- Home

- »

- Market Trend Reports

- »

-

Luspatercept (Reblozyl) Market And Forecast, 2025 - 2033

Report Overview

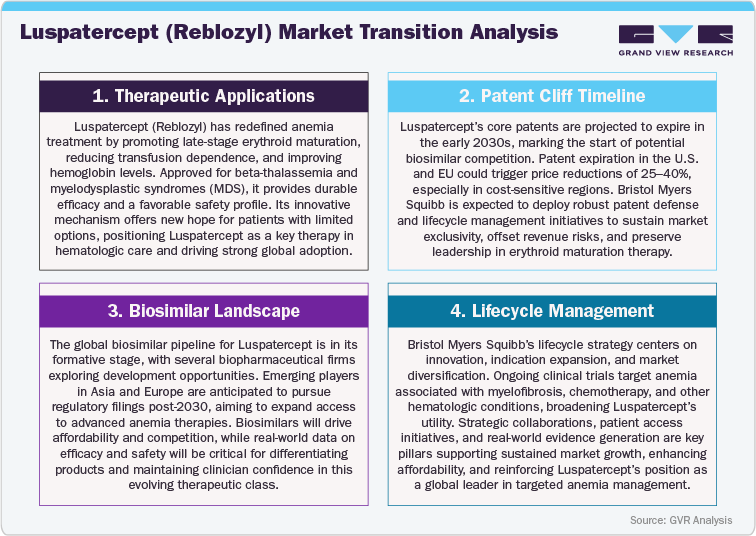

Luspatercept (Reblozyl), co-developed by Acceleron Pharma and Bristol Myers Squibb, represents a transformative innovation in hematology as the first erythroid maturation agent (EMA) designed to address anemia associated with lower-risk myelodysplastic syndromes (MDS) and transfusion-dependent beta-thalassemia. By modulating the TGF-β superfamily signaling pathway, Luspatercept enhances red blood cell maturation, effectively reducing transfusion burden and improving patient quality of life. Its dual regulatory approvals across major markets and expanding clinical pipeline into non-transfusion-dependent thalassemia and chemotherapy-induced anemia highlight its growing therapeutic breadth. As competition intensifies from erythropoiesis-stimulating agents (ESAs), gene therapies, and emerging anemia biologics, Bristol Myers Squibb is capitalizing on Reblozyl’s first-mover advantage, strong real-world data, and payer-aligned value propositions to reinforce market penetration. Strategic lifecycle management continued indication expansion, and accelerated entry into high-prevalence emerging regions are set to drive Reblozyl’s sustained leadership within the global anemia therapeutics landscape.

Key Report Deliverables

-

A comprehensive assessment of the Luspatercept (Reblozyl) market landscape, examining global sales trends, key growth catalysts across myelodysplastic syndromes (MDS) and beta-thalassemia, and the evolving role of erythroid maturation agents (EMAs) in redefining anemia treatment paradigms within the hematology segment.

-

Forecast analyses detailing post-approval market evolution, including anticipated label expansion timelines, regional adoption rates, and the projected impact on market share, revenue trajectory, and competitive differentiation amid rising innovation in anemia biologics and gene therapy solutions.

-

Evaluation of regulatory, pricing, and reimbursement dynamics influencing Reblozyl’s accessibility, highlighting approval pathways, payer evaluations, and health technology assessments across major regions such as the U.S., Europe, Japan, China, and Latin America.

-

An in-depth competitive landscape review profiling leading anemia therapy developer, pipeline entrants advancing erythropoiesis-targeted agents, and emerging combination approaches aimed at improving patient response, safety, and durability of outcomes.

-

Strategic implications for Bristol Myers Squibb, focusing on lifecycle management, indication diversification, global market access optimization, and geographic expansion initiatives designed to strengthen Reblozyl’s leadership and secure long-term growth in the global hematology and anemia therapeutics market.

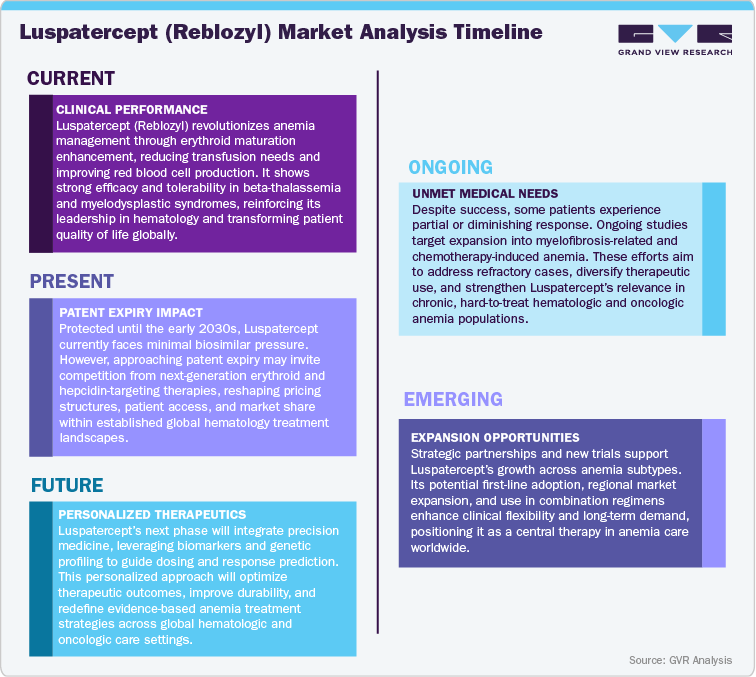

Patent Cliff Analysis

The revenue for Luspatercept (Reblozyl), Bristol Myers Squibb’s pioneering erythroid maturation agent, is anticipated to maintain robust growth over the coming decade, fueled by expanding indications, durable clinical efficacy, and limited biosimilar threats in the near term. With regulatory approvals in lower-risk myelodysplastic syndromes (MDS) and transfusion-dependent beta-thalassemia, and ongoing clinical exploration in non-transfusion-dependent thalassemia and chemotherapy-induced anemia, Reblozyl is set to strengthen its leadership within the global anemia therapeutics market through the late 2020s.

Between 2025 and 2029, continued market expansion, favorable physician adoption, and enhanced reimbursement frameworks will sustain momentum, reinforced by strategic launches in emerging regions and integration into earlier treatment lines.

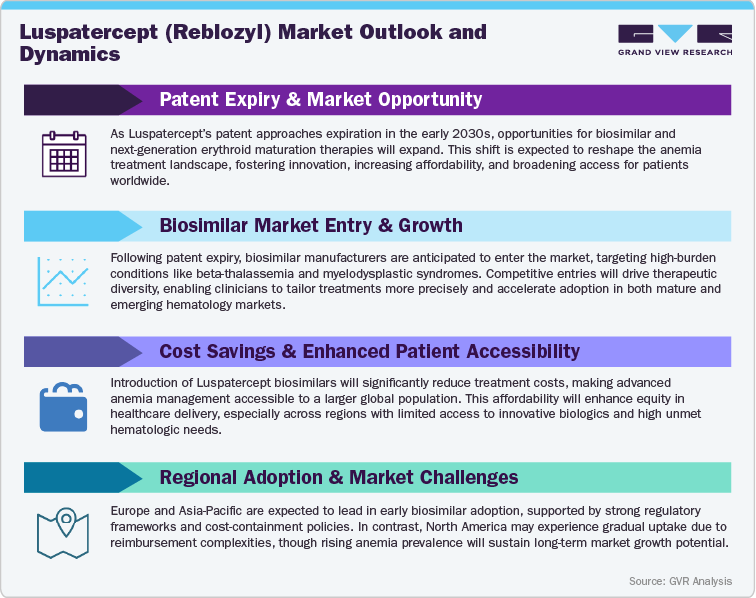

As patent protection begins to approach expiration in the early 2030s, the competitive landscape may evolve with the advent of next-generation erythropoiesis-targeted agents and gene-based therapies aimed at disease modification. During this phase, increasing innovation from rival biopharma players and potential biosimilar interest may gradually heighten pricing competition and market segmentation, though Reblozyl’s strong efficacy profile and broad patient reach are expected to buffer immediate erosion.

Beyond 2035, as biosimilar development accelerates and alternative anemia therapies mature, market share pressures will intensify. Nonetheless, Bristol Myers Squibb’s proactive lifecycle management encompassing label expansions, real-world evidence generation, and strategic collaborations will help sustain Reblozyl’s presence across key hematologic segments.

By the late 2030s, Luspatercept is projected to transition from a breakthrough innovation to an established mainstay in anemia care. While new biologics and gene therapies may redefine treatment frontiers, Reblozyl’s proven clinical durability, broad patient base, and brand equity will ensure its continued role as a trusted and influential therapy in the evolving global hematology landscape.

Current Market Scenarios

Luspatercept (Reblozyl), developed through a collaboration between Acceleron Pharma and Bristol Myers Squibb, has emerged as a transformative therapy in the hematology landscape, pioneering a new class of erythroid maturation agents (EMAs) that redefine anemia management. Following its approvals in lower-risk myelodysplastic syndromes (MDS) and transfusion-dependent beta-thalassemia, and with late-stage investigations in non-transfusion-dependent thalassemia and chemotherapy-induced anemia, Reblozyl continues to strengthen its clinical and commercial presence across major global markets. Its novel mechanism of action, sustained efficacy in reducing transfusion burden, and strong safety record have positioned it as a preferred treatment among hematologists and key opinion leaders worldwide.

In the U.S. and Europe, the market outlook for Reblozyl remains robust, supported by favorable clinical adoption, established reimbursement frameworks, and growing recognition of EMAs as a vital advancement beyond conventional erythropoiesis-stimulating agents (ESAs). Strategic pricing models, successful label expansions, and broad inclusion in treatment guidelines have further enhanced its market footprint, even amid emerging competition from gene therapies and next-generation anemia biologics. Across the Asia Pacific region, particularly in Japan, China, and India, rising prevalence of hematologic disorders, improving diagnostic rates, and accelerating regulatory approvals are fostering strong uptake potential. Regional partnerships and localization strategies are positioning Reblozyl as a first-mover solution in modern anemia management, especially in areas where transfusion dependency remains high.

In Latin America and the Middle East & Africa (MEA), expanding access to innovative hematology treatments and growing government support for rare disease therapies are driving early adoption, though disparities in reimbursement and healthcare infrastructure continue to pose challenges to uniform market penetration. Despite intensifying competition within the anemia therapeutics landscape, Luspatercept’s strong clinical differentiation, expanding indication portfolio, and Bristol Myers Squibb’s continued investments in education, patient access programs, and global commercialization are expected to sustain its growth trajectory. Looking forward, the market will be shaped by pipeline innovation, biosimilar emergence, and strategic lifecycle management, with Reblozyl well positioned to maintain leadership and define the next generation of targeted anemia care.

Market Dynamics

Growing Demand for Anemia and Hematologic Therapies

The rising global burden of anemia and hematologic disorders, particularly myelodysplastic syndromes (MDS) and beta-thalassemia, is fueling strong demand for advanced biologics such as Luspatercept (Reblozyl). As the first-in-class erythroid maturation agent (EMA), Reblozyl offers a targeted approach that enhances late-stage red blood cell production, reducing transfusion dependence and improving patient quality of life. Its broad therapeutic versatility, expanding real-world data, and favorable safety profile have established it as a transformative solution in chronic anemia management. Supported by strong clinical adoption, high unmet medical need, and global launches across major hematology markets, Reblozyl is poised for sustained growth and long-term leadership in the anemia therapeutics segment.

Pricing Dynamics and Competitive Landscape

As the anemia treatment landscape evolves, competition from erythropoiesis-stimulating agents (ESAs), gene therapies, and emerging biologic modulators is expected to shape pricing and access strategies. In cost-conscious regions such as Europe, China, and India, payers are likely to emphasize pharmacoeconomic value and clinical efficiency, prompting adaptive pricing and reimbursement negotiations. Conversely, in premium markets like the U.S. and Japan, Reblozyl’s proven clinical superiority, durable response rates, and expanding approved indications will support premium positioning and early access success. While competitive pricing pressures may increase over time, Reblozyl’s brand recognition, clinical durability, and broad patient applicability will continue to reinforce its dominance in the anemia care continuum.

Opportunities in Lifecycle Management and Regional Expansion

Bristol Myers Squibb is strategically advancing Reblozyl’s lifecycle through expanded indication development, optimized dosing regimens, and combination strategies targeting chemotherapy-induced and non-transfusion-dependent anemia. The company’s emphasis on real-world data generation, physician education, and market access initiatives underscores its commitment to maximizing therapeutic reach and sustainability. While mature markets are expected to sustain steady adoption driven by clinical confidence and reimbursement stability, emerging regions such as Asia Pacific and Latin America present significant growth opportunities due to rising disease awareness, improving healthcare access, and local strategic partnerships. Moving forward, innovation-driven differentiation, global expansion, and strategic commercialization are expected to define Reblozyl’s continued success as a cornerstone therapy in the evolving hematology and anemia therapeutics market.

The Pressure of Pricing and Market Erosion Post-Patent

As Luspatercept (Reblozyl) continues to expand across hematologic and anemia-related indications, the evolving anemia therapeutics landscape is gradually encountering pricing pressures and competitive challenges. With the rise of next-generation erythropoiesis-targeted therapies, gene therapies, and emerging biologic alternatives, market dynamics are shifting toward value-based pricing models and increased payer scrutiny. In cost-sensitive regions such as India, China, and Latin America, expanding government-driven cost-containment policies, local biologics manufacturing, and affordability initiatives are expected to influence adoption patterns, favoring competitively priced agents. Conversely, in mature markets like the U.S., Europe, and Japan, brand loyalty, physician familiarity, and proven efficacy will likely sustain Reblozyl’s premium pricing position in the near term. Over time, as biosimilar pipelines advance and alternative anemia biologics enter the market, the pressure on reimbursement and formulary positioning is expected to intensify. Despite these challenges, Reblozyl’s strong clinical data, broad patient applicability, and established trust among hematologists will help Bristol Myers Squibb preserve resilience. Continued investment in value-based access models, real-world evidence, and patient-centric programs will remain essential to sustaining long-term leadership in a more competitive market.

Innovating Beyond the Patent - Unlocking Future Growth Paths

Facing an increasingly dynamic anemia therapeutics landscape, Bristol Myers Squibb is adopting an innovation-driven strategy to extend Reblozyl’s lifecycle and reinforce its leadership position. Key initiatives include the development of next-generation erythroid maturation formulations, alternative dosing regimens, and combination therapies aimed at optimizing clinical response, patient convenience, and long-term outcomes. Ongoing research into new anemia indications-including chemotherapy-induced anemia, non-transfusion-dependent thalassemia, and other marrow failure syndromes-highlights Reblozyl’s potential to expand into broader patient populations. Regional growth opportunities remain strong in Asia Pacific, Latin America, and the Middle East, where increasing healthcare investment, growing hematology awareness, and expanding access to biologics are driving market acceleration. As the global hematology sector evolves, Bristol Myers Squibb’s strategic focus on clinical innovation, geographic expansion, and sustainable access solutions will be critical to maintaining Reblozyl’s relevance and ensuring it remains a cornerstone therapy in the next era of targeted anemia care.

Shaping the Future - Innovation, Accessibility, and Regional Dynamics

The global anemia therapeutics market is undergoing a transformative shift, with Luspatercept (Reblozyl) at the forefront of redefining patient-centered hematology care. As the first-in-class erythroid maturation agent (EMA), Reblozyl introduces a precision-based approach that enhances red blood cell production, reduces transfusion dependency, and offers durable symptom relief-setting new standards in the management of myelodysplastic syndromes (MDS) and beta-thalassemia. With patients and clinicians increasingly prioritizing therapies that combine efficacy, safety, and convenience, Reblozyl’s differentiated mechanism positions it as a preferred alternative to traditional erythropoiesis-stimulating agents (ESAs) and transfusion-based regimens.

The transition toward value-based healthcare systems and personalized treatment frameworks is expected to accelerate adoption across key regions, especially in North America and Europe, where reimbursement structures, diagnostic infrastructure, and specialist access are well established. In emerging markets across Asia Pacific and Latin America, rising awareness of hematologic diseases, improving healthcare affordability, and collaborations with local providers are expected to drive strong growth momentum. Nonetheless, regional variations in approval timelines, pricing policies, and treatment accessibility may lead to distinct adoption trajectories across global markets.

To reinforce long-term leadership, Bristol Myers Squibb is focusing on lifecycle innovation, including the development of optimized dosing regimens, exploration of new anemia-related indications, and integration of combination therapy strategies to maximize clinical outcomes. Alongside these efforts, patient support initiatives, equitable access programs, and localized market approaches will be central to expanding Reblozyl’s global footprint. As the anemia therapeutics ecosystem continues to evolve, Luspatercept stands poised to shape the next era of innovative, accessible, and patient-driven hematology care, bridging scientific excellence with global health impact.

Overview of Alternative Therapeutics

The competitive environment surrounding Luspatercept (Reblozyl) is intensifying as novel agents targeting erythropoiesis and anemia-related pathways gain clinical traction. Competing therapies, including roxadustat, daprodustat, and vadadustat, are advancing as viable alternatives for anemia management in chronic kidney disease (CKD) and myelodysplastic syndromes (MDS), offering diverse mechanisms that stimulate endogenous erythropoietin production. These entrants are reshaping treatment expectations by providing oral formulations, cost-effective regimens, and broader accessibility in regions where transfusion or ESA therapy remains limited.

As these competitors achieve wider regulatory approvals and commercial expansion, the anemia therapeutics landscape is evolving toward mechanism-driven differentiation and patient-centric convenience. Uptake of these alternatives is expected to be robust in Asia Pacific, Latin America, and Eastern Europe, where affordability, distribution networks, and healthcare modernization strongly influence therapy selection. Conversely, in mature markets such as North America and Western Europe, clinical validation, real-world evidence, and payer-driven value assessments will be pivotal to defining market preference.

To preserve and expand its leadership, Bristol Myers Squibb is expected to leverage Reblozyl’s unique erythroid maturation mechanism, proven transfusion reduction benefits, and broadening indication portfolio. Strategic priorities include advancing lifecycle extensions, pursuing label expansions into non-transfusion-dependent beta-thalassemia and CKD-related anemia, and strengthening global partnerships. As the anemia therapy space shifts toward next-generation and precision-driven solutions, Luspatercept’s clinical differentiation, patient-focused approach, and sustained innovation will be key to maintaining its prominence in this dynamic therapeutic arena.

Competitive Landscape

The competitive landscape for Luspatercept (Reblozyl) is rapidly evolving as the global anemia therapeutics market witnesses a wave of innovation focused on erythropoiesis and red blood cell maturation. Bristol Myers Squibb is positioning Reblozyl as a next-generation treatment for myelodysplastic syndromes (MDS) and beta-thalassemia, leveraging its unique erythroid maturation mechanism to address limitations of conventional erythropoiesis-stimulating agents (ESAs) and reduce transfusion dependence. Competing agents such as roxadustat (FibroGen/AstraZeneca), daprodustat (GSK), and vadadustat (Akebia Therapeutics) are gaining market traction, offering oral hypoxia-inducible factor (HIF) stabilizer mechanisms that provide convenient and cost-effective anemia management alternatives.

Emerging competitors are accelerating development across CKD-related anemia and hematologic malignancies, intensifying therapeutic diversification and regional competition. North America and Europe are projected to remain the dominant markets, supported by advanced diagnostic infrastructure, strong reimbursement frameworks, and high clinical adoption rates. Meanwhile, Asia Pacific and Latin America are expected to experience the fastest growth, driven by increasing disease awareness, improving access to hematology care, and growing investment in local biologic manufacturing.

To maintain its leadership, Bristol Myers Squibb is advancing strategies centered on indication expansion, optimized dosing innovation, and strategic collaborations to strengthen its market footprint. Competitors are responding with differentiated delivery approaches, pricing flexibility, and emerging partnerships aimed at accelerating regional penetration. As the global anemia therapy landscape evolves, success will hinge on combining clinical efficacy with patient-centric value. Ultimately, those companies that deliver sustained innovation, affordability, and accessibility will define the next era of growth in the erythroid maturation and anemia therapeutics market.

North America Luspatercept (Reblozyl) Market

North America leads the Luspatercept (Reblozyl) market, driven by high prevalence of myelodysplastic syndromes (MDS) and beta-thalassemia, robust access to specialty hematology care, and strong reimbursement frameworks. The U.S. remains the core growth hub, supported by rapid physician adoption, early FDA approval, and inclusion in key treatment guidelines. Canada follows similar trends, though provincial formulary reviews can delay access in certain provinces. Continuous clinical education, coupled with growing awareness of erythroid maturation as a novel treatment pathway, reinforces Reblozyl’s strong market presence across North America.

Europe Luspatercept (Reblozyl) Market

Europe represents a key growth region for Reblozyl, particularly in Germany, France, Italy, and the U.K., where established hematology networks and proactive rare disease policies support adoption. The region benefits from strong collaboration between academic institutions and healthcare providers, promoting data-driven uptake in MDS and beta-thalassemia. However, stringent HTA evaluations and national pricing negotiations can pose challenges for premium biologics. As the European Medicines Agency (EMA) continues to expand Luspatercept’s approved indications, access through early treatment pathways and managed-entry agreements will accelerate its presence across major European markets.

Asia Pacific Luspatercept (Reblozyl) Market

The Asia Pacific region is emerging as a major frontier for Reblozyl, with Japan, China, and South Korea driving early adoption. Japan’s advanced hematology research base and rapid integration of novel biologics create strong momentum for growth. In China and India, a rising burden of hematologic disorders, increasing healthcare expenditure, and supportive biologic reimbursement reforms are expanding patient access. However, pricing constraints and regulatory variability may moderate initial uptake. Strategic partnerships, local manufacturing collaborations, and patient access programs will be key to deepening Bristol Myers Squibb’s footprint across the region’s fast-growing hematology markets.

Latin America Luspatercept (Reblozyl) Market

Latin America presents a growing yet cost-sensitive opportunity for Reblozyl, led by Brazil, Mexico, and Argentina. Rising prevalence of inherited and acquired anemias, improving diagnostic infrastructure, and government initiatives supporting rare disease management are fueling demand. However, affordability constraints and fragmented reimbursement systems remain key barriers. Bristol Myers Squibb’s focus on tiered pricing, regional alliances, and compassionate use programs will be vital to expand accessibility. As regional regulatory processes evolve, Reblozyl is positioned to gain steady traction as a breakthrough erythroid maturation therapy across Latin American markets.

Middle East and Africa Luspatercept (Reblozyl) Market

The Middle East and Africa (MEA) market is poised for gradual but promising growth for Reblozyl, supported by expanding rare disease treatment frameworks in Saudi Arabia, UAE, and South Africa. Enhanced diagnostic capabilities, healthcare infrastructure modernization, and increasing hematology specialization are enabling entry for advanced biologics. While affordability and limited healthcare coverage in broader African regions remain challenges, GCC countries’ faster regulatory approvals and inclusion of novel therapies in national formularies are improving access. Over time, continued policy support and public-private collaborations will position MEA as an emerging growth contributor to the global Reblozyl market.

Analyst Perspective

The Luspatercept (Reblozyl) market is entering a robust growth phase as Bristol Myers Squibb (BMS) continues to expand its hematology leadership through innovation in erythroid maturation therapies. Following approvals for beta-thalassemia and myelodysplastic syndromes (MDS)-associated anemia, Reblozyl is rapidly establishing itself as a transformative alternative to chronic transfusions and conventional erythropoiesis-stimulating agents (ESAs). With its unique mechanism targeting late-stage red blood cell maturation, Reblozyl is redefining anemia management by delivering durable hemoglobin improvements, reducing transfusion burden, and enhancing patient quality of life.

Strong physician adoption, expanding clinical data, and favorable inclusion in international treatment guidelines are reinforcing market confidence. However, increasing competition from novel agents targeting anemia pathways-such as roxadustat, vadadustat, and other erythropoietic stimulators-will drive dynamic shifts in pricing and access strategies, especially in cost-conscious regions like Europe and Asia Pacific. Bristol Myers Squibb’s strategic advantage lies in its diversified development pipeline, ongoing studies in non-transfusion-dependent thalassemia (NTDT) and chemotherapy-induced anemia, and sustained investment in global commercialization. Its manufacturing scalability and commitment to equitable access are positioning Reblozyl for continued growth across developed and emerging hematology markets.

To maintain its momentum, BMS is focusing on lifecycle management, real-world evidence generation, and market expansion through collaboration with hematology networks and patient advocacy groups. Efforts to streamline reimbursement pathways, broaden indication coverage, and develop convenient administration formats are expected to further strengthen Reblozyl’s market leadership. As innovation, accessibility, and patient-centered outcomes converge, Luspatercept is set to remain a cornerstone in the next generation of anemia and hematologic disorder therapies.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified