- Home

- »

- Medical Devices

- »

-

X-ray Systems Market Size & Share, Industry Report, 2030GVR Report cover

![X-ray Systems Market Size, Share & Trends Report]()

X-ray Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (Radiography, Fluoroscopy), By Technology (Digital Radiography, Computed Radiography), By Mobility, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-441-3

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

X-ray Systems Market Summary

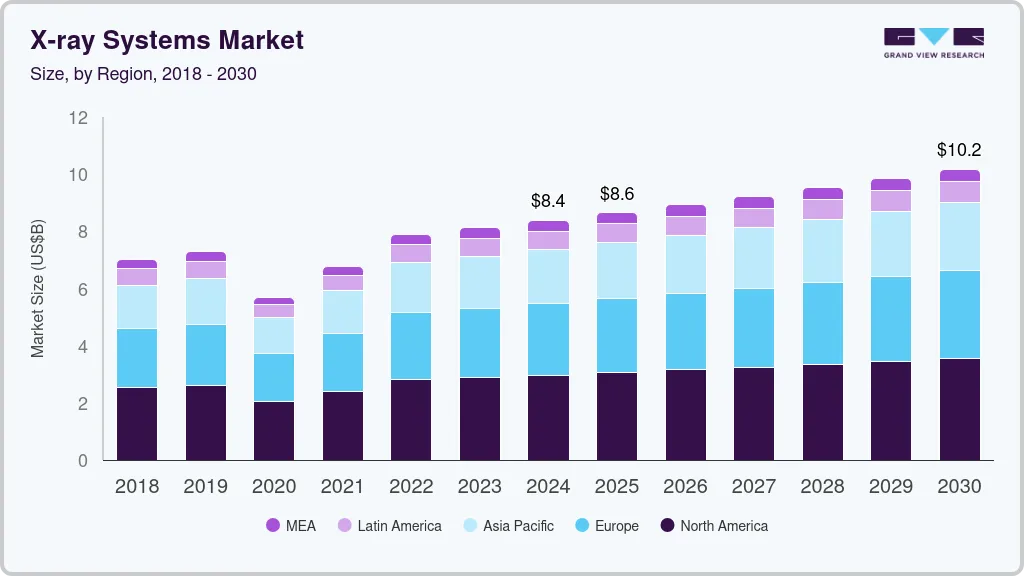

The global x-ray systems market size was estimated at USD 8.38 billion in 2024 and is projected to reach USD 10.16 billion by 2030, growing at a CAGR of 3.28% from 2025 to 2030. The major factor driving the X-ray systems industry includes the growing demand for early-stage diagnosis of chronic diseases.

Key Market Trends & Insights

- North America X-ray systems market held the largest share of 35.44% in 2024.

- The X-ray systems market in the U.S. held the largest market share in 2024.

- By modality, The radiography segment dominated the market and accounted for the largest revenue share of more than 52.91% in 2024.

- By technology, digital radiography held the largest market share in 2024 and is also expected to grow at the fastest CAGR of 3.64% over the forecast period.

- By mobility, the stationary X-ray systems segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.38 Billion

- 2030 Projected Market Size: USD 10.16 Billion

- CAGR (2025-2030): 3.28%

- North America: Largest market in 2024

In addition, continuous technological advancements, improved funding and investments by the government, and a rise in product development along with business expansion by leading manufacturers, particularly in developing countries such as India and China, are expected to contribute to the market growth. For instance, in July 2024, Siemens Healthineers announced that the Multix Impact E digital radiography X-ray machine will be manufactured in India, marking a significant milestone in the company's commitment to improving patient access to care.

Medical imaging has experienced a significant transformation due to the advancements in digital radiology solutions. Diagnostic accuracy is at the healthcare industry's core, and digital X-ray imaging plays a significant role in enhancing this precision. The high-resolution images produced by digital X-rays allow for more accurate and timely diagnoses, which are critical for effective treatment planning and patient outcomes. Furthermore, integrating artificial intelligence (AI) in digital radiology systems has significantly contributed to market growth. AI algorithms can swiftly and accurately analyze images, identifying patterns and anomalies. For instance, in October 2023, DeepTek.ai, India's leading medical imaging AI company, announced that it had received clearance from the US Food and Drug Administration (FDA) for its chest X-ray AI solution, the CXR Analyzer. This advanced technology utilizes deep learning algorithms to detect abnormalities in chest X-rays, automatically identifying, categorizing, and highlighting suspicious areas to assist clinicians in making accurate interpretations.

The increasing efficiency of X-ray technology in detecting various medical conditions is expected to significantly contribute to overall market growth. As advancements in digital radiography continue to improve image quality and diagnostic accuracy, X-rays are becoming a more reliable tool for identifying a wide range of health issues. Moreover, growing R&D activities in this field are further contributing to market growth. For instance, in December 2023, An AI-enhanced chest X-ray reporting solution commenced trials in NHS Greater Glasgow and Clyde, aiming to enhance the early detection of lung cancer.

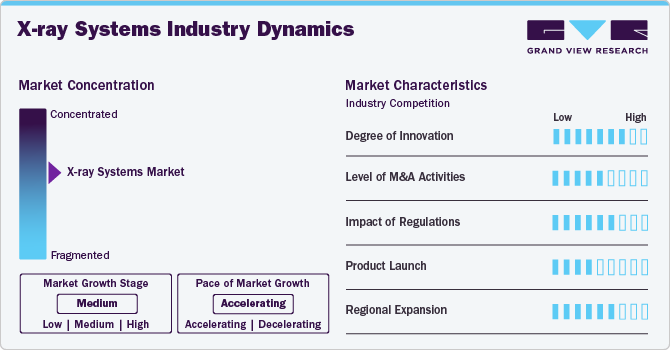

Market Concentration & Characteristics

The X-ray systems industry is accelerating at a moderate pace owing to technological advancements, expansion of healthcare infrastructure, particularly in emerging countries, and increasing partnerships between healthcare providers and technology developers.In addition, the rising demand for early and accurate disease detection and the need for efficient and cost-effective imaging solutions contribute to industry expansion.

Major players in the industry are continuously working to improve their product offerings to expand their customer base and gain a larger industry share. This involves expanding their products, gaining approvals, exploring acquisitions, obtaining government approvals, and engaging in important cooperation activities. For instance, in May 2023, Carestream Health launched the DRX-Rise Mobile X-ray System, a comprehensive and fully integrated digital X-ray unit. This advanced system offers an economical option for customers looking to adopt digital imaging or to replace or expand their existing DR fleet without requiring a substantial capital investment.

The X-ray systems industry is characterized by significant innovation driven by advancements in digital technology, artificial intelligence, and imaging techniques. Innovations such as digital radiography, portable X-ray systems, and AI-enhanced diagnostic tools are revolutionizing the industry. For instance, in January 2024, Carestream Health introduced the upgraded DRX-Excel Plus X-ray System, which enhances the performance of this versatile two-in-one solution. The new system offers increased productivity and efficiency, superior image quality, and an improved user and patient experience.

Companies that manufacture X-ray systems are undertaking merger & acquisition activities. For instance, in April 2024, Shimadzu Medical Systems USA (SMS), a division of Shimadzu Precision Instruments, Inc., which is a subsidiary of Shimadzu Corporation Japan, acquired California X-ray Imaging Services, Inc. (CIS) to further expand its healthcare business in North America.

Regulations play a crucial role in shaping the X-ray systems industry by enforcing treatment safety and efficacy standards. They oversee the development, testing, and approval of new therapies and devices, ensuring patient safety while also promoting innovation within the field. For instance, in February 2025, the FDA granted Lumitron's HyperVIEW X-ray system Breakthrough Device designation for breast cancer imaging. Utilizing K-Edge subtraction and laser-Compton X-rays, HyperVIEW offers 100 times higher resolution and enhanced safety over standard X-rays. Simulations indicate a potential 3000% improvement in tumor detection compared to traditional contrast-enhanced mammography systems.

Product approval for X-ray systems is essential for introducing new treatments and devices to the industry. This process involves extensive testing and clinical trials to comply with regulatory standards, ensuring that products are safe, effective, and dependable for patient use.

Regional expansion involves extending the availability of X-ray systems to new geographic areas. This can improve access to care, promote awareness, and address regional disparities in healthcare, ultimately enhancing patient outcomes globally.

Modality Insights

The radiography segment dominated the market and accounted for the largest revenue share of more than 52.91% in 2024. The segment is further expected to continue its dominance over the forecast period. For most patients, radiography is the initial diagnostic imaging step doctors recommend on their way to a definitive diagnosis. This system has a wide range of applications and is less expensive and less time-consuming than other systems, which is the major reason for this dominance. Furthermore, the increasing technological advancement is expected to boost market growth for this segment. For instance, in August 2022, GE Healthcare introduced its most advanced fixed X-ray system, the next-generation Definium 656 HD. This new overhead tube suspension (OTS) system provides consistent, highly automated, and efficient exams that enhance clinical confidence. It also simplifies workflow, reduces errors, improves consistency, and helps radiology departments operate smoothly.

Mammography is expected to grow at the fastest rate over the forecast period, owing to the increasing incidence of breast cancer and rising awareness about the same amongst the population. As per the Global Cancer Observatory, in 2022, there were about 2,296,840 new breast cancer cases, and the disease accounted for 666,103 deaths globally. Furthermore, end-users' adoption of mammography systems is expected to expand as technology progresses. For instance, in May 2024, UVA Health Outpatient Imaging Culpeper announced the latest upgrade to their center: the addition of a second state-of-the-art mammography machine and a new breast biopsy system.

“This state-of-the-art system, driven by Genius AI-powered analytics, revolutionizes reading efficiency while upholding exceptional image quality. I believe we will see improved diagnostic outcomes and increased patient satisfaction with their experience. We all understand the critical importance of early detection in healthcare; early screening can be truly lifesaving, and this unit represents a significant leap forward in our capabilities.”

-Timothy Rooney, MD, UVA Radiologist Group

Technology Insights

Digital Radiography (DR) held the largest market share in 2024 and is also expected to grow at the fastest CAGR of 3.64% over the forecast period. This growth can be attributed primarily to the increasing demand for DR systems. DR technology produces high-contrast resolution images while using lower levels of ionizing radiation, owing to its advanced flat panel detectors (FPD). This capability improves image quality and reduces patient exposure to radiation, making it a preferred choice in medical imaging. In addition, DR systems are known for their efficiency, compact design, and rapid image viewing capabilities, which streamline the imaging process and enhance overall workflow in healthcare settings. The growing adoption of DR technology by healthcare providers to improve diagnostic accuracy and operational efficiency is expected further to drive the segment's growth throughout the forecast period.

Computed Radiography (CR) is expected to grow at a moderate rate. CR is the first digital replacement for traditional X-ray film radiography with cassette-based Phosphate Storage Plates (PSP), which provides significant benefits such as eliminating consumables and significantly reducing image development time. In developing countries, where new technology is adopted more slowly, computed radiography is in high demand.

Mobility Insights

The stationary X-ray systems segment dominated the market in 2024. Their dominance is attributed to their cost-effectiveness and the lower initial investment required compared to more advanced imaging technologies. Furthermore, stationary systems are preferred in many developing countries where technological adoption is slower, as they provide essential imaging capabilities without requiring high-end equipment. Their fixed nature also ensures consistent performance and ease of maintenance, making them a practical choice for facilities with limited resources.

The mobile X-ray systems segment is expected to exhibit the fastest CAGR of 3.84% during the forecast period. Mobile systems offer several advantages over fixed systems, including portability, superior image quality, speed, safety, and cost-effectiveness, which make them more convenient and versatile for operation. The demand for mobile X-ray systems has surged since the COVID-19 pandemic, as these systems can be easily transported within hospitals or to patients' homes, thereby reducing the risk of virus transmission. Moreover, market players' emphasis on developing innovative and enhanced mobile X-ray units drives increased adoption. For instance, in November 2022, Canon Medical Systems Corporation introduced the Mobirex i9 mobile system to the U.S. market.

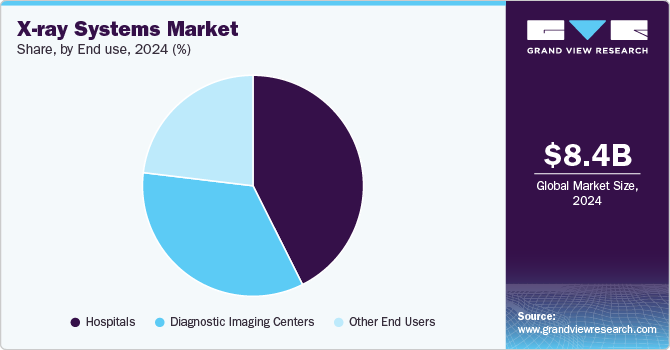

End Use Insights

The hospital segment dominated the market by capturing a share of about 42.65% in 2024. In outpatient settings, the X-ray system is a substantial source of revenue. Also, there is an increase in the number of patients visiting hospitals with various chronic disorders. As a result, these systems are frequently installed and upgraded in hospitals. Furthermore, the increasing partnerships between hospitals and market players are likely to boost demand for new installations in the coming years. For instance, in May 2024, Kingston Public Hospital (KPH) expanded its diagnostic services by installing three new digital X-ray machines.

Imaging centers offer a broad range of diagnostic and preventive health services that hospitals may be unable to accommodate due to space constraints and the high costs associated with specialized equipment and maintenance. According to United Healthcare, medical imaging in hospital outpatient departments can be up to 165% more expensive compared to diagnostic imaging centers. As the patient population with chronic conditions continues to grow, radiologists see an opportunity to establish standalone outpatient imaging centers.

Regional Insights

North America X-ray systems market held the largest share of 35.44% in 2024. The market is being influenced by factors such as increasing adoption of modern technology and improved healthcare infrastructure, strong purchasing power, and a fair reimbursement framework. For instance, in August 2021, Shimadzu Medical Systems USA announced the first North American installation of its RADspeed Pro style edition with GLIDE Technology, DR system at Benefis Orthopedic.

U.S. X-ray Systems Market Trends

The X-ray systems market in the U.S. held the largest market share in 2024 in the North American region. The growth can be attributed to the presence of major market players in this country and the growing prevalence of chronic disorders necessitating medical imaging examinations such as X-rays.

Europe X-ray Systems Market Trends

The X-ray systems market in Europe held a significant market share in 2024. Strong healthcare infrastructure, high standards of medical care, and advanced technological adoption contribute to the market's prominence. In addition, increasing investments in healthcare technology and a growing emphasis on early and accurate diagnosis drive demand for advanced X-ray systems. Europe's well-established regulatory framework and support for innovation also play a crucial role in sustaining market growth and share.

The UK X-ray systems market is expected to grow owing to the growing awareness of early diagnosis and adoption of X-ray devices. For instance, in April 2024, an X-ray machine has been installed at Aldeburgh Hospital. The East Suffolk and North Essex NHS Foundation Trust (ESNEFT) established the new X-ray suite with a donation from the Aldeburgh Hospital League of Friends to the Colchester & Ipswich Hospitals Charity. This advanced digital machine replaces an outdated unit that had reached the end of its service life.

The X-ray systems market in France is expected to grow over the forecast period due to the growing prevalence of chronic disorders and the rising demand for advanced diagnostic imaging. This growth is further supported by ongoing advancements in X-ray technology, which improve diagnostic accuracy and patient care.

Germany X-ray systems market is expected to grow over the forecast period. This can be attributed to various initiatives undertaken by leading market players to expand their presence in the country. For instance, in October 2023, Carestream Health announced a partnership with EXAMION, a prominent provider of medical imaging solutions in Germany. This collaboration reinforces Carestream’s dedication to offering healthcare organizations across Germany and Europe advanced diagnostic imaging solutions. The partnership aims to enhance user and patient experiences, improve clinical outcomes, and streamline radiography workflows.

Asia Pacific X-ray Systems Market Trends

TheX-ray systems market in Asia Pacific is expected to witness the fastest CAGR during the forecast period, owing to the increased demand for better imaging devices and supportive government initiatives to improve healthcare infrastructure in the region. Rapidly developing economies and improving healthcare services in Southeast Asian countries, China, Japan, and India, are expected to propel growth. The region's focus on innovative treatments and increasing product approvals are also key drivers.

China X-ray systems market is expected to grow owing to the increasing prevalence of chronic diseases and an aging population, creating a higher demand for advanced diagnostic imaging solutions.Furthermore, China's rapid healthcare infrastructure development and government initiatives aimed at improving medical services are contributing to the expansion of the market.

The X-ray systems market in Japan is expected to grow over the forecast period. This growth is primarily driven by the country's emphasis on medical research and technological innovation, as well as significant investments in healthcare, which collectively propel market expansion.

Latin America X-ray Systems Market Trends

The X-ray systems in the Latin America market is anticipated to undergo moderate growth throughout the forecast period. Rising healthcare needs, driven by an increasing population and the prevalence of chronic diseases, are fueling demand for advanced diagnostic imaging.

MEA X-ray Systems Market Trends

The X-ray systems market in MEA is anticipated to witness growth. Increasing healthcare investments and expanding healthcare infrastructure across the region are driving demand for advanced diagnostic imaging solutions. Rising prevalence of chronic diseases and an expanding patient population further contribute to the need for modern X-ray systems. Moreover, technological advancements in X-ray technology, such as digital radiography and portable systems, are enhancing diagnostic capabilities and improving patient care. Government initiatives and healthcare reforms aimed at improving medical services and accessibility are also expected to support market growth in the MEA.

Key X-ray Systems Company Insights

Key players are advancing the development of high-end mobile X-ray systems, which have gained prominence since the COVID-19 pandemic, and are incorporating AI into these imaging technologies. AI has proven to significantly enhance accuracy and sensitivity in detecting imaging abnormalities, leading to its broader adoption in medical imaging. In addition, these companies are forming strategic partnerships to adopt and develop advanced software aimed at improving the efficiency and effectiveness of medical imaging.

Key X-ray Systems Companies:

The following are the leading companies in the X-ray systems market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- GE Healthcare

- Canon Medical Systems

- Shimadzu Corporation

- FUJIFILM SonoSite, Inc.

- Carestream

- Mindray Medical International Limited

- Hologic, Inc

- New Medical Imaging

- AGFA

Recent Developments

-

In April 2024, Shimadzu acquired California X-ray Imaging Services, Inc. to enhance its direct sales of medical systems on the West Coast of the U.S.

-

In March 2022, Konica Minolta, Inc. announced the launch of the AeroDR TX m01, a mobile X-ray system with wireless dynamic digital radiography capabilities, in Japan.

-

In November 2021, GE Healthcare received FDA clearance for its artificial intelligence (AI) algorithm to help healthcare professionals evaluate Endotracheal Tube (ETT) placements. The AI algorithms are installed in a mobile X-ray device for automated measurements, case prioritization, and quality control.

-

In March 2021, Philips announced a partnership with Lunit, a leading medical AI startup. Through this collaboration, Lunit’s INSIGHT CXR chest detection suite will be incorporated into Philips diagnostic X-ray suite to improve patient outcomes, improve the experience of patients and staff, and lower the cost of care.

-

In May 2021, the DRX-Compass X-ray System from Carestream Health was upgraded, giving healthcare facilities a new floor-mount option. This handy option provides cutting-edge technology and cost-effective medical imaging solutions to locations that cannot support an overhead tube crane.

X-ray Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.65 billion

Revenue forecast in 2030

USD 10.16 billion

Growth rate

CAGR of 3.28% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, technology, mobility, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; Siemens Healthineers AG; GE Healthcare; Canon Medical Systems; Shimadzu Corporation; FUJIFILM SonoSite, Inc.; Carestream; Mindray Medical International Limited; Hologic, Inc.; New Medical Imaging; AGFA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global X-ray Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global X-ray systems market report based on modality, technology, mobility, end use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Radiography

-

Computed Radiography

-

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Mobile

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centres

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global x-ray systems market size was estimated at USD 8.4 billion in 2024 and is expected to reach USD 8.65 billion in 2025.

b. The global x-ray systems market is expected to grow at a compound annual growth rate of 3.28% from 2025 to 2030 to reach USD 10.16 billion by 2030.

b. North America dominated the x-ray systems market with a share of 35.44% in 2024. This is attributable to the increasing adoption of modern technology and improved healthcare infrastructure, strong purchasing power, and a fair reimbursement framework.

b. Some key players operating in the x-ray systems market include Koninklijke Philips N.V., Siemens Healthineers AG, GE Healthcare, Canon Medical Systems, Shimadzu Corporation, FUJIFILM SonoSite, Inc., Carestream, Mindray Medical International Limited, Hologic, Inc., New Medical Imaging, AGFA

b. Key factors that are driving the x-ray systems market growth include an increase in preventive healthcare and screening programs, technological advancements, and an increasing number of government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.