- Home

- »

- Market Trend Reports

- »

-

EMEA Dietary Supplements Market - Competitive Landscape Analysis

Report Overview

The EMEA market continues to grow steadily, fueled by aging populations, rising healthcare awareness, and a strong cultural orientation toward preventive and integrative health practices. Consumers across the region are increasingly turning to vitamins, minerals, probiotics, plant-based extracts, and immune and gut health formulas to support long-term well-being.

While regulation under the European Food Safety Authority (EFSA) ensures high safety and transparency standards, consumer demand is evolving toward clean-label, vegan/vegetarian-friendly, non-GMO, and clinically supported formulations. E-commerce, pharmacy chains, and specialty health stores serve as key distribution channels, while localized preference such as demand for herbal supplements in Germany or sports nutrition in the UK, drive regional diversification.

While Europe remains the largest and most mature sub-market, with sophisticated regulation (EFSA), high consumer trust, and an aging health-conscious population, Middle Eastern and African countries are rapidly catching up, spurred by urbanization, healthcare investments, and rising awareness of immunity, sports nutrition, and women’s wellness.

This report offers a comprehensive brand-level analysis, covering the top ten players in Europe, Middle East & African Countries by revenue share, along with strategic commentary, innovation highlights, and price positioning analysis for countries including Germany, U.K., France, Italy, Spain, Poland, South Africa, Saudi Arabia, and UAE.

Germany dietary supplements market: revenue, market share, 2024 (in %)

Rank

Brand Name

Company Revenue, 2024

Market Share, 2024 (in %)

#1

Abbott

-

%

#2

Orthomol

-

%

#3

Doppelherz (Queisser)

-

%

#4

Herbalife Nutrition Ltd.

-

%

#5

Haleon Group of Companies.

-

%

#6

Company 6

-

%

#7

Company 7

-

%

#8

Company 8

-

%

#9

Company 9

-

%

#10

Company 10

-

%

Bayer AG continues to lead the European market through its trusted OTC supplement brands such as One A Day, Supradyn and Berocca. With wide pharmacy and online penetration, Bayer has leveraged its pharmaceutical credibility to win consumer trust in core categories like energy, immunity, and bone health.

Nestlé Health Science, through its premium brands Solgar and Garden of Life, is expanding aggressively in Western and Northern Europe. The company’s focus on organic, non-GMO, vegan and whole-food-based supplements aligns with the rising clean-label movement. Solgar, with its long legacy and herbal ranges, is especially strong in countries like the UK, Germany, and the Netherlands.

Glanbia plc, traditionally dominant in sports and performance nutrition, is gaining ground in general wellness by repositioning Optimum Nutrition and Nutramino as holistic lifestyle brands. Its digital-first engagement strategy is paying dividends, especially among fitness-focused millennials in France, Spain, and Scandinavia.

Sanofi retains a solid share in the digestive and energy support categories, particularly through Magne B6 and Pharmaton, brands that benefit from healthcare practitioner endorsements. Sanofi’s formulations enjoy strong trust among older adults in France, Italy, and Portugal.

Holland & Barrett, Europe’s largest specialty health and supplement retailer, leverages its private label strategy to capture value-conscious consumers. Its clean-ingredient supplements, promotions, and loyalty program are driving repeat purchases in the UK and Ireland.

Strategies and Recent Development

In the U.K., major dietary supplement manufacturers are increasingly focusing on product innovation, lifestyle-driven positioning, and digital expansion to capture diverse consumer segments. Vitabiotics, the market leader, continues to dominate with lifecycle-specific ranges such as Pregnacare, Wellman, and Menopace, while expanding its presence in high-growth areas like beauty-from-within and menopause support. The brand invests heavily in R&D, celebrity endorsements, and pharmacy partnerships to reinforce its trust-based positioning.

Similarly, PharmaCare (Europe) Ltd., known for the Bioglan brand, is driving growth through functional supplements for cognitive performance, energy, immunity, and collagen support. These products align with the rising consumer interest in daily wellness routines and holistic self-care.

Meanwhile, international giants like Nestlé Health Science and Herbalife are leveraging the growing appetite for clean-label, personalized, and plant-based supplements. Nestlé has introduced new vegan collagen and organic probiotic lines under the Solgar and Garden of Life brands, appealing to health-conscious, ethically minded consumers. Several leading companies have also stepped up R&D and product innovation efforts in response to emerging health concerns.

-

In February 2024, Herbalife launched the GLP-1 Nutrition Companion, a range of food and supplement combos designed to support individuals on GLP-1 weight-loss medications. These combos include high-protein products and fiber to address nutritional deficiencies caused by appetite suppression. Available in Classic and Vegan options, they aim to promote muscle health and overall nutrition while encouraging sustainable weight loss through lifestyle changes and support from Herbalife's independent distributors.

-

In September 2024, Bayer launched Age Factor, a healthy-aging ecosystem combining a dietary supplement, wellness app, and saliva-based biological age test. The supplement supports cellular health with antioxidants, while the app offers personalized lifestyle insights. The biological age test provides a more accurate measure of aging than chronological age.

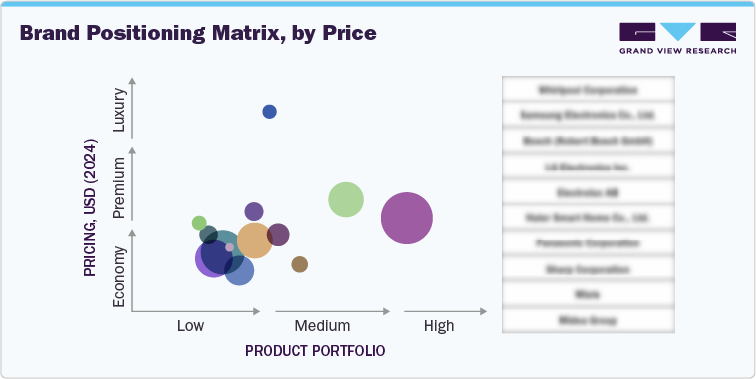

Brand Positioning Analysis: Price vs. Product Portfolio

The EMEA dietary supplements market exhibits distinct brand stratification by price tier, with each major player aligning its positioning strategy to cater to specific consumer expectations related to quality, trust, functionality, and lifestyle alignment.

Pricing is a crucial competitive lever, not only for profitability but also for perceived value and consumer loyalty.

Price Tier

Key Characteristics

Brands

Economy

Basic formulations, high unit volume, and budget-conscious consumers

Doppelherz, Abtei, Seven Seas, Holland & Barrett Private Label

Mid-Range

Quality-focused, broad wellness claims, available across retail chains

Bayer, Sanofi, Haleon (Centrum), Vitabiotics, Nature’s Way, Bioglan

Premium

Clean-label, organic, personalized, or condition-specific SKUs with branded ingredients

Solgar, Orthomol, Garden of Life, Dr. Loges, Garden of Life, Nestlé, Bioglan Advanced

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified