- Home

- »

- Market Trend Reports

- »

-

Personalized Nutritional Supplements Market: Emerging Business Models & Growth Strategies Analysis

Report Overview

The nutritional supplements industry is experiencing a major evolution as consumers shift from standardized health solutions toward highly personalized regimens. Fueled by advances in health diagnostics, wearable tech, and AI, a growing number of consumers now seek supplements tailored to their unique biology, lifestyle, and health goals. This shift reflects a deeper cultural movement toward precision wellness where relevance, efficacy, and long-term value matter more than generic formulations.

New technologies such as at-home blood testing, DNA analysis, and microbiome sequencing are making it possible to develop ultra-targeted supplements based on individual biomarker profiles. Companies are building entire ecosystems that integrate diagnostics, algorithmic product recommendations, and subscription-based delivery models to offer ongoing personalization. These full-stack models, while complex and premium-priced, appeal to health-conscious consumers looking for more measurable and adaptive outcomes.

At the same time, more accessible models are gaining ground by using lifestyle quizzes or wearable data to recommend curated nutrient stacks-often without the need for lab testing. These lower-friction approaches offer a balance between customization and scalability, making personalized nutrition available to a wider audience. Convenience, digital engagement, and habit-forming formats such as daily packs or dynamic refills are key to their success.

As interest in preventive health, longevity, and self-optimization grows, personalized supplementation is poised to become a central pillar of consumer wellness. However, the space also faces challenges-from regulatory scrutiny and data privacy concerns to questions around scientific validation and product efficacy.

Key Business Models Analysis

Full-Stack Personalization (Test, Recommend, Deliver)

The full-stack personalization model represents the most comprehensive and vertically integrated approach within the personalized nutritional supplements space. This model typically begins with the collection of individual health data-ranging from DNA and blood biomarkers to microbiome samples and wearable device inputs. Advanced algorithms or clinician-led assessments are then used to generate tailored supplement recommendations, which are formulated and delivered directly to the consumer.

The value proposition lies in its high degree of personalization, scientific credibility, and the ability to offer measurable outcomes. It appeals primarily to health-committed consumers who prioritize precision and are willing to invest in preventative or performance-oriented wellness strategies. These users are often more engaged and demonstrate higher lifetime value (LTV), particularly when supported by app-based tracking and re-assessment cycles.

However, this model is capital-intensive and operationally complex. Challenges include the need for secure diagnostic logistics, regulatory compliance, personalized formulation capabilities, and customer support infrastructure. As a result, scalability is more constrained compared to lighter-touch models. Nevertheless, companies operating in this segment often benefit from stronger customer retention, premium pricing power, and differentiated brand positioning.

Assessment-Based Personalization (Quiz-Led Models)

Assessment-based personalization models offer a lower-barrier, more scalable alternative by relying on structured digital questionnaires rather than biological diagnostics. Consumers are prompted to input lifestyle data, including diet, stress levels, sleep patterns, and wellness goals. Responses are then analyzed via rules-based engines or machine learning algorithms to recommend tailored supplement bundles from a predefined product catalog.

This approach enables fast onboarding, low customer acquisition cost (CAC), and broad market reach, particularly through direct-to-consumer (DTC) channels. Subscription-based fulfillment models are common, with brands offering daily sachets, personalized packs, or monthly boxes that aim to integrate easily into consumers’ routines.

While the depth of personalization is inherently more superficial compared to test-based models, the perceived customization remains high due to strong UX design, accessible language, and targeted marketing. This has proven especially effective among younger demographics and wellness lifestyle consumers seeking convenience and simplicity over clinical precision.

The key challenge for quiz-based models lies in user retention. Without diagnostic validation or outcome tracking, some consumers may disengage after the novelty fades. As a result, leading brands in this space are increasingly integrating wellness coaching, habit tracking, and lifestyle content to increase engagement and long-term customer value.

Comparative Matrix of Key Models

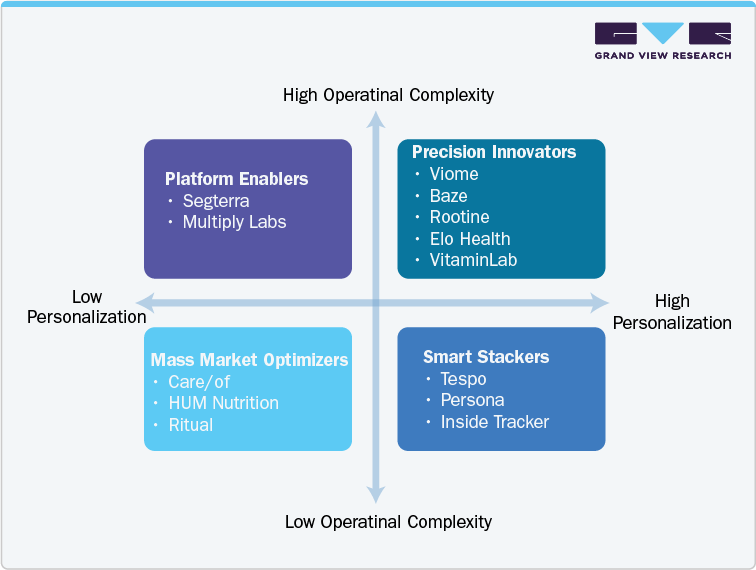

Personalization Depth vs. Operational Complexity

The competitive landscape of personalized nutritional supplements can be effectively analyzed through a matrix comparing personalization depth and operational complexity-two critical dimensions that define scalability, differentiation, and resource intensity.

Personalization depth refers to the extent to which supplement recommendations are tailored to individual users based on unique data inputs. This can range from basic demographic and lifestyle information to more advanced physiological and molecular markers such as blood biomarkers, DNA, or gut microbiome profiles. Models that incorporate clinically validated inputs generally provide higher perceived and actual personalization, often commanding premium pricing and deeper consumer engagement.

Operational complexity, on the other hand, captures the infrastructure, logistics, and technological sophistication required to deliver the personalized product or service. This includes elements such as diagnostic kit distribution, lab processing, data handling, regulatory compliance, custom formulation, and fulfillment operations. As personalization depth increases, operational demands typically grow in parallel, although some models attempt to decouple the two using modular or semi-automated systems.

The two-dimensional matrix can be represented as shown below:

Consumer Behavior and Demand Trends

Preferences by Age Group and Lifestyle

Consumer demand for personalized nutritional supplements varies significantly by age cohort and lifestyle profile, reflecting broader shifts in health consciousness, digital savviness, and preventative care priorities. While personalization is gaining traction across the wellness spectrum, the motivations and product expectations differ by demographic.

Millennials and Gen Z are the most active adopters of personalized supplementation. These cohorts view health and wellness as integral to identity and lifestyle, rather than reactive medical care. Their preferences emphasize convenience, digital-first experiences, and tangible outcomes. Brands targeting this segment are increasingly offering modular supplement packs, quiz-based personalization, and lifestyle-driven branding (e.g., sleep, stress, focus). This group is also highly responsive to peer reviews, influencer endorsements, and app-based engagement.

Generation X and older Millennials tend to prioritize personalization for specific functional benefits such as energy, immunity, weight management, or aging-related concerns. They are more receptive to models that integrate diagnostic testing or clinical language and show greater willingness to pay for products backed by data or scientific credibility. Longevity, chronic disease prevention, and metabolic health are key drivers in this segment.

Boomers and seniors, while less represented in digital-first models, are increasingly open to personalization when accompanied by clear health value and simplified user experiences. Adoption is stronger when integrated into healthcare settings or supported by practitioner referrals. This segment shows interest in joint health, heart health, cognitive support, and bone density, though trust and simplicity remain critical purchase factors.

Digital Influence And E-Commerce Growth

Digital engagement and e-commerce accessibility are central to the rise of personalized supplements, transforming how consumers discover, evaluate, and purchase wellness products. The shift toward online-first behavior accelerated by the COVID-19 pandemic has expanded the reach of personalization platforms, allowing brands to scale direct-to-consumer (DTC) offerings with high precision.

Digital quizzes, personalized onboarding flows, and lifestyle assessments have become standard entry points, reducing friction and enhancing the perception of tailored care. Consumer trust is increasingly driven by the user experience (UX) clarity, interactivity, and visual personalization are now critical to acquisition and conversion. Brands that create seamless digital journeys from initial assessment to checkout and app-based follow-up outperform peers relying on static product models.

Social media and influencer ecosystems also play a pivotal role in shaping consumer decisions. Platforms like Instagram, TikTok, and YouTube have become key education and discovery channels, especially for younger users. Authentic storytelling, “unboxing” of personalized supplement kits, and real-time product feedback foster emotional connections that traditional marketing lacks.

E-commerce convenience is further enhanced by subscription models, refill automation, and integrated habit-tracking tools. These features support customer retention, a crucial factor given the relatively high acquisition costs in the wellness space. As consumer expectations for personalization continue to rise, brands that blend e-commerce agility with digital intelligence are best positioned to capture long-term loyalty.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified