- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape Of Ventral Hernia Mesh Devices

Overview of The Ventral Hernia Mesh Devices Industry

The ventral hernia mesh devices industry is witnessing notable growth due to the rising incidence of hernia cases and increasing awareness of early diagnosis. Data from the Healthcare Cost and Utilization Project and the U.S. Food and Drug Administration show that around 611,000 ventral hernia repairs and 1 million inguinal hernia repairs are conducted annually in the U.S. This totals about 20 million hernia repairs each year, ranking it among the most frequently performed general surgical procedures globally. According to Grand View Research Estimates, the global ventral hernia mesh devices market size was estimated at USD 839.5 million in 2024 and is project to reach a value of USD 1.35 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030.

Additionally, the International Surgery Journal reports that incisional and para-umbilical hernias represent 85% of all ventral hernias. Moreover, umbilical hernias are more prevalent in males (65%) compared to females (35%), primarily because congenital umbilical hernias are less common in females.

Number of Hernia Types Found in a Study, By Age & Gender

Hernia Type

Total Cases Studied

0-20 Years

21-40 Years

41-60 Years

>60 Years

Male

Female

Male

Female

Male

Female

Male

Female

Incisional Hernia

22

1

-

-

3

5

11

-

2

Umbilical Hernia

20

1

-

3

3

9

3

-

1

Epigastric Hernia

17

-

-

1

4

-

5

3

4

Source: International Surgery Journal, GVR Analysis

The incidence of ventral hernia is notably higher in men due to greater engagement in physically demanding activities, increased abdominal wall strain, and certain anatomical differences. Women are prone to ventral hernia due to factors such as pregnancy, previous abdominal surgeries, and obesity. Studies suggest that men are up to 2 to 3 times more likely to develop ventral hernias, particularly incisional and umbilical types, due to factors such as increased abdominal strain and anatomical predispositions. In the U.S., the incidence of ventral hernias in the general population is estimated at 10 to 20 per 10,000 persons annually, with higher rates in older adults.

However, the industry faces several restraints. One significant barrier is the high treatment costs in the hernia mesh devices market, with robotic hernia surgery being a major contributor. While robotic surgeries offer precision and minimally invasive benefits, they involve expensive equipment, training, and maintenance, increasing overall treatment expenses. These costs can limit patients' access to advanced surgical options and strain healthcare budgets.

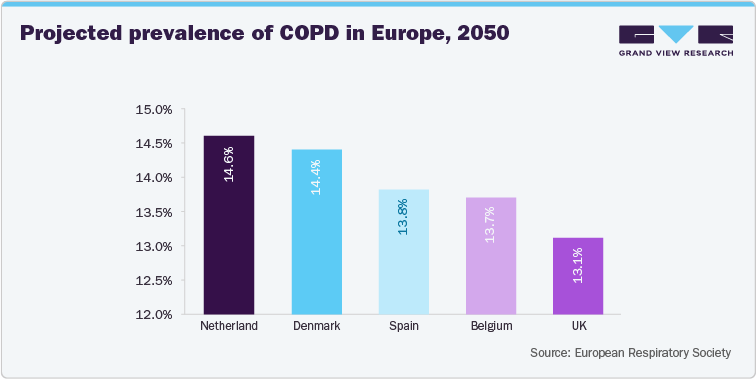

Studies also indicate that diseases such as Chronic Obstructive Pulmonary Disease (COPD) increase the likelihood of ventral hernias. The risk is increased due to chronic coughing, elevated intra-abdominal pressure, and impaired tissue healing. For instance, a large cohort study involving over 28,000 patients found that individuals with COPD had a 50.9% higher likelihood of developing ventral or incisional hernias compared to those without COPD.

Notable Innovations Shaping Ventral Hernia Mesh Devices

Technological advancements are a major competitive force in the ventral hernia mesh devices market. Firms are making substantial R&D investments to boost image clarity, shorten scanning durations, and enhance patient comfort during procedures.

Technological Innovations and Leading Solutions in Ventral Hernia Mesh Devices

Technology

Notable Advancements

Product

Companies

Advanced Biomaterials and Hybrid Meshes

- Composite meshes combine synthetic (e.g., polypropylene) and biologic or absorbable layers to balance strength and biocompatibility.

- Hybrid meshes integrate resorbable biologics with synthetic fibers to support gradual tissue integration and reduce infection risk.

OviTex Reinforced Tissue Matrix

Bard Composix L/P Mesh

GD Medical, C.R. Bard, Inc. (Becton, Dickinson and Company)

Lightweight and Macroporous Meshes

- Improved flexibility and reduced foreign body sensation, chronic pain, and risk of adhesions.

ULTRAPRO Macroporous Partially Absorbable Mesh

Ethicon, Inc.

Antibacterial and Coated Meshes

- Reduced post-surgical infection risk, especially in contaminated or high-risk fields.

OviTex 1S with Gentamicin

TELA Bio, Inc.

Customized Robotic and Laparoscopic Surgery

- Meshes are increasingly being pre-shaped and pre-attached with fixation aids to suit minimally invasive approaches, improving handling and placement.

Ventralight ST Mesh

C.R. Bard, Inc. (Becton, Dickinson and Company)

Competitive Scenario of the Ventral Hernia Mesh Devices Industry

The ventral hernia mesh devices market is moderately competitive. The industry features several established leaders who continuously innovate and expand their market presence. Key players include Medtronic plc, Ethicon Inc., Novus Scientific AB, and B. Braun SE. These companies leverage advanced technologies and strategic partnerships to enhance competitiveness.

Becton Dickinson and Company (BD), through its Davol division (formerly Bard), is a global leader in the ventral hernia mesh devices market. It offers one of the most comprehensive and clinically trusted portfolios of surgical mesh products.

They are a prominent leader with a presence across the globe in countries such as Germany, France, Italy, Spain, Switzerland, Greater China, Japan, South Asia, Southeast Asia, Korea, Australia, New Zealand, Mexico, Central America, the Caribbean, and South America. BD has manufacturing operations outside the United States in Bosnia and Herzegovina, Brazil, Canada, China, Dominican Republic, France, Germany, Hungary, India, Ireland, Israel, Italy, Japan, Malaysia, Mexico, the Netherlands, Singapore, Spain, and the United Kingdom.

BD’s extensive range includes synthetic, composite, resorbable, and robotic-compatible meshes, making it a go-to provider for surgeons using open and minimally invasive hernia repair approaches. Their product line is designed to address diverse clinical needs, from simple ventral hernia repairs to complex, contaminated, or high-risk reconstructions.

The report analyses the competitive landscape in this industry based on the parameters mentioned below:

Competitive Landscape: Top 10 Ventral Hernia Mesh Devices Manufacturers Overview

Market Outlook

Company Categorization

Company Share Analysis (Top 10 companies)

Company Position Analysis

List of Key Companies by Region

Company Overview

Product Benchmarking

Financial Performance

Recent Strategic Initiatives

SWOT Analysis

Emerging Players: Overview of 20+ Emerging Players and Startups in the Ventral Hernia Mesh Devices Industry

Company Overview

Establishment Year

Headquarters

Business Verticals

Employee Count

Investor Information

Total Funding (USD)

Product Benchmarking

Strategic Initiatives

SWOT Analysis

Company Profiles

BECTON, DICKINSON AND COMPANY

Company Overview:

Headquarters: Franklin Lakes, New Jersey, U.S.

Founded: 1897

Ownership: Public

Revenue: Approx. USD 20,178 Million

Specialization: BD operates globally, with international regions organized as EMEA (Europe, Middle East, and Africa), Greater Asia (including China, Japan, South and Southeast Asia, Korea, Australia, and New Zealand), Latin America (Mexico, Central and South America, and the Caribbean), U.S. and Canada. The company manufactures products in multiple countries across North America, Europe, Asia, and South America, including major sites in China, Mexico, Germany, India, and Ireland.

Product Benchmarking

Ventralight ST Mesh

Purpose: The Ventralight ST Mesh is designed for laparoscopic intraperitoneal onlay mesh (IPOM) procedures in ventral and incisional hernia repairs.

Features:

-

Lightweight polypropylene base for flexibility

-

Sepra hydrogel barrier on the visceral side to prevent adhesions

-

Barrier resorbs in ~30 days

-

Macroporous design promotes tissue ingrowth

Clinical Use: Used in minimally invasive (laparoscopic or robotic) ventral hernia repairs, preferred in Intraperitoneal onlay mesh (IPOM) placement, where direct contact with bowel occurs, and also enables easier port insertion and unrolling due to its flexible profile.

Phasix Mesh / Phasix ST Mesh

Purpose: The Phasix Mesh / Phasix ST Mesh is designed for long-term reinforcement in soft tissue where permanent mesh is not desired (e.g., patients at risk of infection or complications).

Features:

-

Made from poly-4-hydroxybutyrate (P4HB) - fully resorbable

-

Phasix ST includes a Sepra barrier for intraperitoneal use

-

Absorbed over 12-18 months, providing sustained strength

-

Reduces chronic foreign body response

Use Case:

-

Ideal for contaminated or high-risk fields

-

Used when mesh removal later is undesired or impractical

-

Excellent in complex abdominal wall reconstruction

Sepramesh IP Composite

Purpose: The Sepramesh IP Composite mesh is a mesh that is used for intraperitoneal placement with adhesion prevention.

Features:

-

Polypropylene mesh base for strength and flexibility

-

Sepra barrier coating to reduce adhesions to viscera

-

Barrier absorbs in 30 days; mesh integrates into tissue

Use Case: Used in IPOM procedures via open or laparoscopic techniques, and is best suited for repairs near bowel or visceral contact

Composix L/P Mesh

Purpose: The Composix L/P Mesh offers strong mechanical support with a barrier for intra-abdominal use

Features:

-

Dual-sided design: polypropylene mesh + expanded PTFE (ePTFE)

-

ePTFE prevents tissue adhesion on the visceral side

-

Heavyweight mesh for robust reinforcement

Use Case: Used in ventral/incisional hernia repairs with a significant defect size. It is particularly useful when strong mechanical support is needed and is often used in open surgeries or procedures.

Bard Soft Mesh

Purpose: The Bard Soft Mesh is a general-purpose and traditional polypropylene mesh used for hernia repair.

Features:

-

Soft, monofilament, polypropylene

-

Macroporous structure for tissue ingrowth

-

Non-coated, non-resorbable

Use Case: This mesh is primarily used for onlay, sublay, or preperitoneal repairs. It is not suited for intraperitoneal use due to the risk of adhesions, and is commonly used for inguinal, umbilical, and small ventral hernias.

3DMax Mesh

Purpose: The 3DMax Mesh is an anatomically contoured mesh for inguinal hernia repair and small ventral defects.

Features:

-

3D shape conforms to the inguinal and ventral anatomy

-

Lightweight, monofilament polypropylene

-

Comes in left/right orientation for specific placement

Use Case: This mesh is primarily used for preperitoneal/laparoscopic inguinal repair but is also used off-label for small ventral or umbilical hernias, and is generally preferred in TAPP (Transabdominal Preperitoneal) or TEP (Totally Extraperitoneal) laparoscopic procedures.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified