- Home

- »

- Market Trend Reports

- »

-

Market Need And Growth Potential for Marijuana Breathalyzers

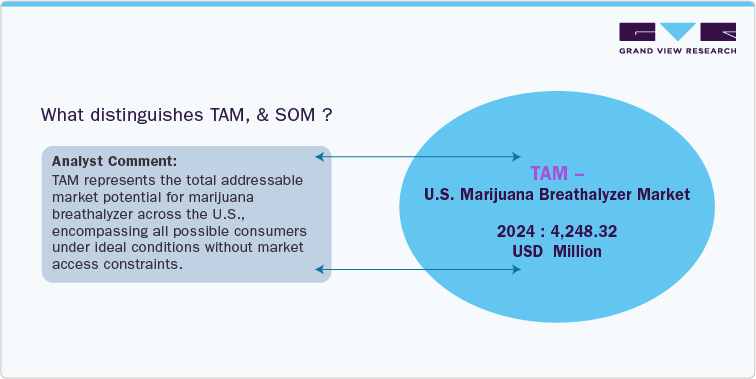

Market Overview: Total Addressable Market (TAM) & Serviceable Obtainable Market (SOM)

1. Total Addressable Market Analysis for the Marijuana Breathalyzer Market (2024 to 2030)

The marijuana Breathalyzer market is set for continued robust growth, driven by technological advancements, regulatory momentum, and increasing societal focus on safety. The next decade will see further innovation in rapid, portable, and highly accurate THC detection devices, with North America remaining the leading region for adoption and development.

Key Factors Driving TAM Growth:

-

According National Conference of State Legislatures (NCSL), as of 2025, 24 states, three territories, and the District of Columbia permit or regulate cannabis for non-medical adult (recreational) use. Increasing legalization of cannabis across various U.S. states is expected to fuel demand for reliable impairment detection solutions.

-

Rising concerns about road safety and workplace drug policies are driving interest in breathalyzer technology as an objective testing tool.

-

Technological advancements in breathalyzer accuracy and portability are enhancing adoption potential.

-

Regulatory developments might influence the market potential by mandating THC impairment detection solutions in various industries.

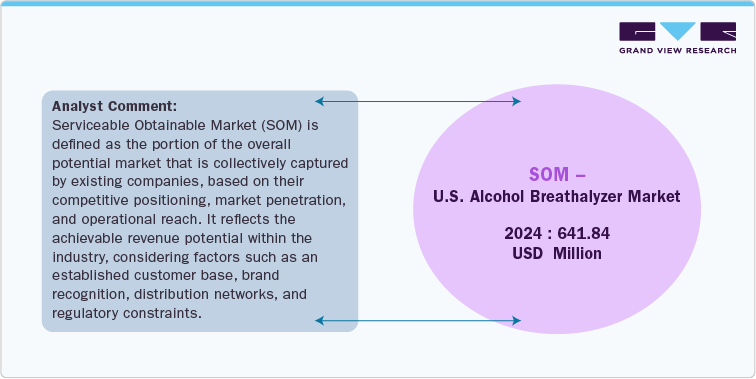

2. Serviceable Obtainable Market (SOM) Analysis for the Alcohol Breathalyzer Market (2024)

3. Comparative Analysis: Alcohol vs. Marijuana Breathalyzers

TABLE 1 Comparative Analysis: Alcohol vs. Marijuana Breathalyzers

Factor

Alcohol Breathalyzers

Marijuana Breathalyzers

Adoption

Widely adopted across law enforcement agencies and workplaces as a standardized tool for alcohol impairment detection.

In the early adoption phase, with increasing regulatory traction across the U.S. for workplace testing.

Market Size

This data will be provided in the final deliverable

Testing Window

Regulatory Support

Technology

Key Users

Source: Grand View Research Analysis

"Assessing the Need and Market Potential for Marijuana Breathalyzers:"

1. Prevalence Data of Marijuana Use:

In the U.S., marijuana is one of the most commonly used federally illegal drugs. As per the data published by the U.S. Centers for Disease Control and Prevention (CDC) in March 2025, around 52.5 million people, which is about 19% of Americans, reported using cannabis at least once in 2021. This statistic highlights the widespread prevalence of marijuana use across different demographics and age groups.

In addition, the data published by the National Institute on Drug Abuse in August 2024 suggested the sustained high prevalence of cannabis use among adults, particularly in the 19–30 and 35–50 age groups in 2023. The long-term increases over five and ten years suggest a shift in societal attitudes, possibly influenced by legalization efforts, increased availability, and changing perceptions of risk.

TABLE 2 U.S. marijuana consumers, by states (2018 - 2024) in thousands

Sr. No.

U.S. States

2018

2019

2020

2021

2022

2023E*

2024E*

1

Alabama

550

551

552

555

556

557

558

2

Alaska

140

146

152

158

164

170

176

3

Arizona

927

1,058

1,188

1,319

1,449

1,580

1,710

4

Arkansas

327

347

369

391

412

433

455

Other 36 states’ data will be provided in the final deliverable

Source: Substance Abuse and Mental Health Service Administration, Grand View Research Analysis

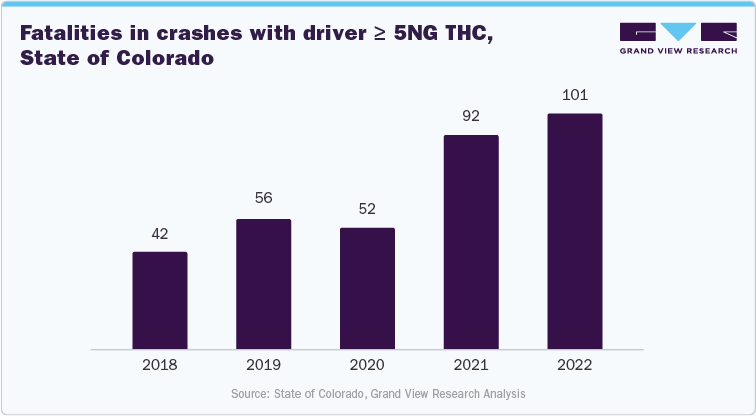

2. Impaired Driving & Road Safety Data:

-

By November 2023, 24 states and D.C. legalized recreational and medical cannabis. A study of 14,079 fatally injured drivers revealed higher cannabis positivity in states with recreational cannabis laws (38.2%).

-

Cannabis positivity rates among fatally injured drivers were 30.7% in non-legal states, 32.8% in medical-only states, and 38.2% in recreational-use states, indicating a direct correlation between legalization and cannabis-related road risks.

Fatalities in Crashes with Driver ≥ 5NG THC

3. Workplace safety & compliance:

TABLE 3 U.S. Pre-Employment THC Drug Testing Laws

Sr. No.

U.S.

States

Medical or Recreational

THC Testing Provisions

Discrimination Laws

1

Arizona

Medical and Recreational

Employers are required to provide applicants with a written drug testing policy before conducting a drug screening.

Employers cannot discriminate against a medical marijuana cardholder solely due to a positive pre-employment drug test, provided the individual is legally registered under state law.

Employers cannot terminate or refuse to hire an applicant based solely on a positive drug test, unless it directly affects job safety, performance, or violates federal regulations.

2

Arkansas

Medical

Employers must provide applicants with a clear drug testing policy and a conditional employment offer before requiring a drug screening.

Employers cannot discriminate against a medical marijuana cardholder based solely on a pre-employment positive drug test.

3

California

Medical and Recreational

THC drug screens must test only for psychoactive cannabis metabolites in applicants.

Employers cannot discriminate against applicants for off-duty cannabis use.

Other 48 states data will be provided in the final deliverable

Source: Verified First, LLC, Secondary Research Analysis

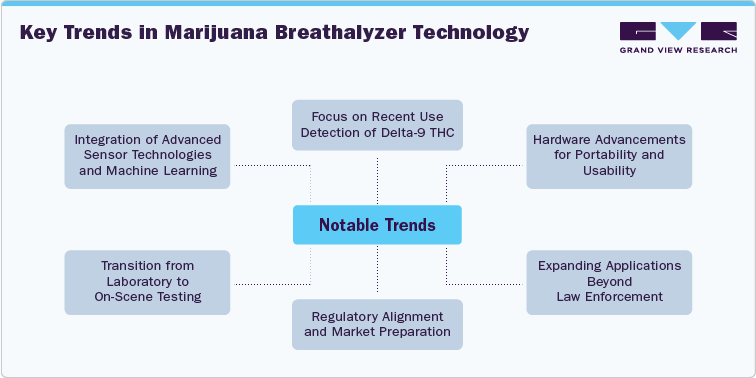

4. Key Trends in Marijuana Breathalyzer Technology

5. Market Potential for Marijuana Breathalyzers

6. Key Recent Collaborations and Partnerships to Deploy Marijuana Breathalyzer:

-

In March 2023, Axiom Medical, a provider of occupational health solutions, partnered with Hound Labs, Inc., the developer of the HOUND CANNABIS BREATHALYZER, to enhance workplace safety through innovative drug testing.

“With the ever-evolving nature of the modern workplace, health and safety needs are constantly evolving as well. We recognize the need for employers to take a proactive approach to total health and wellness and are excited to partner with Hound Labs with their innovative health technology tools to keep our clients safely ahead of the curve.”

- Dara Wheeler, Chief Marketing Officer of Axiom Medical.

“Safety, equity, and objectivity are the cornerstones for the new modern work environment. The time for change is now and we look forward to working closely with Axiom Medical and their clients”

- Jaime Feinberg, VP of Partnerships for Insurance, Risk, and Safety of Hound Labs.

-

In March 2022, Applicant Insight partnered with Hound Labs, Inc. to access the cannabis drug testing solution.

“Our partnership with Hound Labs only makes sense. Our goal has always been to invest in products that are optimized for our safety-minded clients. From this perspective, adding the HOUND BREATHALYZER to our suite of services ensures we continue to offer the most well-rounded product offering available in the market today.”

-Johnny Bitar, President & CEO of aINSIGHT

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified