- Home

- »

- Homecare & Decor

- »

-

Yoga Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Yoga Market Size, Share & Trends Report]()

Yoga Market (2024 - 2030) Size, Share & Trends Analysis Report By Delivery Mode (Online Yoga Course, Offline Yoga Course), By End-use (Male, Female), By Age Group (Below 18 Years, 18-29 Years), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-180-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Yoga Market Size & Trends

The global yoga market size was estimated at USD 107.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030. Factors pushing the market include growing awareness of health and wellness among consumers and the rise in popularity of online yoga courses. Yoga is recognized for providing diverse benefits beyond physical fitness, such as stress reduction, improved flexibility, mental clarity, and emotional well-being. Due to these advantages, a wider range of people, including those seeking mental health benefits, are now practicing yoga. According to a recent survey by Yoga Alliance conducted in 2022, approximately 38.4 million people in the United States, which is around 10% of the total population, practice yoga regularly.

Growing scientific research has supported the health benefits of practicing yoga. This research has led to endorsements from healthcare professionals, which has created potential growth opportunities for the market. The sense of community and social connection fostered by yoga studios, retreats, community-driven events, and group practices has contributed to its appeal, encouraging continued participation and market expansion. Moreover, the increasing prevalence of chronic diseases such as obesity, diabetes, and heart disease is attracting individuals to adopt yoga as a way of managing these conditions. According to the Centers for Disease Control, chronic disease is the leading cause of death and disability in the U.S., accounting for 70% of all deaths.

The popularity of online yoga platforms, apps, and wearable technology is increasing, making yoga more accessible to people of all ages and abilities. Innovations like virtual reality and augmented reality are also emerging as ways to enhance the yoga experience, enabling people to practice from the comfort of their own homes. Since the onset of the COVID-19 pandemic, the demand for online yoga classes has skyrocketed. People's busy lifestyles have led to a need for convenient and accessible fitness options, and online yoga apps and classes are meeting that demand. For example, in July 2021, India-based wearable gadget brand Noise partnered with the digital yoga-based wellness platform Sarva to offer its users virtual yoga and wellness sessions. Under the partnership, Noise users can access Sarva's wellness, yoga, and meditation sessions through the NoiseFit app.

The demand for environmentally friendly and sustainable yoga products, such as mats, clothing, and accessories made from recyclable materials, has led to the growth of a specialized market within the broader yoga industry. Due to yoga's globalization and acceptance across various cultures and regions, it has penetrated previously untapped areas, offering new opportunities for market expansion. In addition, endorsements by celebrities, influencers, healthcare professionals, and wellness advocates have significantly contributed to the popularization of yoga. Social media platforms are powerful tools for spreading awareness and generating interest in yoga practices. International celebrities, including Jennifer Aniston, Miley Cyrus, and Lady Gaga, have attributed their fitness to yoga.

Rising disposable incomes in both developed and developing economies are allowing individuals to spend more on their health and well-being. As a result, there has been an increase in investment in yoga classes, retreats, and accessories. In addition, companies are recognizing the importance of employee well-being and are partnering with yoga studios to integrate yoga into their corporate wellness programs. Yoga has been proven to be effective in reducing stress and improving focus. In September 2023, Yogi on Travel, an India-based provider of yoga and meditation courses, launched corporate yoga programs to promote employee wellness. These programs are customized to meet the unique needs of businesses seeking to improve the health and vitality of their workforce.

Growing awareness and emphasis on health and wellness have driven individuals to seek holistic approaches to fitness and well-being. This trend has resulted in untapped markets in developing countries, driven by increased awareness of mental health benefits, technological advancements in virtual yoga experiences, and a continued focus on holistic well-being. Specialized therapeutic yoga, prenatal yoga, and yoga for seniors are some of the niche segments with substantial growth opportunities. On World Yoga Day in June 2022, a survey found that 91% of expecting mothers agreed that exercise is healthy during pregnancy, with 85% believing that yoga is beneficial during pregnancy and after childbirth.

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The market is characterized by increasing awareness of health benefits, rising disposable income, and the growing popularity of holistic wellness practices. Businesses and individuals to understand market concentration and characteristics to navigate this dynamic and evolving market successfully.

The market is also characterized by a low to moderate level of merger and acquisition (M&A) activity by the leading players. Collaborations between studios, instructors, and wellness brands are prevalent in the fitness industry. This allows them to leverage each other's strengths and expand their reach. The market has experienced significant acquisitions, especially in North America, where large chains such as Lululemon and CorePower Yoga have expanded their operations. However, the fragmented nature of the market limits extensive consolidation.

The market is subject to low regulatory scrutiny. Yoga is not well-regulated globally, which gives studios and instructors a lot of freedom. However, some countries have regulations in place that require yoga teachers to have certain qualifications or ensure safety standards are met in yoga studios. As the market continues to grow, there may be more regulations put in place to address issues such as teacher certification, safety standards in yoga studios, or the accuracy of content on online yoga platforms.

There are a moderate number of direct product substitutes for yoga services. Fitness classes, running, swimming, and various sports are alternative forms of physical activity and stress relief. Personalized fitness apps and platforms provide nutrition plans and sleep tracking for holistic wellness.

End-user concentration is a significant factor in the market. Since there is a diverse end-user base with varying degrees of concentration. Understanding these demographics and their motivations is crucial for market players to develop effective marketing strategies and target specific customer segments.There is an increasing interest in fitness, mindfulness, and unique experiences that attract younger practitioners. Moreover, specific end-user needs and interests can be catered to with prenatal yoga, yoga for athletes, and corporate wellness programs. In addition, the benefits of yoga for managing chronic conditions and improving mobility resonate with older populations. Therefore, it is essential to comprehend these demographics and their motivations to reach out to customers effectively.

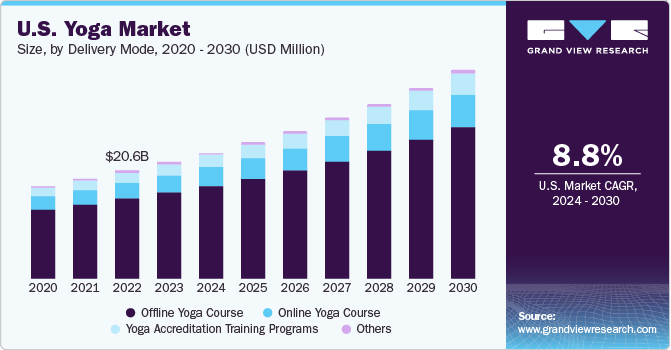

Delivery Mode Insights

Offline yoga course segment accounted for a maximum revenue share of 74.3% in 2023. Offline yoga courses are conducted in person by certified instructors. Many yoga practitioners prefer offline courses for personalized guidance, a group environment, and hands-on correction of postures. Yoga studios offer a wide range of yoga styles, catering to various fitness levels, interests, and needs. This includes hatha, vinyasa, ashtanga, yin, restorative, prenatal, and others. Furthermore, yoga studios are becoming more widespread across the globe, making it easier for individuals to find convenient and affordable classes. According to Zippia, the number of yoga and Pilates studios in the U.S. increased from 32,354 in 2017 to 48,547 in 2023.

Online yoga course is anticipated to register a CAGR of 10.5% over the forecast period. The proliferation of digital technology has facilitated the growth of online yoga courses and platforms. These platforms offer a wide range of classes, catering to different yoga styles and preferences, from beginner to advanced levels. Users can access these courses remotely, enabling flexibility in scheduling and practicing from home. In June 2023, Samsung Partners collaborated with YogiFi, an Indian health-tech startup, to offer an interactive yoga experience on its range of smart televisions. The partnership will bring the ability to pair the world's first AI-enabled yoga mat from YogiFi with its Smart TVs.

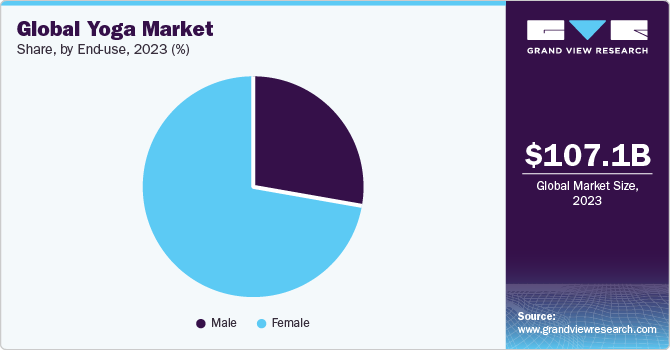

End-use Insights

Female segment dominated the market with a revenue share of 72% in 2023. Female practitioners are more inclined towards attending group classes at yoga studios or community centers. They appreciate the community aspect, social interaction, and sense of belonging offered by group yoga sessions. Yoga is valued by women during different life transitions, such as pregnancy, menopause, or periods of high stress. It offers tools and practices to navigate these changes with more ease. Tailored yoga programs designed for women, such as prenatal yoga for expectant mothers, postnatal yoga for new mothers, or classes focused on women's health issues, address specific needs and life stages.

The demand from male segment is expected to be the fastest growing segment in the yoga industry owing to growing awareness of the diverse health benefits of yoga beyond traditional fitness routines. There has been a growing interest among men in practicing yoga for various reasons such as stress management, athletic performance, mindfulness, and meditation. Yoga brands started offering more gender-neutral or male-specific yoga apparel and equipment’s. Moreover, male athletes are increasingly incorporating yoga into their training routines to enhance their flexibility, recovery, and overall performance. A recent study conducted in the U.S., reveals that the percentage of male yoga practitioners has risen from 17.8% in 2012 to approximately 28% in 2021.

Age Group Insights

The 30-50 years segment dominated the market with a revenue share of 43.5% in 2023. Individuals in the age bracket of 30-50 often turn to yoga as a way to relieve stress, maintain fitness, and promote mental relaxation. They seek yoga to balance their work-life responsibilities, manage stress, and maintain physical health. This group also tends to participate in recreational sports and exercise, and yoga can help enhance their athletic performance and prevent injuries. Nowadays, many yoga studios offer specialized classes for athletes that focus on building strength, flexibility, and balance. Rise Up Yoga Studio, for example, helps athletes enhance their training during the off-season. Yoga can serve as an excellent team bonding tool, improving an athlete's mental and physical strength and flexibility.

The 18-29 years segment is expected to witness a CAGR of 10% over the forecast period. This particular age group often turns to yoga as a means of staying fit, managing stress, and improving their mental well-being, all while juggling the demands of college, work, and personal life. They may practice a variety of yoga styles, ranging from dynamic to mindfulness-based sessions. Online yoga platforms and apps are particularly popular among this group, and they tend to be influenced by social media and celebrity endorsements. In November 2023, CorePower Yoga, a U.S.-based yoga studio, announced a collaboration with EleVen by Venus Williams to launch performance yoga-ready activewear. EleVen is a brand founded by Venus Williams, an American tennis player, in 2007.

Regional Insights

Asia Pacific dominated the market with a revenue share of 37.2% in 2023. The growth of the Asia Pacific yoga industry can be attributed to its large and diverse consumer base, increasing disposable income, and growing awareness of its health benefits. A study conducted by Yoga Journal in 2022, has revealed that the number of yoga practitioners in Japan has increased by 413% in the last five years. Budget-friendly studios and community-based yoga initiatives are making the practice more accessible to broader demographics. Traditional yoga practices, such as hatha and pranayama, are often adapted to local cultural contexts and religious sensitivities. Furthermore, increasing government support for promoting yoga activities will further boost the regional industry growth. For example, in June 2021, the Indian government announced the launch of 25 Fit India Yoga centers across nine states to promote the health and wellness benefits associated with yoga.

North America is set to grow at a CAGR of about 8.8% over the forecast period. The market in North America is rapidly growing, especially in the U.S. and Canada. Hatha yoga, vinyasa, ashtanga, and other dynamic styles are popular, reflecting the region's fitness-focused culture and increasing interest in stress management and holistic health. High-end studios and retreats that offer personalized attention and unique environments are attracting affluent consumers. The use of online platforms and mobile apps is increasing to book classes, practice at home, and access personalized yoga experiences. In May 2023, Yogaworks, a US-based yoga company, launched a new cross-platform app that features industry-leading, digitally exclusive instructors. Users can enjoy daily on-demand content updates, and they can stream live classes in real-time or store on-demand library uploads for anytime access through the app.

Key Companies & Market Share Insights

Some of the key players operating in the market include CorePower Yoga; Honor Yoga; Pure Yoga; Glo Digital, Inc.; and YogaOne

-

CorePower Yoga is a well-established U.S.-based yoga studio chain with over 220 locations in 21 states and virtual live streaming and video-on-demand classes. The company operates over 200 high-end studios offering yoga classes of varying styles and levels. Their facilities include heated practice rooms, a retail shop, changing areas, day lockers, and a modern atmosphere.

-

Pure Yoga is a yoga studio, headquartered in Hong Kong and branches in Beijing, Shanghai, Singapore, and New York. The company conducts over 350 yoga classes every week, covering 20 different styles of yoga, including hot yoga, meditation, ashtanga, and iyengar. The company also offers various programs to its clients, including yoga therapy, Thai yoga bodywork, health coaching, sleep therapy, reiki, ayurvedic assessment, and trigger point therapy.

YogaSix; Yoga Pod; MoreYoga; Power Yoga Canada; and Flyogi LLC. are some of the emerging market participants in the yoga market.

-

Power Yoga Canada (PYC) is a Canadian yoga company that operates several yoga studios across Canada. They also offer online yoga classes, including their 200-hour, 300-hour, and continuing education modules. PYC conducts 275 weekly yoga classes and their 200-hour certification program is one of the most comprehensive Yoga Teacher Training programs in Canada. To date, over 600 students have graduated from this program.

-

YogaSix is a modern boutique yoga brand that is headquartered in the U.S. It was founded in 2012 and offers a range of heated and non-heated yoga classes that are accessible to everyone. The brand offers six core classes which include Y6 101, Y6 Restore, Y6 Slow Flow, Y6 Hot, Y6 Power, and Y6 Sculpt & Flow. It has more than 170 studios and over 550 licensed locations across the globe.

Key Yoga Companies:

- CorePower Yoga

- Honor Yoga

- Pure Yoga

- Glo Digital, Inc.

- YogaOne

- YogaSix

- Yoga Pod

- MoreYoga

- Power Yoga Canada

- Flyogi LLC

Recent Developments

-

In January 2023, CorePower Yoga, announces the launch of their newest studio class offering, CorePower Strength X, a 45-minute high-intensity strength training workout consisting of targeted, muscle group-focused weight circuits, metabolism-boosting cardio, and energizing breathwork. Each CorePower Strength X class includes a dynamic warm-up, two muscle group-focused strength circuits, HIIT-style cardio, a core series, energizing breathwork, and a cool-down such as Savasana.

-

In November 2022, Y7, the U.S.-based yoga studio announced a partnership with Universal Music Group, a Netherlands-based music and entertainment company, to offer the music-driven yoga platform for online yoga classes. The digital yoga platform will include hit music that is synced into all classes. It can be accessed through a new digital-only subscription or omnichannel memberships.

Yoga Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 116.57 billion

Revenue forecast in 2030

USD 200.35 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, end-use, age group, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

CorePower Yoga; Honor Yoga; Pure Yoga; Glo Digital, Inc.; YogaOne; YogaSix; Yoga Pod; MoreYoga; Power Yoga Canada; Flyogi LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

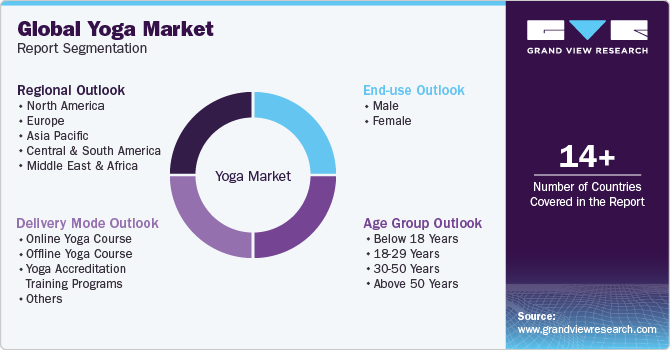

Global Yoga Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global yoga market report based on delivery mode, end-use, age group, and region:

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Yoga Course

-

Offline Yoga Course

-

Yoga Accreditation Training Programs

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 18 Years

-

18-29 Years

-

30-50 Years

-

Above 50 Years

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global yoga market was estimated at USD 107.1 billion in 2023 and is expected to reach USD 116.57 billion in 2024.

b. The global yoga market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 200.35 billion by 2030.

b. Asia Pacific dominated the yoga market with a share of around 37.25% in 2023. The growth of the Asia Pacific yoga market can be attributed to its large and diverse consumer base, increasing disposable income, and growing awareness of its health benefits.

b. Some of the key players operating in the yoga market include CorePower Yoga; Honor Yoga; Pure Yoga; Glo Digital, Inc.; YogaOne; YogaSix; Yoga Pod; MoreYoga; Power Yoga Canada; Flyogi LLC

b. Key factors that are driving the yoga market growth include the growing awareness of health and wellness among consumers and the rise in popularity of online yoga courses

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.