- Home

- »

- Clothing, Footwear & Accessories

- »

-

Yoga Clothing Market Size & Share, Industry Report, 2030GVR Report cover

![Yoga Clothing Market Size, Share & Trends Report]()

Yoga Clothing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Women, Men, Children), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific, Latin America, MEA) And Segment Forecasts

- Report ID: GVR-3-68038-810-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Yoga Clothing Market Summary

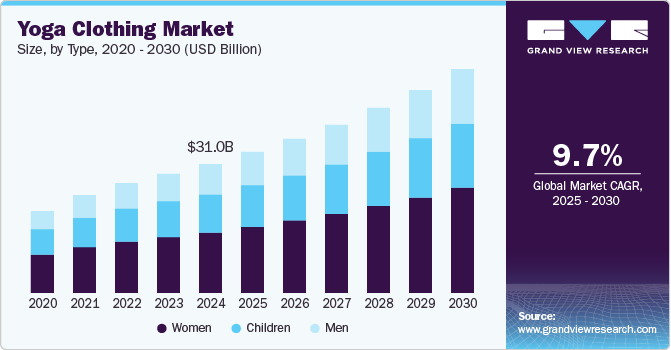

The global yoga clothing market size was valued at USD 31.03 billion in 2024 and is estimated to reach USD 53.59 billion by 2030, growing at a CAGR of 9.7% from 2025 to 2030. A sharp increase in the health-conscious population globally and rising incidences of lifestyle disorders such as diabetes and heart disease have driven the popularity of yoga exercises.

Key Market Trends & Insights

- North America yoga clothing market held a dominant revenue share of 45.0% in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- Based on type, women segment accounted for a revenue share of 47.0% in the global yoga clothing industry in 2024.

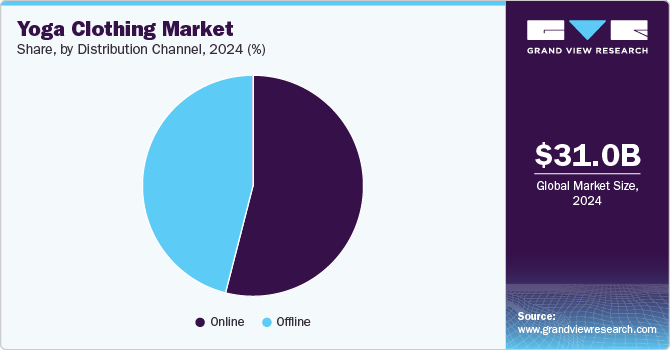

- Based on distribution channel, the online segment accounted for a dominant revenue share in the global yoga clothing industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.03 Billion

- 2030 Projected Market Size: USD 53.59 Billion

- CAGR (2025-2030): 9.7%

- North America: Largest market in 2024

As a result, consumers are compelled to purchase appropriate clothing items and accessories that can enable them to practice different postures while also maintaining their comfort levels. Furthermore, the steadily growing presence of major clothing and lifestyle brands in this segment has boosted competition in the yoga clothing industry, driving the launch of products that offer unique features or use advanced materials. Yoga has become a mainstream fitness activity that people of all ages and backgrounds are practicing. As per a report by Yoga Vidya School, as of 2023, over 300 million people practiced Yoga globally, highlighting its popularity and awareness regarding its health benefits. This growing participation has created a strong market for activewear that accommodates Yoga and other fitness routines such as Pilates, running, or cycling. Social media platforms, including Instagram, TikTok, and YouTube, have played a major role in popularizing Yoga and fitness culture. Influencers and fitness trainers frequently showcase yoga clothing, creating a strong link between activewear and wellness lifestyle, thus driving consumer interest and purchases. Additionally, yoga retreats, workshops, and the expansion of yoga studios worldwide have increased the demand for high-quality, stylish, and comfortable yoga clothing.

The popular fashion trend of ‘athleisure’ has compelled manufacturers to design yoga clothing that can also function as everyday apparel due to its comfort, style, and versatility. Many celebrities, influencers, and high-profile athletes promote such products through collaborations with major brands, which engages customers and boosts product sales. Moreover, innovations in fabric technology, such as moisture-wicking, anti-odor, and flexible materials, have made yoga clothing more comfortable and functional. These fabrics help regulate body temperature, enhance movement, and improve durability, which increases their appeal to consumers. Tech-integrated clothing is also expected to become a major market trend in the coming years as companies seek to leverage smart fabrics that can monitor the wearer’s vitals while they perform their routines. Brands that offer inclusive sizing have also witnessed a surge in demand, as they enable plus-sized people to practice Yoga while also optimizing their comfort.

Type Insights

Women emerged as the leading user segment, accounting for a revenue share of 47.0% in the global yoga clothing industry in 2024. The continued growth of the female population and increasing adoption of a health- and wellness-focused lifestyle among this demographic has led to strong clothing and apparel sales in this segment. A report by Yoga Vidya School states that over 70% of practitioners of Yoga worldwide are women. Women are increasingly turning to Yoga to improve flexibility, strength, and mental health, contributing to a rise in demand for yoga clothing. The demographic is also more likely to be influenced by social media influencers and celebrities, driving the purchase of comfortable and stylish clothing items that are endorsed by them.

Meanwhile, the demand for yoga clothing among men is expected to grow at the fastest CAGR from 2025 to 2030. There has been a substantial increase in the number of men practicing yoga routines, propelled by the need to follow a more active lifestyle and reduce the risk of health issues in the long term. The various types of clothing in this segment include yoga pants, tops, shorts, and jackets, with companies using materials and processes that can ensure moisture absorption and maximum flexibility. As a result, male consumers are increasingly purchasing such items from leading brands such as Lululemon and Alo Yoga.

Distribution Channel Insights

The online segment accounted for a dominant revenue share in the global yoga clothing industry in 2024 and is further anticipated to grow at the highest CAGR from 2025 to 2030. The steadily increasing Internet proliferation globally and rising smartphone usage have made it very convenient for consumers to purchase yoga-specific clothing and accessories. E-commerce retailers provide various benefits, including attractive discounts, membership benefits, and cashback, as well as doorstep delivery services that attract people to make purchases from online platforms. Moreover, the increasing audience on social media platforms allows brands to promote their latest designs through collaborations with celebrities, which presents another notable avenue for product sales.

The offline segment is anticipated to grow at a substantial CAGR during the forecast period in the yoga clothing industry. Offline stores are increasingly boosting their presence across major cities globally that tend to have a larger population of yoga practitioners, enabling significant product sales. Moreover, the emergence of concepts such as virtual fitting rooms and the rising adoption of augmented and virtual reality (AR/VR) tools has further created a seamless experience for shoppers in physical stores, as they can select the right fit in a short time. Hypermarkets, convenience stores, and local outlets offer customized products, enabling buyers to choose their personalized colors and designs with proper fittings.

Regional Insights

North America yoga clothing market held a dominant revenue share of 45.0% in 2024. The growing prevalence of health disorders and continued exposure to the benefits of Yoga have created significant demand for yoga classes among the regional population, aiding market expansion. There is a substantial urban population in economies including Canada and the U.S. that prefers to use fashionable and functional clothing during yoga routines, encouraging manufacturers to launch innovative products. Furthermore, clothing companies are increasingly offering attractive discounts on these products to expand their customer base continuously.

U.S. Yoga Clothing Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, as there has been a strong growth in the yoga-practicing population in the economy. Reports state that around 36 million people in the country regularly practiced Yoga as of 2023, with the number of followers increasing by more than 50% between 2018 and 2023. As a result, there has been a noticeable growth in sales of shorts, leggings, hoodies, tops, and bras, which help ensure a smooth routine. The strong celebrity and sports culture in the country has further driven the popularity of Yoga through the constant promotion of its health benefits. As a result, the market for yoga clothing is expected to remain substantial in the coming years.

Europe Yoga Clothing Market Trends

Europe accounted for a noticeable revenue share in the global market in 2024, aided by the growing awareness regarding the various health benefits of Yoga among the regional population. There is a strong focus on sports and recreational activities among the youth, particularly in Western Europe, which has encouraged them to maintain optimum shape in both physical and mental terms. This can be achieved by practicing Yoga along with other exercises. As a result, there is a highly competitive market for yoga clothing and related accessories in this region. Furthermore, the growing presence of major multinational brands and increasing product sales through both online and offline channels have compelled companies to launch a variety of products that can effectively cater to different demographics in Europe.

Asia Pacific Yoga Clothing Market Trends

The Asia Pacific region is anticipated to grow at the highest CAGR from 2025 to 2030. The rapid shift towards healthy and active lifestyle practices, particularly among working professionals and students, is anticipated to maintain an upward trajectory for the regional yoga clothing market. These clothing items are being designed with functionality and the wearer’s comfort in mind, which holds significant appeal for buyers. Furthermore, economies such as China, India, and Japan have launched various initiatives that aim to encourage the practice of Yoga and other routines to improve the fitness levels of the population. These developments have led to the opening of various regional yoga centers and studios that are witnessing substantial participation, creating positive growth prospects for yoga clothing manufacturers.

China accounted for the largest revenue share in the Asia Pacific market in 2024. Yoga has been gaining popularity in China over the past two decades, and various initiatives have emerged to promote its practice and integrate it into different aspects of Chinese society. These initiatives focus on education, health, fitness, wellness, and cultural exchange. Some Chinese universities have started to offer Yoga as part of their physical education curriculum. The rise in physical and mental health awareness has led to more students incorporating Yoga into their daily routines. As a result, clothing items customized for yoga routines and other exercises have become very attractive to Chinese citizens. The emergence of various local companies that sell their products in both national and international markets further presents promising growth opportunities for the industry.

Key Yoga Clothing Company Insights

Some major companies involved in the yoga clothing industry include lululemon athletica, Alo, and Beyond Yoga, among others.

-

lululemon athletica is involved in the designing, distribution, and sales of athletic apparel, footwear, and accessories. The company offers a range of products catering to yoga enthusiasts, including tops and shirts (both short and long sleeves), yoga pants, yoga leggings, shorts, and joggers. Lululemon also emphasizes sustainability in its clothing production, often using recycled fabrics and eco-friendly materials.

-

Alo Yoga is a major athleisure brand that sells clothing, accessories, and lifestyle products designed for yoga enthusiasts. The company offers clothing items in both men’s and women’s segments, with the former including both short-sleeved and long-sleeved shirts, shorts, t-shirts, and hooded shirts. Meanwhile, women-focused products include leggings, bras, and short sleeves, among others. Alo Yoga is particularly known for its leggings, with popular designs such as Airbrush Leggings and High-Waist leggings. These pants offer great compression, support, and flexibility, making them ideal for yoga, workouts, and casual wear.

Key Yoga Clothing Companies:

The following are the leading companies in the yoga clothing market. These companies collectively hold the largest market share and dictate industry trends.

- lululemon athletica

- Green Apple Active

- Alo, LLC

- Be present

- Beyond Yoga

- Athleta LLC

- CRZ YOGA

- Mukha Yoga

- Mika Body Wear

- Jala

Recent Developments

-

In October 2024, Beyond Yoga announced the launch of an experiential and retail pop-up store called ‘Club Beyond’ in New York. The store remained open from October 11 to 16 and included wellness and fitness classes and workshops while also offering exclusive brand experiences. The store also featured the company’s renowned Spacedye collection, an outerwear collection, new seasonal colors, and the newly launched lifestyle fleece collection.

-

In February 2024, Alo Yoga, in partnership with Cadillac Fairview, inaugurated its newest Alo store at Cadillac Fairview Carrefour Laval, making it the company’s first outlet in the Quebec province of Canada. The company entered the country with a store launch in Toronto in September 2022, followed by expansions in CF Toronto Eaton Centre, CF Chinook Centre, and CF Pacific Centre.

Yoga Clothing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.78 billion

Revenue forecast in 2030

USD 53.59 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

lululemon athletica; Green Apple Active; Alo, LLC; Be present; Beyond Yoga; Athleta LLC; CRZ YOGA; Mukha Yoga; Mika Body Wear; Jala

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Yoga Clothing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global yoga clothing market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.