- Home

- »

- Market Trend Reports

- »

-

Europe Hair Loss Supplements Market - Retailer Landscape Analysis

Report Overview

The Europe hair loss supplements market size was estimated at USD 1.25 billion in 2024 and is projected to reach USD 2.05 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. The Europe Hair Loss Supplements market is experiencing dynamic growth, propelled by changing consumer preferences, demographic shifts, and a heightened awareness of health and wellness. With the aging population across the region, along with increasing consumer concerns about appearance and overall well-being, the demand for hair loss supplements has become a key trend in the broader wellness movement. As the market matures, retailers are adapting to meet consumer demand, incorporating new sales channels, and refining their strategies to cater to an evolving landscape.

Pharmacies and drugstores have long been dominant in the distribution of hair loss supplements, primarily due to the trust consumers place in these outlets for professional guidance. In several European market, particularly Germany, the U.K., France, Italy, and Spain, pharmacies maintain a significant share of the market, not just because of their established presence, but also because of the pharmacist-led recommendations which consumers highly value when choosing health-related products.

In the U.K., for instance, chains like Boots and Superdrug provide expert consultation, making them primary go-to outlets for customers looking for advice on hair loss treatments. This is particularly significant for consumers who seek medical validation or reassurance before purchasing supplements. Moreover, the role of private-label products in pharmacies has grown, with many brands capitalizing on the need for affordable yet credible solutions.

In recent years, online retail has experienced the fastest growth in the hair loss supplements market. E-commerce platforms are gaining ground, as consumers increasingly prefer the convenience of online shopping, particularly in the post-pandemic landscape. Online retailers provide a broader variety of brands and product types, often offering competitive pricing, product reviews, and the option for home delivery. Health-focused e-commerce platforms and pharmacies have expanded their online offerings, allowing them to tap into a broader, more digitally-savvy customer base.

The rise of subscription models is a key factor driving e-commerce growth in the sector. Subscription services offer convenience and personalized treatment plans, which appeal to customers looking for consistent, long-term solutions for hair loss. For example, companies like Hims and Keeps in the U.K. have capitalized on subscription-based services, providing customers with monthly deliveries of hair loss treatments tailored to their needs. These services often include consultations with healthcare professionals, adding an element of trust and personalization to the customer experience.

Additionally, influencer marketing on social media platforms like Instagram and YouTube is creating a new wave of consumer demand, with individuals turning to digital influencers for recommendations on the best hair loss supplements. This shift has made e-commerce a central component of the market, with companies utilizing direct-to-consumer (D2C) platforms to build brand loyalty and capture consumer attention.

Europe hair loss supplements market: Retail Sales by Top 5 Brands in Pharmacies & Drug Stores, 2024

Rank

Pharmacy & Drug Store Brand

Hair Loss Supplements Offline Revenue (USD Million)

Hair Loss Supplements Online Revenue (USD Million)

#1

Dr.Max

-

-

#2

dm-Drogerie Markt

-

-

#3

Redcare Pharmacy

-

-

#4

BENU Pharmacy

-

-

#5

Rossmann

-

-

Strategies and Recent Development

As consumers become more wellness-conscious, they are increasingly seeking supplements that are tailored to their specific health needs, particularly those that align with their broader lifestyle choices. Personalized hair loss solutions are in high demand, with products that cater to specific hair types, ages, and underlying health conditions gaining traction. This demand for personalization is being met by both traditional retailers and new-age e-commerce platforms.

At the same time, sustainability has become a central theme in the market. Consumers are more concerned than ever about the environmental impact of their purchases, and retailers are responding by offering products with sustainable ingredients, eco-friendly packaging, and ethical sourcing. For example, L’Oréal Paris and P&G have incorporated sustainability into their product offerings, emphasizing the use of natural ingredients and recyclable packaging. Such offerings are particularly appealing to the growing number of European consumers who are willing to pay a premium for products that align with their values.

While supermarkets and hypermarkets were historically less focused on wellness products, they are adapting to meet the growing demand for health-conscious options. Retail giants such as Tesco in the U.K., Carrefour in France, and Auchan in Spain are now dedicating more shelf space to wellness products, including hair loss supplements. These retailers are increasingly promoting dedicated wellness aisles and health-oriented sections, making it easier for consumers to find relevant products alongside other health and beauty offerings.

Supermarkets are also tapping into the growing trend of bundled promotions, where hair loss supplements are offered alongside other complementary wellness products such as vitamins and dietary supplements. This allows them to position hair loss supplements as part of a holistic health and wellness approach, which is particularly appealing to consumers seeking overall well-being. Seasonal promotions around key retail events such as New Year’s resolutions or the summer period—are also being used to draw attention to hair loss solutions.

Lidl (Schwarz Group), one of Europe's largest supermarket chains, with over 12,000 stores across 31 countries, has become a significant player in the hair loss supplements market. With its expansive reach and commitment to offering a variety of health and wellness products, Lidl has successfully captured a substantial share of the market by making hair loss supplements widely available to consumers across Europe.

Pharmacies play a crucial role in the distribution of hair loss supplements in Europe, with consumers often relying on their trusted expertise when selecting health-related products. In key European markets like the U.K., Germany, France, Italy, and Spain, pharmacies dominate the market share for hair loss supplements, primarily due to the professional guidance provided by pharmacists. Consumers value personalized recommendations, which helps build trust and drive sales for products in this segment. The availability of premium, clinically-backed hair loss treatments in pharmacies also contributes to their strong position, as these outlets offer higher-margin products compared to other retail channels. Furthermore, the growing trend of clean-label, vegan, and eco-friendly options has led pharmacies to adapt their product offerings, catering to the increasing demand for sustainable and transparent health solutions.

Top pharmacy chains such as Boots in the U.K., Kronans Apotek in Sweden, BENU Pharmacy across several European markets, and Shop Apotheke (Redcare Pharmacy) in the Netherlands, are key players in this space. These pharmacies leverage their established presence and the trust consumers place in them to drive sales of hair loss supplements. With the rising popularity of online shopping, chains like Shop Apotheke are expanding their digital presence, offering convenience while maintaining the credibility associated with pharmacy-led recommendations. The combination of in-store expertise and online accessibility ensures that pharmacies continue to play a significant role in shaping the European hair loss supplement market, adapting to the evolving preferences of wellness-conscious consumers.

In the European drug‑store channel for hair‑loss supplements, drugstores are increasingly leveraging two main strategic levers. First, they are expanding their health‑and‑wellness positioning beyond basic beauty retail by partnering with specialist hair‑care and nutraceutical brands, increasing the prominence of clinically‑backed formulas, and featuring pharmacist or staff‑led recommendations in store. This allows them to capture value from the hair‑loss supplement category by emphasising credibility and premiumisation rather than simply discounts. Second, they are transforming the channel experience: from dedicated “hair‑wellness” zones within drug‑stores to online‑click‑&‑collect integration, subscription options for repeat purchase, and leveraging influencer‑led promotions and in‑store sampling. These tactics help drug‑stores maintain relevance despite growing competition from pure e‑commerce players..

Müller, a leading European drugstore chain with over 900 outlets across multiple countries, plays a significant role in the hair loss supplements market. Known for its extensive range of health, beauty, and wellness products, Müller caters to the growing consumer demand for hair loss solutions. The company offers a variety of supplements alongside hair care products, making it a trusted destination for consumers seeking both preventive and treatment options for hair loss. Müller’s broad market presence, both in physical stores and through its online platform, allows it to capture a large share of the market, especially as consumer preferences shift towards convenient and reliable health solutions.

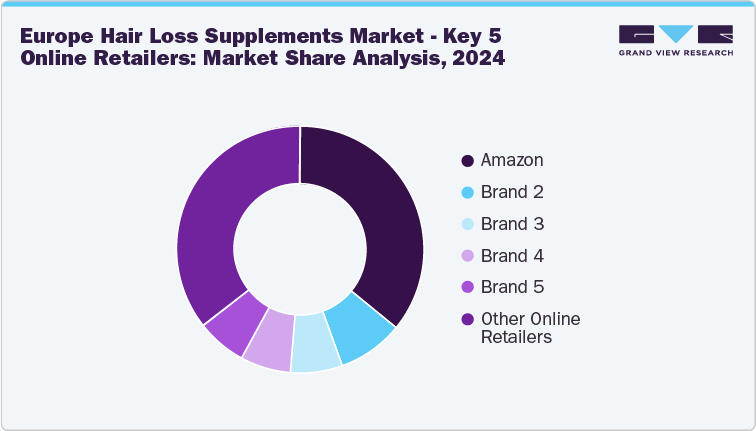

The European hair loss supplements market is increasingly driven by online retail platforms such as Amazon and specialized e-commerce sites. These platforms offer convenience, a wide range of product assortments, and competitive pricing, making them key players in the sector. With fast delivery services, subscription models, and the ability to leverage consumer reviews, online retailers have become a strong alternative to traditional drugstores and pharmacies. As consumer demand for hair loss supplements grows, online platforms enable easy access to both mainstream and niche products, including premium and clean-label formulations. The shift towards online shopping is further fueled by influencer marketing and the increasing reliance on digital content and customer feedback, making e-commerce a critical channel for brands in the hair loss supplement space..

Direct-to-Consumer (D2C) sales have become a significant channel in the European hair loss supplements market, allowing brands to bypass traditional retail intermediaries and connect directly with consumers. This model provides companies with greater control over their branding, customer experience, and pricing. D2C brands can offer personalized solutions, subscription services, and exclusive products that cater to individual customer needs, enhancing customer loyalty. Additionally, the D2C model allows for more efficient marketing, with companies leveraging social media, influencer partnerships, and targeted online advertising to build a direct relationship with their audience. The rise of D2C platforms has also been supported by consumer preferences for convenience, privacy, and the ability to easily compare products and reviews, making it a growing segment in the hair loss supplements market.

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified