- Home

- »

- Medical Devices

- »

-

Wound Therapy Devices Market Size, Industry Report, 2030GVR Report cover

![Wound Therapy Devices Market Size, Share & Trends Report]()

Wound Therapy Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Wound Type (Chronic, Acute), By Product (NPWT, Pressure Relief Devices, Electric Stimulation Devices), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-305-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wound Therapy Devices Market Trends

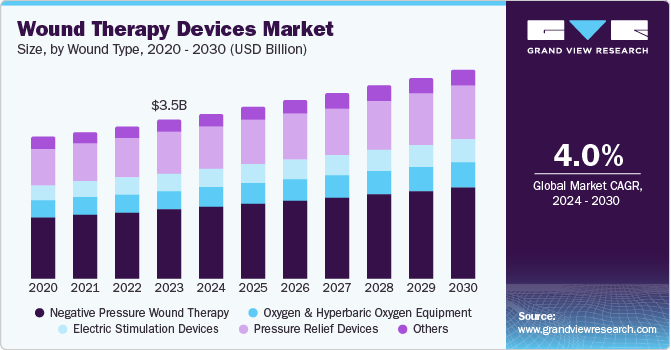

The global wound therapy devices market size was valued at USD 3.49 billion in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. This growth is attributed to the increasing prevalence of chronic wounds, such as diabetic ulcers and pressure sores, especially among the aging population. In addition, the rise in surgical procedures has also led to a greater demand for effective wound management solutions. Furthermore, technological advancements in wound care devices, including negative pressure wound therapy systems, enhance treatment efficacy and patient outcomes, further propelling market expansion.

Wound therapy devices include various medical tools and technologies specifically designed to support the healing process of different wound types. These devices are crucial in contemporary wound care, providing targeted treatments that enhance tissue repair, minimize complications, and improve patient outcomes. Examples include negative pressure wound therapy (NPWT) systems, which utilize controlled suction to aid healing, and advanced wound dressings with antimicrobial properties and moisture management. Such innovations cater to various wound conditions and patient requirements, making them essential components of effective wound management strategies.

The market is experiencing significant growth due to the rising prevalence of diabetic foot ulcers and pressure ulcers globally. A substantial portion of individuals with diabetes may develop diabetic foot ulcers during their lifetime, highlighting the critical need for effective wound care solutions. Furthermore, many Americans suffer from pressure ulcers each year, further driving demand for advanced therapies. Technological advancements, such as the miniaturization of electric wound stimulators, enhance user-friendliness and accessibility for healthcare providers.

Regulatory bodies are increasingly supporting the development and commercialization of innovative wound care technologies, simplifying the approval processes for these devices. As electric stimulation devices gain recognition and acceptance in clinical settings, healthcare professionals are more likely to integrate them into treatment protocols, thus facilitating better patient outcomes and contributing to market expansion. This combination of rising prevalence rates, technological advancements, and supportive regulatory environments positions the wound therapy devices market for continued growth and innovation.

Product Insights

Negative Pressure Wound Therapy (NPWT) led the market and accounted for the largest revenue share of 43.3% in 2023 driven by the increasing prevalence of chronic wounds, particularly among the aging population and those with comorbidities. In addition, this therapy effectively promotes healing by applying controlled negative pressure, which enhances blood flow and reduces edema. Furthermore, technological advancements have improved NPWT devices, making them more user-friendly and effective. The growing awareness of NPWT benefits among healthcare providers also encourages its adoption in clinical settings, further propelling market growth.

Pressure relief devices are expected to grow by 4.1% over the forecast period attributed to the rising incidence of pressure ulcers, particularly among vulnerable populations such as older people and those with restricted mobility. In addition, the demand for effective preventive measures drives healthcare providers to invest in advanced pressure relief technologies. Furthermore, ongoing innovations in device design, including smart mattresses that monitor and adjust pressure points, enhance patient comfort and care quality. Moreover, regulatory support for developing these devices also plays a crucial role in market growth, as it facilitates the introduction of new products that cater to the increasing need for pressure ulcer prevention and management.

Wound Type Insights

Chronic wounds dominated the market and accounted for the largest revenue share, 59.9%, in 2023 driven by the rising incidence of conditions that predispose individuals to chronic wounds, such as diabetes, obesity, and an aging population. As more people develop these risk factors, the number of chronic wounds, including diabetic ulcers, pressure ulcers, and venous leg ulcers, increases. Furthermore, supportive regulatory environments that facilitate the introduction of innovative chronic wound care technologies also contribute to the market expansion.

The acute wound type is expected to grow at a CAGR of 4.1% over the forecast period primarily driven by the increasing prevalence of surgical procedures and traumatic injuries, which drives the development of acute wound therapy devices. As more people undergo surgeries and experience accidental wounds, the demand for effective acute wound management solutions rises. In addition, technological advancements in wound dressings, such as antimicrobial and moisture-controlling features, enhance healing outcomes and reduce complications. Furthermore, the growing awareness among healthcare providers about the importance of proper acute wound care further propels the market expansion.

End Use Insights

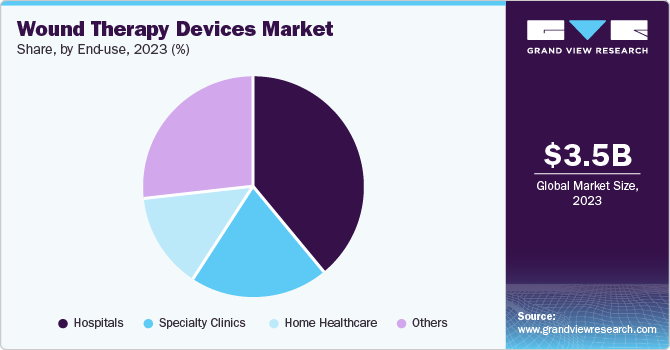

Hospitals led the market and accounted for the largest revenue share of 39.9% in 2023 attributed to the increasing number of surgical procedures and the rising prevalence of chronic wounds among patients. Hospitals are essential settings for advanced wound care, where technologies such as negative pressure wound therapy (NPWT) and specialized dressings are used to improve healing results. In addition, the rising emphasis on patient safety and infection control in healthcare facilities further propels the adoption of innovative wound management devices. Furthermore, the availability of trained healthcare professionals in hospitals also ensures the effective implementation of these therapies, thereby driving market growth.

Home healthcare is expected to grow significantly over the forecast period, owing to the rising preference for at-home care solutions, particularly among elderly patients and those with chronic conditions. In addition, home healthcare offers suitability and comfort, letting patients manage their wounds in familiar environments. Furthermore, cost-effectiveness and reduced hospital readmission rates associated with effective home wound care contribute to market expansion in this segment, making it an attractive option for healthcare providers and patients.

Regional Insights

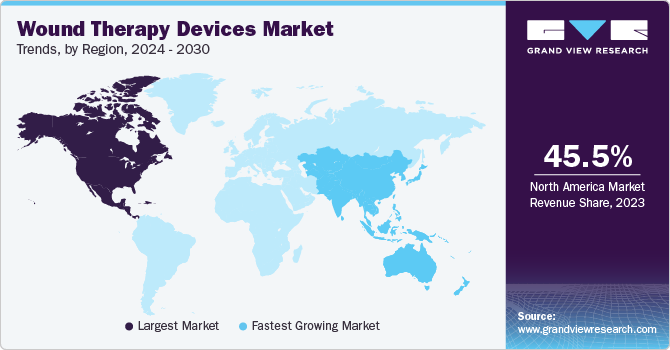

The North America wound therapy devices market dominated the global market and accounted for the largest revenue share of 45.5% in 2023 attributed to a high prevalence of chronic diseases and an aging population. In addition, the region's advanced healthcare infrastructure supports the adoption of innovative wound care technologies, such as negative pressure wound therapy (NPWT) and advanced dressings. Furthermore, increasing surgical procedures increases the demand for effective wound management solutions.

U.S. Wound Therapy Devices Market Trends

The wound therapy devices market in the U.S. dominated North America with the largest revenue share in 2023 driven by the rising incidence of diabetes and obesity, leading to more chronic wounds such as diabetic foot ulcers. In addition, the presence of leading medical device manufacturers fosters innovation and the introduction of advanced treatment options. Furthermore, the U.S. healthcare system's focus on refining patient outcomes drives the adoption of effective wound management technologies. Increased awareness among healthcare providers about best practices in wound care also plays a vital role in market growth.

Asia Pacific Wound Therapy Devices Market Trends

The Asia Pacific wound therapy devices market is expected to grow at a CAGR of 4.6% over the forecast period, owing to a rapidly growing population and increasing urbanization, leading to a higher incidence of injuries and chronic wounds. In addition, the rise in disposable income allows for greater healthcare spending, facilitating access to advanced wound care technologies. Furthermore, government initiatives to improve healthcare infrastructure and increase wound management awareness contribute to market growth. The region's varied demographic needs also create opportunities for tailored wound therapy solutions.

The wound therapy devices market in China is expected to experience significant growth over the forecast period driven by its large population and rising prevalence of chronic conditions such as diabetes, which increases the demand for effective wound care solutions. In addition, the government's investment in healthcare infrastructure and guidelines endorsing advanced medical technologies further enhance market potential. Moreover, rising awareness amongst healthcare professionals about modern wound management practices drives the adoption of innovative devices, making China a key player in the global wound therapy landscape.

Europe Wound Therapy Devices Market Trends

The growth of the Europe wound therapy devices marketis driven by an aging population and increasing cases of chronic wounds, such as pressure ulcers and diabetic foot ulcers. The region's strong regulatory framework encourages innovation and ensures high-quality standards for medical devices. In addition, the importance of cost-effective healthcare solutions also promotes the adoption of advanced wound care technologies that improve healing times and reduce complications. Furthermore, cooperative efforts between healthcare providers and producers further improve market growth across European countries.

The UK wound therapy devices market is expected to grow substantially over the forecast period attributed to rising healthcare expenditures and a growing focus on improving patient outcomes through advanced treatment options. In addition, government initiatives to enhance healthcare services contribute to market expansion. Furthermore, the aging population in the UK also necessitates improved wound care solutions, further supporting growth in this healthcare market segment.

Key Wound Therapy Devices Company Insights

Some key wound therapy devices market companies include Smith & Nephew, 3M, Cardinal Health, and others. These companies invest heavily in research and development to create innovative products that enhance efficiency, reliability, and cost-effectiveness. This focus on product innovation allows businesses to differentiate themselves from competitors while addressing the evolving needs of their customers. Furthermore, strategic alliances and collaborations enable firms to leverage strengths and access new technologies, further enhancing their market presence.

-

3M manufactures advanced wound dressings, including hydrocolloid and foam dressings and negative pressure wound therapy (NPWT) systems. 3M's commitment to research and development allows it to continuously improve its offerings, ensuring they meet the evolving needs of healthcare providers and patients. Their products are widely used in hospitals and home care settings, emphasizing safety, efficacy, and ease of use.

-

Cardinal Health offers a variety of wound care solutions, including advanced dressings, negative pressure wound therapy devices, and other specialized products to promote effective wound management. Cardinal Health focuses on providing high-quality, cost-effective solutions that cater to the needs of healthcare providers and patients alike. With a strong emphasis on innovation and collaboration, Cardinal Health is dedicated to improving patient outcomes through its comprehensive range of wound-care products.

Key Wound Therapy Devices Companies:

The following are the leading companies in the wound therapy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Smith & Nephew

- 3M

- Sky Medical Technology Ltd.

- Cardinal Health

- Talley Group Ltd

- ConvaTec Inc.

- DeRoyal Industries, Inc.

- Devon Medical Products

- BSN medical

- Medela AG

- Paul Hartmann AG

Recent Developments

-

In May 2023, Smith & Nephew received clearance from the U.S. Food and Drug Administration (FDA) for its PICO 7 and PICO 14 Single Use Negative Pressure Wound Therapy Systems. These advanced wound therapy devices are now authorized for use on closed surgical incisions to help reduce the risk of superficial and deep surgical site infections (SSIs) in high-risk patients and prevent post-operative seroma and dehiscence. This approval underscores Smith & Nephew's dedication to improving wound care solutions and patient outcomes.

-

In April 2023, Sky Medical Technology Ltd. announced the accessibility of its Geko device on the Government of India e-Marketplace (GeM) procurement portal. This development provides government hospitals across India with access to the Geko device, an innovative wound therapy device designed to prevent life-threatening blood clots and manage complications related to swelling in patients after orthopedic surgeries and those with chronic wounds. The availability of this device aims to enhance patient care and treatment outcomes in healthcare facilities throughout the country.

Wound Therapy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.63 billion

Revenue forecast in 2030

USD 4.59 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, wound type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Smith & Nephew; 3M; Sky Medical Technology Ltd.; Cardinal Health; Talley Group Ltd; ConvaTec Inc.; DeRoyal Industries, Inc.; Devon Medical Products; BSN medical; Medela AG; Paul Hartmann AG

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Therapy Devices Market Report Segmentation

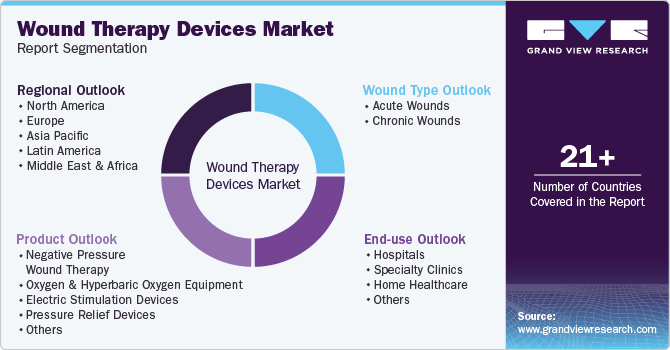

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wound therapy devices market report based on product, wound type, end use, and region:

-

Wound Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Chronic Wounds

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Negative Pressure Wound Therapy

-

Oxygen & Hyperbaric Oxygen Equipment

-

Electric Stimulation Devices

-

Pressure Relief Devices

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global wound therapy devices market size was estimated at USD 3.01 billion in 2019 and is expected to reach USD 3.12 billion in 2020.

b. The global wound therapy devices market is expected to grow at a compound annual growth rate of 3.8% from 2018 to 2026 to reach USD 3.91 billion by 2026.

b. Negative Pressure Wound Therapy (NPWT) devices segment of the wound therapy devices market held the largest share in 2019 with a market share of 43.10% and is expected to witness the fastest growth rate over the forecast period.

b. Some key players operating in the wound therapy devices market include Acelity L.P. Inc., ConvaTec, Smith & Nephew, Mölnlycke Health Care, Sechrist, and Cardinal Health, Inc.

b. Key factors that are driving the wound therapy devices market growth include the increasing prevalence of chronic diseases, the rising geriatric population, the introduction of technologically advanced products, and rising cases of accidents and trauma across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.