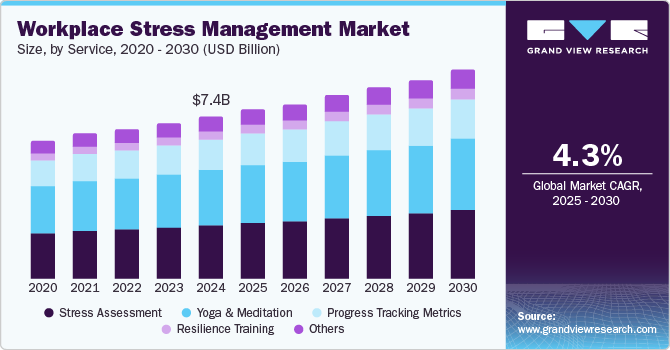

The global workplace stress management market size was estimated at USD 7.35 billion in 2024 and is projected to reach USD 9.47 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The increasing awareness of mental health on a global scale is driving organizations to prioritize workplace well-being.

Key Market Trends & Insights

- The North America region held the largest revenue share of 39.5% in 2024.

- By service, the stress assessment segment dominated the market with a revenue share of 34.9% in 2024.

- By service, the yoga & meditation segment is projected to grow at the highest CAGR of 5.9% over the forecast period.

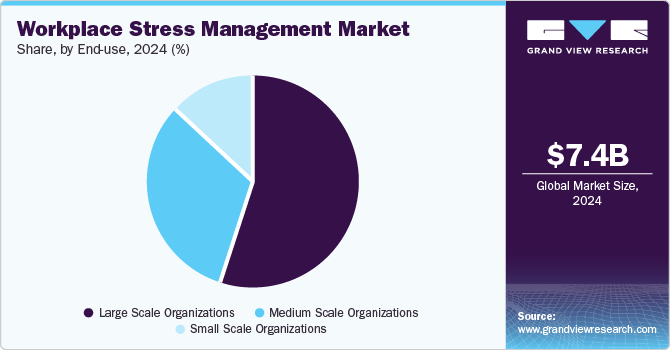

- By end use, the large scale organizations segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.35 Billion

- 2030 Projected Market Size: USD 9.47 Billion

- CAGR (2025-2030): 4.3%

- North America: Largest market in 2024

As more people recognize the impact of stress on employees, employers are becoming more focused on supporting mental health and creating positive work environments. This shift has led companies to invest in workplace stress management solutions to reduce the negative effects of stress on their workforce. Employers understand that managing stress effectively can improve productivity, employee satisfaction, and retention. As a result, there is a growing demand for tools and programs that support mental health in the workplace. This trend is fueling the expansion of the workplace stress management industry.

The rising rates of employee burnout, anxiety, depression, and other mental health issues are driving businesses to invest in stress management programs. These programs are essential for reducing absenteeism, boosting productivity, and supporting the overall well-being of employees. In addition, the shift to remote and hybrid work models has added to workplace stress due to feelings of isolation, workload imbalances, and difficulties in maintaining work-life balance. Hence, there is an increasing need for stress management strategies specifically designed for remote and hybrid work environments. Employers are now more focused on addressing these challenges to ensure a healthier and more productive workforce. This growing demand is advancing the workplace stress management industry.

In addition, Companies are increasingly recognizing that effective stress management can significantly improve employee productivity, engagement, and retention. By addressing workplace stress, businesses can create a more motivated and focused workforce, leading to better performance and higher job satisfaction. Employees who feel supported in managing stress are more likely to remain committed to their roles and aid positively to the organization. Therefore, companies are investing in stress-reduction programs to encourage a healthier work environment. This focus on employee well-being is helping to build stronger teams and drive overall organizational success. These factors are contributing to the growth of the workplace stress management industry.

Service Insights

The stress assessment segment dominated the market with a revenue share of 34.9% in 2024, driven by the increasing focus on employee mental health and well-being. More organizations recognize the importance of stress assessments in identifying workplace stressors, allowing them to take timely action. This proactive approach helps reduce absenteeism, boosts productivity, and fosters a supportive work environment where employees feel valued. As awareness of mental health issues continues to grow, the demand for effective stress assessment solutions is increasing. This trend highlights the evolving nature of the workplace stress management industry.

The yoga & meditation segment is projected to grow at the highest CAGR of 5.9% over the forecast period, fueled by the increasing interest in holistic health practices. Employees are turning to yoga and meditation as effective ways to manage stress, with these practices offering mental clarity and emotional stability benefits. Companies recognize the value of incorporating yoga and meditation into their wellness programs to enhance focus, reduce anxiety, and promote a healthier work-life balance. This growing trend reflects a broader shift toward integrating mindfulness into workplace culture. It highlights the expanding role of the workplace stress management industry.

End-use Insights

The large scale organizations segment dominated the market with the largest revenue share in 2024, driven by its ability to invest significantly in comprehensive stress management programs. These organizations often have more resources to implement advanced wellness initiatives that address employees physical and mental health needs. Their commitment to fostering a positive workplace culture enhances employee satisfaction and retention, making them leaders in adopting effective stress management strategies. In addition, large companies are often more visible in their efforts, setting industry standards that smaller firms may follow.

The medium scale organizations segment is projected to grow at the highest CAGR over the forecast period due to an increasing recognition of the importance of employee well-being. As these organizations expand, they are more likely to adopt tailored stress management solutions that cater specifically to their workforce's needs. The growing emphasis on creating supportive work environments prompts medium-sized firms to invest in effective stress reduction strategies that enhance overall productivity and employee morale.

Delivery Mode Insights

The personal fitness trainers dominated the market with the largest revenue share in 2024, driven by their essential role in promoting physical health to alleviate workplace stress. Organizations are increasingly aware that physical fitness contributes significantly to mental well-being. This leads to a higher demand for personal trainers who can provide customized fitness programs to reduce employee stress. This focus on physical activity improves individual health and fosters teamwork and camaraderie within organizations.

The meditation specialists segment is projected to grow at a significant CAGR over the forecast period, which can be attributed to the rising interest in mindfulness practices as effective tools for managing stress. As companies strive for innovative ways to enhance employee resilience and focus, meditation specialists are integral to workplace wellness programs. Their expertise helps employees develop coping mechanisms that can significantly reduce anxiety and improve overall mental health, aligning with contemporary trends towards holistic wellness.

Regional Insights

North America workplace stress management market held the highest revenue share of 39.5% in 2024, driven by a strong focus on employee wellness initiatives and mental health awareness. The competitive business environment compels organizations in this region to prioritize workplace stress management to enhance productivity and reduce turnover rates. This commitment is reflected in the widespread adoption of various stress management programs across industries, highlighting North America's leadership in promoting mental health initiatives.

U.S. Workplace Stress Management Market Trends

The U.S. workplace stress management market dominated North America with a significant revenue share in 2024 due to its proactive approach to addressing employee mental health issues. Companies are increasingly implementing comprehensive wellness programs that include stress assessments, resilience training, and mindfulness practices, recognizing these as essential components for maintaining a healthy workforce amidst rising pressures. This focus on mental well-being has become crucial for sustaining productivity levels and fostering a positive work environment.

Europe Workplace Stress Management Market Trends

Europe workplace stress management market is expected to grow at a significant CAGR over the forecast period, which can be attributed to heightened awareness regarding mental health issues among employees and employers alike. European organizations increasingly invest in innovative stress management solutions as part of their corporate wellness strategies, reflecting a broader cultural shift toward prioritizing employee well-being. This trend is expected to drive substantial growth within this region as businesses strive for enhanced productivity through improved employee support systems.

The Germany workplace stress management market dominated the Europe with a significant revenue share in 2024 due to its robust economy and commitment to employee welfare initiatives that address physical and mental health needs. German companies are known for their proactive stance on employee well-being, implementing comprehensive programs that promote work-life balance and reduce burnout risks. This focus on mental health is becoming integral to corporate culture, positioning Germany as a leader in workplace wellness initiatives across Europe.

Asia Pacific Workplace Stress Management Market Trends

Asia Pacific workplace stress management market is expected to maintain a significant share in 2024, largely due to rapid economic growth coupled with an increasing number of organizations recognizing the importance of employee mental health. As work environments become more demanding, companies adopt stress management practices tailored to their workforce's unique cultural contexts. This trend reflects an evolving understanding of mental health impact on productivity and employee satisfaction within this dynamic region.

Key Workplace Stress Management Company Insights

Some key companies operating in the market are ActiveHealth Management, Inc.; Asset Health; Central Corporate Wellness; ComPsych Corporation, and CuraLinc Healthcare. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in workplace stress management market.

-

ActiveHealth Management, Inc. offers a range of products and services to support workplace stress management, including stress assessments, yoga and meditation programs, and resilience training. These services help organizations identify stress levels, promote mental well-being, and equip employees with coping strategies. Their progress monitoring tools track wellness metrics, ensuring continuous improvement and a healthier work environment that boosts productivity and employee satisfaction.

-

Asset Health provides various products and services designed for workplace stress management, focusing on improving employee wellness and productivity. Its offerings include a health portal with personalized assessments, biometric screenings, health coaching, and wellness courses. In addition, the company offers financial well-being programs and communication strategies to foster a health-focused culture within organizations.

Key Workplace Stress Management Companies:

The following are the leading companies in the workplace stress management market. These companies collectively hold the largest market share and dictate industry trends.

- ActiveHealth Management, Inc.

- Asset Health

- Central Corporate Wellness

- ComPsych Corporation

- CuraLinc Healthcare

- Marino Wellness

- SOL - Wellness

- Truworth Wellness

- Vitality Group International, Inc.

- Wellsource, Inc

Recent Developments

-

In December 2024, CuraLinc Healthcare announced the acquisition of the Employee Assistance Program (EAP) from Wellspring Family Services, a nonprofit focused on family homelessness, to improve access to mental health resources for employees and their families.

-

In October 2020,

Vitality Group International, Inc. launched a first-of-its-kind health and wellness marketplace aimed at employers. This innovative platform enhanced employee engagement in health initiatives by providing access to various wellness resources and services. The marketplace included personalized health assessments, various wellness programs, and tools for tracking health goals, all intended to foster a healthier workforce and improve overall employee satisfaction.

Workplace Stress Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.66 billion

Revenue forecast in 2030

USD 9.47 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Service,end-use, delivery mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Poland, Netherlands, Switzerland, Austria, Norway, Denmark, Sweden, Japan, China, India, South Korea, Australia, Thailand, Singapore, Taiwan, Russia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

ActiveHealth Management, Inc.; Asset Health.; Central Corporate Wellness; ComPsych Corporation; CuraLinc Healthcare; Marino Wellness; SOL - Wellness; Truworth Wellness; Vitality Group International, Inc.; Wellsource, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Workplace Stress Management Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global workplace stress management market report based on service, end-use, delivery mode, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stress Assessment

-

Yoga & Meditation

-

Resilience Training

-

Progress Tracking Metrics

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small Scale Organizations

-

Medium Scale Organizations

-

Large Scale Organizations

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individual Counselors

-

Personal Fitness Trainers

-

Meditation Specialists

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Switzerland

-

Austria

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Singapore

-

Taiwan

-

Russia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global workplace stress management market size was estimated at USD 7.35 billion in 2024 and is expected to reach USD 7.66 billion in 2025.

b. The global workplace stress management market is expected to grow at a CAGR of 4.31% from 2025 to 2030 to reach USD 9.47 billion by 2030.

b. North America dominated the workplace stress management market with a share of 39.53% in 2024. The growing awareness of mental health issues and their effects on employee productivity is driving an increased demand for effective stress management in the workspace.

b. Some of the key companies in this market are Fitbit; ActiveHealth Management; ComPsych; Marino Wellness; Truworth Wellness; Wellness Corporate Solutions (WCS); Wellsource, Inc.; CuraLinc Healthcare; Central Corporate Wellness.

b. Key factors that are driving the workplace stress management market growth include growing workplace stress level and mental issues, and increasing awareness about mental wellness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.