- Home

- »

- Market Trend Reports

- »

-

Ivacaftor + Tezacaftor + Elexacaftor (Trikafta/Kaftrio) Market: Trends, Competitive Landscape, And Growth Opportunities In Cystic Fibrosis

Report Overview

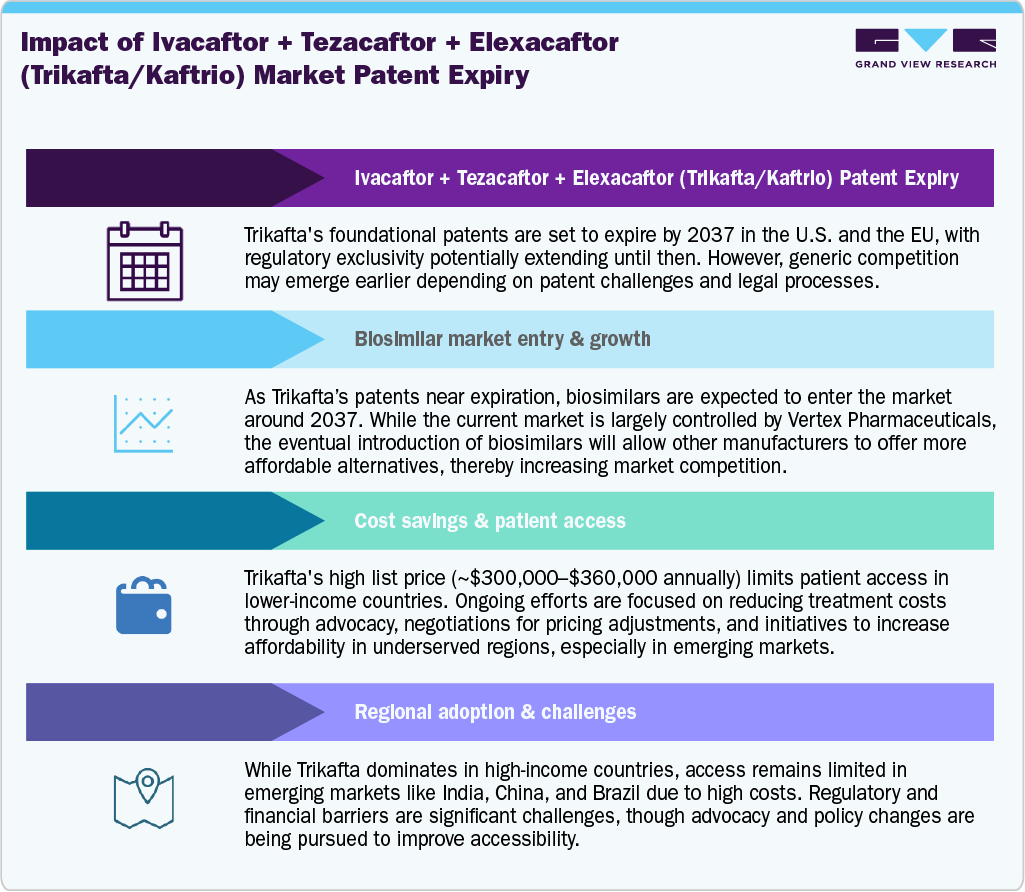

Trikafta (U.S.) / Kaftrio (EU), developed by Vertex Pharmaceuticals, represents a major advancement in cystic fibrosis (CF) therapeutics, redefining disease management through a triple-combination CFTR modulator approach. Since receiving FDA approval in 2019, followed by regulatory clearances across Europe, the UK, and other key markets, therapy has become the global standard of care for patients carrying at least one F508del mutation, addressing approximately 90% of the CF population. Clinically, the combination delivers superior efficacy outcomes, including sustained improvements in pulmonary function, nutritional status, and quality of life, driving robust adoption across developed markets. Ongoing label expansions into younger age cohorts continue to broaden the therapy’s patient base, reinforcing Vertex’s leadership position in the CF landscape.

Despite its clinical success, high annual treatment costs estimated at USD 300,000–360,000 per patient-remain a barrier to widespread adoption, particularly in price-sensitive markets. While patent protection through 2037 ensures continued market exclusivity, early-access initiatives, compulsory licensing discussions, and advocacy-driven affordability programs in countries such as Argentina and India are reshaping the global access narrative.

Over the medium term, Trikafta/Kaftrio is expected to maintain a dominant market position, supported by strong clinical validation, expanded reimbursement frameworks, and Vertex’s R&D pipeline focused on next-generation CFTR modulators and gene-based therapies. The commercial trajectory will depend on the company’s ability to balance pricing strategies, geographic expansion, and portfolio innovation ahead of potential generic entry post-2037.

Key Report Deliverables

-

Analyze the Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market landscape, detailing the current market size, growth drivers, and key industry trends, particularly in light of the upcoming patent expiration and the impact of biosimilars entering the market.

-

Forecast Market Growth, projecting future trends for the Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market, highlighting emerging opportunities within the biosimilar space, and assessing potential risks to growth as competition increases following patent expiry.

-

Identify Regulatory and Market Barriers, providing insights into regulatory and market barriers that could impact future market expansion and product development, with a specific focus on the challenges biosimilars may face in gaining approval and market access.

-

Concurrent Competitive Landscape, identifying key players in the Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market, including both originator and biosimilar manufacturers. Examine their strategic moves, partnerships, and distribution of market share to understand competitive positioning and potential shifts as biosimilars are introduced.

-

Regulatory Barriers, identifying key regulatory challenges related to the entry of Ibalizumab (Trogarzo) biosimilars, including approval processes and market access restrictions, and assessing their potential impact on the speed and scope of market expansion.

-

Strategic Implications, evaluating strategic moves for Janssen Biotech and its competitors to maintain leadership in the Aflibercept market. This includes exploring innovation, differentiation, potential patient support programs, and geographic expansion strategies.

Patent Landscape and Exclusivity Outlook

The patent landscape for Ibalizumab (Trogarzo) reflects the typical progression of a biologic product that transitioned from early research to niche commercialization. The core composition-of-matter patents, covering the antibody structure and its complementary determining regions (CDRs), were initially filed in the early 1990s and expired between 2011 and 2016 across major jurisdictions including the United States, Europe, Canada, and Australia. This expiry effectively released the foundational antibody structure into the public domain, eliminating the primary intellectual property barriers around the molecule itself.

Despite the expiration of the original patents, regulatory exclusivity now serves as the primary protection mechanism. Under the U.S. Biologics Price Competition and Innovation Act (BPCI Act), Trogarzo benefits from 12 years of biologic exclusivity, protecting it from biosimilar competition until March 2030. Similarly, in the European Union, data and market exclusivity are expected to extend until 2028–2030, depending on national extensions.

Beyond these regulatory protections, secondary patents covering formulations, dosing regimens, and administration methods have been filed, with at least one U.S. patent extending until November 2036. Additional filings listed in the Medicines Patent Pool (MPP) indicate certain method-of-use or process patents potentially valid until 2040, though these are narrower in scope and jurisdictionally dependent.

In practical terms, biosimilar entry is not anticipated before 2030 in regulated markets such as the U.S. and EU. Emerging markets like India, China, and Brazil, where patent coverage has lapsed or was never filed, may witness earlier biosimilar development between 2026 and 2028. Overall, the patent expiry pattern positions Trogarzo as a protected biologic asset through 2030, with extended defensive IP layers offering incremental exclusivity until the mid-2030s.

Current Market Scenarios

The current market scenario for Ivacaftor + Tezacaftor + Elexacaftor, marketed as Trikafta in the U.S. and Kaftrio in Europe, reflects a period of sustained dominance and controlled expansion within the global cystic fibrosis (CF) therapeutics landscape. Since its launch in 2019, the therapy has emerged as the cornerstone of CF management, transforming patient outcomes and establishing Vertex Pharmaceuticals as the undisputed leader in CF treatment.

Clinically, the triple-combination therapy remains the most effective CFTR modulator available, showing substantial and durable improvements in lung function, pulmonary exacerbation rates, and nutritional parameters. Physician preference and patient adherence levels are exceptionally high due to the product’s proven efficacy and manageable safety profile, resulting in near-complete conversion of eligible CF patients in the U.S. and Western Europe.

Commercially, Vertex’s CF franchise continues to outperform, driven primarily by Trikafta/Kaftrio uptake. The therapy accounts for over 80% of Vertex’s total revenue, with steady volume growth in existing markets and new patient additions from recent age-based label expansions (down to patients as young as two years old). However, pricing and reimbursement negotiations remain a key operational focus-particularly across Europe, Canada, and emerging markets-as healthcare systems evaluate long-term cost-effectiveness and budgetary impact.

Market access disparities persist, especially in low- and middle-income countries, where high list prices (USD 300,000–360,000 annually) limit availability. Advocacy-led initiatives and compulsory licensing discussions are gaining momentum to improve access. Meanwhile, Vertex is advancing next-generation CFTR modulators and gene-editing programs, aiming to extend its leadership beyond the current lifecycle of Trikafta/Kaftrio.

Overall, the market remains highly consolidated, with Vertex holding near-monopoly control until generic entry post-2037, underpinned by a strong patent portfolio, regulatory exclusivity, and a robust global supply network.

Market Dynamics

“Expanding Clinical Reach and Transformative Therapeutic Efficacy”

The foremost driver propelling the Ivacaftor + Tezacaftor + Elexacaftor (Trikafta / Kaftrio) market is its unparalleled clinical performance and broad therapeutic applicability across the cystic fibrosis (CF) patient spectrum. The triple-combination CFTR modulator directly addresses the underlying genetic defect (F508del mutation), covering approximately 90% of all CF patients worldwide, compared to less than 50% coverage by earlier modulators such as Orkambi or Symdeko. Clinical trials and real-world evidence have demonstrated significant improvements in lung function (FEV₁ increases of up to 14%), weight gain, and quality of life, alongside substantial reductions in pulmonary exacerbations and hospitalizations. These outcomes have led to rapid adoption among physicians and payers in high-income markets, with strong patient adherence due to visible therapeutic benefits.

Furthermore, regulatory approvals in younger age groups, including patients as young as two years old are broadening the treatment base. The continuous label expansion and clinical validation across multiple demographics ensure sustained demand growth and reinforce Vertex Pharmaceuticals’ dominant market leadership in the CF domain.

“High Pricing, Access Inequality, and Reimbursement Complexity”

The leading restraint in the Trikafta/Kaftrio market is the prohibitively high cost of therapy, which poses significant challenges for reimbursement and equitable access across global healthcare systems. The annual list price ranges between USD 300,000–360,000 per patient in the U.S., making it one of the most expensive chronic therapies worldwide. While payers in the U.S., Canada, and Europe have gradually integrated the drug into reimbursement frameworks, negotiations often involve cost-effectiveness assessments, real-world outcome evaluations, and long-term value-based agreements.

In contrast, low- and middle-income countries (LMICs) face systemic barriers to access, leading to widespread treatment gaps and patient-led advocacy movements. The patent protection until 2037, coupled with regulatory exclusivity, prevents generic entry and maintains pricing rigidity. This has triggered compulsory licensing debates in markets such as India, Brazil, and Argentina, where governments and NGOs are pressing for affordable alternatives. Thus, while the product’s clinical efficacy is undisputed, its economic burden and access disparity remain major commercial and ethical challenges.

“Next-Generation Modulators and Global Access Expansion”

The opportunity landscape for Trikafta/Kaftrio is anchored in portfolio diversification, geographic expansion, and next-generation innovation. Vertex is actively developing new CFTR modulator combinations and gene-editing therapies to target patients with non-F508del mutations, a segment currently underserved by existing treatments. These R&D initiatives aim to extend the company’s franchise lifecycle well beyond 2037, ensuring continuity in market leadership post-patent expiry.

On the geographic front, emerging markets such as Asia-Pacific, Latin America, and the Middle East present untapped potential as diagnostic capabilities, screening programs, and rare disease funding improve. Collaborative initiatives between Vertex, national health agencies, and global health organizations can facilitate tiered pricing, local manufacturing, and expanded access frameworks, unlocking new revenue streams while advancing global health equity.

Additionally, ongoing digital patient monitoring and real-world evidence programs are expected to strengthen payer confidence and support long-term therapy adoption.

“Broadening Patient Eligibility Through Label Expansion, Global Push Toward Access and Affordability, Advancements in Next-Generation and Gene-Based Therapies contributing to the market”

- Broadening Patient Eligibility Through Label Expansion

A major trend shaping the Trikafta/Kaftrio market is the progressive expansion of regulatory approvals to younger patient populations. Initially approved for individuals aged 12 years and older, Trikafta has now been authorized for children as young as two years old in the U.S., EU, and select APAC markets. This broadening eligibility base significantly increases the long-term treatment pool and strengthens Vertex’s commercial sustainability. Early intervention not only improves lung development and life expectancy but also reduces lifetime healthcare costs, driving payer and physician support. As diagnostic programs and newborn CF screening coverage expand globally, early initiation of CFTR modulator therapy is expected to become standard clinical practice, ensuring consistent market growth.

- Global Push Toward Access and Affordability

Rising awareness of CF treatment disparities has sparked a global push for access and affordability. Trikafta’s high annual cost of USD 300,000–360,000 per patient has fueled advocacy movements and compulsory licensing discussions in countries such as India and Argentina. Health agencies and patient groups are increasingly calling for tiered pricing models, local manufacturing partnerships, and government-led funding programs. This shift indicates a broader move toward equitable healthcare access and sustainable pricing strategies, particularly in emerging markets where affordability remains a critical barrier to adoption.

- Advancements in Next-Generation and Gene-Based Therapies

The cystic fibrosis treatment landscape is evolving rapidly with the rise of next-generation CFTR modulators and gene therapies. Vertex is advancing novel combination regimens and genetic correction approaches, including mRNA-based and CRISPR-driven therapies, aimed at addressing mutations unresponsive to current drugs. These innovations represent the transition from chronic management to potentially curative solutions, positioning Vertex to maintain leadership beyond Trikafta’s patent horizon while reshaping the long-term future of CF care

Overview of Alternative Therapeutics

The cystic fibrosis (CF) therapeutics landscape is evolving beyond CFTR modulators such as Ivacaftor + Tezacaftor + Elexacaftor (Trikafta/Kaftrio), with several alternative treatment modalities under development targeting either complementary mechanisms or curative outcomes. These emerging approaches aim to address patient populations ineligible for CFTR modulator therapy, particularly those with non-F508del mutations or advanced pulmonary decline where modulators offer limited efficacy.

One major category of alternative therapeutics is gene-based therapy, focusing on CFTR gene replacement, editing, and mRNA delivery technologies. Companies such as ReCode Therapeutics, 4D Molecular Therapeutics, and Arcturus Therapeutics are developing inhaled mRNA and viral vector-based gene delivery platforms designed to restore normal CFTR protein function regardless of mutation type. Similarly, CRISPR/Cas9 and base-editing programs from Vertex Pharmaceuticals and Moderna aim to achieve permanent genetic correction at the root cause level, representing a potential paradigm shift from chronic management to one-time curative treatment.

In parallel, anti-inflammatory, mucolytic, and airway hydration therapies continue to complement CFTR modulators, improving symptom control and lung function maintenance. Notable candidates include lenabasum (Corbus Pharmaceuticals) targeting inflammation, and inhaled nitric oxide and ENaC inhibitors under study for airway clearance. Additionally, antimicrobial peptides and bacteriophage therapies are gaining traction as solutions to antibiotic-resistant pulmonary infections, a persistent challenge in CF management.

Together, these alternative therapeutics represent the next wave of innovation in CF care, emphasizing mutation-independent, long-lasting, and potentially curative strategies. While CFTR modulators like Trikafta dominate current treatment, the emergence of gene and RNA-based platforms could redefine the competitive landscape by 2030 and beyond, expanding options for patients who remain underserved by existing therapies.

Competitive Landscape

The competitive landscape for Ivacaftor + Tezacaftor + Elexacaftor (Trikafta / Kaftrio) remains highly consolidated, with Vertex Pharmaceuticals holding a dominant market position in the global cystic fibrosis (CF) therapeutics segment. Vertex’s proprietary CFTR modulator portfolio-including Kalydeco (Ivacaftor), Orkambi (Ivacaftor + Lumacaftor), Symdeko/Symkevi (Ivacaftor + Tezacaftor), and Trikafta/Kaftrio-collectively accounts for over 95% of the CF drug market revenue. The company’s integrated strategy combining strong clinical data, robust intellectual property (IP) protection, and rapid global regulatory expansion has established a near-monopoly in space.

Currently, Trikafta/Kaftrio serves as the flagship product, driving Vertex’s annual revenues above USD 11 billion in 2024, with continuous uptake across new age groups and regions. Competitors face significant barriers to entry due to Vertex’s multi-layered patent protection until 2037, covering composition of matter, combination use, and formulation technology. Additionally, Vertex’s deep R&D investments into next-generation CFTR modulators and gene-editing therapies reinforce its long-term competitive moat.

Despite this dominance, emerging biotech firms and academic collaborations are pursuing alternative therapeutic platforms that may redefine the CF treatment paradigm post-2030. Companies such as ReCode Therapeutics, 4D Molecular Therapeutics, Arcturus Therapeutics, and Cystetic Medicines are developing mRNA-based and gene-replacement therapies aimed at addressing mutations unresponsive to current modulators. Moreover, Sionna Therapeutics, a Vertex-partnered spinout, is exploring novel small-molecule CFTR stabilizers, adding further innovation to the competitive pipeline.

While Vertex maintains a commanding global presence, future competition will likely emerge from mutation-agnostic, curative therapies, particularly those leveraging gene editing, mRNA delivery, and inhaled gene-transfer platforms. Over the next decade, the competitive intensity is expected to rise as new entrants target residual unmet needs, yet Vertex’s brand equity, regulatory experience, and extensive clinical data will continue to provide a decisive strategic advantage.

Regional Analysis

North America Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market

North America represents the largest and most mature market for Ivacaftor + Tezacaftor + Elexacaftor (Trikafta), driven by early regulatory approval, favorable reimbursement structures, and strong clinical adoption. In the United States, Vertex Pharmaceuticals continues to dominate the cystic fibrosis (CF) space, supported by broad payer coverage across both private and public insurers. The FDA approval in 2019 and subsequent label expansions to younger pediatric populations have significantly widened the eligible patient base. Reimbursement frameworks emphasize long-term value based on improvements in lung function, hospitalization reduction, and quality of life, positioning Trikafta as the standard of care. Canada has followed a similar path, with pan-Canadian reimbursement agreements ensuring wide access. The market benefits from high diagnostic accuracy, patient registry networks, and advanced clinical infrastructure, enabling consistent treatment adherence and monitoring. However, the pricing structure, averaging USD 300,000–360,000 annually, continues to draw attention from policymakers and advocacy groups demanding cost optimization. Despite these discussions, Vertex’s revenue trajectory remains stable, reflecting sustained demand and the absence of meaningful competition. The company’s North American performance serves as a benchmark for its global CF portfolio and underscores the region’s strategic importance as a key revenue

Europe Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market

Europe constitutes the second-largest market for Kaftrio, the European brand name for Trikafta, with extensive regulatory and reimbursement progress achieved since its EMA approval in 2020. The therapy’s rollout has been guided by country-specific health technology assessments (HTAs) and managed access agreements designed to balance cost with demonstrated clinical benefit. Major economies including the United Kingdom, Germany, France, and Italy have incorporated Kaftrio into national formularies following long negotiations with Vertex Pharmaceuticals to secure favorable pricing and early access. The European market has also benefited from strong collaboration with patient advocacy organizations, accelerating approvals for younger patient populations. Despite these advancements, pricing disparities and budget constraints remain key barriers in smaller EU states and Eastern Europe, where delayed reimbursement limits penetration. Nevertheless, Kaftrio’s expanding clinical evidence base continues to strengthen its cost-effectiveness profile, supporting sustainable adoption. Ongoing pediatric label extensions, combined with the European Supplementary Protection Certificates (SPCs) extending exclusivity until 2037–2038, ensure long-term commercial protection. Europe’s coordinated regulatory environment and growing emphasis on rare disease funding position it as a cornerstone of Vertex’s international CF strategy, balancing commercial success with equitable patient access initiatives across diverse healthcare systems.

Asia Pacific Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market

The Asia Pacific region presents a highly heterogeneous market for Trikafta/Kaftrio, characterized by variations in regulatory readiness, income levels, and CF prevalence awareness. Developed markets such as Australia, Japan, and New Zealand have demonstrated strong uptake following local approvals, supported by robust reimbursement programs and national rare disease initiatives. In Australia, Trikafta’s inclusion under the Pharmaceutical Benefits Scheme (PBS) has enhanced accessibility for eligible patients, while Japan has begun evaluating CFTR modulators within its orphan drug framework. Conversely, emerging economies such as India, China, and Southeast Asian countries face considerable barriers due to patent restrictions, high pricing, and limited diagnostic capacity. India’s market, in particular, is shaped by ongoing patent disputes and compulsory licensing debates, as advocacy groups push for more affordable alternatives. CF remains underdiagnosed in much of Asia, restricting potential patient reach despite an expanding clinical footprint. Vertex’s regional strategy focuses on market prioritization, early engagement with regulators, and strategic collaborations with global health organizations to improve access. As healthcare spending and genomic testing capabilities expand, Asia Pacific is poised to evolve from an access-limited region to a long-term growth driver, offering significant potential for Vertex’s future CF franchise expansion.

Latin America Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market

Latin America represents an emerging but complex market for Trikafta/Kaftrio, influenced by economic disparities, limited reimbursement coverage, and variable patent enforcement. Countries such as Brazil, Mexico, and Chile have expressed growing interest in incorporating CFTR modulators into national health systems, yet budgetary constraints and lengthy regulatory processes continue to delay full-scale adoption. Argentina stands out as a notable exception, where local pharmaceutical manufacturers have initiated non-licensed generic production due to the absence of enforceable patents, offering patients limited access at lower prices. This precedent has sparked regional advocacy for price negotiations and compulsory licensing models to enhance affordability. The region’s CF population remains relatively small, yet the increasing focus on rare disease awareness programs, newborn screening, and international donor support is improving the diagnostic landscape. Vertex’s market approach in Latin America centers on partnership-driven access models, aligning with health authorities and non-profit organizations to promote treatment availability. Despite infrastructure and pricing challenges, the region holds long-term strategic potential, especially as healthcare reforms prioritize equitable access to high-impact therapies. Latin America’s trajectory will largely depend on policy alignment and pricing flexibility from innovators in the coming decade.

Middle East and Africa Ivacaftor + Tezacaftor + Elexacaftor (Trikafta Kaftrio) Market

The Middle East and Africa (MEA) region remains the most underserved market for Trikafta/Kaftrio, constrained by limited CF awareness, scarce genetic testing infrastructure, and restricted healthcare budgets. While CF incidence is lower compared to Western populations, underdiagnosis and lack of specialized care centers significantly hinder treatment penetration. In the Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia, the UAE, and Qatar, increasing healthcare investment and rare disease funding have led to selective access agreements with Vertex, ensuring coverage for a small but growing patient base. North African markets, including Egypt and Morocco, remain at early stages of regulatory evaluation, with access largely confined to private or out-of-pocket channels. Sub-Saharan Africa faces the steepest barriers due to economic constraints and limited clinical infrastructure. Humanitarian programs, global non-profits, and patient-led initiatives are gradually improving access awareness, though affordability remains the most significant bottleneck. In the long term, MEA offers incremental growth potential as governments strengthen rare disease policies and diagnostic networks. However, achieving sustainable market presence will depend on tiered pricing strategies, technology partnerships, and expanded local clinical collaboration to bridge the current accessibility gap.

Analyst Perspective

From an analyst standpoint, Ivacaftor + Tezacaftor + Elexacaftor (Trikafta / Kaftrio) remains the cornerstone of Vertex Pharmaceuticals’ CF franchise, backed by unmatched clinical efficacy, broad patient eligibility, and strong patent protection until 2037. The therapy has achieved market saturation in North America and Europe, supported by high treatment adherence and favorable reimbursement frameworks. Analysts note that continued label expansions, particularly into pediatric populations, will sustain moderate growth over the next decade.

However, the premium pricing structure poses ongoing access challenges in emerging markets, where advocacy groups and policymakers are pushing for affordability mechanisms and compulsory licensing. Despite these pressures, Vertex’s revenue resilience and innovation-driven pipeline provide a strong competitive moat. The company’s strategic investments in next-generation CFTR modulators, gene therapies, and mRNA platforms reflect a proactive approach to mitigating the post-2037 patent expiry risk.

In the medium term, analysts anticipate steady revenue performance, supported by expanding global access and lifecycle management initiatives. Over the long term, Vertex’s ability to transition from CFTR modulation to genetic correction will define its market leadership beyond Trikafta’s exclusivity horizon.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028–2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU −15–30% Yr-1, deepening to −45–60% by Yr-3; U.S. −10–25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25–40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30–40% global revenue decline by Year-3 post-LOE.

-

Downside: 45–55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~−20–25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a

transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified