- Home

- »

- Medical Devices

- »

-

Wound Dressing Market Size, Share & Trends Report, 2030GVR Report cover

![Wound Dressing Market Size, Share & Trends Report]()

Wound Dressing Market Size, Share & Trends Analysis Report By Product (Traditional Dressing, Advanced Dressing), By Application (Chronic Wounds, Acute Wounds), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-558-8

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Wound Dressing Market Size & Trends

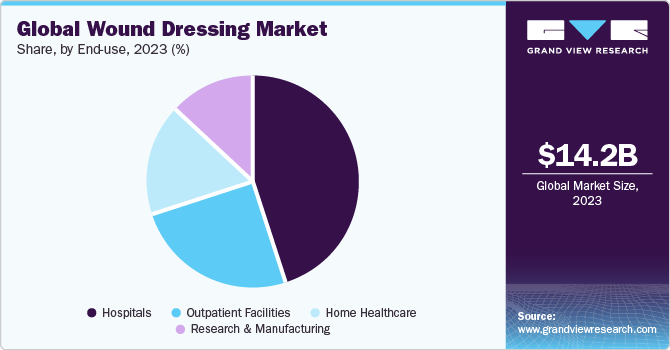

The global wound dressing market size was estimated at USD 14.20 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.16% from 2024 to 2030. The increasing prevalence of diverse wounds, including pressure ulcers and surgical site wounds, coupled with a growing aging population and a rise in traumatic accidents globally, is anticipated to drive the growth of the market. According to the WHO report published in June 2022, about 1.3 million people die each year as a result of road accidents. These factors are expected to boost market growth over the forecast period.

The global incidence of chronic wounds, such as venous leg ulcers and diabetic foot ulcers, is on the rise. For instance, in January 2023 report from NCBI revealed that approximately 6.5 million people in the United States are grappling with various chronic wounds. In addition, the growing diabetic population is expected to play a pivotal role in driving the expansion of the market. For instance, as per CDC, in October 2022, approximately 38.4 million people in the U.S. have been diagnosed with diabetes, which comprises around 11.6% of the total U.S. population. In addition, diabeticfootonline.com reported in 2021 that up to 34% of people with diabetes are susceptible to developing diabetic foot ulcers. Consequently, due to these factors, the increasing demand for wound dressing is anticipated to foster the growth of the market.

The elderly population is particularly prone to wounds, and the increasing number of older individuals is anticipated to drive the growth of the market. For instance, according to the European Parliament, Japan holds the distinction of being the fastest-aging country worldwide, with approximately 28.7% of its population aged 65 years and above. Moreover, according to the same source, it is anticipated that by 2036, one-third of the Japanese population will be aged 65 years and above. In addition, as highlighted by NCBI, the aging process can impact wound healing, underscoring the need for wound dressing in the geriatric population to facilitate the healing of wounds and thereby drive the growth of the market.

The surge in the incidence of global traumatic accidents. For instance, based on statistics released by WHO in June 2022, approximately 1.3 million individuals die due to road crashes annually, while an additional 20 to 50 million people endure non-fatal injuries. Similarly, according to the Economic Times, India recorded 554,796 road accident cases in the year 2020. These accidents often lead to considerable blood loss and various injuries, demanding swift medical intervention, and in some cases, necessitating surgical procedures to provide immediate relief to the affected individuals. Consequently, the increasing frequency of accidents is expected to drive the need for wound dressing products, contributing to significant growth in the market over the forecast period.

The outbreak of COVID-19 pandemic was expected to lower the use of advanced wound dressing, as they require healthcare advice, thereby restricting the growth of the market. However, post-pandemic, the market is anticipated to grow at a significant growth rate over the forecast duration. This can be attributed to initiatives such as partnership, research and development, geographic expansion, and launch of technologically advanced products by major market players. For instance, in September 2021, Coloplast Corp. inaugurated a factory in Central America, which was intended to support the global growth of the company. Similarly, in October 2021, Medline Industries announced an investment of USD 77.5 million to build a new distribution center in Kansas. Thus, due to the aforementioned factors, the market is expected to boost over the post-pandemic period.

Market Characteristics

The wound dressing market is driven by continuous technological advancements and innovations, focusing on product enhancement and development to meet evolving market demands. Development of advanced wound care technologies, such as, bioengineered allogeneic cellular therapies, stem cell therapies, xenograft cellular matrices, and growth factors. Thus, market players are investing in innovative technologies and procedures to keep up with the demand.

Several market players such as 3M; Coloplast Corp.; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Derma Sciences (Integra LifeSciences); Ethicon (Johnson & Johnson); Baxter International; Molnlycke Health Care AB and others, indicating a concerted effort towards strategic collaborations and geographical expansion to address the growing demand and capitalize on market opportunities.

Regulatory standards, such as FDA (Food and Drug Administration) approvals in the United States or CE marking in the European Union, are essential, demanding comprehensive preclinical and clinical assessments, stringent manufacturing practices, and documentation to gain market approval.

The market expansion is driven by the development of innovative wound dressing. More than 3000 products have been developed with the goal of treating various wound types and targeting different points of the healing cascade. Wound dressings have developed from crude applications of natural products, including plant herbs, animal fat, and honey, to tissue-engineered scaffolds. This product expansion is expected to continue, benefiting patients, surgeons, and healthcare providers.

Product Insights

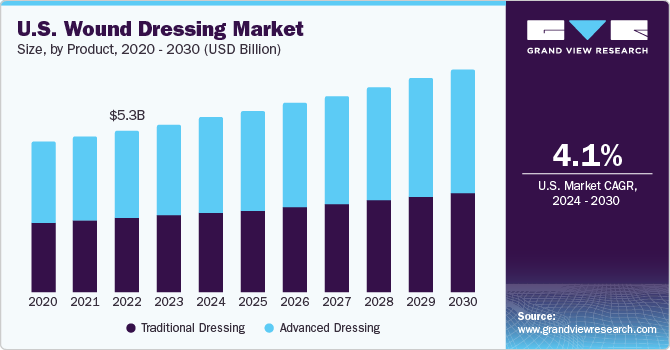

Advanced dressing led the market and accounted for a revenue share of 52.7% in 2023. This can be attributed to rising cases of obesity and venous leg ulcers. For instance, as per a study by Sage Journals in 2020, the prevalence rate of obesity in India is 40.3%. Similarly, according to a WHO report published in 2022, 19.0% of the population in Germany is classified as obese. Individuals with obesity are at a heightened risk of developing venous leg ulcers, indicating that the increasing prevalence of obesity within the population is likely to contribute to the dominance of the advanced dressing segment in the forecast period.

Traditional dressing is expected to witness a considerable CAGR over the forecast period. Traditional dressings are most commonly used to treat burn cases, thus, rising number of burn cases is expected to boost the traditional dressing segment. For instance, according to WHO in October 2023, about 180,000 deaths were caused due to burns every year. Moreover, in India, around 1,000,000 people are moderately or severely burnt each year. Similarly, as per CDC in the U.S., approximately, 4,500 burn victims die annually & 10,000 die due to burn-related infections. These factors are boosting the segment growth.

Application Insights

The chronic wounds segment dominated the market in 2023. This can be attributed to the increasing incidence of chronic diseases and geriatric population globally. For instance, as per Ageing Asia, in Indonesia, in 2019, the population aged above 60 stood at 27,524,000, and it is anticipated to surge to 69,792,000 by the year 2050. Similarly, there has been an increase in number of people suffering from diabetes & diabetic foot ulcers. For instance, as per ScienceDirect, diabetic foot ulcers may impact 25% of the diabetic population, and approximately 20% of those affected may face the risk of amputation. Furthermore, according to a CDC report, in November 2023, approximately 38.4 million individuals in the U.S. were diagnosed with diabetes, and this figure is expected to triple by 2060, as indicated by BMC Population Health Metrics. Thus, these factors are boosting the segment growth over the forecast period.

The acute wounds segment is projected to witness a significant CAGR over the forecast period. This can be accredited to the rising number of surgical wounds and surgical site infections worldwide. For instance, as per a study by Wound International, the incidence rate of surgical site infections in general surgery was found to be 11.7%. Similarly, rising incidence of traumatic accidents is expected to impel the segment growth. For instance, as per an article by Brady United Organization, in July 2021, around 316 people in the U.S. are shot every day, leading to acute wounds, which require wound dressing to heal. Thus, due to abovementioned factors, the market is expected to impel over the forecast years.

End-use Insights

The hospital segment dominated the market in 2023. This can be credited to rising surgical procedures and an increasing number of hospitals. For instance, as per a 2020 study published by NCBI, an estimated 310 million surgical procedures occur worldwide annually, with 40 to 50 million taking place solely in the U.S. Furthermore, there's been a notable rise in the global count of hospitals and hospitalizations. According to the Australian Institute of Health & Welfare, hospitalizations in Australia have seen a significant increase. In the 2019-2020 period, 11.1 million individuals in Australia underwent hospitalization. Consequently, these trends are expected to elevate the prominence of the hospital segment within the end-use market.

The home healthcare segment is projected to witness the fastest CAGR during the forecast period. The prevalence of home healthcare settings is on the rise globally, with an increasing number of countries adopting this approach. In addition, numerous surgical procedures necessitate an extended recovery period, resulting in frequent wound dressing changes. The preference for home healthcare settings is particularly notable among the geriatric and bariatric populations. The growing numbers within these demographics are expected to contribute to the expansion of the home healthcare segment. For instance, according to WHO's June 2021 report, worldwide obesity has tripled since 1975. Similarly, the same source notes that in 2020, 39 million children under the age of five were classified as overweight or obese. These factors are poised to drive the growth of the home healthcare segment throughout the forecast period.

Regional Insights

North America dominated the market with a revenue share of 45.49% in 2023. The prevalence of dominance in the North America region within the market can be attributed to its well-established healthcare infrastructure, rising awareness, and the presence of key industry players. Furthermore, an anticipated increase in the volume of surgeries in North America is poised to propel the growth of the market in the region. For instance, in August 2022, according to the New Jersey Department of Health, around 7,398 open-heart surgeries were conducted in New Jersey during the 2019-2020 period. Similarly, in 2020, approximately 40,000 children in the U.S. underwent congenital heart surgery, as reported by AHA Journals. As such surgeries take time to heal, and wound dressing products help in healing these wounds in quick duration. Hence, wound dressing is preferred post-surgery, thereby impelling the market in the North America region.

The U.S. held the largest share of North America wound dressings market in 2023. The growth of the market is driven by factors such as a robust healthcare infrastructure, rising awareness of the use of advanced wound care products, and the presence of several leading market players. In addition, the rise in orthopedic procedures due to the high incidence of sports injuries is expected to further propel the market. Hence, such factors are anticipated to propel the market growth in the U.S. over the forecast period.

However, Asia Pacific is estimated to witness the fastest CAGR over the forecast period. This can be accredited to the rising diabetic population in the region. For instance, according to the Down to Earth organization, as of December 2021, India had 74.2 million diabetic populations which were aged 20 – 79. Moreover, this number is anticipated to increase and reach 124.8 million by 2045. As diabetic people are more prone to diabetic foot ulcers, therefore, an increase in diabetic population may help the market grow in the Asia Pacific region.

China accounted for Asia Pacific largest share of the market in 2023. The regulatory process for product approvals is relatively less stringent in China, facilitating the easy entry of advanced products into the market. In addition, the availability of resources enables technological advancements at lower costs, contributing to a rise in the number of manufacturing facilities in the country. Furthermore, China has introduced Order 650 (formerly Order 276), known as the Regulations for the Supervision and Administration of Medical Devices, which aims to restrict foreign investment in the country, primarily to safeguard local medical device manufacturing companies. As a result, an anticipated increase in the number of local wound dressing manufacturers is expected to drive market growth over the forecast period.

Key Companies & Market Share Insights

Smith & Nephew plc, 3M, ConvaTec Inc., Coloplast Corp. Molnlycke Health Care AB, B. Braun Melsungen AG, Cardinal Health, are some of the dominant players operating in the wound dressing industry.

- 3M develops, manufactures, & markets a range of products and services globally. The company functions across four reportable segments: transportation & electronics; safety & industrial; healthcare; and consumer goods.

- Smith & Nephew is a medical technology company engaged in developing, manufacturing, marketing, and selling medical services & devices. The company provides its services in orthopedics, sports medicine & ENT, and advanced wound care management.

- Coloplast Corp. is a Danish manufacturing and marketing company. It has a distribution network spread across 53 countries. Its product range includes ostomy, urology, continence, wound care, and skin care verticals.

Imbed Biosciencesa, Kerecis, are some of the emerging market players functioning in wound dressings market.

- Imbed Biosciencesa is a provider of nanotech-based wound care products. The company has developed technologies for embedding bioactive molecules in wound dressings and surgical implants. The products are based on the Microlyte Matrix technology platform. The company also offers antibacterial, anti-biofilm, and analgesic wound dressings.

- Kerecis is engaged in the development of MariGen Omega3 acellular dermal matrix technology for applications in addressing chronic wounds, hernia repair, breast reconstruction, and abdominal wall reconstruction. Their proprietary acellular fish skin-derived material enhances existing human and porcine technologies through enhanced economic benefits superior clinical performance, and decreased disease transmission risks.

Key Wound Dressing Companies:

The following are the leading companies in the wound dressing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these wound dressing companies are analyzed to map the supply network.Smith+Nephew

- Smith+Nephew

- Mölnlycke Health Care AB

- Convatec Group PLC

- Ethicon (Johnson & Johnson)

- Coloplast Corp.

- URGO

- Coloplast Corp.

- 3M

- Integra LifeSciences

- PAUL HARTMANN AG

- DR.AUSBÜTTEL (DRACO)

- Integra LifeSciences

- Medline Industries, Inc.

- Brightwake Ltd..

Recent Developments

-

In June 2023, JeNaCell introduced the epicite balancing wound dressing to the German market. The dressing is especially well-suited and adapted for the management of chronic wounds with low to medium levels of exudation, including soft tissue lesions, diabetic foot ulcers, venous leg ulcers, and arterial leg ulcers.

-

In January 2023, Convatec Group PLC launched Convafoam, an advanced foam dressing in the U.S. The product is designed to fulfill the needs of patients and healthcare providers. It can be used for various types of wounds at any stage of the wound, which makes it the simple dressing choice for skin protection and wound management.

-

In October 2022, Healthium Medtech introduced a new line of wound dressings "Theruptor Novo". For the treatment of persistent sores such as diabetic foot ulcers and leg ulcers.

Wound Dressing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.77 billion

Revenue forecast in 2030

USD 18.86 billion

Growth rate

CAGR of 4.16% from 2024 to 2030

Actual Years

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; Coloplast Corp.; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Derma Sciences (Integra LifeSciences); Ethicon (Johnson & Johnson); Baxter International; Molnlycke Health Care AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound dressing market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Dressing

-

Gauze

-

Tape

-

Bandages

-

Cotton

-

Others

-

-

Advanced Dressing

-

Moist Dressing

-

Foam Dressing

-

Hydrocolloid Dressing

-

Film Dressing

-

Alginate Dressing

-

Hydrogel Dressing

-

Collagen Dressing

-

Other Advanced Dressing

-

-

Antimicrobial Dressing

-

Silver Dressing

-

Non-silver Dressing

-

-

Active Dressing

-

Biomaterials

-

Skin-substitute

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Healthcare

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound dressing market size was estimated at USD 14.20 billion in 2023 and is expected to reach USD 14.77 billion in 2024.

b. The global wound dressing market is expected to grow at a compound annual growth rate of 4.16% from 2024 to 2030 to reach USD 18.86 billion by 2030.

b. The advanced product segment that comprises moist, antimicrobial, and active products dominated the overall wound dressing market, commanding over 52.7% revenue share in 2023.

b. Some key players operating in the wound dressing market include 3M Healthcare, ColoPlast, Medline Industries, HARTMANN, BSN Medical, Medtronic Plc, Smith & Nephew, ConvaTec, Derma Sciences, and Systagenix.

b. Key factors that are driving the wound dressing market growth include the rising prevalence of conditions such as leg ulcers, venous stasis ulcers, pressure ulcers, and diabetic ulcers, which require lesion management, and are anticipated to boost the global wound dressing market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."