- Home

- »

- Market Trend Reports

- »

-

Asia Pacific Beer Market - Importers And Exporters Trade Data Analysis

Report Overview

Beer imports in Asia Pacific continue to rise, driven by increasing demand for premium, craft, and international styles in key markets such as China, Japan, South Korea, and Australia. Higher disposable incomes, urbanization, and evolving consumer preferences have fueled interest in European lagers, American IPAs, and Mexican-style beers. As a result, both retail and on-trade channels are broadening their imported portfolios to meet this shift toward premiumisation.

Concurrently, several Asia Pacific countries-most notably China, Vietnam, and Thailand-are strengthening their position as beer exporters. These markets are capitalising on low production costs, improving quality standards, and rising global appeal. Japanese and Thai brands, in particular, benefit from strong international brand equity and tourism-driven recognition, supporting their expansion into Europe, North America, and neighbouring Asian economies.

Intra-regional trade is also accelerating, supported by regional trade agreements and efficient logistics infrastructure. Countries such as Singapore and Hong Kong serve as key import-reexport hubs, while ASEAN markets increasingly exchange beer products within the bloc. Collectively, these dynamics reflect Asia Pacific’s evolution from a primarily import-led market to a more integrated and competitive participant in global beer trade.

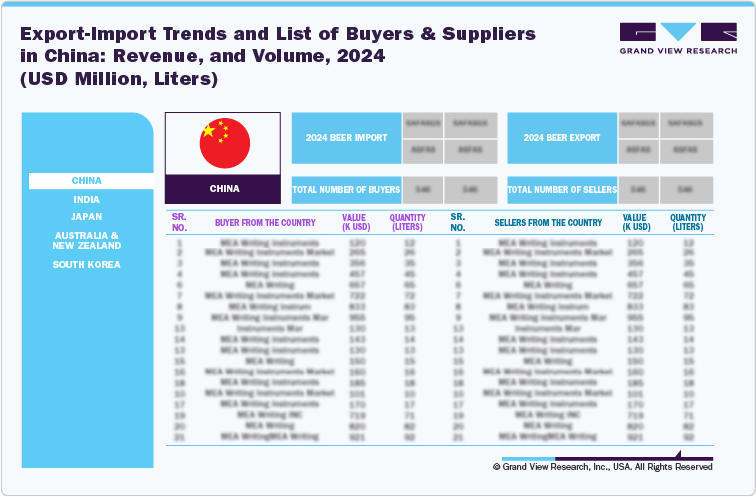

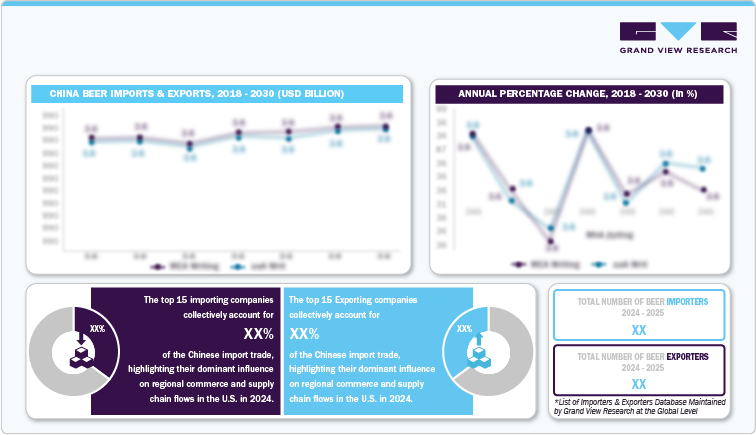

China’s beer trade reflects a strategic duality: while it remains the world’s largest beer consumer by volume, its import and export dynamics are increasingly shaped by shifting domestic demand and rising manufacturing capabilities.

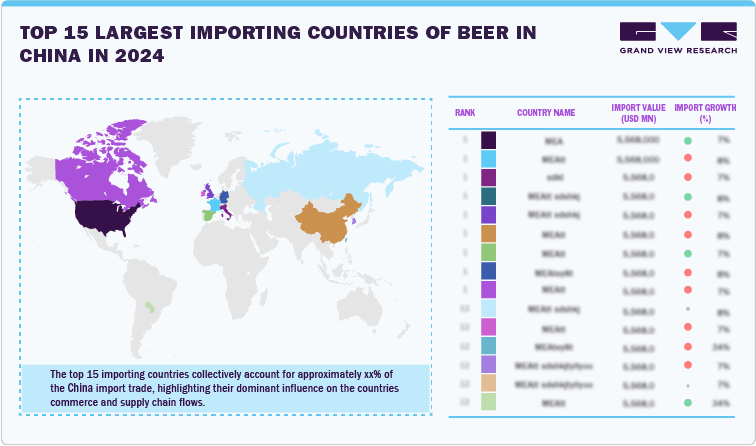

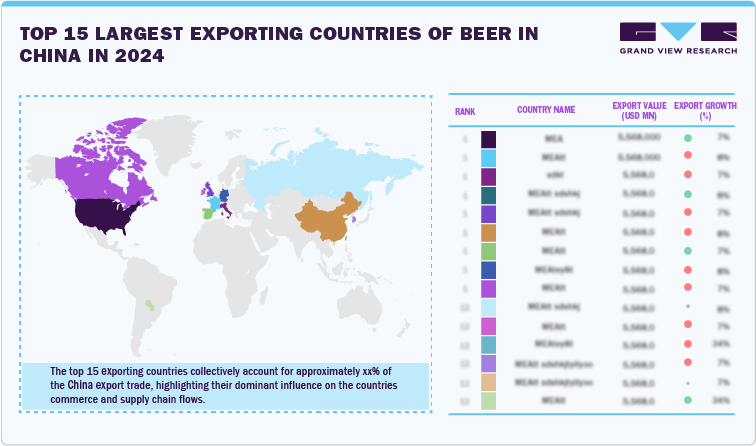

On the import side, China has become a key destination for premium and craft beers, particularly from Europe, Mexico, and the United States, as urban middle-class consumers seek higher-quality, international brands driving a value-led, rather than volume-led, import growth trajectory. Simultaneously, China’s beer exports have expanded, surpassing 300 million litres annually, with Southeast Asia, South Korea, and Russia as core markets.

This growth is fueled by competitive pricing, improving product quality, and the international push of leading domestic brewers such as Tsingtao and Snow. China’s evolving trade profile underscores its transition from a consumption-driven beer economy to a more globally integrated, brand-forward export player.

China’s beer import landscape is undergoing a notable transformation, characterized by a shift from volume-driven growth to value-led consumption. While total import volumes have stabilized, demand is increasingly concentrated in premium, niche, and foreign craft segments. Urban consumers especially in Tier 1 and Tier 2 cities are gravitating toward imported European lagers, Belgian ales, and American IPAs, viewing them as lifestyle-oriented products. Germany remains a key supplier, valued for quality and authenticity, while rising imports from Mexico and the U.S. reflect growing openness to diverse styles and branding. This trend reflects not just globalisation of taste but also a maturing domestic market seeking quality over quantity.

On the export side, China is strategically expanding its beer footprint, particularly across regional markets in Asia, Eastern Europe, and Africa. Exports have crossed 300 million litres annually, driven by strong price competitiveness and improving product quality. Breweries like Tsingtao and Snow are investing in brand development, logistics partnerships, and distribution networks abroad, targeting markets with large overseas Chinese populations or growing demand for affordable lager-style beers. The push is no longer limited to surplus volume disposal-it’s a calibrated effort to build sustainable export channels and elevate the global standing of Chinese beer brands.

China’s evolving beer trade strategy is reshaping the Asia beer market by simultaneously driving up demand for premium imports and intensifying regional export competition. Its shift toward high-value international brands has elevated consumer expectations across Asia, influencing product positioning and portfolio strategies in neighboring markets. At the same time, China’s expanding export footprint-anchored by competitively priced domestic brands-has disrupted price structures and market share dynamics in Southeast Asia and beyond, positioning China as both a premium demand catalyst and a volume-based competitor within the regional beer landscape.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified