- Home

- »

- Market Trend Reports

- »

-

Top 20 Lung Cancer Drugs Market Analysis and Segment Forecasts to 2030

Report Overview

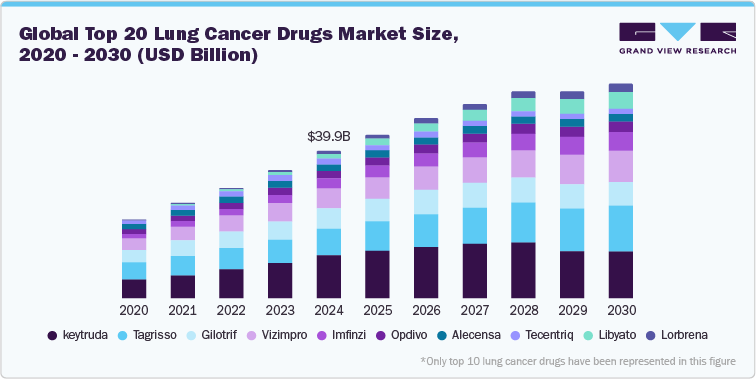

The lung cancer drugs market has witnessed significant growth in recent years, driven by advancements in cancer treatment, increasing awareness, and an aging population. Lung cancer remains one of the leading causes of cancer-related deaths worldwide, making the demand for effective therapies crucial. As research continues to evolve, innovative drugs, including targeted therapies, immunotherapies, and chemotherapy agents, are revolutionizing treatment options for patients. This trend report explores the top 20 lung cancer drugs currently shaping the market, offering insights into their mechanisms, efficacy, and the evolving landscape of lung cancer treatment.

The rapid advancements in targeted therapies and immunotherapy treatments is a factor driving market growth. These innovative therapies focus on specific genetic mutations and immune system enhancement, offering better outcomes with fewer side effects compared to traditional chemotherapy. Drugs like Tagrisso and Alecensa are examples of targeted therapies that specifically address genetic mutations in non-small-cell lung cancer (NSCLC), allowing for more personalized treatment plans. Similarly, immunotherapies such as Keytruda, Opdivo, and Tecentriq work by stimulating the body’s immune system to recognize and fight cancer cells more effectively. The success of these therapies in improving patient survival rates has sparked significant investment and research in this field, accelerating the market's growth and providing new hope for patients battling lung cancer.

Top 20 Lung Cancer Drugs Market, 2024 (USD Million)

Drug Name (Generic Name)

Company

2024 Revenue (USD Billion)

2030 Revenue (USD Billion)

Date of First Regulatory Approval

Approved Indications

Keytruda (Pembrolizumab)

Merck & Co.

11.04

11.85

September 2014 (U.S. FDA)

Immune checkpoint inhibitor that works by blocking PD-1, used for various cancers including non-small cell lung cancer (NSCLC), melanoma, head and neck cancers, and more.

Tagrisso (Osimertinib)

Avastin (Bevacizumab)

Vizimpro (Dacomitinib)

Tarceva ( Erlotinib)

Gilotrif ( Afatinib)

Keytruda(Pembrolizumab)

Iressa (Gefitinib)

Enhertu(Trastuzumab deruxtecan)

Libyato( Lurbinectedin)

Imfinzi ( Durvalumab)

Lumakras (Sotorasib)

Lorbren(Lorlatinib)

Yervoy (Ipilimumab)

Alecensa (Alectinib)

Alunbrig (Atezolizumab)

Tecentriq(Atezolizumab)

Cosela (Trilaciclib)

Tabrecta (Capmatinib)

Retevmo (Selpercatinib)

The global incidence of lung cancer continues to rise, with an increasing number of people being diagnosed each year, now accounting for over 2.3 million new cases annually.. Factors such as smoking, environmental pollution, and an aging population contribute significantly to the number of new cases. Drugs such as Keytruda, Tagrisso, and Imfinzi are gaining traction as they offer promising results for different stages of lung cancer, including both small-cell and non-small-cell lung cancer. The demand for novel, more effective treatments continues to grow as more patients seek better outcomes, thereby expanding the market for lung cancer medications. Enhanced screening programs and growing public awareness have led to earlier detection, enabling timely and more effective interventions. In March 2021, the United States Preventive Services Task Force (USPSTF) broadened its screening guidelines to cover a wider age range and additional current and former smokers. This significantly raised the number of women and Black individuals classified as being at high risk for lung cancer. Additionally, adoption in comprehensive biomarker testing coverage is important for removing a cost barrier to people with lung cancer. Targeted treatments are available for various biomarkers, making it crucial for patients and their healthcare providers to understand the results of biomarker testing before starting treatment. As of August 2024, 15 states in U.S. required insurance coverage of comprehensive biomarker testing. Hence, increased awareness for coverage and adoption of biomarker testing are fueling the market growth.

Patent Expiry & Biosimilar Impact

Patent expirations are reshaping the competitive dynamics within the lung cancer drug market. Well-established blockbusters like Avastin (Bevacizumab), Tarceva (Erlotinib), and Iressa (Gefitinib) have already encountered the impact of biosimilars or generics, leading to a substantial decline in revenues for their original manufacturers. The emergence of biosimilars, especially for monoclonal antibodies such as Avastin, which targets vascular endothelial growth factor (VEGF), has made treatment more affordable, enhancing accessibility in cost-sensitive regions. However, this has also heightened competition in more developed markets.

Table: Key Patent Expiries & Biosimilar Landscape

Drug

Originator

Indication

Patent Expiry

Biosimilar Status

Avastin

Roche

Non-Small Cell Lung Cancer (NSCLC)

2023 U.S

Biosimilars named Mvasi and Zirabev

Tarceva

AstraZeneca

Non-Small Cell Lung Cancer (NSCLC)

2016 U.S.

Generics available

Iressa

AstraZeneca

Non-Small Cell Lung Cancer (NSCLC), EGFR mutation-positive NSCLC

2023 U.S

Generics available

Keytruda

Merck & Co

Non-Small Cell Lung Cancer (NSCLC)

Expected in 2025

Yet to launch

Opdivo

Bristol-Myers Squibb

-Non-Small Cell Lung Cancer (NSCLC)

Expected in 2025

Biosimilar (Under development)

Vizimpro

AstraZeneca

Non-Small Cell Lung Cancer (NSCLC) with EGFR Exon 19 Deletions or Exon 21 L858R Mutations

Expected in 2026

Generics available

Cosela

Menarini Group

Small Cell Lung Cancer (SCLC) - In combination with chemotherapy to reduce chemotherapy-induced myelosuppression

Expected in 2026

Generics available

While immunotherapies like Tecentriq, Keytruda, Opdivo, and Yervoy have biosimilars in development, none are expected to be approved by 2025. Over the coming years, more biologics will face loss of exclusivity (LOE), paving the way for additional biosimilar launches. However, the adoption of biosimilars varies significantly across regions, influenced by factors such as regulatory readiness, provider trust, and payer incentives.

Pipeline & Innovation Spotlight

The lung cancer pipeline is rich with innovation, targeting both high-incidence subtypes and hard-to-treat populations. Recent years have seen the emergence of next-generation antibody-drug conjugates (ADCs) such as Lumakras (trastuzumab deruxtecan) and Iressa (sacituzumab govitecan), which are demonstrating strong clinical outcomes in HER2-low and triple-negative lung cancer (TNBC)-areas with historically limited treatment options. These therapies have redefined HER2 expression thresholds, offering hope for a broader patient population and opening up new commercial avenues.

Table: Selected Promising Pipeline Therapies in Lung Cancer

Drug (Code Name)

Developer

Target/Subtype

Class

Stage

Sintilimab

Innovent Biologics

PD-1 (Programmed Death-1)

Monoclonal Antibody

Phase III

Durvalumab

AstraZeneca / Daiichi

PD-L1 (Programmed Death Ligand-1)

Monoclonal Antibody

Phase III

Brigatinib

ARIAD Pharmaceuticals (AstraZeneca)

ALK (Anaplastic Lymphoma Kinase)

Tyrosine Kinase Inhibitor (TKI)

Phase III

Amivantamab

Johnson & Johnson

EGFR & MET

Monoclonal Antibody (Bispecific)

Phase II

Tezolizumab

Bristol-Myers Squibb

PD-L1 inhibitor

Monoclonal Antibody (Checkpoint Inhibitor)

Phase II

Dostarlimab

GlaxoSmithKline (GSK)

PD-1 inhibitor

Monoclonal Antibody (Checkpoint Inhibitor)

Phase II

Sotorasib

Amgen

KRAS G12C

KRAS G12C Inhibitor

Phase II

Regulatory & Policy Environment

The regulatory environment for lung cancer therapies has become more adaptive, particularly in the U.S., EU, and select Asia-Pacific regions. Agencies like the U.S. FDA and European Medicines Agency (EMA) have embraced expedited approval pathways, such as Breakthrough Therapy Designation, Fast Track, Accelerated Approval, and Priority Review, to expedite the availability of innovative treatments. Notably, therapies like Tarlatamab-dlle for extensive-stage small cell lung cancer (SCLC) and Sotorasib for KRAS G12C-mutated non-small cell lung cancer (NSCLC) were granted accelerated approvals based on early-phase efficacy data, allowing for faster access to promising treatments while ongoing evidence generation continues.

Regulatory bodies are increasingly focusing on companion diagnostics and biomarker-driven indications, aligning with the broader precision medicine trend. Despite these advancements, global disparities persist in regulatory efficiency. While over 70% of lung cancer trials are conducted in China, the U.S., and Japan, the European Economic Area (EEA) has seen its share of global trials decrease by 50% in the last decade. Meanwhile, regions like South Korea and Australia are aligning more closely with Western standards, but slower drug review processes in parts of Latin America and Africa still hinder timely access to treatments. As the regulatory ecosystem evolves, balancing speed, safety, and scientific rigor remains essential.

Pricing & Reimbursement Landscape

Pricing and reimbursement in the lung cancer drug market are increasingly influenced by rising healthcare cost concerns, changing government policies, and evolving market dynamics. High-cost therapies, particularly biologics and immunotherapies such as Keytruda, Opdivo, and Gilotrif, face significant reimbursement challenges in regions like Europe and Asia due to austerity measures and ongoing healthcare reforms, which limit the ability to set high prices. In the U.S., the Inflation Reduction Act allows Medicare to negotiate drug prices, with the Centers for Medicare & Medicaid Services (CMS) slated to negotiate additional Part D drugs starting in 2026, impacting the cost and availability of lung cancer treatments from 2027 onward. Meanwhile, countries like India, Brazil, and South Africa are implementing price caps, centralized purchasing, or risk-sharing agreements to expand treatment access while controlling costs.

As biosimilars enter the market post-2030, they are expected to drive down prices for immunotherapies in developed markets, while generics continue to dominate in emerging markets at lower prices. Many pharmaceutical companies also offer patient assistance programs to alleviate financial burdens, particularly in high-income countries. With growing global pressure for affordability without compromising innovation, pricing and reimbursement strategies will be crucial in determining both patient access and the long-term viability of the lung cancer drug market.

Product Insights

The lung cancer therapeutics market is primarily driven by targeted therapies, including EGFR, ALK, ROS1, and KRAS inhibitors, as well as immunotherapies, each contributing uniquely to the evolving treatment paradigm. Keytruda (pembrolizumab) stands out with significant sales, largely due to its broad use as a first-line therapy and adjuvant treatment for both non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC). Its widespread adoption is supported by substantial clinical evidence that highlights its superior survival outcomes compared to chemotherapy. In 2024, Keytruda generated an estimated USD 11,042 million in revenue, solidifying its dominant position in standard-of-care treatment protocols. Furthermore, its role in combination therapies and the ongoing exploration of new indications and biomarker-driven approaches in clinical trials continue to reinforce its strong market presence.

In contrast, Cosela (trilaciclib) and Enhertu (trastuzumab deruxtecan) have emerged as the fastest-growing products in the lung cancer market, driven by their innovative mechanisms of action and expanding indications. Cosela is specifically approved for extensive-stage small cell lung cancer (ES-SCLC) to mitigate chemotherapy-induced myelosuppression by protecting bone marrow cells during treatment. Enhertu, an antibody-drug conjugate (ADC) targeting HER2, is gaining momentum in non-small cell lung cancer (NSCLC) patients with HER2 mutations. Its unique mechanism, characterized by a high drug-to-antibody ratio (DAR), has shown remarkable efficacy, even in patients who have previously progressed on other HER2-targeted therapies. Cosela's sales are projected to grow at a compound annual growth rate (CAGR) of over 50.77% from 2025 to 2030, driven by strong prescriber satisfaction, reduced hospitalizations, and its increasing use in combination with standard chemotherapy for this aggressive cancer subtype. Its rapid adoption is further supported by favorable regulatory designations, including Breakthrough Therapy Status from the FDA and Accelerated Approval in several regions. Similarly, Enhertu is expected to experience a CAGR of more than 48.72% from 2025 to 2030, as its innovative design and expanding clinical indications continue to fuel its rapid market penetration.

Tagrisso (osimertinib) continue to be significant revenue contributors within the third-generation EGFR tyrosine kinase inhibitor (TKI) targeting both sensitizing and resistance mutations, with approvals for first-line and adjuvant treatment in non-small cell lung cancer (NSCLC). Despite increasing biosimilar competition, the combination of Avastin remains a cornerstone of non-squamous non-small cell lung cancer (NSCLC), including cases with EGFR mutations, when used in combination with chemotherapy or targeted agents like Tacerva (Erlotinib) due to its proven efficacy in both neoadjuvant and adjuvant settings.

Meanwhile, immune checkpoint inhibitors targeting the PD-1 receptor are a cornerstone of lung cancer immunotherapy, particularly for non-small cell lung cancer (NSCLC). Opdivo (Nivolumab) and Libtayo (Cemiplimab) work by blocking the PD-1 receptor on immune cells, preventing tumor cells from evading immune detection and destruction. They have shown significant benefits across various patient subgroups regardless of gender. Their mechanism of enhancing the immune system’s ability to attack cancer cells, leading to improved overall survival (OS) and progression-free survival (PFS) in many patients with advanced or metastatic NSCLC is proved beneficial.

The ALK inhibitor class, represented by Alecensa (alectinib) and Lorbrena (lorlatinib), continues to grow, primarily preferred as a first-line treatment due to its efficacy and CNS penetration. Both drugs benefit from their formulations as ALK inhibitors are generally well tolerated with manageable side effects, enhancing quality of life.

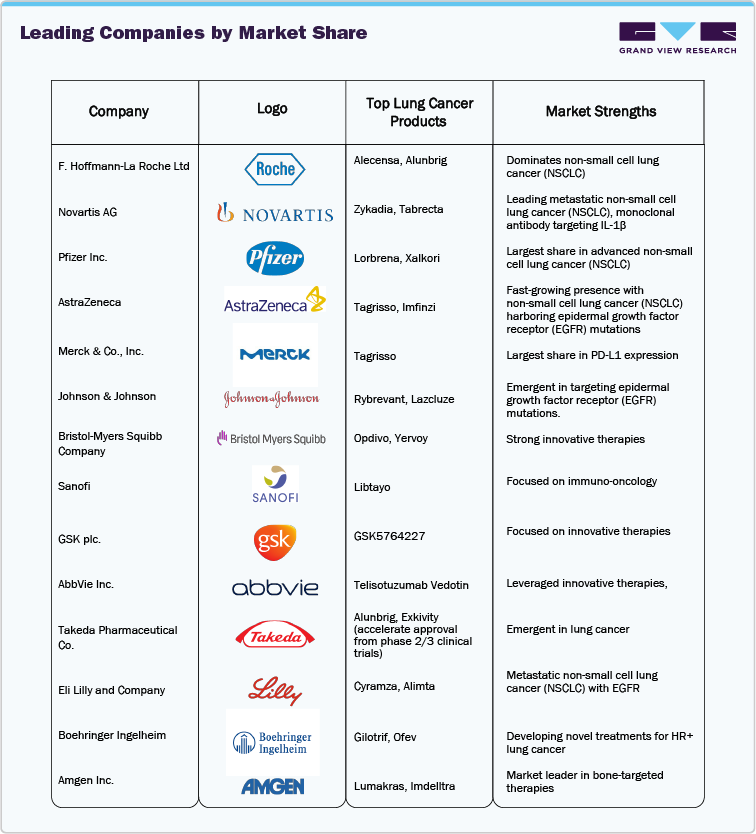

Key Companies & Market Share Insights

The top 20 lung cancer drugs market is largely led by a few major multinational pharmaceutical companies, which have solidified their leadership through the development of innovative therapies, extensive clinical trials, and strong marketing strategies. The market remains highly competitive, with these companies focused on improving patient outcomes through targeted therapies, antibody-drug conjugates (ADCs), and other precision-based treatments.

Key Top 20 Lung Cancer Drugs Market Companies:

The following are the leading companies in the top 20 lung cancer drugs market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Pfizer Inc.

- AstraZeneca

- Merck & Co., Inc.

- Johnson & Johnson

- Bristol-Myers Squibb Company

- Sanofi

- GSK plc.

- AbbVie Inc.

- Takeda Pharmaceutical Co.

- Eli Lilly and Company

- Boehringer Ingelheim

- Amgen Inc.

Recent Developments

-

In April 2025, Akeso Inc. received approval from China's National Medical Products Administration (NMPA) for Ivonescimab, a first-in-class bispecific antibody targeting PD-1 and VEGF, as a monotherapy for the first-line treatment of patients with advanced, PD-L1-positive (tumor proportion score ≥1%) non-small cell lung cancer (NSCLC) without EGFR or ALK mutations.

-

In December 2024, FDA approved Ensartinib for the first-line treatment of patients with ALK-positive locally advanced or metastatic non-small cell lung cancer (NSCLC) who have not previously received an ALK inhibitor.

-

In October 2024, A global clinical trial demonstrated that combining Amivantamab with Lazertinib significantly prolongs progression-free survival in patients with advanced EGFR-mutated non-small cell lung cancer (NSCLC).

-

In June 2024, the U.S. Food and Drug Administration (FDA) approved Repotrectinib is a next-generation tyrosine kinase inhibitor targeting ROS1-positive NSCLC.

-

In May 2024, the U.S. Food and Drug Administration (FDA) approved Imdelltra a bispecific T-cell engager (BiTE) therapy for small cell lung cancer (SCLC) that has progressed after platinum-based chemotherapy.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global top 20 lung cancer drugs market report based on product, route of administration, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tecentriq

-

Keytruda

-

Avastin

-

Tarceva

-

Gilotrif

-

Iressa

-

Tagrisso

-

Vizimpro

-

Imfinzi

-

Enhertu

-

Opdivo

-

Yervoy

-

Alecensa

-

Alunbrig

-

Lorbrena

-

Cosela

-

Tabrecta

-

Lumakras

-

Libyato

-

Retevmo

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified