- Home

- »

- Market Trend Reports

- »

-

U.S. Dietary Supplements Market - Competitive Landscape Analysis

Report Overview

The U.S. dietary supplements market continues to evolve in response to rising consumer awareness around preventive health, personalized nutrition, and clean-label consumption. From foundational vitamins and minerals to targeted probiotics, nootropics, and functional blends, the demand remains resilient and diversified. Post-pandemic health priorities, aging populations, and the mainstreaming of holistic wellness have created strong momentum across all demographics. Notably, the market is witnessing rapid innovation in delivery formats, ingredients, and formulations, with leading brands expanding their portfolios to remain competitive.

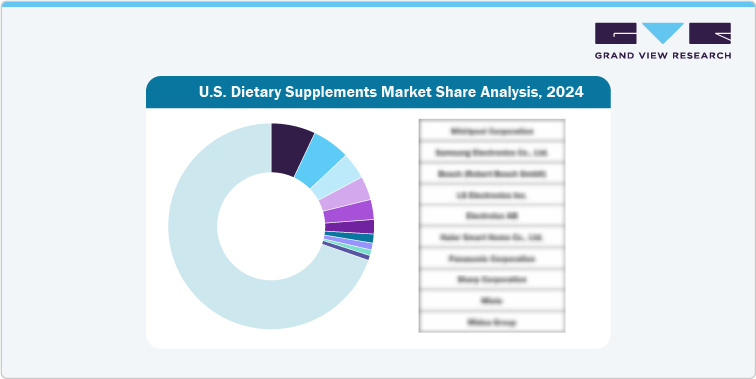

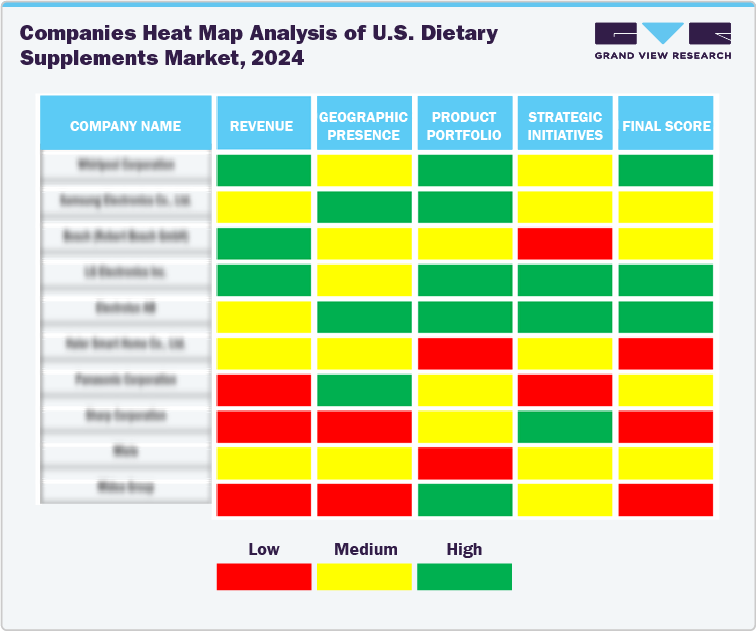

This report focuses on brand-level dynamics, offering a detailed breakdown of the top 10 players in the U.S. dietary supplements market by revenue share, based on 2024 estimates. It analyzes their strategic positioning, consumer appeal, distribution strengths, and innovation approaches providing an essential snapshot for stakeholders across the value chain.

U.S. dietary supplements market: revenue, market share, 2024 (in %)

Rank

Brand Name

Company Revenue, 2024

Market Share, 2024 (in %)

#1

Archer Daniels Midland Company

-

%

#2

Glanbia plc

-

%

#3

GlaxoSmithKline plc

-

%

#4

Bayer AG

-

%

#5

Herbalife Nutrition

-

%

#6

Company 6

-

%

#7

Company 7

-

%

#8

Company 8

-

%

#9

Company 9

-

%

#10

Company 10

-

%

The U.S. dietary supplements market is moderately fragmented but led by several dominant players with high consumer trust and expansive retail penetration. Nature Made, by Pharmavite, maintains its leading position due to its science-backed formulations, strong retail footprint (Walmart, Walgreens, CVS), and increasing presence in e-commerce. Its emphasis on USP-verified products and transparent labeling has helped reinforce consumer confidence.

Nature’s Bounty, a brand under Nestlé Health Science, follows closely, offering a broad product portfolio that appeals to both budget and premium segments. Its growing investments in online distribution, influencer marketing, and gummy-based supplements have significantly boosted its millennial reach.

Garden of Life, known for its organic, non-GMO, and whole food-based offerings, has captured a loyal base among wellness-conscious consumers. Its focus on clean-label innovation, plant-based proteins, and probiotics has made it a preferred brand in natural and specialty channels like Whole Foods and Sprouts.

NOW Foods remains a strong player by combining affordability with quality. With a wide SKU range including condition-specific products, it appeals to value-driven and supplement-savvy consumers. Its positioning as a family-owned, independent brand also resonates well in the clean and sustainable product space.

GNC, though traditionally brick-and-mortar focused, has undergone significant digital transformation, strengthening its online platform and product customization tools. Its strength in sports nutrition and condition-specific vitamins keeps it competitive, especially among active consumers and older adults.

Strategies And Recent Development

Major players in the U.S. dietary supplement space are increasingly focusing on innovation, transparency, personalization, and digital transformation. Nature Made has launched AI-backed health tools to recommend personalized supplement regimens, while Nature’s Bounty continues to invest in novel delivery forms such as soft chews, melts, and sprays.

Garden of Life is doubling down on sustainability, introducing carbon-neutral packaging and expanding its certified organic line. NOW Foods is investing in in-house testing and quality assurance labs to reinforce its transparency pledge. Meanwhile, GNC has restructured its subscription model and loyalty programs to regain share lost to online-first brands. Several leading companies have also stepped-up R&D and product innovation efforts in response to emerging health concerns.

-

In June 2024, Bayer launched a new dietary supplement under the One A Day brand aimed at supporting cellular aging. This product is designed to help combat the effects of aging at the cellular level by incorporating a blend of vitamins, minerals, and antioxidants that promote overall health. The supplement targets key areas such as energy production, immune function, and DNA protection, making it suitable for adults looking to maintain their vitality as they age.

-

In May 2024, Abbott launched a new generation of nutritional supplements aimed at enhancing the health and well-being of individuals with specific dietary needs. This innovative product line is designed to support various health conditions, including malnutrition and gastrointestinal disorders, by offering a balanced mix of macronutrients and micronutrients tailored to improve nutrient absorption and overall health outcomes. The supplements are formulated to meet the evolving needs of healthcare professionals and patients, ensuring they deliver effective nutritional support for those requiring specialized diets.

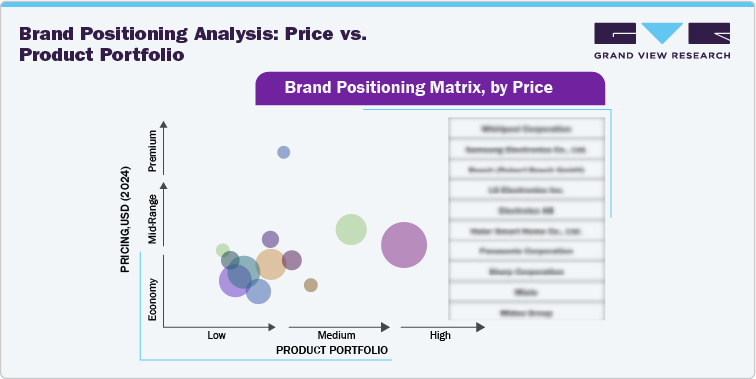

The U.S. dietary supplements market exhibits distinct brand stratification by price tier, with each major player aligning its positioning strategy to cater to specific consumer expectations related to quality, trust, functionality, and lifestyle alignment.

Pricing is a crucial competitive lever, not only for profitability but also for perceived value and consumer loyalty.

Price Tier

Key Characteristics

Brands

Economy

Basic formulations, high unit volume, budget-conscious consumers

NOW Foods, Spring Valley (Walmart), Nature’s Truth

Mid-Range

Quality-focused, broad wellness claims, available across retail chains

Nature Made, Nature’s Bounty, GNC

Premium

Clean-label, organic, personalized, or condition-specific SKUs with branded ingredients

Garden of Life, Ritual, HUM Nutrition, Persona

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified