- Home

- »

- Market Trend Reports

- »

-

Digital Healthcare Supply Chain Management - Survey Insights

Industry Insights

Government initiatives to improve medical supply, increased investment in next-generation technologies such as digital twin technology and control towers, and the adoption of virtual control towers and dashboards to enhance visibility, analytics, and execution tools are some of the factors driving the demand for digital supply chain management solutions across the healthcare industry, including pharmaceuticals.

Furthermore, through market survey research, it has been found that digitalization within the supply chain is becoming increasingly necessary to meet the demands of consumers in a timely and efficient manner. Current market players are exploring the potential of transitioning from traditional supply chain models to digitalization.

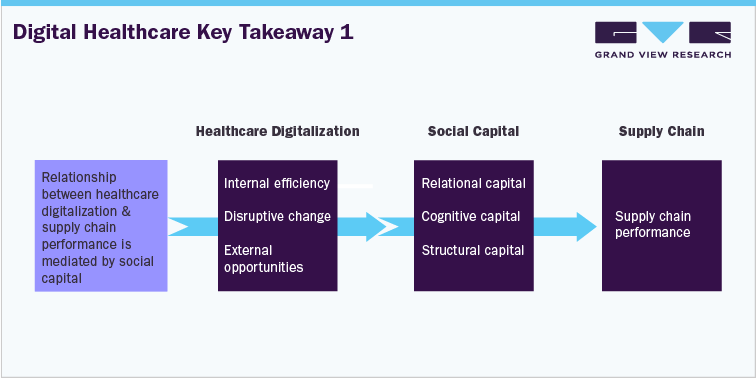

According to existing survey studies and by analyzing our research data, it is evident that supply chain managers have an understanding of digitalization to effectively employ AI and automation tools. Moreover, successful supply chain performance is contingent upon maintaining social capital and supply chain-related partnerships

Key Takeaway 1

According to a 2021 article published in the National Library of Medicine (Kim HK, 2021), a relationship between healthcare digitalization, social capital, and supply chain performance in the healthcare manufacturing industry has been identified. Qualitative research has explored digitalization in supply chains, but empirical evidence on the performance of companies adopting digitalization is still being determined. Efficient delivery of product specifications and market-trend information in a supply chain network relies on social capital. The survey findings suggest that healthcare manufacturers can improve their performance by increasing supply chain visibility through digitalization and by fostering the rapid formation of social capital.

Analyst Insights - According to existing survey studies and by analyzing our research data, it is evident that supply chain managers have an understanding of digitalization to effectively employ AI and automation tools. Moreover, successful supply chain performance is contingent upon maintaining social capital and supply chain-related partnerships.

“130 responses were analyzed using a structural equation model in SPSS with the AMOS module.

Survey Period - September 5th, 2020, to October 24th, 2020

Article published date -February 3rd, 2021”Key Takeaways 2

According to a 2021 article published in the National Library of Medicine (Kim HK, 2021), a relationship between healthcare digitalization, social capital, and supply chain performance in the healthcare manufacturing industry has been identified. Qualitative research has explored digitalization in supply chains, but empirical evidence on the performance of companies adopting digitalization is still being determined. Efficient delivery of product specifications and market-trend information in a supply chain network relies on social capital. The survey findings suggest that healthcare manufacturers can improve their performance by increasing supply chain visibility through digitalization and by fostering the rapid formation of social capital.

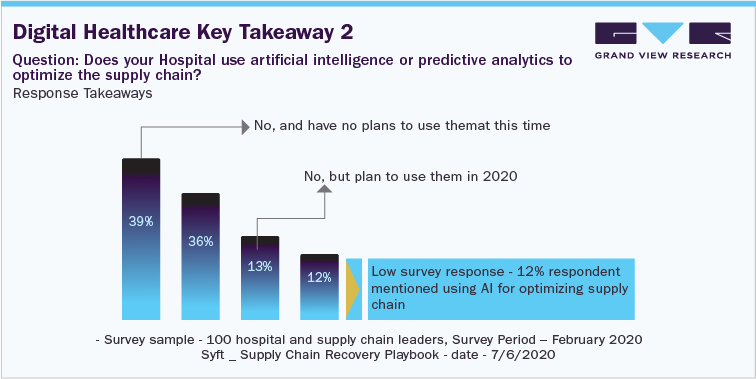

Analyst Insights - AI is one of the most significant strategic advancements in supply chain technology and has a big impact on many different industries. Furthermore, a survey conducted in February 2020 by Syft, a provider of software and services for end-to-end supply chain management and AI-enhanced inventory control, revealed that few hospitals in the U.S. use AI and predictive analytics for supply chain management, highlighting a growing opportunity for the healthcare sector to investigate digitization to improve its supply chain management.

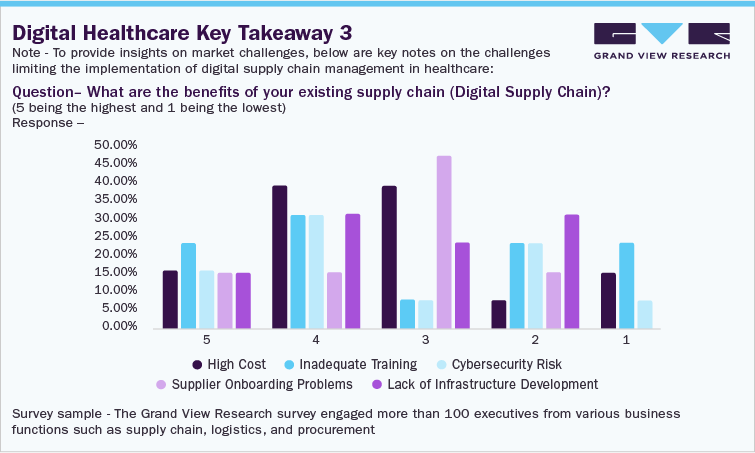

Analyst Insights - According to the survey results, respondents who have implemented digital supply chain software in their organizations reported that the high cost of implementing supply chain management software (38.5% rated it the highest at “4”), inadequate training of specialized operating talent/labor (30.8% rated it the highest at “4”), and cybersecurity risk (30.8% rated it the highest at “4”) were their biggest challenges.

Moreover, the survey results reveal that supply chain professionals face other challenges, including difficulties in onboarding new suppliers due to inadequate software implementation and lack of training (rated highest at “3” by 46.2% of respondents) as well as insufficient infrastructure required for supply chain management software implementation (rated highest at “4” by 30.8% of respondents).

Market Opportunities - Key Insights from Grand View Research Survey

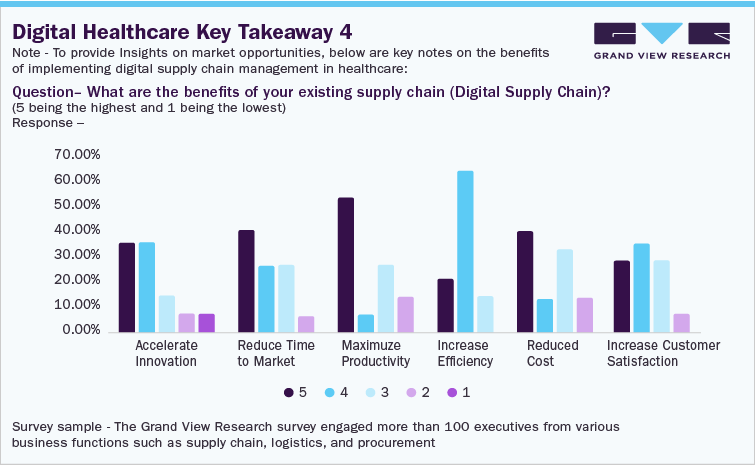

Analyst Insights - The survey results indicate that respondents who have implemented digital supply chain software in their organizations reported significant benefits, such as accelerated innovation (35.7% rated it the highest at “5”), reduced time to market for products (40% rated it the highest at “5”), and maximized productivity (53.3% rated it the highest at “5”).

In addition, the survey highlighted other advantages of supply chain digitalization and transformation programs, including increased efficiency (64.3% rated it the highest at “4”), reduced cost (40% rated it the highest at “5”), and increased customer satisfaction (35.7% rated it the highest at “4”).

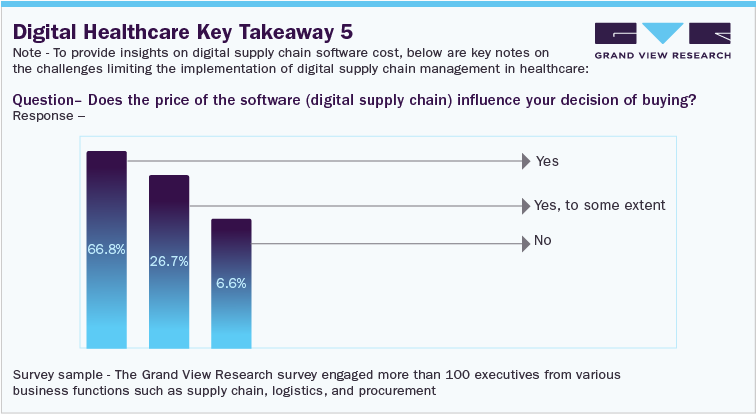

Key insights on digital supply chain software costs from Grand View Research survey

Analyst Insights - "Cost is a significant factor for supply chain executives.”

According to survey respondents, when asked about the most important consideration for their organization when selecting software, 66.7% indicated that cost was the primary factor.

Report Methodology

Point

Details

Survey General Methodology

Utilized survey data sets, published articles, podcasts, industry sources, and analyst perspectives to provide key market insights. Our analyst perspective is based on more than 50 survey-based articles, podcasts, and primary insights mentioned in press releases

Grand View Research Survey Methodology

- For the Grand View Research survey, we received more than 100 responses through LinkedIn. The survey was targeted at the pharmaceutical and life sciences industries.

- All respondents participated voluntarily, and over 40% of them hold managerial positions or higher.

- Here is the link to the survey for your ready reference - Link.!

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified