- Home

- »

- Market Trend Reports

- »

-

Improving Patient Care With Advanced Sterile Processing In 2025 And Beyond

Executive Summary

As healthcare continues to evolve, companies are developing new methods to ensure the highest level of sterilization for medical instruments. Advancements in technology are expanding what's possible, allowing for more efficient, reliable, and innovative solutions to meet the growing demands of sterile processing departments (SPDs). This report discusses product trends, company strategies, statements from key opinion leaders (KOLs), and insights from analysts.

Introduction

The fundamental principle remains constant: thoroughly cleaned, disinfected, and sterilized medical instruments are paramount to preventing infections and ensuring optimal patient outcomes. However, the complexity of modern healthcare, with its increasingly sophisticated surgical procedures and instruments, escalating surgical volumes, and persistent threats of antimicrobial resistance, has propelled sterile processing into a new era of innovation and strategic importance. This report aims to provide a comprehensive overview of the current and emerging trends that are transforming sterile processing, underscoring its pivotal role in enhancing patient safety and satisfaction.

Below Table Represents National standardized infection ratios (SIRs) and facility-specific summary SIRs using adult surgical site infection (SSI) data1 reported to NHSN from NHSN Acute Care

Surgical Procedure

No. of Acute Care

No. of

No. of Infections

Hospitals Reporting2

Procedures

Observed

Predicted3

U.S., all NHSN procedures

3,270

2,971,381

23,938

24,811.222

U.S., SCIP procedures only5

3,239

1,602,268

15,410

16,605.919

AAA Abdominal aortic aneurysm repair5

152

610

5

4.148

AMP Limb amputation

233

17,858

216

72.628

APPY Appendix surgery

497

42,117

115

169.932

AVSD Shunt for dialysis

124

1,368

3

3.557

BILI Bile duct, liver or pancreatic surgery

370

10,868

371

381.145

BRST Breast surgery

358

24,831

204

296.131

CABG- Coronary artery bypass graft5,6

654

115,621

715

950.846

CARD Cardiac surgery5

405

50,864

174

223.494

CEA Carotid endarterectomy

194

6,021

12

5.055

CHOL Gallbladder surgery

511

78,078

339

322.610

COLO Colon surgery5

3,050

331,774

7,789

8,858.806

CRAN Craniotomy

250

48,012

602

541.454

CSEC Cesarean section

673

355,094

877

741.294

FUSN Spinal fusion

928

248,686

2,362

2,016.520

FX Open reduction of fracture

506

67,980

532

502.806

GAST Gastric surgery

468

39,803

195

292.719

HER Herniorrhaphy

306

22,963

148

181.323

HPRO Hip arthroplasty5

2,165

366,097

2,695

2,608.633

HTP Heart transplant

34

1,201

18

16.695

HYST Abdominal hysterectomy5

2,767

250,781

1,846

1,790.612

KPRO Knee arthroplasty5

2,081

460,370

1,905

1,742.560

KTP Kidney transplant

49

6,950

68

41.325

LAM Laminectomy

676

154,988

459

591.169

LTP Liver transplant

36

2,873

80

143.889

NECK surgery

118

3,928

46

82.345

NEPH Kidney surgery

325

12,604

48

41.593

OVRY Ovarian surgery

438

22,324

21

16.937

PACE Pacemaker surgery

326

23,428

52

40.889

PRST Prostate surgery

140

5,415

52

14.079

PVBY Peripheral vascular bypass surgery5

246

8,867

172

178.149

REC Rectal surgery5

431

11,860

78

215.498

SB Small bowel surgery

493

48,003

903

981.069

SPLE Spleen surgery

281

3,054

18

18.411

THOR Thoracic surgery

407

36,796

160

160.081

THYR Thyroid and/or parathyroid surgery

157

4,996

5

3.997

VHYS Vaginal hysterectomy5

493

5,424

31

33.174

VSHN Ventricular shunt

158

5,489

100

78.046

XLAP Abdominal surgery

496

73,385

522

447.605

Source: CDC

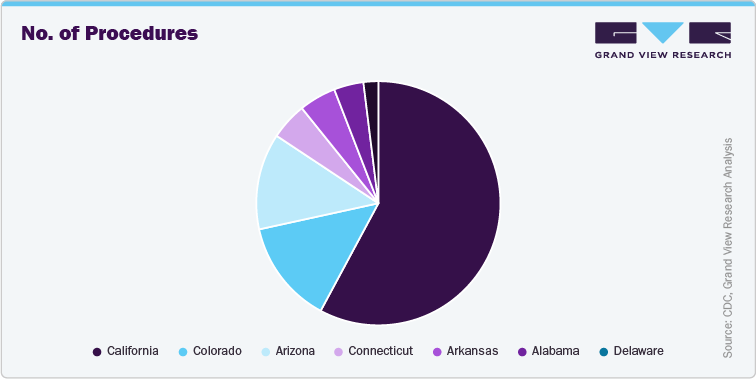

Below Graph represent: State-specific standardized infection ratios (SIRs) and facility-specific SIR summary measures: NHSN Acute Care Hospitals reporting during 2023, Central line-associated bloodstream infections (CLABSI), all locations

Below Graphs represent: State-specific standardized infection ratios (SIRs) and facility-specific SIR summary measures, NHSN Acute Care Hospitals reporting during 2023, Surgical site infections (SSI) following hip arthroplasty1 in adults, ≥ 18years:

Key Trends and Impact

Technological Advancements in Sterilization and Instrument Reprocessing:

The instruments themselves are becoming more complex, demanding sophisticated reprocessing techniques. This has spurred innovation in sterilization technology.

-

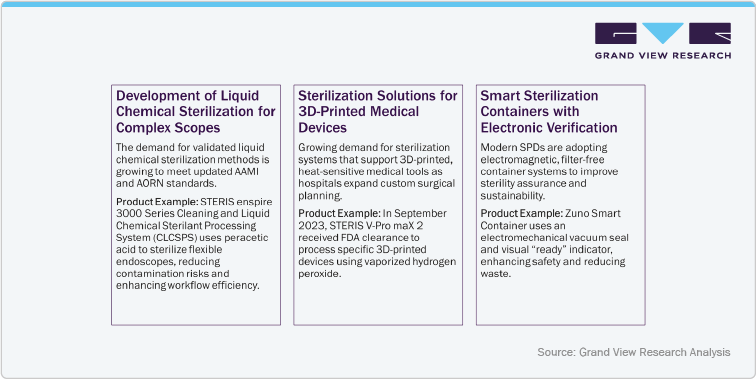

Adoption of HLD: The focus is on high-level disinfection (HLD) and advancements in sterilization technologies for intricate instruments like flexible endoscopes and robotic surgical tools. Innovations include UV-C radiation systems for rapid disinfection without chemicals, and vaporized hydrogen peroxide technology for heat-sensitive and 3D-printed devices. These technologies ensure a higher degree of sterility, reducing the risk of pathogen transmission, especially for devices with complex lumens or materials. Enhanced electronic traceability within these systems provides auditable records, further bolstering safety and compliance.

-

Growing focus on automation of reprocessing: Industry players are launching automated medical device reprocessing solutions to capitalize on the growing demand.. For instance, CS Medical launched its Ethos Automated Ultrasound Probe Cleaner Disinfector, a Class II medical device approved by the U.S. FDA in June 2023. Ethos is the first device in North America to offer both high-level disinfection and cleaning for surface and endocavity ultrasound probes. It reduces the time and labor involved in reprocessing by eliminating manual steps and creating repeatable & validated processes for medical device reprocessing.

Companies are also launching products to protect patients and ensure sterility across modalities. For instance, in October 2023, ASP reported a substantial expansion in its sterilization monitoring portfolio with new steam monitoring products to help SPDs in healthcare facilities ensure greater sterility, efficiency, and effectiveness.

The new solutions support compliance across all major sterilization modalities and include:

-

BIOTRACE Readers - Enable faster result reading and better workflow integration.

-

BIOTRACE Biological Indicators - Offer streamlined, traceable monitoring for steam sterilization.

-

VERISURE Chemical Indicators - Allow quick, easy sterilization process checks.

-

SEALSURE Steam Indicator Tape - Visually distinguishes processed from unprocessed items.

“With a strong history of excellence in Sterile Processing, ASP is extending its expertise into steam sterilization monitoring. This enhanced sterilization monitoring portfolio is aimed at supporting our customers in SPD/CSSD and will allow hospitals to reprocess instruments across all major modalities with greater speed, compliance, and confidence,” said Chad Rohrer, President of ASP. “With this enhanced portfolio, ASP further demonstrates its commitment to advancing sterility assurance and continues its mission to protect patients during their most critical moments.”

Rise of VH₂O₂ Technology in Low-Temperature Sterilization

Healthcare facilities are increasingly adopting Vaporized Hydrogen Peroxide (VH₂O₂) sterilization to process delicate, heat-sensitive instruments safely. This low-temperature, residue-free method ensures effective microbial inactivation while preserving device integrity. The trend reflects growing demand for safer, efficient sterilization and improved infection control in Sterile Processing Departments. Companies are launching VH₂O₂ Technology based products.

For example: in June 2024, Getinge introduced the Poladus 150, an advanced VH₂O₂ low-temperature sterilizer designed for modern surgical needs.

Product & Technology Highlights:

-

VH₂O₂ Sterilization Technology: Delivers efficient, low-residue sterilization suitable for sensitive instruments.

-

Operates at Up to 55°C: Ideal for sterilizing heat- and moisture-sensitive devices.

-

Supports Multiple Instrument Types: Compatible with non-lumen, flexible lumen, and rigid lumen instruments.

-

Cross-Contamination Barrier Technology: Enhances patient safety by minimizing the risk of healthcare-associated infections (HCAIs).

"Today marks a significant milestone for our Infection Control business. The Poladus 150 materializes our ambition to be a leading player in the field of VH2O2 low-temperature sterilization, which is one of the most dynamic segments, with the development of more and more advanced endoscopic and robotic procedures. This product launch is a great addition to our portfolio for central sterile supply departments (CSSDs)," says Stéphane Le Roy, President of Surgical Workflows at Getinge.

“It offers competitive sterilization claims and capacity, ensuring a safe and effective way of reprocessing both flexible and rigid instruments used in endoscopy and surgical operations,” says Sophia Brüggemann, Product Manager at Getinge.

Impact on Patient Safety Due to Technological Advancements

-

Reduces healthcare-associated infections (HCAIs) through effective VH₂O₂ sterilization and HLD.

-

Enables safe sterilization of heat-sensitive and complex surgical instruments.

-

Enhances consistency and reliability in reprocessing with automated systems.

-

Minimizes human error, improving sterility assurance.

-

Supports compliance with infection control standards and protocols.

Workforce Challenges in Sterile Processing Departments

Despite technological advancements, a critical barrier to effective sterile processing remains the shortage of trained personnel and limited awareness around proper reprocessing practices.

-

According to the U.S. Bureau of Labor Statistics, employment for sterile processing technicians is projected to grow by 6% between 2021 and 2031, reflecting increasing demand amid persistent staffing shortages.

These challenges can compromise sterility standards, ultimately affecting patient safety and satisfaction. Addressing this workforce gap is essential to sustain high-quality care and infection prevention in 2025 and beyond.

Some of the key players operating in the sterile processing sector include:

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified