- Home

- »

- Market Trend Reports

- »

-

Global Animal Population Databook

Report Overview

The global animal population is growing steadily, driven by rising pet ownership and expanding livestock demand. Companion animals, particularly dogs and cats, are increasingly integrated into households, with ownership surging across the U.S., UK, Australia, Mexico, and UAE, reflecting shifting demographics, higher disposable incomes, and evolving lifestyles. Dogs dominated most of the animal health market due to the rising dog population and pet healthcare costs, particularly in developed countries. According to the National Pet Owners Survey 2023-2024 conducted by the American Pet Products Association, 86.9 million households (around 66%) in the U.S. owned dogs. For decades, dogs have gained greater importance and popularity in North America, where owners frequently treat them as devoted family members, to a degree, where one-third of the U.S. population loves their dogs more than their partners.

At the same time, livestock populations remain critical to global food systems, with poultry, cattle, and fish leading production to meet rising protein demand. These parallel trends highlight the dual role of animals as companions and essential contributors to food security, underscoring the growing influence of welfare, sustainability, and cultural preferences in shaping global ownership patterns.

Global Animal Population Databook Coverage

Global Animal Population Databook Report Coverage

Market Outlook

Population & Demographics Analysis

Market Dynamics

Economic & Market Linkage Analysis

Emerging Trends & Models of Animal Ownership and Farming

The global animal population is rising across companion animals and livestock, reflecting shifting demographics and economic demand. Pet ownership has surpassed one billion worldwide, with rapid growth in emerging markets and record highs in the U.S., China, and Japan. Livestock populations continue to expand, with global milk production reaching 950 Mt and meat output 365 Mt in 2024, led by poultry and beef. Together, these trends highlight the dual role of animals, first as family companions and livestock, as essential to global food security, shaped increasingly by welfare, health, and sustainability priorities.

Population & Demographics Analysis

The global animal population reflects the growing demand for companion animals and the sustained importance of livestock for food security. Companion animal ownership is highly concentrated in developed markets such as the U.S., U.K., and Australia, where over 60–70% of households own at least one pet, with millennials and Gen X forming the largest demographic of pet owners. In emerging markets like Mexico and the UAE, ownership rates are rising rapidly, driven by urbanization, rising incomes, and cultural shifts. Dogs and cats remain the most popular pets worldwide, but regional variations exist; cats dominate in the UAE, while dogs lead in Mexico and Australia.

On the livestock side, global herds and flocks continue to expand, with poultry and cattle populations driving growth. For example, poultry exceeds 28 billion globally, while cattle populations are above 1.5 billion, primarily concentrated in Asia and South America. These demographic patterns highlight the diversity of pet ownership behaviors and the regional differences in livestock reliance, shaping future veterinary, feed, and pet care markets.

Companion Animal Ownership by Country (Household %)

Country

Dog Ownership

Cat Ownership

Other Pets (Fish, Birds, Rabbits, etc.)

Total Pet Ownership (HH%)

U.S.

63%

40%

~15%

~66%

U.K.

28%

24%

~10% (fish, rabbits, birds)

51%

Australia

48%

33%

15–20% (fish, birds, reptiles)

69%

Mexico

65%

24%

~17%

71%

UAE

33%

53%

~25%

42%

Sources: AVMA, PDSA, AMA, INEGI, TGM Survey, Grand View Research

Economic & Market Linkage Analysis

Global livestock and poultry populations influence trade flows, production patterns, and market dynamics. According to the USDA, Livestock and Poultry: World Markets and Trade report published in April 2025, beef exports are projected to rise 1% to 13.1 million tons in 2025, driven by record shipments from Brazil and Australia, which more than offset declining U.S. exports due to facility registration lapses in China and retaliatory tariffs. Similarly, chicken meat exports are forecast to increase 2% to 14.0 million tons, with Brazil benefiting most from its price-competitive position and versatile product offerings. Conversely, pork exports are expected to decline 1% to 10.2 million tons as lower shipments from the EU and U.S. offset Brazil’s 5% export expansion, reflecting shifts in demand from China to other Asian and Latin American markets.

These trends underscore the strong linkage between animal population dynamics and global markets. For instance, Brazil’s rising cattle and swine populations allow it to maintain low-cost, high-volume exports, capitalizing on demand shifts caused by tariffs, disease outbreaks, and changing consumer preferences. In contrast, constrained cattle supply in the U.S. and EU due to herd contraction and high input costs limits export growth despite stable domestic consumption. Overall, population trends serve as a leading indicator for trade competitiveness, pricing strategies, and market access, demonstrating how shifts in animal stocks directly impact economic and trade outcomes across the global livestock sector.

Emerging Trends & Models of Animal Ownership and Farming Analysis

Globally, animal ownership is undergoing a structural shift driven by demographic and lifestyle changes. There are now likely over a billion pets worldwide, with households in the U.S., Brazil, the EU, and China alone accounting for more than half a billion dogs and cats. Pet ownership is rising rapidly among millennials and urban households, where smaller family sizes and delayed parenthood fuel higher demand for companion animals. In emerging markets, the expanding middle class is accelerating this growth. At the same time, research increasingly highlights the positive health outcomes of pet ownership, ranging from improved heart health to lower anxiety, which further reinforces this trend.

In livestock farming, global demand is being reshaped by productivity innovations and sustainability pressures. Poultry and beef are driving meat production growth, with Brazil emerging as a record exporter in 2024 due to favorable exchange rates, strong disease-free status, and competitive feed costs. At the same time, dairy production grew 1.1% to 950 Mt, led by India and Pakistan, while butter prices surged to record highs. However, demand growth is slowing in high-income countries as consumers adopt more welfare- and climate-conscious diets, leading to stagnating per capita meat consumption. To balance this, producers are adopting precision farming, genetic improvements, and biosecurity collaboration to raise efficiency while curbing environmental impacts. These dual dynamics, such as pet humanization and sustainable livestock intensification, define the new global animal ownership and farming models.

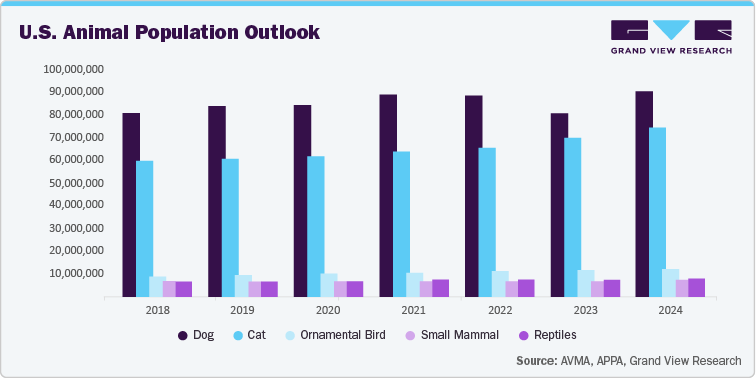

U.S. Animal Population Outlook

The U.S. companion animal population steadily grew between 2018 and 2024, with dogs and cats remaining the most significant segments. Dog ownership rose from ~79.9 million in 2018 to ~89.7 million in 2024, while cats increased from ~59.2 million to ~73.8 million in the same period, reflecting changing lifestyles and rising pet humanization. Ornamental birds also grew strongly, surpassing 117 million by 2024. In contrast, small mammals showed a flat to slight decline, remaining around ~61–62 million. Reptiles displayed steady gains, rising from ~61 million in 2018 to over 69 million in 2024. This demographic expansion underpins higher veterinary spending, preventive care, and pet services demand, reinforcing the positive outlook for the U.S. animal health market.

Global Animal Population Databook Report Scope

The deliverable provides companion animal and livestock population data for approximately 66 countries, covering key animal species and major countries over the period 2018-2033.

Animal Population Databook Report Scope

Report Attribute

Details

Total number of animal species covered in the database

12

Total countries covered in the database

66

Deliverable format

Excel

Countries scope

Albania, Argentina, Australia, Austria, Belgium, Bosnia & Herzegovina, Brazil, Bulgaria, Canada, Chile, China, Colombia, CROATIA, Cyprus, Czechia, Denmark, Ecuador, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Italy, Japan, Kuwait, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Mexico, Montenegro, Netherlands, North Macedonia, Norway, Oman, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, Türkiye, U.S., UAE, UK, Ukraine, Uruguay, Venezuela, Vietnam

Animal Scope

Dog, Cat, Bird, Small Mammal, Reptiles, Cattle, Buffalo, Chicken, Goats, Horse, Sheep, Swine

Customization scope

Free report customization (equivalent to up to 4 analysts' working days) with purchase. Addition or alteration to country, & regional scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified