- Home

- »

- Market Trend Reports

- »

-

Elagolix (Orilissa) Market Analysis, 2033: Competitive Landscape, Patent Outlook, & Future Growth Opportunities

Report Overview

Elagolix (Orilissa), developed by AbbVie Inc., represents a major advancement in women’s health as the first oral gonadotropin-releasing hormone (GnRH) antagonist approved for the management of endometriosis-associated pain and uterine fibroids. Designed to provide dose-dependent estrogen suppression, it offers a flexible, non-surgical treatment alternative with improved safety and tolerability compared to traditional hormonal options. Its oral formulation enables precise hormonal control, allowing individualized therapy and enhanced patient adherence. Since approval, Elagolix has redefined treatment standards for chronic gynecologic disorders by addressing unmet needs for effective and reversible pain relief. Supported by AbbVie’s robust clinical programs, strategic collaborations, and growing market presence, Elagolix is positioned for sustained global expansion, driven by increasing diagnosis rates, rising awareness of reproductive health disorders, and ongoing efforts toward lifecycle management and geographic diversification.

Key Report Deliverables

-

A comprehensive analysis of the Elagolix (Orilissa) market landscape, detailing global revenue performance, therapeutic adoption trends across endometriosis and uterine fibroids, evolving treatment paradigms in GnRH receptor antagonism, and the shifting competitive environment within the women’s health therapeutics segment.

-

Forecasts assessing post-launch market evolution, including anticipated label expansions, regional growth projections, and the impact of rising diagnosis rates and patient preference for non-surgical therapies on overall market penetration and revenue trajectory.

-

Identification of key regulatory, pricing, and reimbursement challenges influencing Elagolix adoption, encompassing approval pathways, payer evaluations, formulary inclusion trends, and market access barriers across major regions such as the U.S., Europe, Japan, China, and Latin America.

-

An in-depth competitive landscape overview, profiling leading market participants and pipeline developers in the GnRH antagonist class, ongoing innovations in hormonal modulation, strategic collaborations, and clinical differentiation shaping the future of endometriosis and fibroid management.

-

Strategic implications for AbbVie Inc., including lifecycle management initiatives, portfolio diversification, pricing optimization, and geographic expansion strategies aimed at sustaining leadership and maximizing long-term growth opportunities within the global women’s health therapeutics market.

Patent Landscape - Elagolix Sodium (Orilissa)

-

AbbVie’s Orilissa maintains one of the most robust intellectual property portfolios within the women’s health therapeutics domain. The FDA Orange Book lists eight active U.S. patents under NDA 210450, with expirations extending from 2029 through 2040.

-

These patents collectively cover drug substance, formulation, and methods of use - creating a layered “patent fence” that effectively restricts generic entry and sustains AbbVie’s revenue stream well into the late 2030s.

-

Commercial impact: The extended patent protection ensures AbbVie can preserve pricing power, market share, and cash-flow stability through most of the next decade, with limited generic erosion risk until ~2040 in the U.S. market.

Table: Detailed Patent Portfolio Analysis

Patent No.

Expiry Date

Patent Scope

Market Relevance

Strategic Implications

7,419,983

6-Jul-29

Drug Substance / Product

Core composition-of-matter protection; foundational IP for elagolix molecule.

Sets baseline exclusivity; generics cannot launch before this expires without challenging later patents.

10,537,572

1-Sep-36

Method of Use (U-2735)

Covers dosing and clinical administration protocols.

Sustains partial exclusivity for prescribed use; discourages label carve-outs by generics.

10,682,351

1-Sep-36

Method of Use (U-2850)

Additional use claim reinforcing dosing/indication control.

Reinforces therapeutic positioning for long-term use.

11,707,464

14-Mar-34

Method of Use (U-3672)

Secondary clinical claim (possibly fibroid or hormone modulation context).

Adds overlapping IP to prevent early design-arounds.

11,690,854

19-Apr-38

Formulation / Use (U-3653)

Protects formulation and excipient combinations.

Extends protection to formulation technology and manufacturing IP.

12,102,637

20-Aug-38

Drug Product

Protects dosage form, stabilizers, and manufacturing process.

Raises the barrier for bioequivalent generics; manufacturing complexity increases.

11,542,239

23-Jul-39

Drug Substance / Process

Broader coverage for composition, intermediates, and processes.

Critical for long-term control over API supply and licensing.

11,690,845

27-Aug-40

Method of Use (U-3654)

Protects optimized dosing regimens and combination therapy (elagolix + add-back).

Locks exclusivity for combination product (Oriahnn) formulations.

Source: U.S. FDA, GVR Analysis

Key points

-

Layered protection: The combination of early (2029) and late (2039-2040) patent expiries indicates staggered protection - some patents cover composition/substance while others protect methods/dosing or specific product/formulations. This typically delays full generic market entry until later patents are overcome or expire.

-

Generic timing: Because patents extend into 2039-2040, an unencumbered generic launch in the U.S. is unlikely before the latest relevant patents expire unless successful patent challenges (e.g., Paragraph IV litigation) or settlements occur.

Table: Commercial and Competitive Implications

Dimension

Impact Assessment

Revenue Protection

Patent coverage through 2040 allows AbbVie to maintain branded pricing and stable revenue contribution within the women’s health segment. Limited risk of generic erosion before late 2030s.

Market Competition

Emerging competitors (e.g., relugolix-based therapies by Myovant/Pfizer and Takeda) target overlapping indications but operate outside Elagolix’s IP scope. Competitive risk is therapeutic, not generic.

Lifecycle Management

AbbVie is actively expanding indications (uterine fibroids, potential combination therapies) and may pursue reformulations (extended-release, fixed-dose combinations) to prolong market life beyond patent expiry.

Pricing Strategy

Sustained exclusivity enables AbbVie to balance price stability with payer rebates, preserving margins even as regional price pressures emerge.

Post-Patent Outlook

Expected gradual erosion post-2040 with generics capturing cost-sensitive segments; however, brand equity and physician trust likely preserve a loyal share in chronic gynecologic pain management.

Analyst Perspective:Elagolix’s IP portfolio provides two decades of protection since approval, ensuring AbbVie’s continued dominance in oral GnRH antagonists. This long patent runway underpins the company’s women’s health revenue projections and buffers against generic erosion - a critical differentiator in a market increasingly defined by cost-sensitive hormone therapies.

By combining molecule patents (to 2029), use patents (to 2036), and formulation/process patents (to 2040), AbbVie has effectively insulated Orilissa’s commercial lifecycle through at least Q3 2040 in the U.S.

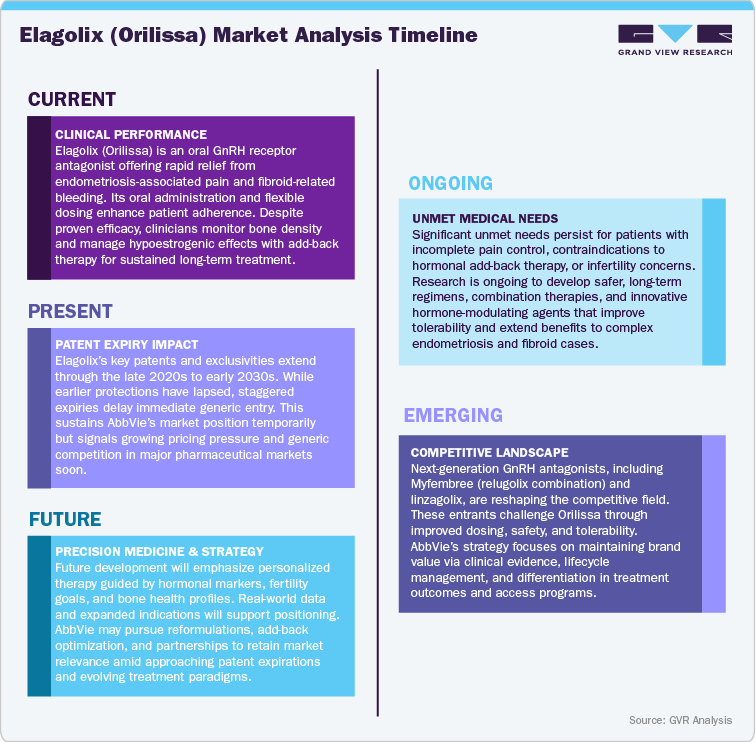

Current Market Scenarios

Elagolix (Orilissa), developed by AbbVie Inc., has established itself as a breakthrough innovation in the women’s health therapeutics landscape, redefining hormonal management for endometriosis-associated pain and uterine fibroids. As the first oral GnRH antagonist approved for these indications, Elagolix offers a flexible, non-surgical treatment approach that precisely modulates estrogen levels, addressing a major unmet need in chronic gynecologic disorders. Its dose-dependent efficacy, rapid onset of action, and improved tolerability have made it a preferred option among gynecologists and reproductive health specialists seeking alternatives to invasive interventions and long-term hormonal suppression therapies.

In the U.S. and Europe markets, Elagolix continues to demonstrate strong adoption driven by rising disease awareness, increased screening rates, and broad payer coverage supporting non-surgical treatment pathways. AbbVie’s strategic marketing and education initiatives have enhanced physician familiarity, while favorable real-world outcomes and patient-reported benefits have reinforced market confidence. Label expansion into uterine fibroids and the successful co-formulation of Elagolix with add-back therapy (Oriahnn) have further diversified the product’s therapeutic reach. Despite emerging competition from other GnRH modulators, including relugolix-based combinations, AbbVie maintains a leading position through its established brand trust, optimized pricing models, and robust clinical evidence base.

Across Asia Pacific, particularly in Japan, China, and South Korea, market growth is gaining momentum due to expanding healthcare infrastructure, increasing recognition of endometriosis as a chronic condition, and supportive regulatory pathways that accelerate access to women’s health innovations. In Latin America and the Middle East & Africa (MEA), improving diagnostic capabilities, government-led reproductive health programs, and AbbVie’s partnerships with local distributors are facilitating gradual adoption. However, regional disparities in healthcare affordability and reimbursement frameworks continue to influence the pace of penetration in lower-income markets.

Market Dynamics

Growing Demand for Hormonal and Reproductive Health Therapies

The rising global prevalence of endometriosis and uterine fibroids, coupled with increasing awareness of women’s reproductive health, is fueling strong demand for targeted hormonal therapies such as Elagolix (Orilissa). As the first oral gonadotropin-releasing hormone (GnRH) antagonist, Elagolix provides a non-surgical, reversible treatment alternative that allows dose-dependent estrogen suppression with greater safety and tolerability compared to traditional hormonal therapies. Its rapid onset of action, individualized dosing flexibility, and oral formulation have enhanced patient convenience and adherence, driving widespread clinical adoption. Growing advocacy for early diagnosis, government-led women’s health initiatives, and expanding access to specialty care are further reinforcing Elagolix’s position as a cornerstone therapy in the evolving women’s health therapeutics landscape. Supported by sustained physician confidence, robust real-world data, and a favorable benefit-risk profile, the drug is poised for continued global growth through 2033.

Pricing Dynamics and Competitive Landscape

As the GnRH antagonist segment matures, competition from therapies such as relugolix-based combinations (e.g., Myfembree) and next-generation hormonal modulators is expected to shape pricing and market access dynamics. In cost-sensitive regions like Europe, China, and India, payers are emphasizing cost-effectiveness, patient-reported outcomes, and long-term safety evidence, prompting AbbVie to pursue optimized pricing and value-based reimbursement models. Conversely, in premium markets such as the U.S. and Japan, strong clinical differentiation, specialist prescribing patterns, and established reimbursement frameworks support Orilissa’s premium positioning and stable adoption. While competitive intensity is expected to rise post-2030 with the anticipated entry of generic versions, AbbVie’s strong brand equity, broad clinical footprint, and proven efficacy will continue to protect market share and sustain long-term performance within the women’s health therapeutics category.

Opportunities in Lifecycle Management and Regional Expansion

AbbVie is strategically advancing a comprehensive lifecycle management plan to extend Elagolix’s commercial and clinical value. Key initiatives include label extensions, combination formulations (such as Oriahnn for uterine fibroids), long-term safety studies, and targeted physician education programs to reinforce treatment confidence and expand therapeutic reach. The company’s proactive focus on real-world data generation and partnerships with regional healthcare providers will enhance patient access and accelerate market penetration in emerging regions. While mature markets like the U.S. and Western Europe will continue to drive steady adoption through 2033, rapid growth is anticipated across Asia Pacific and Latin America, supported by improving healthcare infrastructure and rising attention to women’s health priorities. Moving forward, innovation-driven differentiation, expanded clinical use, and geographic diversification will be central to sustaining Elagolix’s leadership and ensuring its enduring relevance in the global women’s health therapeutics market.

The Pressure of Pricing and Market Erosion Post-Patent

As Elagolix (Orilissa) continues to strengthen its global footprint in the treatment of endometriosis-associated pain and uterine fibroids, the evolving GnRH antagonist market is beginning to face early pricing pressures and competitive shifts. The introduction of alternative hormonal modulators, including relugolix-based therapies and future generic entrants, is expected to reshape cost dynamics and payer expectations across key markets. In cost-sensitive regions such as China, India, and Latin America, growing emphasis on affordability programs, government-led cost-containment measures, and local manufacturing partnerships will drive demand for lower-cost oral therapies. Conversely, in mature markets like the U.S., Europe, and Japan, strong prescriber familiarity, robust clinical data, and AbbVie’s established brand trust are likely to preserve Orilissa’s premium positioning in the near term. However, as patent exclusivity approaches expiration after 2032, competitive pricing negotiations and reimbursement challenges will intensify, gradually exerting downward pressure on market share. Despite these headwinds, Elagolix’s differentiated clinical profile, patient adherence benefits, and proven efficacy will help AbbVie maintain market stability through strategic pricing agility and proactive payer engagement. Sustained investments in access programs, value-based contracting, and patient education initiatives will be key to mitigating erosion and preserving long-term brand relevance.

Innovating Beyond the Patent - Unlocking Future Growth Paths

Facing the realities of an evolving competitive landscape, AbbVie is advancing innovation-driven lifecycle strategies to extend Elagolix’s market leadership and therapeutic utility well beyond its patent window. The company is focusing on the development of next-generation formulations, combination regimens, and add-back therapies designed to optimize safety, reduce side effects, and improve long-term adherence. Expanding clinical research into new indications within women’s reproductive and endocrine health further underscores Elagolix’s potential to address broader unmet needs in hormone-driven disorders. Regional growth opportunities remain particularly strong across Asia Pacific, Latin America, and the Middle East, where improved healthcare infrastructure, rising awareness of endometriosis, and supportive government initiatives are expanding patient access to innovative treatments.

Shaping the Future - Innovation, Accessibility, and Regional Dynamics

The global women’s health therapeutics landscape is undergoing a pivotal transformation, with Elagolix (Orilissa) at the forefront of redefining treatment paradigms for endometriosis-associated pain and uterine fibroids. As a first-in-class oral GnRH antagonist, Elagolix offers rapid, reversible suppression of estrogen production-delivering effective pain relief with flexible dosing and fewer long-term hormonal side effects compared to traditional therapies. Its differentiated mechanism positions it as a preferred non-surgical, patient-centered option for women seeking to balance efficacy with quality of life, reshaping expectations in the management of chronic gynecologic conditions.

The shift toward personalized and hormone-modulating therapies, coupled with expanding awareness of endometriosis and fibroids, is expected to strengthen adoption across major markets. In North America and Europe, robust diagnostic infrastructure, favorable reimbursement frameworks, and physician familiarity continue to drive clinical uptake. Meanwhile, in emerging regions such as Asia Pacific, Latin America, and the Middle East, rising healthcare expenditure, improved access to gynecologic care, and government initiatives promoting women’s health are fostering stronger market penetration. However, disparities in treatment affordability and diagnostic accessibility may lead to varied adoption trajectories across geographies.

To sustain long-term leadership, AbbVie is focusing on lifecycle innovation through combination regimens, optimized dosing strategies, and real-world data generation to refine patient outcomes. The company’s commitment to expanding access-through affordability programs, physician education, and partnerships with regional healthcare systems-will further enhance its global reach. As the therapeutic landscape continues to evolve toward safer, more effective hormonal solutions, Elagolix (Orilissa) is set to remain a cornerstone in women’s reproductive health-balancing innovation, accessibility, and global well-being through science-driven advancement.

Overview of Alternative Therapeutics

The competitive landscape surrounding Elagolix (Orilissa) is rapidly evolving as newer hormonal and non-hormonal therapies emerge to address the complex and underserved needs in endometriosis and uterine fibroid management. Competing agents such as relugolix (Myfembree) and linzagolix (Yselty) are gaining momentum with innovative dosing regimens and combination formulations that balance efficacy with bone health preservation and tolerability. These next-generation GnRH antagonists, along with novel progestin-based and non-hormonal modulators, are offering patients greater flexibility and personalization in symptom control-shaping a new era of medical therapy for women’s reproductive health.

As these alternatives expand their global footprint, the market is witnessing intensified competition across North America, Europe, and Asia Pacific, where regulatory approvals and favorable reimbursement decisions are broadening access. In value-sensitive regions such as Latin America, India, and Southeast Asia, the growing emphasis on affordability, patient adherence, and long-term safety will influence therapeutic preference and brand penetration. Meanwhile, in developed markets, Elagolix’s established clinical heritage, rapid symptom relief, and strong specialist adoption continue to reinforce its standing as a trusted first-line oral therapy despite the growing number of entrants.

To maintain leadership, AbbVie is focusing on lifecycle management through combination formulations, expanded indications, and real-world data initiatives that highlight Orilissa’s long-term benefits in pain reduction and quality-of-life improvement. Strategic collaborations, patient-support initiatives, and continued innovation in dosing convenience and safety optimization will further strengthen its competitive position. As the global women’s health landscape evolves toward more individualized, patient-driven treatment approaches, Elagolix (Orilissa) is poised to remain a foundational therapy-anchoring AbbVie’s leadership in the dynamic and expanding hormonal therapeutics market.

Competitive Landscape

The competitive landscape for Elagolix (Orilissa) is becoming increasingly dynamic as the GnRH antagonist class continues to redefine treatment standards for endometriosis and uterine fibroids. AbbVie, the developer of Orilissa, has established a strong early-mover advantage with its oral, nonpeptide GnRH antagonist that effectively manages moderate-to-severe endometriosis pain while allowing flexible dosing to balance efficacy and bone health. However, competition is intensifying from newer agents such as relugolix (Myfembree) by Sumitomo Pharma/Pfizer and linzagolix (Yselty) from ObsEva/Theramex, both of which offer combination formulations designed to mitigate hypoestrogenic side effects and improve long-term tolerability-reshaping the therapeutic landscape for women’s hormonal health.

Emerging therapies are broadening their reach across reproductive and gynecologic disorders, with ongoing clinical programs exploring expanded use in adenomyosis, heavy menstrual bleeding, and chronic pelvic pain. Regional adoption trends will differ significantly North America and Europe remain leading markets, supported by robust clinical evidence, established specialist networks, and favorable reimbursement pathways. Meanwhile, Asia Pacific and Latin America are expected to experience accelerated growth driven by improving diagnosis rates, growing awareness of non-surgical treatment options, and evolving healthcare accessibility for women’s health conditions.

To sustain its leadership position, AbbVie is leveraging strategic lifecycle management initiatives, including exploring combination therapies, enhancing real-world data evidence, and pursuing geographic expansion to maintain Orilissa’s relevance in a competitive environment. Competitors are differentiating through dose optimization, safety enhancements, and pricing strategies tailored to regional needs. As the women’s health therapeutics market transitions toward personalized and hormone-sparing approaches, success will hinge on innovation, accessibility, and long-term patient outcomes. Ultimately, Elagolix’s proven clinical value, flexible dosing, and trusted brand profile position it as a cornerstone therapy amid the evolving landscape of global hormonal and gynecologic care.

North America Elagolix (Orilissa) Market

North America holds the dominant position in the Elagolix (Orilissa) market, driven primarily by the U.S., where AbbVie first launched its groundbreaking GnRH antagonist therapy for endometriosis-associated pain and uterine fibroids. The region benefits from strong clinical adoption, extensive gynecological specialist networks, and favorable reimbursement frameworks that promote early access. In the U.S., growing physician confidence in non-surgical, hormone-regulated treatments and rising diagnosis rates for endometriosis continue to propel market growth. Canada reflects similar momentum, though market expansion is moderated by formulary assessments and cost-control initiatives. Overall, North America’s advanced women’s health infrastructure and growing preference for oral hormonal alternatives establish it as the leading revenue hub for Elagolix.

Europe Elagolix (Orilissa) Market

Europe represents a key growth territory for Elagolix, with strong adoption led by Germany, France, and the U.K. The region’s structured focus on reproductive health and minimally invasive treatment approaches supports increasing physician and patient uptake. However, stringent health technology assessments (HTAs) and cost-effectiveness evaluations by national payers can limit premium pricing flexibility. Strategic partnerships with healthcare organizations and early access programs are enhancing awareness and accessibility across major EU markets. As more data supports Elagolix’s role in improving quality of life for women with endometriosis, Europe is expected to emerge as a major contributor to AbbVie’s international women’s health portfolio.

Asia Pacific Elagolix (Orilissa) Market

The Asia Pacific region is experiencing rapid growth in the Elagolix market, driven by rising awareness of endometriosis and uterine fibroids and the growing acceptance of non-surgical therapies. Japan leads regional adoption with advanced gynecologic research networks and strong clinician familiarity with hormone-modulating therapies. In China and India, growing healthcare investments, expanding diagnostic capabilities, and increasing patient education initiatives are unlocking new opportunities, though regulatory timelines and affordability challenges remain. Collaborations with local distributors and advocacy programs are expected to further strengthen AbbVie’s presence, positioning Asia Pacific as a high-growth frontier for Elagolix expansion.

Latin America Elagolix (Orilissa) Market

Latin America is emerging as a promising yet cost-sensitive market for Elagolix, with Brazil, Mexico, and Argentina driving early adoption. Growing awareness of women’s reproductive health disorders and improved access to specialty care are fueling demand for innovative hormonal therapies. However, limited reimbursement frameworks and pricing constraints continue to present challenges. AbbVie’s regional strategy-focused on tiered pricing models, public-private partnerships, and local distribution alliances is expected to enhance treatment accessibility and awareness. As healthcare systems modernize and prioritize women’s health, Latin America is set to witness steady growth in Elagolix adoption over the forecast period.

Middle East and Africa Elagolix (Orilissa) Market

The Middle East and Africa (MEA) region presents an emerging opportunity for Elagolix, supported by improving healthcare infrastructure and growing government initiatives in women’s reproductive health. Saudi Arabia, the UAE, and South Africa are leading early adoption, aided by specialist expansion and increasing diagnosis of endometriosis. While affordability challenges and limited awareness persist across parts of Africa, regional collaborations and patient-access initiatives are improving treatment reach. Accelerated regulatory pathways in GCC markets and the gradual evolution of reimbursement policies are expected to drive uptake. Over time, MEA is anticipated to evolve into a significant emerging market for Elagolix, supported by healthcare modernization and policy-driven investment in women’s wellness.

Analyst Perspective

The Elagolix (Orilissa) market is entering a pivotal phase of transformation as AbbVie continues to strengthen its leadership in women’s health therapeutics, particularly within the domains of endometriosis-associated pain and uterine fibroids. As the first oral, nonpeptide GnRH antagonist approved for these indications, Elagolix has redefined hormonal management by offering dose flexibility, rapid symptom relief, and reversible ovarian suppression, distinguishing it from traditional hormonal therapies. With rising awareness of endometriosis and increasing emphasis on non-surgical treatment options, Elagolix is shaping a modern paradigm in reproductive health management. However, competition from newer entrants such as relugolix (Myfembree) by Sumitomo Pharma/Pfizer and linzagolix (Yselty) by ObsEva/Theramex is expected to intensify pricing and access challenges, particularly in mature markets such as North America and Europe.

Elagolix’s first-mover advantage, strong clinical evidence base, and growing real-world adoption position AbbVie favorably for sustained market leadership through 2033. The therapy’s ability to provide effective symptom control while maintaining bone density through dose optimization has bolstered clinician confidence and patient adherence. Moreover, AbbVie’s ongoing research into new hormonal applications and potential combination regimens reflects a broader commitment to expanding its women’s health portfolio beyond endometriosis.

To maintain long-term momentum, AbbVie is focusing on lifecycle management, geographic expansion, and real-world data generation to reinforce clinical and economic value across global markets. Patient-focused initiatives such as digital awareness campaigns, affordability programs, and partnerships with gynecology specialists are expected to enhance access and engagement. As healthcare systems increasingly prioritize women’s wellness, AbbVie’s strategic focus on innovation, accessibility, and affordability will be instrumental in sustaining Elagolix’s competitive edge-cementing its role as a cornerstone therapy in the next generation of hormone-modulating treatments for women worldwide.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified