- Home

- »

- Market Trend Reports

- »

-

Tariff Impacts & Strategic Opportunities in the Global Healthcare CDMO/CMO Market

Report Overview

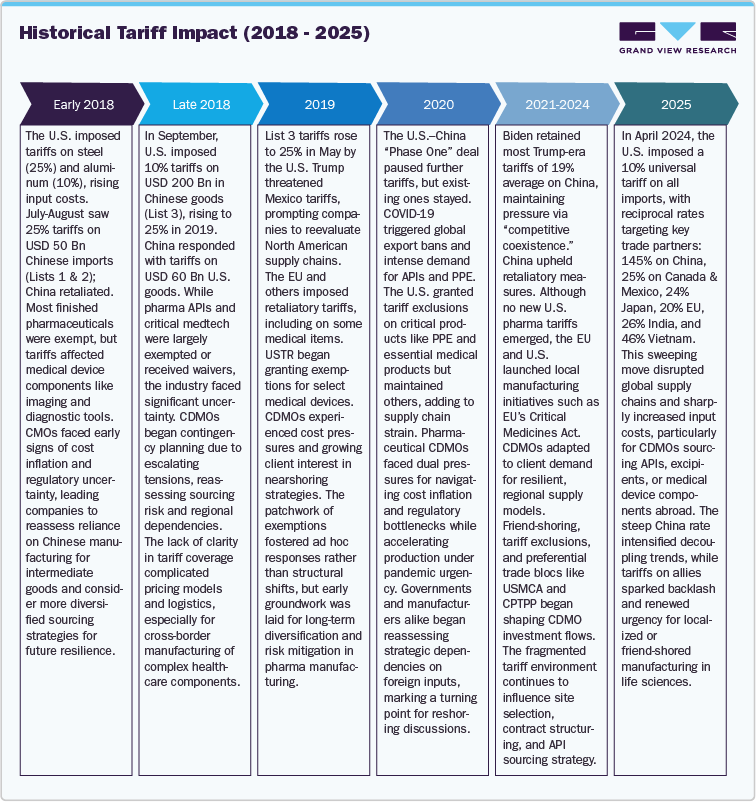

The ongoing trade conflicts and tariff wars, particularly between the U.S. and its major trading partners, have created significant challenges across various industries, including the healthcare sector. Since the implementation of tariffs under the Trump administration, the healthcare manufacturing landscape has faced disruptions, particularly in the procurement of raw materials, medical devices, and pharmaceutical ingredients. While finished pharmaceuticals were exempt from the tariffs, the raw materials, including Active Pharmaceutical Ingredients (APIs), and medical devices fell under increased tariffs, causing a ripple effect across the U.S. healthcare system.

The U.S. relies heavily on imports from China, Canada, and Mexico, with pharmaceutical imports alone reaching USD 203 billion in 2023. Tariffs on APIs and components have raised production costs, driving up prices for healthcare services, affecting consumers, especially those relying on generics and public healthcare programs like Medicare and Medicaid. These rising costs have also pressured healthcare providers operating on tight budgets. Additionally, tariffs have weakened the global competitiveness of U.S. manufacturers, particularly against state-backed initiatives like China’s “Made in China 2025,” which supports medical device industry expansion. This led to the exit of several generic drug manufacturers, enhancing existing drug shortages. This study explores the widespread impact of tariffs on pharmaceutical and medical device CDMOs, supply chains, and healthcare costs, while evaluating potential policy reforms to ease the burden on the healthcare ecosystem and ensure continued access to affordable medical products in the U.S.

-

Input cost inflation: The initial U.S. tariffs on steel (25%) and aluminum (10%) in early 2018 and the 25% Section 301 import tax on Chinese imports raised raw material costs for CDMOs. Sector analyses indicate API and excipient costs rose by 10-25%, squeezing CDMO margins by approximately 3% points on average. Similarly, medical device component costs such as precision metals and electronic parts spiked 15-20%, driving device CMO input costs higher.

-

Trade Diversion and Manufacturing Shifts: As U.S. imports of Chinese medical devices fell by around 30% in H2 2018-H1 2019, importers shifted USD 10 billion of device sourcing to Mexico and Vietnam, boosting Mexico’s share of U.S. device imports from 17% in 2018 to 20% in 2019. In pharmaceuticals, India’s API export volume to the U.S. increased by over 12% year-on-year in 2019 as Chinese APIs became costlier, supporting India’s pharma CDMO market growth from USD 7.4 billion in 2018 to USD 12.5 billion in 2023.

-

CDMO Market Share Dynamics: U.S.-based CDMOs grew from USD 22.0 billion in 2018 to USD 34.5 billion in 2023, sustained by reshoring pressures and domestic demand, while China’s CDMO sector, though still expanding saw growth slow down from 11.3% to 8.4% annually as clients redirected projects to India and Southeast Asia.

-

Projected Input Cost Increases: Early 2024 data show raw materials prices climbing an additional 15-35% for key APIs sourced from China and India, and 25-30% for device components from tariffed countries. This is expected to increase operating costs for global CDMOs by an average of USD 1.5 billion in 2024, translating into a 2-3% uptick in end-product contract costs.

-

Supply Chain Realignment: Companies are accelerating friend-shoring and onshoring investments. For instance, U.S. CDMOs report a 20% increase in RFPs for domestic manufacturing since January 2024; Indian CDMOs note a 15% rise in contracts for U.S. markets. Mexico and Vietnam continue to gain share for device assembly, each rising 2% points in U.S. import share by Q1 2024.

Current Tariff Environment and Future Impact (2025)

In April 2025, the U.S. administration implemented a sweeping trade policy introducing a 10% universal tariff on all imports. This includes formula-based reciprocal rates targeting specific countries: 145% on Chinese goods, 25% on imports from Canada and Mexico, 24% on Japan, 20% on the European Union (EU), 26% on India, and 46% on Vietnam. In retaliation, China imposed a 125% tariff on U.S.-based products, while several other countries signaled intentions to pursue countermeasures, escalating global trade tensions. However, these tariffs have been suspended for 90 days for all countries except China, providing a temporary reprieve for most trading partners.

Healthcare CDMO/CMO Market

Region

Key Trade Analysis & Impact on Healthcare CDMO/CMO Market

U.S.-China

- Tariffs (10-25%) between 2018 and 2024 impacted APIs, excipients, chemicals, and electronics for devices.

- As per WTO data, U.S. API imports from China fell ~15% (USD 3.1B to 2.6B) from 2018 to 2022.

- CDMOs faced rising input costs, especially mid/small-scale firms lacking scale/flexibility.

- Tariffs impact medical device CMOs on aluminium, precision steel, sensors, and electronic components.

- FDA compliance limited agility in supplier shifts.

- Friend-shoring trend benefited India, Vietnam, Thailand, and Malaysia for formulation, packaging, and component assembly.

- Dual-site CDMOs in the U.S. expanded domestic capabilities to reduce China exposure.

- Mexican CDMOs leveraged USMCA exemptions for nearshoring.

- U.S. federal incentives such as BARDA, grants, and tax credits supported the reshoring of high-tech biomanufacturing.

U.S.-Mexico-Canada (USMCA)

- USMCA maintained tariff-free access but increased labor, origin, and IP enforcement.

- Mexico became a major low-to-mid complexity CDMO hub for devices and packaging.

- Cross-border integration between the U.S. and Mexico is enabled by proximity and logistics.

- U.S. biologics upstream production paired with Mexico's downstream packaging.

- Canada benefited from FDA regulatory alignment (MRAs) and grew in clinical trials and biologics.

- Canadian post-COVID investments boosted mRNA and viral vector CDMO capacity.

- Dual-site operations across the U.S.-Mexico border became common for flexibility.

U.S.-European Union

- 20% U.S. tariffs on select EU goods such as steel and aluminium; minimal direct impact on pharma/medical devices.

- Tariffs mostly targeted API/raw material imports rather than finished drugs.

- EU remains a major supplier of CDMO services.

- Ireland, Germany, Belgium, and Switzerland consolidated accounted for 55% of exports to the U.S.

- Biopharma imports from the EU rose from USD 18B (2018) to USD 26B (2023).

- European CDMOs serve high-value biologics, CGTs, and injectables for U.S. clients.

- Skilled labor and advanced infrastructure continue to attract U.S. contracts.

U.S.-Rest of World

- India’s API supply affected by regulatory scrutiny, export bans, and logistical delays.

- India is not directly tariffed but is impacted by U.S. self-sufficiency policy trends.

- U.S. CDMOs relying on Indian APIs faced rising costs and requalification challenges.

- Advocacy for domestic API production (HDA, AAM) faces slow progress.

- Trade rebalancing favors Singapore, South Korea, and Switzerland for high-end CDMO services.

- Samsung Biologics (Korea) and Singapore’s mRNA infrastructure gained prominence.

- Vietnam, Poland, Czech Republic, Malaysia, and Thailand emerging in cost-sensitive manufacturing.

- Stable U.S. trade pacts with Japan, Korea enable smoother market access.

- IPEF framework expected to drive bifurcated sourcing: cost-efficient base + tech-intensive hubs.

U.S. Tariffs Impact on the Pharmaceutical CDMO Sector

As a strategic response to earlier tariffs, CDMOs and sponsors increasingly turned to India and Europe for contract manufacturing. India emerged as a key market, with pharma exports rising from USD 19 billion in 2018 to USD 27 billion in 2023, primarily driven by expanded CDMO services in generic and formulation manufacturing. Indian CDMOs captured an estimated 15-20% more U.S.-focused contracts during this period. Likewise, Europe, particularly Ireland and Germany, attracted new investments from major CDMOs due to tariff exemptions and regulatory stability. For instance, Thermo Fisher’s USD 300 million investment in Ireland demonstrated a strategic shift in manufacturing footprint, indicating the industry's broader move away from reliance on China. Meanwhile, Mexico began emerging as a nearshoring destination under the USMCA framework, benefiting from its tariff-exempt status and proximity to the U.S.

The proposed 25% tariff on imported pharmaceuticals is poised to disrupt the U.S. pharmaceutical industry, potentially raising drug costs by nearly USD 51 billion annually. If fully passed on to consumers, this could result in price hikes of up to 12.9%. These tariffs are particularly impactful due to the U.S.'s reliance on imported APIs, especially from China. With around 80% of generic drugs in the U.S. sourced or manufactured overseas, a 145% tariff on Chinese goods could increase API-related manufacturing costs by 20-25% nonetheless, because the U.S. imports the majority of branded drugs from Europe and over half of its generics from India, where tariff rates are lower. The full impact on drug prices is somewhat moderated. Still, concerns around critical drug shortages persist, as cost increases may force manufacturers to rethink production and sourcing.

In response, pharmaceutical companies are adjusting supply chains to counter rising costs and mitigate risks. AstraZeneca announced a USD 3.5 billion investment to shift production of U.S.-sold medicines from Europe to the U.S. by 2026. Similarly, Merck revealed a USD 1 billion plan to build a new manufacturing facility in Delaware, operational by 2028, with production of experimental drugs beginning by 2030. These strategic moves highlight the sector’s broader shift toward domestic manufacturing amid ongoing tariff pressures.

U.S. Tariffs Impact on the Medical Device CDMO Sector

Similar to the pharmaceutical sector, the medical device industry faces significant challenges due to tariff impositions on imported components. Several devices and supplies rely on parts from China, Mexico, and Canada, and the 25% tariffs have led to increased manufacturing costs. Essential medical devices such as gloves, syringes, and diagnostic equipment have become more expensive, adding financial pressure on hospitals and providers, with costs likely passed on to patients.

Medical device CDMOs are particularly impacted, as tariffs on critical materials like medical-grade metals, polymers, and electronic components have raised input costs. This has limited profit margins and increased the prices of final products, challenging OEMs and healthcare providers alike. In response, CDMOs are actively restructuring their global supply chains to manage costs and reduce tariff exposure.

In response to these cost pressures, CDMOs have increasingly followed geographic diversification of their supply chains. Several companies have adopted a "right-shoring" strategy, relocating sourcing and production from China to lower-tariff jurisdictions such as Vietnam, Malaysia, Mexico, and Costa Rica. This transition has introduced new complexities around quality control, logistics, and regulatory compliance while reducing tariff exposure. Additionally, several companies have increased domestic investments to reduce dependency on foreign inputs altogether. For instance, AbbVie announced over USD 10 billion in investment to build domestic manufacturing capacity, highlighting a broader trend of reshoring efforts aimed at creating tariff-resilient operations within the U.S.

While these strategies help mitigate tariff impacts, they also introduce complexities in logistics and regulatory compliance. Moreover, CDMOs based in non-tariffed countries now have a competitive pricing advantage, challenging the global position of U.S. manufacturers and reshaping investment trends and supply chain strategies in the sector.

Strategic opportunities

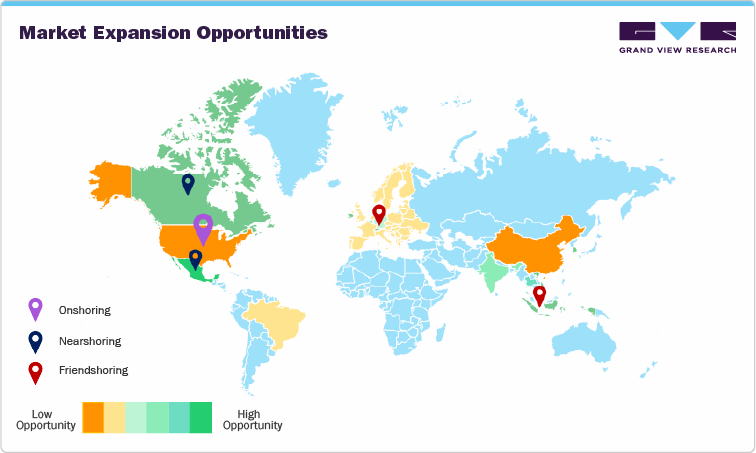

1. Geographic Opportunities

The shifting landscape of global trade presents an array of opportunities for countries that possess strong healthcare contract manufacturing capabilities and lower tariff barriers. As healthcare companies seek to mitigate the impact of rising costs and supply chain disruptions caused by tariffs, these countries can capitalize on the growing demand for cost-effective and reliable manufacturing solutions.

Below are strategic opportunities for key countries that are prominent in healthcare contract manufacturing and offer low tariffs or favorable trade conditions.

Country

Strategic Value Proposition

Key Contract Manufacturing Segments

Tariff/Trade Advantages

CDMO/CMO Strategic Implications

Mexico

- Geographical proximity to the U.S.

- Beneficiary of the USMCA trade agreement

- Established medtech clusters in Baja California, Chihuahua, and Nuevo León

- Cost-effective labor and logistics for nearshoring

- Medical devices: diagnostic equipment, surgical tools, orthopedic implants

- Reduced/zero tariffs under USMCA for compliant healthcare products.

- Strong alternative to China for U.S.-based production.

- Supports resilient supply chains for both medtech and pharma.

India

- Global API leader

- Cost-effective and high-volume capacity.

- Government incentives (PLI Scheme) for API, FDF, and biosimilars

- Intense CRAMS ecosystem

- APIs and generics, particularly in oncology, cardiovascular, antidiabetics, etc.

- Biopharmaceuticals, biosimilars, and vaccines

- Analytical, formulation, and fill finish services

- Low export tariffs; FTAs with ASEAN, Japan

- Tariff exemptions for WHO pre-qualified/ export-oriented units

- Ideal for scaling low-cost production.

- Key partner to mitigate API dependence on China.

Singapore

- High-tech hub with advanced biologics infrastructure

- Robust IP protection, R&D support, and fast regulatory approvals

- Gateway to Southeast Asia

- Biologics, mRNA, and CGT manufacturing

- High precision medtech: diagnostics, implantables, orthopedic tools

- Free trade environment with low import-export tariffs

- Bilateral and multilateral FTAs such as CPTPP, ASEAN, EU–Singapore FTA.

- Best suited for high-value biologics and precision devices

- Strategic base for APAC commercialization

- Supports early phase and GMP grade CDMO partnerships

Ireland

- Strong EU market access (post-Brexit advantage)

- Low corporate tax and R&D credits

- Host to 18 of the top 20 global pharma firms

- Large molecule biologics

- Biosimilars and sterile injectables

- Advanced medical devices

- Zero tariffs within EU

- Harmonized EMA regulations enable access to 27 countries

- Optimal EU hub for CDMOs targeting U.S./EU dual access.

- Supports long-term strategic investments for biologics and advanced therapies

South Korea

- Biotech intensive ecosystem

- Strong government subsidies and innovation clusters

- Emphasis on digital biomanufacturing and smart factories

- Biosimilars, biologics

- High-end medtech and diagnostic imaging equipment

- mRNA and viral vector platforms emerging

- Bilateral FTAs with the U.S., EU, ASEAN

- Tariff concessions on biotech exports.

- High regulatory efficiency, MFDS alignment with FDA/EMA

- Rapid scale-up opportunities for late-stage biologics

- Ideal for strategic APAC access and technology-intensive manufacturing

- Attractive for long-term partnerships in cell therapy and biosimilars

Thailand

- Strategic ASEAN location with RCEP and CPTPP linkages

- Low-cost manufacturing with improving GMP compliance.

- BOI incentives and tax holidays for healthcare investments

- Generics and API manufacturing

- Contract manufacturing of injectables, oral solids

- Midrange medical devices: diagnostic kits, surgical tools

- Low tariffs under ASEAN FTAs and GSP schemes

- BOI exemptions for imports and profit repatriation

- Attractive for midmarket CDMO players targeting emerging Asia.

- Supports regional redistribution and dual market manufacturing.

- Competitive backup base to diversify from China and India

Onshoring to the U.S.: Boosting Domestic CDMO Capacity

Amid rising 2025 tariffs on imports from China, India, and Southeast Asia, U.S. healthcare companies are accelerating onshoring to strengthen manufacturing resilience. Tariff avoidance, national security priorities, and incentives from the Inflation Reduction Act and CHIPS Act drive this shift. Domestic CDMOs are expanding capabilities in sterile fill-finish, biologics, and advanced therapies, particularly in North Carolina, Texas, and Massachusetts. In March 2025, Johnson & Johnson announced a USD 55 billion investment to build four new U.S. facilities, 25% higher than its previous four-year spending, reflecting a strategic pivot toward localized production. Similarly, in February 2025, Eli Lilly announced a USD 27 billion investment to construct four U.S. plants, including three for API production and one for injectable drugs, with construction set to begin this year.

Moreover, onshoring is fueled by strong demand for formulation, analytical testing, and GMP-compliant services. Smaller biotechs are seeking domestic capacity to meet “Buy American” provisions and reduce global supply chain risks. CDMOs with automated, integrated, and flexible manufacturing platforms are emerging as key beneficiaries. With increasing government interest in healthcare manufacturing self-sufficiency, innovation-focused CDMOs that ensure quality and rapid delivery are well-positioned to capture long-term growth opportunities.

Nearshoring to Mexico & Puerto Rico: Balancing Cost and Proximity

Nearshoring presents an ideal middle ground between cost and market access in response to U.S. tariff pressures. Mexico and Puerto Rico are emerging as key hubs due to proximity, infrastructure, and exemption from recent tariffs. Under the USMCA, Mexico offers FDA-compliant production at lower cost, particularly for medical devices, generic drugs, and packaging services. Locations like Baja California and Jalisco are attracting investments in formulation and final dosage manufacturing to bypass tariffs on APIs from Asia.

Puerto Rico, benefiting from U.S. territory status, offers FDA-aligned operations with domestic sourcing benefits. CDMOs expanding in Puerto Rico can offer U.S.-compliant services without tariff penalties, especially for sterile and controlled substances. Both regions provide strong regulatory alignment, skilled labor, and logistical ease. For CDMOs and clients seeking tariff-free access to the U.S. market without the cost of reshoring, nearshoring to North American zones provides a stimulating strategic alternative.

Friendshoring: Diversifying Risk Through Strategic Global Hubs

Friendshoring is gaining momentum as companies seek geopolitical stability and tariff-neutral manufacturing options. Aligned nations such as Ireland, South Korea, Singapore, and Poland are becoming key CDMO destinations due to strong trade relations, IP protections, and government incentives. Ireland offers EU access, low tax rates, and is home to major biologics CDMOs. South Korea excels in biosimilars and high-tech medtech manufacturing, offering high regulatory standards and tariff benefits. Singapore’s biopharma ecosystem supports advanced services like mRNA and CGT manufacturing with strong government backing and free trade access. These countries enable CDMOs to maintain global reach without supply chain risk tied to trade disputes. Expanding in these hubs also offers incentives such as tax credits, expedited approvals, and regional market access. For CDMOs, friendshoring is a strategic justification against tariff volatility, offering stable growth channels and innovation platforms beyond U.S.-China trade dynamics.

This study provides a comprehensive analysis of the impact of tariffs on the global healthcare CDMO/CMO market. It covers key dimensions such as economic and geopolitical consequences, tariff impact by region, and country-specific opportunities. Initial findings include the early impact of the tariff measures introduced in April 2025. However, as trade developments continue to unfold, the study will be updated with recent data and evolving insights. This ensures the report indicates current implications and emerging opportunities for CDMOs, manufacturers, and investors navigating a rapidly changing global trade environment.

Market Voice- Key Opinions:

The imposition of aggressive tariffs between key trade partners has reshaped the global large manufacturers aim to absorb additional tariff-related costs by investing in domestic production facilities and capitalizing on supply gaps in the U.S. market to maintain competitive advantage. For instance, Boston Scientific anticipated a USD 200 million tariff-related cost in the second half of the year but intends to offset the impact through robust sales growth and operational efficiencies.

"Our ability to absorb the tariffs, I think, is more unique than most companies, given the strength of the growth and the leverage that we're driving to absorb the $200 million, which is unfortunate, but we're able to absorb it and still deliver very high performance,"

-Mike Mahoney, CEO, Boston Scientific

While several medical device players are anticipated to witness declining revenue growth due to excessive tariff impositions on medical devices. As these impositions enhanced the cost of raw materials and end products, thereby restricting geographical penetration.

"With respect to the previously mentioned tariffs of 125% on imports of excise systems and excise subassemblies into China, these tariffs have a material impact to the product cost of excise systems in China and may adversely impact our ability to win future tenders,"

-Jamie Samath, CFO, Intuitive Surgical

Whereas, these tariffs are creating lucrative growth opportunities for minimally impacted countries such as Mexico, Canada, Puerto Rico, Singapore, India, Switzerland, etc. These countries offer cost-effective infrastructure, skilled labor, and favorable trade agreements, enabling CDMOs and CMOs to provide tariff-free, FDA-compliant manufacturing. As companies engage in geographic diversification, these nations are becoming critical hubs for contract manufacturing services, fostering investment inflows and supply chain resilience amid shifting global trade landscapes.

“Manufacturers that build Mexican-made products can ship to any of these 50+ countries, with favorable tariff conditions. A European company that produces in Mexico, for instance, could ship to Europe with a very low or zero tariff imposed.”

-Doug Donahue, Co-managing partner, Entrada Group

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified