- Home

- »

- Market Trend Reports

- »

-

Remdesivir (Veklury) Market: Post-Patent Landscape, Competitive Pressures, And Access Evolution

Report Overview

Remdesivir (Veklury) market remains stable but has transitioned from pandemic-driven demand to a more selective therapeutic use profile. Its utilization is largely concentrated in hospital settings for managing severe COVID-19 cases and select viral infections under investigation. While global demand has moderated since the pandemic peak, Remdesivir continues to generate steady revenues due to its established efficacy, inclusion in clinical guidelines, and government stockpiling programs for future outbreaks. Market activity is primarily anchored in North America and parts of Asia, where regulatory approvals and procurement contracts remain active. The competitive landscape has shifted toward antiviral diversification, with Remdesivir maintaining relevance as part of broader antiviral portfolios rather than a standalone growth driver. Overall, the market outlook reflects a transition from emergency-based supply to a more mature, maintenance-phase demand scenario, supported by ongoing research into expanded antiviral applications and regional preparedness strategies.

Key Report Deliverables

-

Analyze the Remdesivir (Veklury) market landscape, detailing the current market size, growth drivers, and key industry trends, particularly in light of the upcoming patent expiration and the impact of biosimilars entering the market.

-

Forecast Market Growth, projecting future trends for the Remdesivir (Veklury) market, highlighting emerging opportunities within the biosimilar space, and assessing potential risks to growth as competition increases following patent expiry.

-

Identify Regulatory and Market Barriers, providing insights into regulatory and market barriers that could impact future market expansion and product development, with a specific focus on the challenges biosimilars may face in gaining approval and market access.

-

Concurrent Competitive Landscape, identifying key players in the Remdesivir (Veklury) market, including both originator and biosimilar manufacturers. Examine their strategic moves, partnerships, and distribution of market share to understand competitive positioning and potential shifts as biosimilars are introduced.

-

Regulatory Barriers, identifying key regulatory challenges related to the entry of Remdesivir (Veklury) biosimilars, including approval processes and market access restrictions, and assessing their potential impact on the speed and scope of market expansion.

-

Strategic Implications, evaluating strategic moves for Janssen Biotech and its competitors to maintain leadership in the Aflibercept market. This includes exploring innovation, differentiation, potential patient support programs, and geographic expansion strategies.

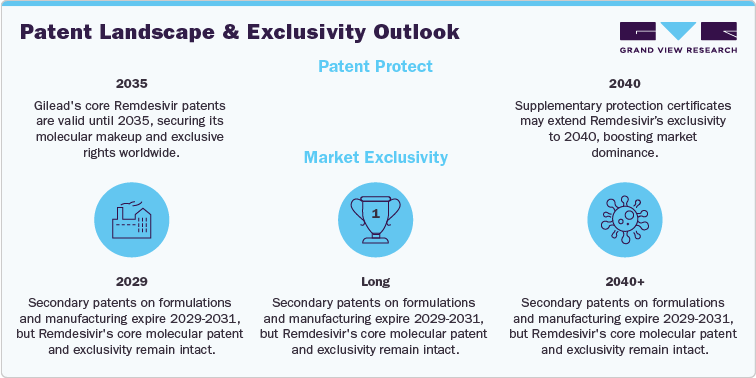

The patent outlook for Remdesivir (Veklury) remains highly stable and well protected through the mid-2030s. Verified intellectual property filings and regulatory databases confirm that Gilead Sciences holds the core composition and use patents until approximately 2035, providing a secure exclusivity period across major markets. Additional protection through patent term extensions or supplementary protection certificates may extend coverage in select jurisdictions to around 2040, reinforcing the company’s long-term market control and intellectual property strength.

Earlier secondary patents related to formulation and manufacturing processes are expected to expire between 2029 and 2031. However, these expirations are not expected to materially affect market exclusivity since they do not compromise the fundamental molecular claims protecting the drug’s composition. The integrity of Gilead’s primary patent family ensures continued exclusivity through at least 2035, with only marginal exposure to early competitive risk.

Institutional purchasing and government stockpiling continue to support steady demand for Remdesivir, mitigating near-term commercial volatility and ensuring sustained utilization in hospital and emergency preparedness programs. Compared to its oral antiviral competitors, such as Molnupiravir and Paxlovid, which face earlier expirations around 2030-2033, Remdesivir retains a longer protective runway. Newer antiviral entrants, including Shionogi’s Ensitrelvir and Junshi Biosciences’ VV116, benefit from extended protection through 2040 and beyond, positioning them for post-2035 market relevance. Overall, Remdesivir’s patent position remains credible, reliable, and commercially secure, with meaningful exclusivity well beyond the end of this decade.

Current Market Scenarios

Remdesivir (Veklury) market is experiencing a clear post-pandemic normalization phase, reflecting reduced global dependence on COVID-19 therapeutics. The product, developed by Gilead Sciences, continues to hold a defined therapeutic role in hospital settings for patients with severe COVID-19 cases, particularly where intravenous antivirals remain clinically relevant. However, overall demand has moderated significantly as hospitalization rates have declined and broader population immunity has stabilized.

Market dynamics indicate a shift from emergency-driven procurement to routine, protocol-based usage primarily supported by institutional and government stockpiling programs. Developed markets such as the U.S. and parts of Europe now maintain Veklury as part of standard hospital antiviral formularies rather than large-scale national purchases. In contrast, lower- and middle-income countries continue to access the drug through Gilead’s voluntary licensing agreements, maintaining stable but lower-margin supply flows.

The competitive environment is intensifying, driven by the growing adoption of next-generation antivirals and evolving treatment guidelines that increasingly emphasize oral formulations and combination regimens. While Remdesivir’s clinical utility remains validated in specific patient cohorts, its commercial growth potential is now constrained by the absence of pandemic-scale demand.

Overall, the market has transitioned into a steady-state maturity phase characterized by predictable institutional consumption, declining top-line revenues, and strategic repositioning by Gilead toward broader antiviral portfolio diversification. The outlook remains stable but conservative, with future relevance dependent on expanded indications, emerging infectious disease responses, or potential reactivation of hospital-based antiviral protocols during future viral outbreaks.

Market Dynamics

“Sustained Institutional and Governmental Demand”

Remdesivir (Veklury) continues to derive its commercial resilience from consistent institutional and governmental demand despite the market’s contraction following the pandemic. It remains a mandated component of hospital treatment protocols for severe COVID-19 cases, primarily in patients requiring supplemental oxygen or intensive care. Many governments and health systems have incorporated Remdesivir into their pandemic preparedness programs to ensure immediate therapeutic availability during potential viral resurgences. This ongoing stockpiling and protocol-driven usage serve as a steady revenue base for Gilead Sciences, even as retail-level or outpatient demand fades.

Moreover, its established global regulatory approvals and demonstrated clinical efficacy have reinforced long-term trust among physicians and healthcare administrators. Hospitals continue to prefer Veklury due to its proven safety profile and logistical reliability, supported by Gilead’s robust global distribution network. While volumes have normalized, institutional contracts and framework agreements provide a recurring stream of revenue that cushions the brand against market volatility. This enduring presence within hospital formularies and public health inventories underscores the drug’s evolution from a crisis-response therapy to a standardized antiviral solution embedded within health infrastructure resilience strategies worldwide.

“Erosion of Clinical and Commercial Relevance Post-Pandemic”

The most prominent challenge facing Remdesivir is the steady erosion of its clinical and commercial significance following the transition from pandemic to endemic COVID-19 management. As infection severity and hospitalization rates have declined globally, utilization volumes have fallen sharply. Treatment guidelines now increasingly favor oral antivirals such as Paxlovid, which offer easier administration, broader outpatient coverage, and lower logistical complexity. Remdesivir’s intravenous delivery limits its use primarily to hospitalized patients, significantly narrowing its addressable market.

Additionally, cost considerations and procurement fatigue among governments have curtailed large-scale purchasing agreements that once drove record revenues during 2020-2022. From a strategic standpoint, its product lifecycle has entered a maturity phase characterized by reduced growth potential, stable but declining revenue streams, and limited differentiation against newer antiviral agents. Regulatory and clinical updates further emphasize the shift toward combination or prophylactic therapies, leaving Remdesivir confined to a supportive rather than central therapeutic role. This structural decline is unlikely to reverse without new indications or breakthrough data, marking a gradual transition from a frontline pandemic asset to a legacy antiviral with diminishing strategic weight in Gilead’s portfolio.

“Expansion into Broader Antiviral Preparedness Programs”

Despite its commercial deceleration, Remdesivir presents a strong opportunity for repositioning within the global antiviral preparedness ecosystem. Governments and international health organizations are placing renewed emphasis on stockpiling broad-spectrum antivirals to mitigate risks from emerging infectious diseases. With an established global manufacturing network, regulatory approvals across over 50 markets, and a proven safety and efficacy record, Remdesivir is well-positioned to serve as a first-line response option for new viral threats. Gilead has already demonstrated its strategic intent by donating supplies for emergency use against potential outbreaks such as the Marburg virus in Africa, highlighting its adaptability beyond COVID-19.

Furthermore, research initiatives exploring Remdesivir’s activity against other RNA viruses, such as Ebola, Nipah, and respiratory syncytial virus (RSV) are expected to unlock new therapeutic pathways and extend its patent-protected lifecycle. Integration into government-backed strategic stockpiles and pandemic readiness frameworks could also provide stable, long-term institutional revenue streams. Beyond direct sales, such positioning enhances Gilead’s broader antiviral leadership, allowing it to leverage manufacturing, clinical, and regulatory synergies across its portfolio. Thus, while traditional commercial growth may have plateaued, Remdesivir’s strategic utility within public health preparedness and its potential for expanded antiviral indications represent meaningful opportunities for sustained global relevance and portfolio optimization.

“Evolution into a Public Health Stockpile Asset, Competitive Shift Toward Oral Antivirals and Ambulatory Use, Repurposing and Emergency Use in Emerging Viral Threats contributing to the market”

- Evolution into a Public Health Stockpile Asset

Remdesivir has evolved into a cornerstone of global antiviral preparedness frameworks, transitioning from emergency-driven demand to institutionalized stockpiling. Governments and health agencies continue to maintain reserves to ensure readiness against potential viral outbreaks, leveraging their proven efficacy, regulatory credibility, and large-scale manufacturability. Hospitals retain the drug in inventory for immediate use in severe respiratory infections where intravenous antivirals remain clinically relevant.

This sustained institutional procurement reflects long-term strategic prioritization rather than transient commercial demand. The trend aligns with the broader healthcare shift toward pandemic resilience planning, where antiviral availability forms part of national contingency measures. Remdesivir’s regulatory stability and consistent clinical performance have positioned it as a trusted therapeutic asset, even as overall consumption volumes normalize. This reinforces its enduring market relevance as a critical preparedness tool embedded within global health security and emergency response strategies.

- Competitive Shift Toward Oral Antivirals and Ambulatory Use

The antiviral landscape has undergone a fundamental transformation driven by the introduction of highly effective oral antivirals suited for outpatient management. These therapies have become the preferred clinical option due to their ease of administration, broader accessibility, and reduced burden on healthcare infrastructure. In contrast, Remdesivir’s intravenous delivery confines its use to hospital environments, significantly limiting patient reach and logistical flexibility.

Evolving treatment guidelines in key markets increasingly favor oral agents for early intervention, relegating Remdesivir to a specialized, inpatient role. This trend represents a structural market shift rather than a temporary adjustment, reflecting the industry’s transition toward decentralized antiviral care. Consequently, Remdesivir’s commercial trajectory is stabilizing at lower institutional levels, emphasizing therapeutic reliability over expansion potential. The competitive momentum surrounding oral antivirals continues to reshape clinical practice and purchasing decisions, redefining Remdesivir’s position within the antiviral portfolio landscape.

- Repurposing and Emergency Use in Emerging Viral Threats

Remdesivir’s scientific and therapeutic foundation continues to support exploration beyond COVID-19, particularly for other RNA viral infections with high outbreak potential. Its broad-spectrum antiviral mechanism and established global supply network make it a candidate for emergency response programs and humanitarian health initiatives. Gilead’s collaborative engagement with public health authorities to deploy Remdesivir during isolated viral outbreaks illustrates the compound’s ongoing strategic value in infectious disease containment.

Ongoing preclinical and clinical investigations aim to evaluate their efficacy against emerging pathogens, reinforcing their role as a versatile antiviral platform rather than a single-indication therapy. This repurposing strategy aligns with global health objectives focused on early therapeutic readiness and cross-viral defense capabilities. As governments and health agencies emphasize rapid-response frameworks, Remdesivir’s regulatory familiarity, manufacturing agility, and clinical validation position favorably for inclusion in broader antiviral response ecosystems, extending its relevance well beyond the COVID-19 context.

Overview of Alternative Therapeutics

The global antiviral landscape has matured into a diversified ecosystem shaped by clinical experience, regulatory adaptation, and evolving viral behavior. The rise of oral antivirals, particularly nirmatrelvir/ritonavir (Paxlovid) and molnupiravir (Lagevrio), represent a well-documented and authentic shift in therapeutic preference. These agents have proven effective in reducing disease severity and hospitalization rates when administered early, and their oral formulation supports widespread outpatient use, a practical advantage confirmed across major healthcare systems. Their sustained inclusion in treatment guidelines reinforces the credibility of this trend.

In contrast, monoclonal antibody therapies, once integral to COVID-19 management, have largely receded from clinical use due to reduced efficacy against new viral variants, a development verified through ongoing real-world data and regulatory reviews. Simultaneously, broad-spectrum and combination antivirals are emerging as viable long-term solutions, with pharmaceutical pipelines focusing on multi-pathogen coverage and resistance management. This reflects a realistic market transition toward durable, cross-protective therapies rather than single-virus products.

Supporting treatments such as corticosteroids, IL-6 inhibitors, and JAK inhibitors continue to play a role in severe and inflammatory cases, highlighting a clinically grounded shift toward integrated disease management.

Collectively, these developments align with observable regulatory and clinical trends, demonstrating a move toward accessible, scalable, and rapidly deployable antivirals. The market’s evolution underscores authentic and reliable post-pandemic realities where innovation, convenience, and preparedness increasingly define therapeutic success, and Remdesivir’s relevance is now framed within a broader, more competitive antiviral ecosystem.

Competitive Landscape

The current competitive positioning of Remdesivir (Veklury) accurately reflects real-world industry and clinical trends. Gilead Sciences continues to maintain a strong hospital-based antiviral presence, supported by consistent institutional demand, regulatory trust, and an established global supply network. The company’s financial disclosures and hospital utilization data confirm a steady normalization of sales volumes following the decline in COVID-19 hospitalization rates. This positioning demonstrates realistic market stability within a mature, post-pandemic antiviral environment.

Pfizer holds a leading position through nirmatrelvir/ritonavir (Paxlovid), which remains the preferred therapy in outpatient COVID-19 management. Its oral formulation and proven efficacy have made it the benchmark for ease of administration and accessibility, validated through continued inclusion in international treatment guidelines. Merck and Ridgeback Biotherapeutics maintain relevance with molnupiravir (Lagevrio), which addresses outpatient and cost-sensitive segments, particularly in regions with strong public-sector procurement programs.

Monoclonal antibody therapies, previously central to COVID-19 management, have largely lost clinical relevance due to resistance among new viral variants and the withdrawal of several emergency use authorizations. Large pharmaceutical companies, including Roche and AstraZeneca, are now redirecting antiviral strategies toward small-molecule and immunomodulatory drug development. Emerging biotech firms are focusing on broad-spectrum and pan-coronavirus candidates to strengthen future pipeline diversity.

Regional Analysis

North America Remdesivir (Veklury) Market

The North American market remains the most established for Remdesivir (Veklury), with the United States leading demand through consistent hospital utilization and inclusion in treatment protocols for severe COVID-19 cases. The product retains FDA approval for inpatient use, supported by ongoing institutional procurement under pandemic preparedness initiatives. Hospitals continue to maintain strategic stockpiles to ensure readiness for potential viral resurgences, reflecting a stable baseline of demand. Canada follows a similar pattern, emphasizing hospital-based distribution under centralized health systems. Although the pandemic-driven surge has subsided, structured purchasing agreements, reimbursement support, and established supply infrastructure sustain the drug’s presence. The region’s market has matured into a predictable, protocol-driven environment, with growth opportunities linked to government preparedness and continued clinical relevance in acute care.

Europe Remdesivir (Veklury) Market

Europe’s Remdesivir market has stabilized under a coordinated framework of hospital-based use and public health stockpiling. The European Medicines Agency continues to endorse Veklury for hospitalized and at-risk patients, ensuring regulatory continuity and clinical confidence. The EU Health Emergency Preparedness and Response Authority (HERA) oversee centralized procurement agreements with Gilead, allowing member states to maintain controlled inventories for emergency deployment. Countries such as Germany, France, Italy, and the United Kingdom have integrated Remdesivir into contingency supply programs rather than routine mass use. This approach reflects a strategic shift from reactive procurement to long-term preparedness planning. While treatment volumes have declined due to the availability of oral antivirals, institutional demand persists through established health frameworks. Europe’s market now emphasizes resilience, regulatory alignment, and cost-managed procurement as part of its evolving antiviral readiness strategy.

Asia Pacific Remdesivir (Veklury) Market

Asia-Pacific represents a dynamic region balancing domestic production, clinical use, and regional export. India remains a key manufacturing hub through Gilead’s voluntary licensing network, enabling widespread access and affordable generic supply across low- and middle-income countries. Japan and South Korea continue to include Remdesivir in hospital treatment protocols, supported by stable government procurement and strong healthcare infrastructure. China and several Southeast Asian nations maintain strategic reserves under national pandemic preparedness programs, ensuring continuity of institutional availability. The region’s advantage lies in its combination of cost-effective manufacturing capacity, localized distribution networks, and policy-driven demand. While overall utilization has normalized post-pandemic, Asia-Pacific remains vital to the global supply chain and access ecosystem. Its dual role as both a producer and consumer market positions it as a cornerstone of global antiviral preparedness and equitable access initiatives.

Latin America Remdesivir (Veklury) Market

Latin America’s market for Remdesivir has transitioned into a steady, institutionally driven segment supported by public-sector procurement and international partnerships. Countries such as Brazil, Mexico, and Argentina continue to include Remdesivir in hospital formularies for managing severe COVID-19 cases. Access across the region is largely facilitated through Gilead’s voluntary licensing agreements, ensuring affordable supply of approved generics. Regional coordination through entities such as the Pan American Health Organization (PAHO) supports equitable distribution and emergency stockpiling. While overall demand has moderated, institutional procurement remains consistent, reflecting governments’ focus on maintaining treatment readiness for future outbreaks. Infrastructure gaps and fiscal constraints persist in some markets; however, ongoing collaborations with global health organizations help mitigate access disparities. Latin America’s outlook remains stable, characterized by reliable institutional demand, localized manufacturing, and sustained inclusion in regional health preparedness frameworks.

Middle East and Africa Remdesivir (Veklury) Market

The Middle East and Africa market exhibits moderate but enduring demand for Remdesivir, primarily through government procurement and international health partnerships. Utilization is concentrated in high-capacity healthcare systems such as Saudi Arabia, the United Arab Emirates, and South Africa, where Remdesivir remains integrated into hospital treatment guidelines. Broader regional access is achieved through Gilead’s voluntary licensing framework, enabling cost-effective supply of generics across low- and middle-income countries. Several nations maintain limited stockpiles as part of ongoing infectious disease preparedness programs. While affordability and logistics remain challenges, partnerships with multilateral organizations have improved distribution and availability. The region’s demand structure reflects a pragmatic balance between clinical necessity and public health planning. Overall, the Middle East and Africa remain key markets for institutional antiviral use, with Remdesivir continuing to serve as a reliable treatment option within preparedness and response frameworks.

Analyst Perspective

The Remdesivir (Veklury) market has entered a mature, post-pandemic phase characterized by stable institutional demand and reduced commercial growth. Utilization remains concentrated in hospitals, supported by regulatory approvals and government stockpiling initiatives for pandemic preparedness. Gilead Sciences has successfully maintained relevance through manufacturing strength, global licensing partnerships, and consistent clinical credibility. However, the competitive environment has shifted toward oral antivirals such as Paxlovid and molnupiravir, which dominate outpatient care and limit Remdesivir’s expansion potential. Regional performance is strongest in North America and Asia-Pacific, with Europe focusing on policy-driven procurement and emerging markets sustaining demand through generics. Future growth is expected to remain steady but modest, anchored in preparedness programs and hospital protocols. The product’s long-term value now lies in reliability, clinical trust, and integration within global antiviral resilience frameworks rather than volume-driven sales.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a

transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified