- Home

- »

- Market Trend Reports

- »

-

Olaparib (Lynparza): Navigating The Patent Cliff And Strategic Implications

Report Overview

Olaparib (Lynparza), developed by AstraZeneca and Merck, is a leading PARP inhibitor approved for the treatment of ovarian, breast, prostate, and pancreatic cancers. With global revenues reaching approximately USD 3.67 billion in 2024, Lynparza has established itself as a top-performing oncology therapy. However, the approaching patent cliff, with major U.S. patents expiring in 2027 and 2031, EU protection via Supplementary Protection Certificate (SPC) lasting until 2029, and Japanese patents expiring in 2024, signals significant market shifts ahead. This transition opens the door for generic competition from companies like Natco Pharma and Sandoz, prompting ongoing legal challenges. Strategically, AstraZeneca and Merck are focusing on oncology pipeline expansion, pursuing partnerships, and exploring emerging markets to mitigate potential revenue erosion and sustain Lynparza’s market leadership.

Key Report Deliverables

-

Detailed analysis of the Lynparza market landscape, covering global revenue size, oncology growth drivers, adoption trends across ovarian, breast, prostate, and pancreatic cancers, and the evolving competitive context shaping the PARP inhibitor segment.

-

Forecasts evaluating post-patent market growth trajectories, expected generic entry timelines across regions (U.S., EU, Japan), and the projected impact on revenue streams, pricing dynamics, and market access in oncology treatments.

-

Identification of regulatory and market barriers affecting generic penetration, including patent litigation, approval complexities, interchangeability requirements, pricing policies, and payer-driven access restrictions in different geographies worldwide.

-

Comprehensive competitive landscape overview, highlighting direct PARP inhibitor rivals (e.g., rucaparib, niraparib), emerging pipeline candidates, next-generation oncology therapies, and innovation strategies shaping the cancer treatment ecosystem.

-

Strategic implications for AstraZeneca and Merck, focusing on pipeline expansion, lifecycle management, combination therapies, strategic partnerships, and regional positioning to sustain leadership post-patent cliff.

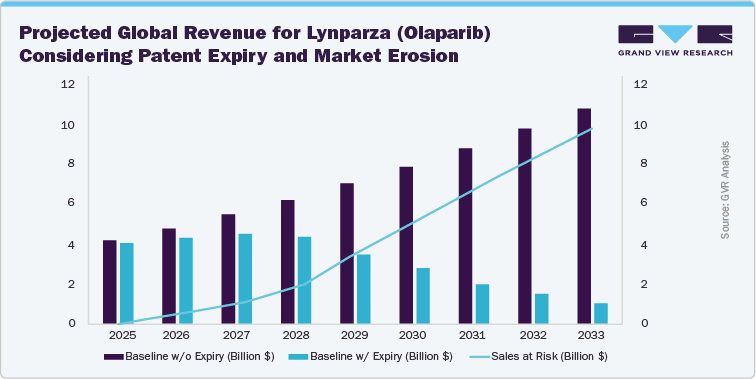

Near-Term Stability and Initial Impact of Patent Expiry

Lynparza’s revenue is expected to remain stable between 2025 and 2027, with minimal erosion at or below 5%. This stability is supported by AstraZeneca and Merck’s strong patents, continued adoption across ovarian, breast, prostate, and pancreatic cancer indications, and the expansion of combination regimens. Competitive pressures are moderate during this period, allowing Lynparza to sustain robust sales. Following U.S. and European patent expiries in 2028-2029, revenue decline is projected to become more noticeable, with reductions of 8%-15% driven by early generic entry, payer negotiations, formulary adjustments, and competition from PARP inhibitor rivals such as Rucaparib, Niraparib, and Talazoparib.

Long-Term Revenue Erosion and Market Dynamics

Between 2030 and 2033, Lynparza is expected to face significant revenue erosion, ranging from 15% to 55%, as generic competition intensifies globally and pricing pressures increase, especially in cost-sensitive regions like Europe. Patient switching to lower-cost alternatives, contracting payer strategies, and the maturation of the generic PARP inhibitor market will accelerate market share losses. AstraZeneca and Merck can maintain a competitive position through brand recognition, patient support programs, lifecycle management strategies including combination therapies and new formulations, and ongoing expansion into emerging oncology indications. Post-patent, the market will be shaped by generics, evolving treatment patterns, and regional adoption trends, creating a highly competitive environment for Lynparza.

Current Market Scenarios

Lynparza continues to benefit from patent protection and regulatory exclusivities across major global markets, though expiry timelines vary by region. In the U.S., primary patents are set to expire in 2027 and 2031, opening the door for generic competition. In the European Union, patents and Supplementary Protection Certificates (SPC) could extend coverage until 2029, granting AstraZeneca and Merck a longer period of market defense. Japan is expected to face patent expiry in 2024, while emerging markets such as China and India may see earlier exposure to generics due to local legal frameworks and comparatively weaker patent enforcement. This uneven schedule sets the stage for region-specific competitive and pricing dynamics.

The U.S. market, representing Lynparza’s single largest revenue contributor, may experience potential disruption once generics enter, with expectations of price erosion and shifts in market positioning. Europe, with its cost-sensitive national health systems, is expected to adopt generics relatively quickly once protections expire, intensifying downward pricing pressure. In China and India, domestic generic manufacturers are advancing toward launch, supported by government initiatives to improve treatment accessibility. Conversely, Japan, despite its high market value, is likely to experience delayed generic uptake due to stringent regulatory scrutiny and slower clinical adoption, creating uneven adoption patterns across the Asia-Pacific region.

Despite the impending patent cliff, Lynparza demand remains strong as PARP inhibitors expand into broader cancer indications, including earlier-line treatments and combination therapies. Backed by clinical evidence, ongoing innovation, and new formulation strategies, the global oncology therapy market is projected to grow, with Lynparza sustaining a central role amid generic competition and pricing pressures.

Market Dynamics

Growing Demand for PARP Inhibitors

The global rise in cancer prevalence, particularly ovarian, breast, prostate, and pancreatic cancers, coupled with expanded approvals for PARP inhibitors, fuels demand for Lynparza. It has become a standard of care in BRCA-mutated and homologous recombination-deficient cancers, highlighting its clinical value. Broad adoption and expansion into earlier-line treatments and combination therapies reinforce its central role, sustaining strong demand worldwide.

Pricing and Market Erosion Post-Patent

The expiration of Lynparza patents will open the market to generic competitors, introducing significant downward pricing pressure. While oncology generics may initially face adoption barriers due to clinical caution and regulatory requirements, payers and governments will increasingly promote cost-effective alternatives. This will accelerate generic uptake, particularly in Europe, India, and China, reshaping market dynamics and reducing AstraZeneca and Merck’s market exclusivity advantage.

Opportunities in Lifecycle Management

AstraZeneca and Merck are actively defending Lynparza’s market position through combination therapies, expanded cancer indications, and innovative treatment regimens. Beyond lifecycle extensions, the companies are investing in next-generation PARP inhibitors, novel formulations, and pipeline oncology assets, providing promising growth avenues. These strategies aim to sustain revenue streams and strengthen long-term leadership despite intensifying generic competition.

Regional Divergence

Post-patent impacts will differ regionally: mature markets (U.S., EU, Japan) will see slower generic adoption due to stringent regulations and cautious uptake, while emerging markets (China, India, Latin America) will transition faster, driven by affordability initiatives, government incentives, and cost-focused healthcare priorities.

The Pressure of Pricing and Market Erosion Post-Patent

The expiration of Lynparza patents will trigger heightened competition from generic PARP inhibitors, profoundly influencing pricing dynamics and market share in oncology. In the post-patent environment, downward pricing pressure is inevitable, particularly in price-sensitive markets where payers emphasize cost-effective cancer care. As lower-cost alternatives emerge, AstraZeneca and Merck’s market share may erode, with patients and providers increasingly considering affordable substitutes. However, oncology generics typically face initial adoption barriers due to clinical comparability concerns and therapeutic outcome considerations.

The regulatory approval process will shape the pace of generic entry. In mature markets such as the U.S. and EU, stringent clinical and regulatory requirements may delay penetration, though competition will intensify once approvals are secured. In contrast, Canada, India, and China are positioned for earlier generic launches, driven by favorable regulatory pathways and active domestic manufacturers. These regions are likely to experience faster pricing erosion and market share shifts.

The entry of generics will also raise clinical confidence concerns, as oncologists may be cautious about switching patients solely on price considerations, especially for life-critical cancer therapies. Nevertheless, payer policies, tender systems, and cost-containment measures will ultimately accelerate adoption, reshaping the competitive landscape. Over time, generics will normalize oncology therapy pricing, forcing AstraZeneca, Merck, and competitors to differentiate through innovation, lifecycle strategies, and patient-centric value propositions.

“Innovating Beyond the Patent - Unlocking Future Growth Paths”

Despite the unavoidable generic competition following Lynparza’s loss of exclusivity, the oncology market will continue to present meaningful growth opportunities. One of the most significant lies in the development of next-generation formulations and novel delivery mechanisms, which could improve treatment convenience, enhance patient adherence, and expand adoption in broader cancer populations. Additionally, ongoing research into combination regimens-pairing PARP inhibitors with immune checkpoint inhibitors, targeted therapies, or chemotherapy backbones offers differentiated market positioning and reinforces Lynparza’s role in multi-modal cancer care.

Innovation will also be critical in maintaining clinical relevance despite pricing pressures. AstraZeneca and Merck are advancing new oncology pipeline assets and exploring next-generation PARP inhibitors and formulation strategies, which can extend leadership beyond the current Lynparza portfolio. Meanwhile, the rise of generics may also create market access opportunities in emerging economies, where affordability has historically been a barrier. By leveraging authorized generics or strategic partnerships, AstraZeneca and Merck could expand treatment access while preserving brand presence.

Another important growth driver lies in the expansion into emerging markets where the burden of ovarian, breast, and prostate cancers is increasing and healthcare infrastructure is improving. Countries across Asia, Latin America, and Africa are witnessing growing demand for effective and affordable oncology therapies. As healthcare systems strengthen, there will be greater emphasis on cost-effective cancer treatments. Ensuring availability of both branded and generic alternatives will allow broader patient access and sustain Lynparza’s strategic relevance in the global oncology market.

“Shaping the Future - Generics, Patient-Centric Models, and Regional Shifts”

-

Shift Towards Patient-Centric Oncology Treatments

There is a growing emphasis on patient-centric cancer therapies, focusing on treatment convenience, adherence, and long-term outcomes. Innovations such as next-generation PARP inhibitor formulations, combination regimens, and optimized dosing schedules enhance therapy personalization. These approaches address multiple patient needs simultaneously, reinforcing the relevance of Lynparza in delivering comprehensive cancer care, even amid generic competition.

-

Adoption of Value-Based Healthcare Models

The global transition toward value-based oncology care is accelerating, with cost-effectiveness and measurable clinical outcomes guiding treatment decisions. This model will encourage the uptake of generic PARP inhibitors, particularly in price-sensitive markets where healthcare budgets are constrained. Payers and providers will increasingly prioritize therapies that maintain clinical efficacy while delivering cost savings, reshaping competitive dynamics for Lynparza and its generic challengers.

-

Regional Divergence in Competitive Dynamics

Following Lynparza’s patent expiry, regional variations will strongly shape adoption trends. In mature markets such as the U.S. and EU, generic uptake may progress slowly due to regulatory caution and oncologist hesitancy. In contrast, emerging markets like China, India, and Brazil are expected to transition faster, driven by affordability pressures, supportive government policies, and streamlined generic approval processes.

Overview of Alternative Therapeutics

Lynparza faces direct competition from other PARP inhibitors such as rucaparib (Clovis Oncology), niraparib (GlaxoSmithKline), and talazoparib (Pfizer). These agents are expanding their indications, treatment regimens, and geographic reach to capture larger shares of the oncology market. Beyond PARP inhibitors, emerging innovations including ATR inhibitors, combination immunotherapies, and next-generation targeted therapies are shaping future treatment landscapes and increasing competitive pressures.

A wave of Lynparza generics is advancing through global development and regulatory programs, led by manufacturers including Natco Pharma, Sandoz, and other regional developers. Their ability to gain traction will hinge on demonstrating clinical comparability, securing regulatory approvals, achieving cost advantages, and leveraging pricing strategies to penetrate oncology markets where affordability and payer acceptance strongly influence adoption.

Competitive Landscape

The competitive landscape for Lynparza is evolving rapidly, with major players pursuing diverse strategies to sustain leadership as the patent cliff approaches. AstraZeneca and Merck, the dominant players, continue to leverage Lynparza’s broad label portfolio and lifecycle management initiatives, including the development of next-generation formulations and combination regimens. However, rivals such as rucaparib (Clovis Oncology), niraparib (GSK), and talazoparib (Pfizer) are aggressively broadening indications and geographic reach, intensifying competition in the PARP inhibitor market.

On the indirect competition front, generic PARP inhibitors are advancing quickly. Companies including Natco Pharma, Sandoz, and other regional developers are conducting regulatory and development programs to prepare for launches post-patent expiry. China-based innovators are strengthening local competition, with government support accelerating adoption in Asian markets. Additionally, next-generation oncology therapies such as ATR inhibitors, combination immunotherapies, and novel targeted therapies remain in development and represent significant longer-term competitive pressures due to promising efficacy and novel mechanisms of action.

As the market shifts, key players are employing proactive strategies to safeguard their positions. AstraZeneca and Merck are prioritizing pipeline expansion, global collaborations, and patient-support initiatives, while competitors emphasize portfolio diversification and digital health platforms to reinforce engagement. The introduction of generics and next-generation therapies, especially in emerging regions, is expected to drive pricing pressure, expand treatment accessibility, and reshape oncology care paradigms. Ultimately, companies’ ability to innovate, differentiate, and deliver patient-centric solutions will determine their resilience in navigating the post-patent oncology landscape.

North America Olaparib (Lynparza) Market

North America remains the largest market for Lynparza, driven primarily by the U.S., where the therapy accounts for the majority of AstraZeneca and Merck’s oncology revenues. Patent expirations in 2027 and 2031 create opportunities for generic PARP inhibitors to enter and disrupt pricing. The U.S. market will likely undergo significant shifts post-expiry, with payers favoring cost-effective cancer therapies. In Canada, where exclusivity also ends in the late 2020s, generics may arrive sooner, intensifying competition. While regulatory hurdles could delay immediate penetration, the region is expected to see substantial price erosion once generics establish clinical and payer confidence.

Europe Olaparib (Lynparza) Market

The European Lynparza market is strong, with Germany, France, and the U.K. being the largest contributors. Patent protections, supported by Supplementary Protection Certificates (SPCs), extend exclusivity until 2029, giving AstraZeneca and Merck a slightly longer runway compared to North America. However, once generics gain approval, Europe’s cost-conscious healthcare systems are expected to prioritize switching to lower-cost alternatives. The region’s regulatory approval process for generics is stringent, which may delay immediate adoption, but once approved, competitive pricing pressures and tender-based procurement systems will rapidly reshape market share dynamics in favor of generics.

Asia Pacific Olaparib (Lynparza) Market

The Asia Pacific region offers significant growth opportunities, especially in China, India, and Japan, where cancer awareness and treatment uptake are rising. China is likely to see earlier generic entry due to local patent challenges and strong support for domestic oncology therapies, creating heightened competition. In India, where affordability is crucial, generics are expected to gain rapid traction once exclusivity lapses. Japan, however, with its stringent regulatory requirements, may see slower generic adoption despite high demand for advanced cancer treatments. Overall, the region presents substantial growth opportunities but also notable challenges, as regulatory timelines and local competition will strongly influence Lynparza’s market trajectory.

Latin America Olaparib (Lynparza) Market

In Latin America, the prevalence of target cancers is rising, driving demand for therapies such as Lynparza. Countries including Brazil, Mexico, and Argentina are the key markets, but affordability challenges remain central to adoption. With patent expirations approaching, the region is likely to see wider generic availability, which will reduce prices and improve access. Regulatory agencies in Brazil and Mexico may facilitate faster generic approvals, accelerating competitive dynamics. However, logistical barriers and healthcare infrastructure limitations could restrict penetration in certain areas, making pricing and distribution strategies critical for both AstraZeneca, Merck, and generic developers.

Middle East and Africa Olaparib (Lynparza) Market

The Middle East and Africa (MEA) market for Lynparza is emerging, with relatively lower penetration compared to developed regions. Key markets include Saudi Arabia, UAE, and South Africa, where demand for oncology therapies is rising due to increasing disease awareness. However, the region remains highly cost-sensitive, and the high price of branded Lynparza limits widespread access. The introduction of generics post-patent expiry will be essential for expanding availability. Regulatory pathways differ across countries; while the UAE and Saudi Arabia offer more efficient approval processes, other nations may experience delays. Nevertheless, improving healthcare infrastructure and patient access will drive long-term expansion.

Analyst Perspective

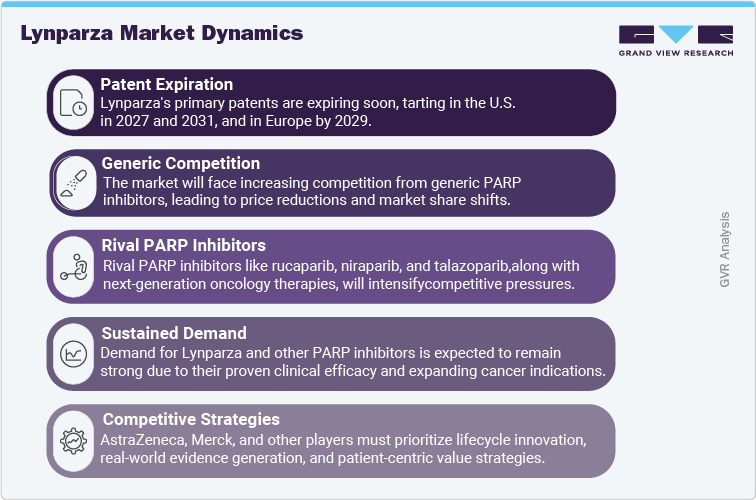

The Lynparza market is approaching a pivotal transition as its primary patents near expiration, beginning in the U.S. in 2027 and 2031 and in Europe by 2029. Currently dominated by AstraZeneca and Merck, the market will face increasing competition from generic PARP inhibitors, which are expected to drive substantial price reductions and market share shifts. At the same time, rival PARP inhibitors such as rucaparib, niraparib, and talazoparib along with next-generation oncology therapies like ATR inhibitors and combination immunotherapies are set to intensify competitive pressures, particularly in price-sensitive regions.

Despite these challenges, demand for Lynparza and other PARP inhibitors is expected to remain strong, supported by their proven clinical efficacy, expanding cancer indications, and continued integration into treatment guidelines. To sustain competitiveness, AstraZeneca, Merck, and other players must prioritize lifecycle innovation, real-world evidence generation, and patient-centric value strategies in navigating this evolving oncology therapy landscape.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified