- Home

- »

- Pharmaceuticals

- »

-

Antibody Drug Conjugates Market, Industry Report, 2033GVR Report cover

![Antibody Drug Conjugates Market Size, Share & Trends Report]()

Antibody Drug Conjugates Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Blood Cancer, Urothelial Carcinoma, Ovarian Cancer, Breast Cancer, Other Cancer), By Product, By Payload, By Technology, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-741-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antibody Drug Conjugates Market Summary

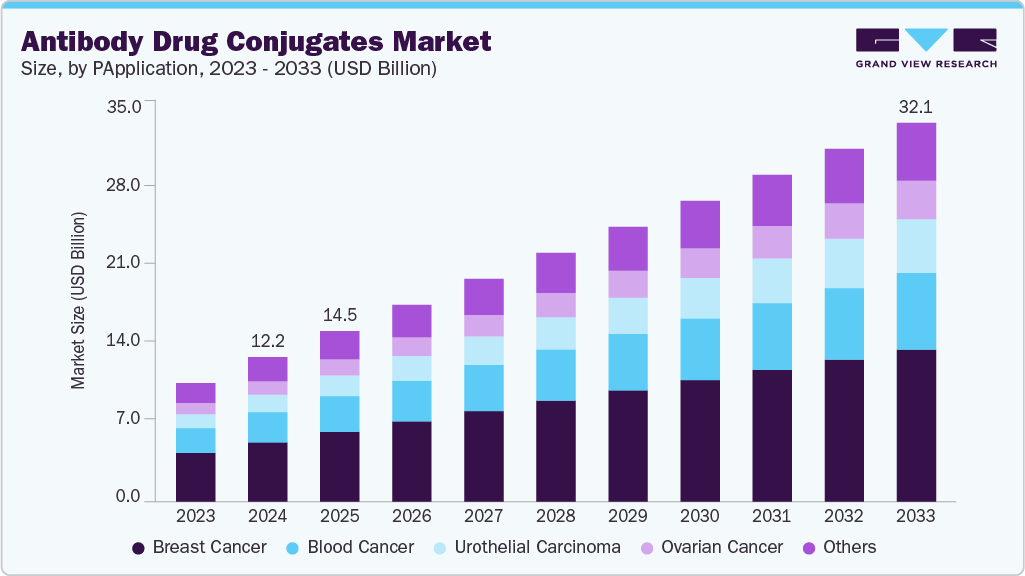

The global antibody drug conjugates market size was estimated at USD 12.26 billion in 2024 and is projected to reach USD 32.11 billion by 2033, growing at a CAGR of 10.49% from 2025 to 2033. This growth is primarily driven by the increasing prevalence of cancer and the growing demand for targeted therapies that offer greater efficacy with reduced systemic toxicity.

Key Market Trends & Insights

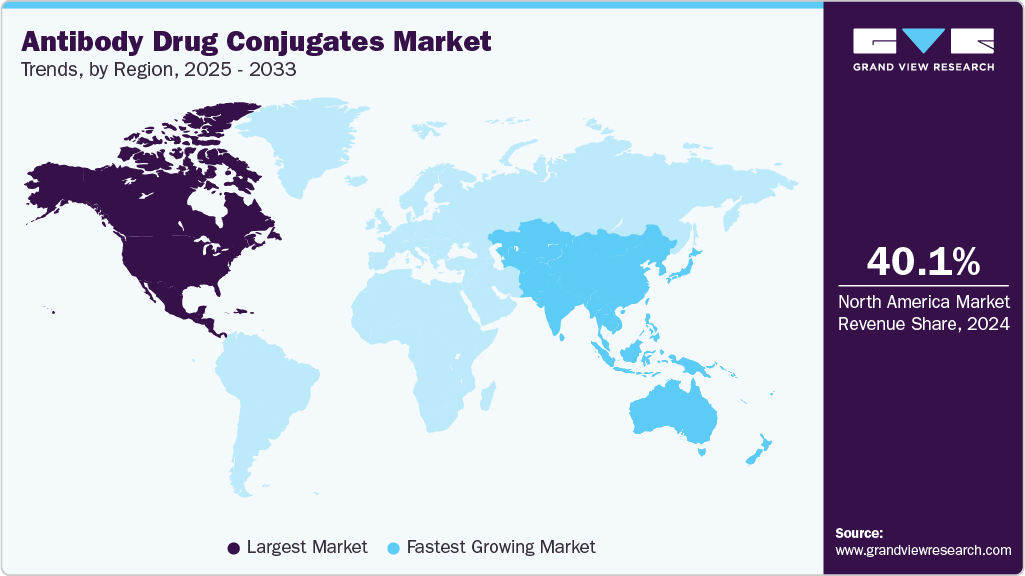

- North America antibody drug conjugates market held the largest share of 40.08% of the global market in 2024.

- The antibody drug conjugates industry in the U.S. is expected to grow significantly over the forecast period.

- By application, the breast cancer segment held the highest market share of 40.96% in 2024.

- By product, enhertu segment held the highest market share of 27.73% in 2024.

- By payload, auristatins segment held the highest market share of 36.01% in 2024.

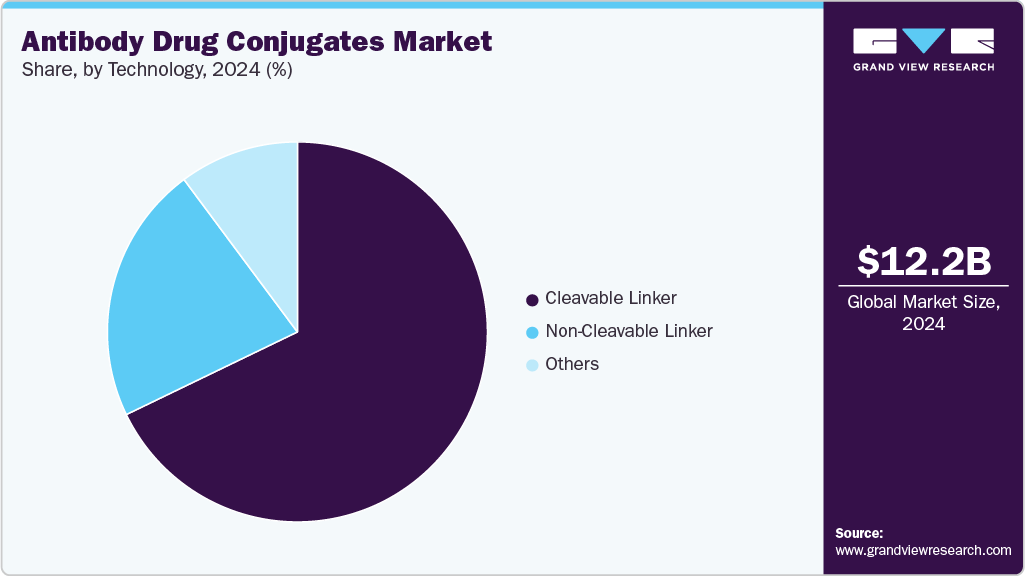

- By technology, the cleavable linker segment held the highest market share of 67.84% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.26 Billion

- 2033 Projected Market Size: USD 32.11 Billion

- CAGR (2025-2033): 10.49%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The antibody-drug conjugates (ADC) market is experiencing significant growth, driven by advancements in targeted therapies, increasing clinical trials, and strategic investments by pharmaceutical companies. Ongoing research and development activities support this expansion, with ongoing advancements in targeted therapy and precision medicine increasing the appeal of ADCs as a preferred treatment option in oncology. The rising global incidence of various cancer types has created a demand for therapies that offer high efficacy with fewer adverse effects. ADCs address this need by delivering potent cytotoxic agents directly to cancer cells while sparing healthy tissues, thereby improving patient outcomes. The increasing number of clinical trials and regulatory approvals reflects the commitment of pharmaceutical companies to invest in this novel treatment class.

For instance, in June 2025, the U.S. approved Datroway (datopotamab deruxtecan), an ADC targeting the TROP 2 protein, for the treatment of advanced non-small cell lung cancer in adults who had previously undergone treatment. Additionally, in February 2025, the FDA approved Datroway for the treatment of unresectable or metastatic hormone receptor-positive, HER2-negative breast cancer in adults who had undergone prior endocrine-based therapy and chemotherapy. Similarly, in April 2025, GSK received UK regulatory approval for Blenrep, an ADC for the treatment of adults with multiple myeloma in combination with another medication after at least one prior therapy. These developments highlight the continued growth and validation of ADC therapies.

In addition to the pipeline momentum, the availability of several approved ADCs is shaping the current market landscape. Key products include Kadcyla and Polivy by Genentech/Roche, Adcetris by Seattle Genetics, Enhertu from AstraZeneca and Daiichi Sankyo, and Pfizer’s Besponsa and Mylotarg. These drugs have demonstrated clinical success in targeting specific cancer indications, increasing physician confidence and patient acceptance. Furthermore, strategic collaborations and acquisitions are driving market growth. For example, in March 2025, AstraZeneca agreed to acquire biotechnology company EsoBiotec for up to $1 billion to expand its investments in cell therapies for cancer treatment. In June 2025, BioNTech and Bristol Myers Squibb announced a collaboration to co-develop and commercialize BNT327, an experimental ADC, with BioNTech receiving an upfront payment of $1.5 billion and potential milestone payments totaling up to $7.6 billion. ADCs are designed to combine a monoclonal antibody with a chemotherapy drug, connected through a stable chemical linker. This targeted mechanism enables precise treatment delivery to tumor cells while reducing systemic toxicity, differentiating ADCs from traditional chemotherapy. As demand grows for therapies that balance effectiveness with safety, the role of ADCs in cancer care is expected to become even more prominent across global markets.

Market Concentration & Characteristics

The Antibody Drug Conjugates market is marked by a high degree of innovation, with continuous advancements in the linker and payload technologies. Leading firms such as Seagen and Daiichi Sankyo are investing in cleavable and non-cleavable linkers to improve drug stability and precision. Innovation is also seen in payload diversity, expanding beyond MMAE and DM4 to novel cytotoxins. HER2 and CD30 remain prominent targets, but new antigen discoveries push the boundaries of antibody-drug conjugates' applicability. This technological evolution supports pipeline diversification and helps address unmet needs in various cancers.

The antibody drug conjugates market presents significant barriers to entry due to high R&D costs, complex manufacturing processes, and stringent clinical trial requirements. Emerging firms face challenges in developing stable linkers and effective targeting mechanisms. Established players like Roche and AstraZeneca benefit from intellectual property, production expertise, and access to global clinical networks. Regulatory hurdles also require substantial financial and technical resources, limiting new entrants. Moreover, the need for interdisciplinary integration of biologics, small molecules, and drug delivery platforms further restricts easy market access.

Regulatory frameworks substantially impact the antibody drug conjugates market, particularly concerning safety, efficacy, and manufacturing standards. Agencies like the FDA and EMA require comprehensive data on linker stability, toxicity profiles, and off-target effects. While accelerated approval pathways exist for breakthrough therapies, post-marketing surveillance obligations remain stringent. Regulatory scrutiny favors firms with established compliance infrastructure, such as Pfizer and Gilead Sciences. Additionally, companion diagnostics and biomarker validation are often mandated, influencing development timelines and market readiness.

While antibody drug conjugates offer targeted efficacy, competition from immune checkpoint inhibitors, CAR-T cell therapies, and small molecule inhibitors poses substitution threats. For certain cancers like lymphoma or urothelial carcinoma, these alternatives may offer similar or superior outcomes with differing side effect profiles. However, antibody drug conjugates remain preferred when tumor-specific targeting is crucial, particularly with HER2 and CD30 expression. The presence of existing monoclonal antibodies without payloads also presents internal substitution risks. Despite this, the unique mechanism of antibody drug conjugates sustains their relevance, especially when other therapies fail, or resistance develops.

Geographical expansion in the antibody drug conjugates market is increasing, with key players entering Asia Pacific, Latin America, and Middle East regions to tap into unmet oncology needs. Companies like Astellas and AstraZeneca are forming regional collaborations and investing in localized trials. Japan, China, and India are gaining prominence as clinical trial hubs and commercial targets. Regulatory harmonization efforts are facilitating broader market access, although reimbursement policies vary. This global outreach supports market growth and offsets North America and Europe saturation.

Application Insights

Breast Cancer segment holds the largest market share of 40.95% in 2024. Growth is driven by a large addressable incidence and the expansion of HER2 testing from “positive” to include HER2-low and ultralow categories. In May 2019, ado-trastuzumab emtansine (Kadcyla; Genentech/Roche) received adjuvant approval, establishing an early market position. In July 2022, trastuzumab deruxtecan demonstrated clinical superiority in the DESTINY-Breast04 trial, leading to label expansions during 2024-2025 that extended access in HR-positive disease. Sacituzumab govitecan continues to contribute to demand in metastatic triple-negative breast cancer, including cases with minimal or absent HER2 expression. Favorable inclusion in clinical guidelines, expanded use of companion diagnostics, and established reimbursement mechanisms in the United States, EU5, and Japan are supporting broader adoption.

Urothelial Carcinoma segment is projected to grow the fastest in the forecast period. Growth is supported by shifts in first-line treatment and the adoption of broader biomarker strategies. In December 2023, the U.S. FDA approved enfortumab vedotin plus pembrolizumab as a first-line regimen, following the pivotal EV-302/KEYNOTE-A39, which showed superior survival outcomes. Expansion of infusion infrastructure, payer alignment, and endorsement in clinical guidelines are improving treatment access. Real-world data are also mitigating prescriber concerns about adverse effects such as rash and neuropathy associated with Nectin-4-targeted MMAE therapies. Regional approvals, including disitamab deruxtecan and other HER2-directed antibody-drug conjugates in Asia and ongoing trials in maintenance, perioperative, and cisplatin-ineligible settings, continue to add momentum.

Product Insights

The Enhertu (trastuzumab deruxtecan) segment led the market with market share of 27.73% in 2024. Growth is supported by label expansion and increasing clinical adoption. In June 2024, the FDA granted tumor-agnostic approval for previously treated HER2-positive solid tumors. In January 2025, Enhertu received U.S. approval for unresectable or metastatic HR-positive, HER2-low/ultralow breast cancer, significantly expanding its eligible population. Core evidence includes the DESTINY-Breast04 trial, pan-tumor data, and ESMO 2025 results indicating performance advantages over Kadcyla in high-risk early disease and promising neoadjuvant activity.

The AstraZeneca-Daiichi Sankyo collaboration supports global commercialization, with planned ADC manufacturing expansion in Singapore to strengthen supply resilience. Adoption has accelerated as HER2 testing extends to low and ultralow categories, and standardized ILD monitoring has increased clinician confidence. Reimbursement approvals across the U.S., EU5, and APAC markets have improved access and expanded community oncology uptake. With several peri-operative and early-line studies maturing and diagnostic reach growing in emerging markets, Enhertu’s demand outlook remains strong, supported by expanded indications and sustained sponsor investment.

Payload Insights

Auristatin (MMAE, MMAF) segment dominates the market with revenue share of 36.01% in 2024, Growth reflects proven clinical performance, regulatory familiarity, and scalable production. Auristatins-monomethyl auristatin E (MMAE) and F (MMAF)-are synthetic analogs of dolastatin 10 that disrupt microtubule assembly and trigger apoptosis in tumor cells. These payloads support leading ADCs such as Adcetris (brentuximab vedotin; Seagen/Pfizer), Polivy (polatuzumab vedotin; Roche), and (enfortumab vedotin; Astellas/Pfizer).

Topoisomerase I Inhibitors (SN-38, DXd) segment is expected to grow the fastest, supported by strong efficacy in solid tumors and evolving safety data. These payloads inhibit topoisomerase I, leading to DNA damage and apoptosis with a differentiated toxicity profile versus microtubule disruptors. In July 2022, trastuzumab deruxtecan achieved landmark results in HER2-low disease, while in June 2024, the TROPION-Breast01 study (Lancet Oncology) validated datopotamab deruxtecan (Datroway; AstraZeneca/Daiichi Sankyo), later approved in 2025 for HR+/HER2- breast cancer. Controlled-release formulations, such as the DXd payload, have improved potency-risk balance and regulatory acceptance. Rapid adoption in breast, lung, gastric, and urothelial cancers, combined with active pipelines for SN-38-based ADCs, indicates a sustained shift toward DNA-targeting payloads. As production efficiency and monitoring frameworks advance, topoisomerase inhibitor-based ADCs are positioned to lead the next phase of oncology payload innovation.

Technology Insights

Cleavable Linker segment is expected to maintain the largest market share of 67.84% in 2024, driven by its established role in targeted therapy. Cleavable linkers are designed to release the drug payload selectively within the target cell, enhancing therapeutic efficacy. This segment's growth is supported by the increasing adoption of antibody-drug conjugates (ADCs) in various oncology indications. Additionally, regulatory approvals and the ongoing clinical development of new ADCs using cleavable linkers are contributing to market stability and expansion. Increasing investments in research and development by major pharmaceutical companies, coupled with growing collaborations, are anticipated to further drive the segment’s dominance in the coming years.

Non-Cleavable Linker segment is projected to experience the highest growth during the forecast period, primarily due to advancements in the design of more stable ADCs that are capable of delivering a potent and sustained drug release. Non-cleavable linkers provide greater stability during systemic circulation, which reduces premature release and improves therapeutic outcomes in certain cancer types. The segment is benefitting from increased focus on improving drug delivery systems to overcome challenges related to linker stability and premature payload release. Clinical trials demonstrating the effectiveness of ADCs using non-cleavable linkers, especially in solid tumors, are expected to further accelerate market growth.

Distribution Channel Insights

The Hospital Pharmacy segment dominated the market with revenue share of 52.94% in 2024. Growth reflects the concentration of oncology care in hospital settings and the handling standards required for complex biologics. ADCs such as Enhertu (AstraZeneca/Daiichi Sankyo), Polivy (Roche), and Adcetris (Pfizer/Seagen) are administered through intravenous infusion, requiring specialized supervision from pharmacists, oncologists, and nursing staff. Hospital systems manage the storage and reconstitution processes under controlled conditions and operate within established reimbursement frameworks, including Medicare Part B in the U.S. and DRG-based systems across Europe.

The Specialty Pharmacy segment is expected to record the highest growth through 2033, supported by the decentralization of cancer care and the rise of value-based distribution models. Specialty pharmacies are increasingly integrated into oncology care pathways to facilitate patient access and manage high-cost biologics. Their expertise in cold-chain logistics, reimbursement coordination, and adverse event tracking positions them as key intermediaries between manufacturers and payers.

Regional Insights

North America Antibody Drug Conjugates Market Trends

North America held the largest share of 40.08% of the Antibody drug conjugates market in 2024, due to strong clinical research infrastructure and early adoption of advanced oncology therapies. High prevalence of cancer and increasing use of targeted therapies support sustained demand for antibody drug conjugates. Major pharmaceutical companies such as Seagen, Pfizer, and Gilead Sciences maintain extensive development and commercialization capabilities across the region. Strategic partnerships and continuous innovation in payload and linker technologies enhance regional competitiveness. The presence of experienced regulatory agencies ensures smooth market entry for novel therapeutics. High healthcare spending further drives accessibility and utilization of antibody drug conjugates across various cancer indications.

U.S. Antibody Drug Conjugates Market Trends

The U.S. holds the largest share in the North America antibody drug conjugates market owing to advanced healthcare systems and robust oncology pipelines. High incidence of breast and blood cancers creates steady demand for HER2- and CD-targeted antibody drug conjugates. Companies such as Roche, AstraZeneca, and Daiichi Sankyo have expanded their commercial footprint through key product launches and label expansions. Favorable reimbursement policies for oncology treatments increase patient access to antibody drug conjugates therapies. The market benefits from continuous R&D investment and rapid clinical trial execution. Strong academic-industry collaboration further supports innovation and adoption of next-generation antibody drug conjugates.

Europe Antibody Drug Conjugates Market Trends

Europe represents a significant region in the global antibody drug conjugates market, supported by expanding access to precision oncology therapies. Rising cancer burden across countries such as Germany, France, and Italy boosts clinical demand for targeted treatments. Pharmaceutical companies are increasing their focus on Europe through regulatory approvals and strategic product launches. Widespread use of Kadcyla, Polivy, and Adcetris across major indications strengthens regional adoption. Oncology research centers and academic hospitals support ongoing development of novel antibody drug conjugates. Growing awareness of treatment safety and efficacy is influencing clinical decision-making in favor of antibody drug conjugates.

UK Antibody Drug Conjugates Market Trends

The UK is emerging as a key contributor to the European antibody drug conjugates market, driven by strong cancer research programs and early access schemes. High adoption of antibody drug conjugates in breast and hematologic cancers reflects growing clinical confidence in targeted approaches. Ongoing collaborations between academic institutions and global pharmaceutical firms support innovation in this space. Enhertu and Trodelvy have gained traction in UK oncology clinics through expanding indication approvals. Market expansion is further supported by widespread diagnostic capabilities that aid in biomarker-based patient selection. The UK’s healthcare infrastructure allows for efficient integration of new oncology drugs into treatment pathways.

Germany Antibody Drug Conjugates Market Trends

Germany holds a strong position in the European antibody drug conjugates market due to its advanced pharmaceutical industry and oncology expertise. High patient volumes and demand for personalized therapies contribute to increased antibody drug conjugates utilization. Hospitals and specialty clinics are equipped to administer antibody drug conjugates for both solid and hematologic tumors. Companies such as Roche and Takeda have established deep market penetration through locally approved antibody drug conjugates. The presence of efficient clinical trial networks aids in early product testing and introduction. Germany’s emphasis on treatment precision supports the sustained growth of the antibody drug conjugates segment.

France Antibody Drug Conjugates Market Trends

France holds a strong position in the European antibody drug conjugates market due to high healthcare standards and advanced cancer treatment practices. antibody drug conjugates such as Kadcyla, Enhertu, and Polivy are widely used across cancer centers for indications including breast and blood cancers. The country benefits from a well-organized clinical trial ecosystem that supports innovation and faster product introduction. Leading pharmaceutical companies have a strong presence, ensuring consistent supply and training for antibody drug conjugates use. Adoption is also supported by widespread access to molecular diagnostics, enabling more targeted treatment approaches. France’s emphasis on treatment precision and patient outcomes continues to reinforce market expansion.

Asia-Pacific Antibody Drug Conjugates Market Trends

Asia Pacific antibody drug conjugates market is expected to register the significant CAGR of 11.77% over the forecast period, due to rising cancer incidence and increased adoption of targeted therapies. Expanding healthcare infrastructure and oncology diagnostics are key enablers for market entry and growth. Companies are pursuing aggressive expansion strategies through pricing adjustments, local partnerships, and regulatory approvals. Launches of products such as Kadcyla and Enhertu in Asian countries have accelerated market uptake. Demand is rising for antibody drug conjugates in breast and blood cancers, supported by an evolving treatment landscape. Continued investment in clinical trials and R&D activities is expected to further drive regional expansion.

Japan Antibody Drug Conjugates Market Trends

Japan’s antibody drug conjugates market is gaining traction through strong clinical research and early integration of innovative therapies. High awareness of precision oncology drives adoption of HER2- and CD-targeted antibody drug conjugates across major cancer centers. Collaborations between Japanese pharmaceutical firms and global companies facilitate timely market introductions. Enhertu, co-developed by Daiichi Sankyo, has seen rapid uptake following its domestic approval. Availability of specialized diagnostic tools aids in identifying suitable patients for antibody drug conjugates therapies. Japan’s well-established pharmaceutical sector continues to support both domestic and imported antibody drug conjugates products.

China Antibody Drug Conjugates Market Trends

China is emerging as a major market for antibody drug conjugates due to rapid healthcare modernization and growing cancer treatment demand. The approval of Kadcyla and other antibody drug conjugates has contributed to wider clinical availability and use. Roche’s strategic pricing adjustments and commercial focus have strengthened its position in the Chinese oncology space. Increasing patient access to HER2-targeted therapies is shaping the growth trajectory of the antibody drug conjugates market. Domestic firms are also investing in antibody drug conjugates development, fostering local innovation and competition. China’s rising healthcare consumption and expanding diagnostic capabilities are supporting sustained demand for antibody drug conjugates.

Latin America Antibody Drug Conjugates Market Trends

The antibody drug conjugates market in Latin America is growing steadily, driven by the rising cancer burden and increasing focus on precision oncology. Breast and hematologic cancers are contributing significantly to the regional demand for targeted treatments. Pharmaceutical companies are expanding their operations through collaborations with local healthcare providers and distributors. Access to approved antibody drug conjugates is gradually improving as countries enhance regulatory frameworks and oncology capabilities. Awareness of the clinical benefits of antibody drug conjugates is encouraging oncologists to shift from traditional chemotherapy to targeted options. Ongoing clinical trials and product registrations are expected to support future market growth across Latin America.

Brazil Antibody Drug Conjugates Market Trends

Brazil is the leading market for antibody drug conjugates in Latin America, supported by its large population and increasing incidence of cancer. The country is seeing rising adoption of antibody drug conjugates such as Kadcyla and Adcetris for treating HER2-positive breast cancer and lymphomas. Private and public hospitals are enhancing oncology services, which include targeted therapies as part of standard care. Pharmaceutical firms are actively working to expand product availability through pricing strategies and regulatory approvals. Clinical infrastructure is improving, enabling better patient access to biomarker testing and precision treatments. Brazil’s growing oncology focus is expected to drive continued uptake of antibody drug conjugates.

Middle East & Africa Antibody Drug Conjugates Market Trends

The MEA region is witnessing gradual growth in the antibody drug conjugates market due to increasing cancer burden and improved access to advanced therapies. Major hospitals and specialty centers are expanding oncology services that include antibody drug conjugates administration. International pharmaceutical companies are working with regional stakeholders to introduce approved antibody drug conjugates for breast and blood cancers. Enhancements in diagnostic capabilities are enabling biomarker-driven treatment strategies. Rising awareness among healthcare providers is contributing to a shift toward precision oncology. Although market penetration remains moderate, the outlook for antibody drug conjugates adoption is positive across the region.

Saudi Arabia Antibody Drug Conjugates Market Trends

Saudi Arabia is expanding its presence in the antibody drug conjugates market through increasing adoption of modern oncology therapies. Key hospitals are incorporating antibody drug conjugates into standard cancer treatment regimens for HER2-positive and hematologic malignancies. The demand for innovative therapies is rising in response to growing cancer prevalence and changing treatment protocols. International pharmaceutical firms are establishing collaborations to support the introduction of antibody drug conjugates. Diagnostic improvements are enabling more effective targeting of therapies based on tumor markers. This focus on precision treatment is expected to strengthen the market’s growth in the country.

Key Companies & Market Share Insights

Seagen, Inc. leads the antibody drug conjugates market with strong clinical success and products like Adcetris. Takeda, AstraZeneca, and Roche maintain solid positions through strategic collaborations and targeted oncology portfolios. Pfizer, Gilead, and Daiichi Sankyo continue to expand access with effective distribution and promising label expansions. ADC Therapeutics is emerging with innovative technologies and niche focus. Competitive intensity is rising as companies target broader cancer types and improve therapeutic precision. The market is set for sustained growth driven by innovation and clinical adoption.

Key Antibody Drug Conjugates Companies:

The following are the leading companies in the antibody drug conjugates market. These companies collectively hold the largest market share and dictate industry trends.

- Seagen, Inc.

- Takeda Pharmaceutical Company Ltd.

- AstraZeneca

- F. Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Ltd.

- antibody drug conjugates Therapeutics SA

Recent Developments

-

In January 2024, Celltrion, Inc. and WuXi XDC entered into a Memorandum of Understanding (MoU) to collaborate on comprehensive antibody-drug conjugate (ADC) services, covering both development and manufacturing activities.

-

In January 2024, Johnson & Johnson Services, Inc. completed the acquisition of Ambrx Biopharma, Inc., a company known for its proprietary antibody-drug conjugate (ADC) technology used in creating advanced cancer therapies. This move is intended to strengthen J&J’s oncology portfolio, particularly in prostate cancer, by leveraging Ambrx’s innovative ADC platform.

-

In January 2024, MediLink Therapeutics entered into a licensing and collaboration agreement with F. Hoffmann-La Roche Ltd. to advance the development of YL211, a next-generation antibody-drug conjugate (ADC).

Antibody Drug Conjugates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.46 billion

Revenue forecast in 2033

USD 32.11 billion

Growth rate

CAGR of 10.49% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, product, payload, technology, distribution channel and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key company profiled

Seagen, Inc.; Takeda Pharmaceutical Company Ltd.; AstraZeneca; F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; Gilead Sciences, Inc.; Daiichi Sankyo Company Ltd.; antibody drug conjugates Therapeutics SA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibody Drug Conjugates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global antibody drug conjugates market report based on application, product, payload, technology, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Breast Cancer

-

Blood Cancer

-

Lymphoma

-

Leukemia

-

-

Urothelial Carcinoma

-

Ovarian Cancer

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Kadcyla (ado-trastuzumab emtansine)

-

Enhertu (trastuzumab deruxtecan)

-

Trodelvy (sacituzumab govitecan)

-

Adcetris (brentuximab vedotin)

-

Polivy (polatuzumab vedotin)

-

Others (Padcev, Tivdak, Elahere, Zynlonta, Mylotarg, Besponsa)

-

-

Payload Outlook (Revenue, USD Million, 2021 - 2033)

-

Auristatins (MMAE, MMAF)

-

Maytansinoids (DM1, DM4)

-

Calicheamicin Derivatives

-

Topoisomerase I Inhibitors (SN-38, DXd)

-

Pyrrolobenzodiazepine (PBD) Dimers

-

Others

-

-

TechnologyOutlook (Revenue, USD Million, 2021 - 2033)

-

Cleavable Linker

-

Non-Cleavable Linker

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Specialty Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.