- Home

- »

- Market Trend Reports

- »

-

Ustekinumab (Stelara) Market: Strategic Shifts Post-Patent Expiry And Biosimilar Impact

Report Overview

Ustekinumab, marketed as Stelara by Janssen Biotech, has become a cornerstone treatment for autoimmune conditions, including psoriasis, Crohn's disease, and psoriatic arthritis. Its strong market performance has been driven by its proven efficacy and broad therapeutic applications. As the expiration of its patent draws near, the Ustekinumab market is poised for significant change. The impending patent cliff creates both challenges and opportunities, particularly with the rise of biosimilars. The entry of biosimilars into the market will introduce competitive pressures, potentially reshaping treatment protocols and market share dynamics in the autoimmune space.

Key Report Deliverables

-

Analyze the Ustekinumab (Stelara) market landscape, detailing the current market size, growth drivers, and key industry trends, particularly in light of the upcoming patent expiration and the impact of biosimilars entering the market.

-

Forecast Market Growth, projecting future trends for the Ustekinumab market, highlighting emerging opportunities within the biosimilar space, and assessing potential risks to growth as competition increases following patent expiry.

-

Identify Regulatory and Market Barriers, providing insights into regulatory and market barriers that could impact future market expansion and product development, with a specific focus on the challenges biosimilars may face in gaining approval and market access.

-

Concurrent Competitive Landscape, identifying key players in the Ustekinumab market, including both originator and biosimilar manufacturers. Examine their strategic moves, partnerships, and distribution of market share to understand competitive positioning and potential shifts as biosimilars are introduced.

-

Regulatory Barriers, identifying key regulatory challenges related to the entry of Ustekinumab biosimilars, including approval processes and market access restrictions, and assessing their potential impact on the speed and scope of market expansion.

-

Strategic Implications, evaluating strategic moves for Janssen Biotech and its competitors to maintain leadership in the Ustekinumab market. This includes exploring innovation, differentiation, potential patient support programs, and geographic expansion strategies.

Patent Cliff Analysis:

Stelara (ustekinumab), developed by Johnson & Johnson, experienced its key composition-of-matter patent expiry in the U.S. in September 2023, with biosimilar entry expected from 2025 onward. While Johnson & Johnson reached settlement agreements with biosimilar manufacturers, allowing controlled entry from early 2025, the drug is now facing accelerated erosion similar to Humira’s trajectory.

The impact of biosimilar competition is compounded by the U.S. Medicare Part D redesign, which shifts greater cost burden to manufacturers. Stelara’s results have already been negatively affected, with management citing ~1,170 basis points of impact in recent earnings.

Looking forward, Stelara’s sales are projected to decline sharply in 2025, with continued erosion through 2028. Despite ongoing demand in psoriasis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis, the entry of multiple biosimilars and pricing pressures will significantly reduce Stelara’s market share. The franchise’s erosion highlights the importance of pipeline diversification and lifecycle management for Johnson & Johnson as it transitions reliance toward newer immunology assets.

Current Market Scenarios

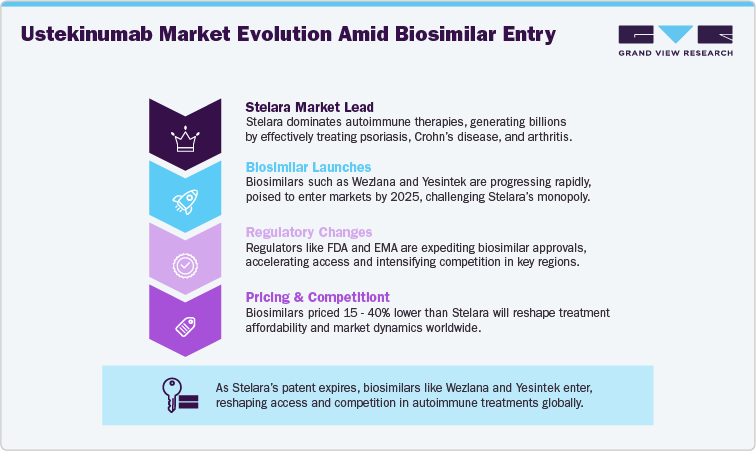

The Ustekinumab (Stelara) market is entering a period of significant transformation due to the impending expiration of its patent. Currently, Stelara is a leading biologic treatment in the autoimmune therapeutic area, particularly for conditions such as psoriasis, Crohn’s disease, and psoriatic arthritis. Since its launch, the drug has shown substantial market success, generating billions in revenue for Janssen Biotech, largely due to its efficacy in treating these chronic conditions. The global Ustekinumab market x` driven by ongoing patient demand and treatment effectiveness. However, as the patent expires, a wave of biosimilars is expected to enter the market, posing a direct challenge to Stelara’s dominant position.

The expiration of Ustekinumab’s primary patent in September 2023 opens the door for biosimilars to enter key markets like the United States and Europe. Several biosimilar candidates are already in advanced stages of development and regulatory approval. For example, biosimilars such as Wezlana (Amgen) and Yesintek (Biocon Biologics) are expected to be launched in early 2025, with other biosimilars like Steqeyma (Celltrion) and Otulfi (Formycon/Fresenius Kabi) following closely behind. The approval of these biosimilars could significantly alter the competitive dynamics in the autoimmune treatment market, particularly in cost-sensitive healthcare environments. Biosimilars are typically priced 15-40% lower than the originator drug, which will likely result in increased patient access to biologic therapies, especially in regions with strong cost containment measures.

The regulatory environment surrounding biosimilars is also evolving, with agencies such as the U.S. FDA and the European Medicines Agency (EMA) fast-tracking approvals for these products, enabling quicker market entry. For example, the FDA approved the first biosimilar for Stelara in 2023, further intensifying market competition. In addition to regulatory support, the growing presence of these biosimilars will likely drive increased adoption in both established markets like the U.S. and Europe, and emerging markets, where access to biologic treatments remains limited due to high costs. These shifts will create both challenges and opportunities for Janssen Biotech, which will need to adapt to the new competitive landscape.

For Janssen, the challenge will be to sustain market leadership as biosimilars offer more affordable alternatives to Stelara. The company may need to implement strategies such as reinforcing brand loyalty through patient support programs, exploring new indications, and advancing next-generation therapies to maintain its market share. The market dynamics are expected to evolve rapidly in the next few years, with biosimilars becoming a key player in the Ustekinumab market, thereby reshaping competition and expanding patient access to treatment.

Market Dynamics

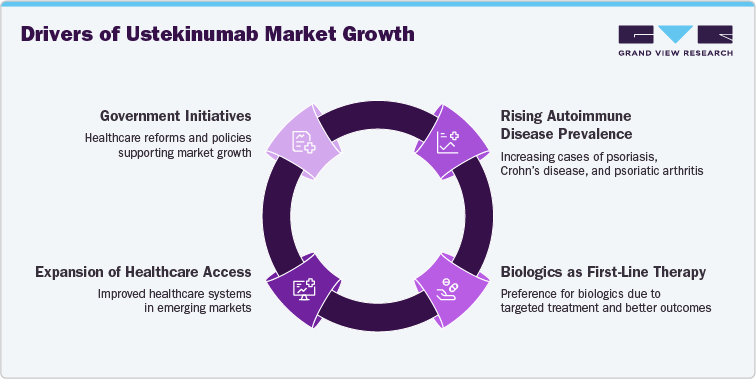

Rising autoimmune disease prevalence drives Ustekinumab market growth

The Ustekinumab (Stelara) market is primarily driven by the rising prevalence of autoimmune diseases such as psoriasis, Crohn’s disease, and psoriatic arthritis, conditions that affect millions globally. The increasing burden of these chronic diseases, particularly in developed regions like North America and Europe, is contributing to sustained demand for biologic treatments. Ustekinumab has demonstrated significant efficacy in managing these conditions, making it a preferred choice for both patients and healthcare providers. This strong clinical foundation supports Ustekinumab's dominant market position. Additionally, biologics in general are being increasingly adopted as the first-line therapy for chronic autoimmune diseases due to their ability to target specific pathways, offering better long-term outcomes compared to traditional therapies.

Another critical driver is the expansion of healthcare access in emerging markets. As healthcare systems in Asia, Latin America, and Africa improve, and medical expenditures rise, biologic treatments like Ustekinumab are becoming more accessible. In these regions, the demand for advanced therapies is growing as patient awareness of biologics improves, opening new revenue opportunities. Government initiatives and healthcare reforms in these regions also play a pivotal role in driving market growth. As the accessibility of biologics increases in these markets, Ustekinumab could see accelerated adoption.

Patent expiration and biosimilar competition limit Ustekinumab growth

Despite Ustekinumab’s strong market performance, the drug faces significant challenges that could hinder its continued growth. The most immediate restraint is the expiration of its patent protection, which occurred in September 2023. As a result, biosimilars are set to enter the market in the coming years, starting in 2025. These biosimilar products, typically priced 15-40% lower than the originator biologic, represent a serious competitive threat. In particular, biosimilars such as Wezlana (Amgen) and Yesintek (Biocon Biologics) are expected to enter the market shortly after the patent expiration, increasing price competition and potentially shifting market share away from Ustekinumab.

The presence of biosimilars will put downward pressure on Ustekinumab's pricing in certain markets, particularly in price-sensitive regions where healthcare systems are under budget constraints. In these regions, healthcare providers may prefer the more affordable biosimilar alternatives, leading to reduced market share for Ustekinumab. Moreover, the regulatory environment is increasingly focused on cost containment, especially in developed markets like the U.S. and Europe, where policymakers are emphasizing the need for affordable biologic treatments. This trend could further limit Ustekinumab’s pricing flexibility.

Additionally, the fast-tracked approval of biosimilars, particularly in emerging markets, may enable these products to capture market share more rapidly. As these biosimilars become available, healthcare providers in these regions will have access to more cost-effective alternatives, possibly reducing Ustekinumab’s overall sales in those markets.

Opportunities in Indications, Formulations, and Emerging Markets for Ustekinumab Growth

While the entry of biosimilars poses a challenge, the Ustekinumab market also presents several key opportunities for growth and market positioning. One significant opportunity lies in expanding Ustekinumab's indications. Currently approved for conditions such as psoriasis, psoriatic arthritis, and Crohn’s disease, the drug could be explored for other autoimmune conditions or inflammatory diseases. This expansion could enable Janssen Biotech to capture new patient populations and further solidify Ustekinumab’s role in the autoimmune therapy landscape. Clinical trials targeting new indications could provide a strong avenue for Ustekinumab to differentiate itself from emerging biosimilars.

Another growth opportunity lies in the development of next-generation biologics or improved formulations of Ustekinumab. For instance, extended-release versions or more convenient dosing regimens could improve patient adherence, making Ustekinumab more appealing compared to biosimilars that may not offer these enhanced features. Additionally, combination therapies that integrate Ustekinumab with other biologics or immunomodulators could offer synergistic benefits, making Ustekinumab more effective in treating complex cases of autoimmune diseases.

The expansion into emerging markets presents another crucial opportunity. Regions like Asia, Latin America, and Africa are seeing significant improvements in healthcare infrastructure and spending, making biologic treatments more accessible. As biologic treatment adoption increases in these markets, Ustekinumab is well-positioned to capitalize on this trend, particularly if Janssen can strategically partner with local healthcare providers to enhance market access and affordability.

Post-patent competition, personalized medicine, market expansion lifts Ustekinumab market

- Biosimilar Competition Post-Patent Expiry and Market Dynamics

With the expiration of Ustekinumab’s patent in September 2023, biosimilars are set to enter the market by 2025, offering lower-cost alternatives. Biosimilars like Wezlana (Amgen) and Yesintek (Biocon Biologics) will introduce price competition, particularly in cost-sensitive regions. These products are expected to capture market share, especially in emerging markets where price is a significant factor. Janssen Biotech will need to adjust its pricing, marketing, and patient support strategies to maintain its position in the market amidst increasing competition. The introduction of biosimilars may also encourage a shift towards value-based pricing models focused on health outcomes and efficacy.

- Shift Towards Personalized Medicine and Ustekinumab’s Role

Personalized medicine is a growing trend in autoimmune disease treatment. Advances in biomarker identification and genomic profiling will help identify patients who would benefit most from biologics like Ustekinumab. This could expand Ustekinumab’s use in targeted therapies and improve treatment efficacy. The growth of companion diagnostics will help match the right patients with the right biologic treatments, supporting Ustekinumab’s role in personalized therapy and differentiating it from biosimilars. Janssen Biotech may also explore expanding Ustekinumab’s indications based on emerging patient needs.

- Market Expansion in Emerging Markets

Emerging markets offer significant growth opportunities for Ustekinumab as healthcare access improves and demand for biologics rises. Government spending and health insurance penetration are increasing, particularly in regions like Asia, Latin America, and Africa. However, pricing strategies will need to be adapted to meet local market conditions. Collaborating with local healthcare providers and offering patient support programs can enhance access and drive Ustekinumab adoption. The rise in autoimmune disease incidence in these regions will further fuel the demand for biologic treatments.

Overview of Alternative Therapeutics

As the Ustekinumab (Stelara) market faces increasing competition, several alternative therapeutics are gaining prominence. TNF inhibitors, such as Adalimumab (Humira) and Infliximab (Remicade), remain widely used in the treatment of autoimmune diseases like psoriasis, psoriatic arthritis, and Crohn’s disease, targeting TNF-α. These established biologics, while effective, face competition from newer agents like IL-17 inhibitors, including Secukinumab (Cosentyx) and Ixekizumab (Taltz), which target IL-17A and have demonstrated significant efficacy in treating psoriasis and psoriatic arthritis. Additionally, the entry of biosimilars to Ustekinumab, such as Wezlana (Amgen) and Yesintek (Biocon Biologics), will offer cost-effective alternatives, providing similar clinical outcomes to the reference biologic. The market is also witnessing the growth of JAK inhibitors, such as Tofacitinib (Xeljanz) and Upadacitinib (Rinvoq), which offer oral treatment options for autoimmune conditions like rheumatoid arthritis and psoriasis, providing an alternative to injectable biologics. Together, these alternative therapies, along with biosimilars, are increasing competition in the autoimmune treatment market, particularly in cost-sensitive regions where affordability is a key consideration.

Competitive Landscape

The competitive landscape for Ustekinumab (Stelara) has undergone significant changes following the patent expiration in September 2023. This event has facilitated the entry of multiple biosimilars, which are expected to play a crucial role in reshaping the market dynamics. The launch of these biosimilars, along with other alternative therapies, introduces significant price competition and is likely to impact Ustekinumab’s market share, particularly in cost-sensitive regions.

Several biosimilars have either received approval or are expected to enter the market in the coming years. Amgen's Wezlana, which became the first interchangeable biosimilar to be approved by the FDA in October 2023, is slated for launch in January 2025. Other biosimilars such as Pyzchiva, developed by Samsung Bioepis and Sandoz, and Yesintek, developed by Biocon Biologics, are also expected to enter the market in 2025. These biosimilars are typically priced 15-40% lower than the original Stelara product, which is expected to create significant pricing pressure and potentially shift market share away from Ustekinumab.

In addition to biosimilars, Ustekinumab faces competition from alternative therapies within the same therapeutic space. Tumor necrosis factor-alpha (TNF-α) inhibitors, including adalimumab (Humira), infliximab (Remicade), and etanercept (Enbrel), remain widely used in the treatment of autoimmune diseases. Despite the availability of biosimilars for Humira, it continues to hold a significant position in the market due to its long-standing efficacy and patient familiarity.

Interleukin-17 (IL-17) inhibitors, such as secukinumab (Cosentyx) and ixekizumab (Taltz), also represent significant indirect competitors to Ustekinumab. These biologics target a different inflammatory pathway and have established themselves as key treatments for conditions like psoriasis and psoriatic arthritis. The growth of IL-17 inhibitors in the market further diversifies the treatment options available to patients, thereby intensifying competition.

Janus kinase (JAK) inhibitors, including tofacitinib (Xeljanz) and upadacitinib (Rinvoq), have gained attention as oral treatments for autoimmune diseases. These oral therapies offer a convenient alternative to biologic injections, appealing to patients who prefer non-injection-based therapies. JAK inhibitors are now increasingly included in treatment regimens for conditions such as rheumatoid arthritis and psoriatic arthritis, adding another layer of competition for Ustekinumab.

Lastly, interleukin-23 (IL-23) inhibitors like guselkumab (Tremfya) and risankizumab (Skyrizi) are gaining market traction. These drugs target immune pathways similar to Ustekinumab and are approved for similar indications, including psoriasis and Crohn’s disease. The presence of these IL-23 inhibitors further contributes to the competitive pressure faced by Ustekinumab in the autoimmune disease treatment landscape.

As biosimilars and alternative biologics continue to penetrate the market, the competitive dynamics for Ustekinumab will evolve. The increasing availability of treatment options across different classes of biologics intensifies the competition within the autoimmune therapy market.

North America Ustekinumab (Stelara) Market

The Ustekinumab (Stelara) market in North America remains significant, with strong demand driven by its efficacy in treating psoriasis, psoriatic arthritis, and Crohn’s disease. The U.S. healthcare system supports the use of biologic therapies, with Medicare and private insurers maintaining favorable coverage for Stelara. Additionally, Stelara’s established position in treatment guidelines continues to solidify its presence. However, biosimilars expected in 2025 will introduce price competition, particularly in the U.S., where the cost of biologics is a major focus in healthcare reforms. The competitive landscape is expected to shift as insurers increasingly look for more affordable alternatives, while Stelara’s established clinical outcomes help maintain its relevance in the market.

Europe Ustekinumab (Stelara) Market

The Ustekinumab (Stelara) market in Europe is influenced by several key factors, including the increasing adoption of biologic therapies for autoimmune conditions. Following its patent expiration in September 2023, biosimilars are expected to enter the European market in 2025, creating competition for Stelara, particularly in price-sensitive regions. European markets with strong healthcare systems, such as Germany, France, and the UK, continue to prioritize biologics for psoriasis, psoriatic arthritis, and Crohn’s disease treatments. However, biosimilar pricing is anticipated to pressure Stelara’s sales, with ongoing market access reforms focusing on cost containment and reimbursement strategies across the region. Despite these challenges, Stelara’s established clinical efficacy maintains its strong market presence.

Asia Pacific Ustekinumab (Stelara) Market

The Ustekinumab (Stelara) market in the Asia Pacific region is experiencing growth due to increasing adoption of biologic therapies for autoimmune conditions such as psoriasis, psoriatic arthritis, and Crohn’s disease. The rising prevalence of these diseases, coupled with improving healthcare infrastructure in countries like China, Japan, and India, is driving demand for advanced treatments. Stelara is well-positioned in developed markets like Japan due to its established efficacy and regulatory approval. However, the market dynamics in Asia Pacific are also influenced by the rise of biosimilars and cost-sensitive healthcare systems in emerging markets, where affordable alternatives are gaining traction. Stelara faces competition from local biosimilars and other biologics, but its proven clinical outcomes continue to support its presence in the region.

Latin America Ustekinumab (Stelara) Market

The Ustekinumab (Stelara) market in Latin America is expanding, driven by increasing healthcare access and growing awareness of autoimmune diseases such as psoriasis, psoriatic arthritis, and Crohn’s disease. Countries like Brazil, Mexico, and Argentina are seeing greater demand for biologic treatments as healthcare infrastructure improves. However, cost-sensitive markets in the region pose challenges, with biosimilars expected to become a key factor in driving competition. The affordability of biosimilars will likely impact Stelara’s market share, especially as healthcare systems prioritize cost-effective alternatives. Despite this, Stelara’s established reputation and efficacy in treating complex autoimmune diseases continue to maintain its presence in the region, with growing opportunities as biologic access improves across Latin America.

Middle East and Africa Ustekinumab (Stelara) Market

The Ustekinumab (Stelara) market in the Middle East and Africa is in a phase of growth, driven by improving healthcare infrastructure and rising awareness of autoimmune diseases such as psoriasis, psoriatic arthritis, and Crohn’s disease. In developed markets like the UAE and Saudi Arabia, demand for biologic therapies is increasing, with Stelara being a preferred option due to its efficacy. However, in emerging markets across Africa and parts of the Middle East, cost-sensitive healthcare systems may limit access to biologics, with biosimilars expected to gain traction. These biosimilars will likely drive price competition, especially in countries where affordability is a primary concern. Despite these challenges, Stelara’s established clinical outcomes and growing healthcare investments continue to support its market presence in the region.

Analyst Perspective

The Ustekinumab (Stelara) market faces significant changes post-patent expiration in September 2023, with biosimilars expected to enter by 2025. In North America and Europe, these biosimilars will introduce pricing pressures, particularly in cost-sensitive markets. While Stelara maintains strong clinical efficacy, biosimilars like Wezlana and Pyzchiva are poised to capture market share by offering more affordable alternatives. In regions like Asia Pacific and Latin America, growing healthcare access may increase Stelara’s demand, though affordability remains a concern. Overall, Stelara’s market position will be challenged by the rise of biosimilars and pricing dynamics.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price-Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy.

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

- A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified