- Home

- »

- Market Trend Reports

- »

-

Relugolix Combination Therapy Market: Commercial Landscape & Growth Outlook (Myfembree/Ryeqo)

Report Overview

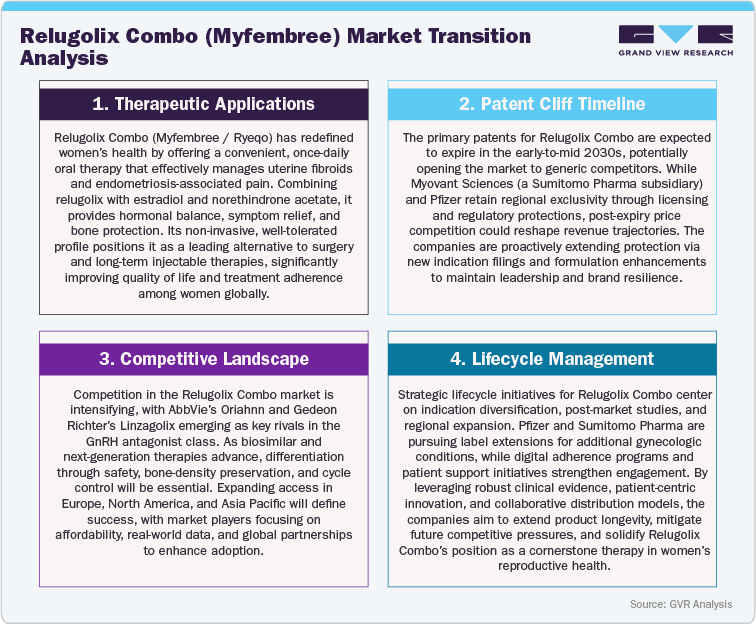

Relugolix Combo (Myfembree/Ryeqo), developed by Myovant Sciences now part of Sumitomo Pharma and co-commercialized with Pfizer Inc., is an oral, once-daily GnRH receptor antagonist combination indicated for uterine fibroids and endometriosis-associated pain. The therapy combines relugolix, estradiol, and norethindrone acetate to maintain hormonal suppression while reducing hypoestrogenic effects. Ryeqo is the corresponding brand name in ex-U.S. markets with the same formulation and clinical profile. The product is approved in the U.S. and Europe, with additional geographic expansion underway. Growing clinical adoption, collaborative commercialization, and ongoing development activities in related hormonal conditions support the therapy’s continued positioning within the women’s health treatment landscape.

Key Report Deliverables

-

A comprehensive analysis of the Relugolix Combo (Myfembree) market landscape, covering global revenue performance, key growth drivers across uterine fibroids and endometriosis, evolving treatment paradigms in non-surgical hormonal therapies, and the shifting competitive dynamics within the women’s reproductive health segment.

-

Forecasts evaluating post-launch market dynamics, including anticipated label expansions, adoption trends across major geographies, and projected impact on revenue growth, market penetration, and competitive positioning amid increasing clinical activity from rivals such as elagolix (Orilissa) and dienogest-based therapies.

-

Identification of regulatory, market access, and reimbursement barriers influencing adoption of oral GnRH antagonist therapies, including approval pathways, payer coverage policies, and pricing considerations across key regions such as the U.S., Europe, China, and Latin America, with Japan included only for evaluation of future opportunities, as the combination therapy is not currently approved there.

-

An in-depth competitive landscape overview, profiling leading developers in women’s health therapeutics, late-stage pipeline entrants, ongoing clinical innovations in hormonal modulation and symptom management, strategic alliances, and evolving treatment strategies reshaping chronic gynecologic care.

-

Strategic implications for Myovant Sciences and Pfizer, including lifecycle management initiatives, indication diversification, pricing optimization, market access strategies, and geographic expansion to sustain competitive leadership and maximize long-term growth potential in the global uterine fibroids and endometriosis therapeutics market.

Canada Relugolix Combo (Myfembree) Market (Strategic Relaunch Strengthens Women’s Health Portfolio)

The Canadian market for Relugolix Combo (Myfembree) has progressed into a renewed growth phase following its relaunch by Knight Therapeutics Inc. in October 2025. Under a licence and supply agreement with Sumitomo Pharma America, Inc., Knight manages the commercialization of Myfembree, Orgovyx (relugolix), and vibegron in Canada. Myfembree received Health Canada approval in September 2023 for heavy menstrual bleeding associated with uterine fibroids and in October 2023 for moderate to severe endometriosis pain in premenopausal women. The Canadian GnRH therapy market is valued at approximately CAD 45 million with a CAGR near 8%. Myfembree generated around CAD 2.9 million in 2024 sales. Knight’s relaunch strategy emphasizes improved patient access, physician education, and broader specialty coverage, supporting increased adoption. As market penetration expands, Canada is positioned to become an important growth contributor within the global Relugolix Combo (Myfembree/Ryeqo) market.

Relugolix Combo (Myfembree): Patent and Exclusivity Details

The Relugolix Combination Tablet (estradiol 1 mg, norethindrone acetate 0.5 mg, and relugolix 40 mg), marketed as Myfembree, is protected under multiple regulatory and patent listings in the U.S. Orange Book.

The NDA entry for the product (NDA 214846) includes a long-dated patent expiring in 2038, providing extended protection for the combination formulation. This listing plays a central role in shaping the projected exclusivity window, influencing competitive entry timing, generic development strategies, and long-term revenue forecasts. The table below summarizes the key Orange Book details associated with Myfembree.

Table: Orange Book Listing for Myfembree (NDA 214846)

Product Name

Strength (Estradiol / Norethindrone Acetate / Relugolix)

NDA Number

Listed Patent Expiration

Submission / Listing Date

Myfembree

1 mg / 0.5 mg / 40 mg Tablets

214846

3-May-38

18-Dec-24

Current Market Scenarios

Relugolix Combo (Myfembree/Ryeqo), developed by Myovant Sciences (Sumitomo Pharma) and Pfizer, is an oral, once-daily GnRH receptor antagonist combination indicated for uterine fibroids and endometriosis-associated pain. The therapy integrates relugolix, estradiol, and norethindrone acetate to maintain estrogen levels while enabling sustained symptom control. Myfembree is approved in the U.S., and the same formulation is marketed as Ryeqo in the EU. Current data do not show regulatory approval of the combination product in Japan.

In North America and Europe, adoption is supported by reimbursement coverage, physician familiarity with oral GnRH antagonists, and interest in non-surgical treatment options. Pricing strategies, patient access initiatives, and evolving clinical guidelines continue to influence uptake relative to competitors such as elagolix and dienogest-based therapies. In the Asia Pacific region particularly China and South Korea regulatory engagement, local research activity, and broader women’s health priorities are facilitating early market development.

In Latin America and the Middle East & Africa, growth reflects improvements in healthcare infrastructure and partnerships with regional distributors, though affordability and reimbursement remain constraints. Overall, expansion into additional geographies, label development efforts, and real-world clinical adoption trends are expected to shape the therapy’s positioning within the global market for non-surgical management of chronic gynecologic disorders.

Market Dynamics

Growing Demand for Non-Surgical Women’s Health Therapies

The rising global prevalence of uterine fibroids and endometriosis, coupled with increasing awareness of non-surgical treatment options, is driving strong demand for targeted therapies like Relugolix Combo (Myfembree/Ryeqo). As a first-in-class oral GnRH receptor antagonist combination, Myfembree delivers effective hormonal modulation, alleviating pain and heavy menstrual bleeding while minimizing hypoestrogenic side effects. Its patient-friendly oral dosing, clinical efficacy, and favorable safety profile make it a preferred choice among gynecologists and key opinion leaders. With robust adoption trends, expanding clinical data, and growing physician awareness, Myfembree/Ryeqo is well-positioned for sustained global growth in chronic gynecologic care.

Pricing Dynamics and Competitive Landscape

As the oral GnRH antagonist and hormonal therapy segment expands, competition from therapies such as elagolix (Orilissa), dienogest-based therapies, and emerging hormonal agents will influence pricing and access. In value-sensitive regions like Europe, China, and India, payers are expected to emphasize cost-effectiveness and health technology assessments, prompting strategic pricing strategies. In contrast, in markets such as the U.S., Japan, and select APAC countries, strong clinical differentiation, specialist prescribing patterns, and early reimbursement approvals will support premium positioning for Myfembree/Ryeqo. While pricing pressures may intensify as alternatives enter the market, the therapy’s first-mover advantage, proven safety-efficacy profile, and brand recognition are likely to sustain market strength.

Opportunities in Lifecycle Management and Regional Expansion

Myovant Sciences and Pfizer are proactively addressing competitive challenges through lifecycle management initiatives, including label expansion for additional hormonal indications, potential combination strategies, and optimization of treatment protocols. Strategic investments in real-world evidence generation, physician education, and patient support programs are further enhancing adoption and market penetration. Regional market performance will vary developed markets are expected to maintain steady uptake through clinical familiarity and reimbursement stability, while emerging regions such as Asia Pacific and Latin America are anticipated to see faster adoption due to increasing healthcare access and local partnerships. Moving forward, innovation-led differentiation, expanded clinical application, and strategic commercialization will drive Myfembree/Ryeqo’s continued leadership in the evolving women’s health therapeutics market.

The Pressure of Pricing and Market Erosion Post-Patent

As Relugolix Combo (Myfembree/Ryeqo) continues to expand its footprint in uterine fibroids and endometriosis, the oral GnRH antagonist market is beginning to face early pricing pressures and competitive dynamics. Rival therapies, including elagolix (Orilissa), dienogest-based treatments, and emerging hormonal alternatives, are expanding their clinical labels and geographic reach, prompting greater payer scrutiny and value-based reimbursement frameworks. In cost-sensitive regions such as China, India, and Latin America, government cost-containment programs, local partnerships, and patient affordability initiatives are expected to favor competitively priced options. Conversely, in mature markets like the U.S., Europe, and Japan, strong prescriber loyalty, clinical familiarity, and established brand recognition are likely to preserve Myfembree/Ryeqo’s premium positioning in the near term. Over time, the entry of next-generation hormonal therapies and novel non-surgical interventions will influence pricing negotiations and formulary access, requiring strategic adaptation. Nevertheless, Myfembree/Ryeqo’s first-mover advantage, proven safety-efficacy profile, and broad clinical adoption will help Myovant and Pfizer maintain market resilience. Focused investment in patient support programs, reimbursement facilitation, and innovative contracting models will be key to sustaining long-term leadership.

Innovating Beyond the Patent - Unlocking Future Growth Paths

Amid rising competition and evolving payer expectations, Myovant and Pfizer are pursuing innovation-driven strategies to extend the lifecycle of Myfembree/Ryeqo and reinforce its leadership in women’s health. Efforts include exploring new dosing regimens, potential combination therapies, and expanded hormonal indications to enhance convenience, adherence, and clinical outcomes. Research into additional gynecologic and hormonal conditions highlights the therapy’s potential to address a broader spectrum of unmet needs in chronic women’s health care. Regional growth opportunities are particularly strong in Asia Pacific, Latin America, and the Middle East, where improving healthcare infrastructure, increasing awareness of non-surgical treatments, and supportive regulatory frameworks are driving adoption. As the global women’s health market evolves, clinical innovation, real-world evidence generation, and patient access expansion will be critical for Myfembree/Ryeqo to maintain market relevance and remain a cornerstone therapy in the management of uterine fibroids and endometriosis.

Shaping the Future - Innovation, Accessibility, and Regional Dynamics

The global women’s health therapeutics market is undergoing a period of structural change, with the Relugolix Combination Therapy (Myfembree/Ryeqo) emerging as a key option within non-surgical hormonal management for uterine fibroids and endometriosis. The fixed-dose combination of relugolix, estradiol, and norethindrone acetate provides consistent hormonal suppression while maintaining estrogen levels to support tolerability. Its once-daily oral administration offers an alternative to procedural and injectable interventions, aligning with clinical demand for pharmacologic options that can be used in chronic management settings. As adoption grows in approved markets, the therapy is shaping treatment preferences among providers evaluating oral GnRH antagonist-based approaches in gynecologic care.

The evolution of healthcare systems toward value-based care, early access programs, and patient-centric models is expected to accelerate adoption in key markets such as North America and Europe, where reimbursement frameworks, specialist infrastructure, and clinical familiarity are well established. In emerging regions, including Asia Pacific, Latin America, and the Middle East, expanding healthcare infrastructure, patient support initiatives, and partnerships with local providers will be pivotal in improving accessibility. However, variations in regulatory timelines, pricing, and reimbursement policies may influence adoption curves across different geographies.

To sustain leadership, Myovant Sciences and Pfizer are focusing on lifecycle innovation, including potential expanded hormonal indications, optimized dosing regimens, and combination therapy approaches, alongside robust patient support programs and regional market strategies. These efforts, combined with real-world evidence generation and education initiatives, are expected to solidify Myfembree/Ryeqo’s role as a cornerstone therapy in women’s reproductive health-balancing clinical innovation, accessibility, and global market impact.

Overview of Alternative Therapeutics

The competitive landscape for Relugolix Combo (Myfembree/Ryeqo) is evolving rapidly as multiple oral GnRH antagonists, dienogest-based therapies, and other hormonal treatments advance through late-stage clinical development. Rivals such as elagolix (Orilissa) and emerging non-surgical hormonal therapies are expanding their indications in uterine fibroids, endometriosis, and related gynecologic disorders, offering alternative dosing regimens and administration formats that provide physicians and patients with increased treatment flexibility. These innovations are reshaping therapeutic choice in chronic women’s health conditions and driving heightened competition for patient adherence, convenience, and safety profiles.

As competitors secure broader regulatory approvals and enter new geographies, the global market is witnessing greater innovation in non-surgical hormonal management. Uptake of these alternatives is expected to be particularly strong in cost-sensitive regions, including Asia Pacific, Latin America, and parts of Europe, where pricing, reimbursement, and treatment accessibility heavily influence prescribing behavior. In mature markets such as the U.S., Japan, and Western Europe, factors such as specialist familiarity, real-world evidence, and formulation convenience will continue to define market differentiation and patient preference.

To maintain competitive leadership, Myovant Sciences and Pfizer are leveraging Myfembree/Ryeqo’s first-in-class clinical profile, once-daily oral convenience, and established safety-efficacy balance. Strategic initiatives including lifecycle management, label expansion, real-world evidence generation, and targeted regional partnerships are expected to sustain momentum. As the oral GnRH antagonist and hormonal therapy market expands, Myfembree/Ryeqo’s patient-centric approach, clinical differentiation, and global adoption efforts will define its long-term positioning in the evolving women’s health therapeutics landscape.

Competitive Landscape

The competitive landscape for the Relugolix Combination Therapy (Myfembree/Ryeqo) continues to broaden as the oral GnRH antagonist class expands within the treatment of uterine fibroids and endometriosis. Myovant Sciences (Sumitomo Pharma) and Pfizer market the therapy as a once-daily oral option that maintains hormonal suppression with an add-back regimen to support tolerability. Competition is strengthening with agents such as elagolix (Orilissa), dienogest-based therapies, and other non-surgical hormonal treatments that are progressing through clinical development or expanding approved indications. These alternatives, along with variations in dosing formats and regional access, are contributing to a more diverse therapeutic environment and shaping provider decision-making in chronic gynecologic care.

Emerging competitors are accelerating development across gynecologic indications, with several oral GnRH antagonists and combination therapies advancing through late-stage clinical trials. Market adoption is expected to vary across regions-North America and Europe will likely remain the largest markets due to established specialist networks, reimbursement frameworks, and patient awareness, while Asia Pacific, Latin America, and the Middle East are expected to experience faster growth driven by improving healthcare infrastructure, regulatory support, and expanding access programs.

To sustain leadership, Myovant and Pfizer are focusing on strategic differentiation, including lifecycle management, label expansion into additional hormonal indications, optimized dosing regimens, and patient support initiatives. Competitors are pursuing aggressive pipeline diversification, regional expansion, and competitive pricing strategies to strengthen their market presence. As the women’s health therapeutics landscape evolves, success will depend on clinical differentiation, real-world evidence generation, patient-centric outcomes, and strategic commercialization. Companies that best combine innovation, accessibility, and market agility will define the next phase of growth in the global non-surgical gynecologic therapy market.

North America Relugolix Combo (Myfembree) Market

North America is the primary launch market for MYFEMBREE, with the United States leading adoption for both heavy menstrual bleeding associated with uterine fibroids and moderate-to-severe endometriosis pain. Widespread physician awareness among gynecologists, integration into specialized women’s health centers, and robust reimbursement systems have contributed to strong uptake. In Canada, MYFEMBREE is available for the same indications, enhancing regional coverage. The therapy’s once-daily oral formulation provides a convenient alternative to invasive procedures, appealing to both physicians and patients. While Canadian cost-containment policies and formulary restrictions slightly temper growth, the overall market benefits from high specialist engagement, early adoption trends, and strong patient preference for non-surgical, effective, and well-tolerated hormonal therapy, making North America a critical revenue hub.

Europe Relugolix Combo (Ryeqo) Market

In Europe, RYEQO leads the market for oral GnRH antagonist therapy, with Germany, France, and the U.K. driving uptake. Initially approved for uterine fibroids and later for endometriosis, the therapy addresses a significant unmet need for non-surgical women’s health treatments. Europe’s mature gynecologic care infrastructure, combined with specialist familiarity and patient preference for convenient oral regimens, supports strong adoption. However, national health technology assessments, pricing negotiations, and reimbursement policies may limit premium positioning. Strategic initiatives such as early access programs, academic collaborations, and physician education are critical to building long-term market share. As adoption accelerates across EU member states, RYEQO’s differentiated clinical profile and patient-centered approach solidify its presence in Europe.

Asia Pacific Relugolix Combo (Ryeqo) Market

Asia Pacific represents a developing opportunity area for the relugolix combination (Ryeqo), with growth potential varying across markets. China and South Korea are emerging as priority regions where expanding awareness of uterine fibroids and endometriosis, combined with broader investment in women’s health, is supporting early market development. In India, access is influenced by affordability considerations and evolving regulatory pathways. While Japan has established physician familiarity with hormonal therapies, the relugolix combination is not currently approved there, positioning it as a potential future-entry market rather than an active one. Across the region, partnerships with local healthcare providers, patient-support programs, and educational initiatives will be important for driving adoption as healthcare infrastructure and specialist capacity continue to expand.

Latin America Relugolix Combo (Ryeqo) Market

Latin America represents a promising yet cost-sensitive market for Ryeqo, with Brazil and Argentina leading adoption. Rising awareness of gynecologic conditions, coupled with increasing access to specialty care, is driving demand for non-surgical therapies. However, limitations in reimbursement infrastructure and affordability challenges may constrain widespread uptake. Early-entry strategies, including patient assistance programs, tiered pricing models, and partnerships with regional distributors, are critical to expand access. Physician education and market awareness initiatives will further support adoption. Despite economic and regulatory hurdles, Latin America represents an important frontier for growth, as RYEQO’s convenient oral formulation, strong safety profile, and efficacy in managing uterine fibroids and endometriosis align with evolving patient and physician preferences.

Middle East and Africa Relugolix Combo (Ryeqo) Market

The Middle East and Africa (MEA) region represents an emerging opportunity for the relugolix combination (Ryeqo), with uptake expected to vary across markets. In GCC countries such as Saudi Arabia and the UAE, ongoing healthcare modernization and increasing attention to women’s health are creating a more receptive environment for advanced gynecologic therapies, though access to higher-cost products remains uneven. Potential entry into these markets will depend on regulatory timelines, pricing assessments, and stakeholder engagement with specialist networks. Broader African markets are likely to see slower adoption due to infrastructure constraints and reimbursement limitations. Across the region, local partnerships, clinician education, and patient-support initiatives will be important in shaping future demand as the therapy progresses through market-access pathways.

Analyst Perspective

The Relugolix Combo (Myfembree/Ryeqo) market is entering a pivotal growth phase as Myovant Sciences and Pfizer strengthen their leadership in oral GnRH receptor antagonist therapies, addressing significant unmet needs in women’s reproductive health. Following its initial approval for heavy menstrual bleeding associated with uterine fibroids, and subsequent approval for moderate-to-severe endometriosis pain, the therapy is gaining traction as a non-surgical, once-daily oral alternative to invasive procedures and long-term injectable treatments. With strong clinical efficacy, an innovative combination of relugolix, estradiol, and norethindrone acetate, and growing physician confidence, Myfembree is redefining standards of care in chronic gynecologic management. Competition from other hormonal therapies and emerging oral alternatives is expected to influence market dynamics, particularly in mature regions such as North America and Europe.

Myfembree’s first-mover advantage, comprehensive clinical program, and scalable manufacturing support position Myovant and Pfizer favorably for sustained commercial growth. The therapy’s ability to alleviate symptoms effectively while minimizing hypoestrogenic side effects enhances patient adherence and broadens its appeal across multiple high-burden populations. Its convenience and favorable tolerability profile are driving rapid adoption among gynecologists and healthcare providers focused on women’s health, supporting long-term clinical and commercial success.

To maintain momentum, Myovant and Pfizer are emphasizing lifecycle management, including potential label expansions for additional gynecologic and hormone-related indications, as well as real-world evidence generation to reinforce clinical value. Patient-centric initiatives, such as support programs, education campaigns, and partnerships with specialty clinics, are expected to further drive uptake and brand loyalty. Strategic focus on global market access, pricing optimization, and regional partnerships-particularly in emerging markets will be critical in consolidating Myfembree/Ryeqo’s leadership as a cornerstone therapy in next-generation women’s health management.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price - Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified