- Home

- »

- Medical Devices

- »

-

Ventral Hernia Mesh Devices Market, Industry Report, 2030GVR Report cover

![Ventral Hernia Mesh Devices Market Size, Share & Trends Report]()

Ventral Hernia Mesh Devices Market (2025 - 2030) Size, Share & Trends Analysis Report, By Mesh Type (Resorbable Mesh, Partially Absorbable, Non-resorbable Mesh), By Indication, By Procedure, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-568-4

- Number of Report Pages: 195

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ventral Hernia Mesh Devices Market Size & Trends

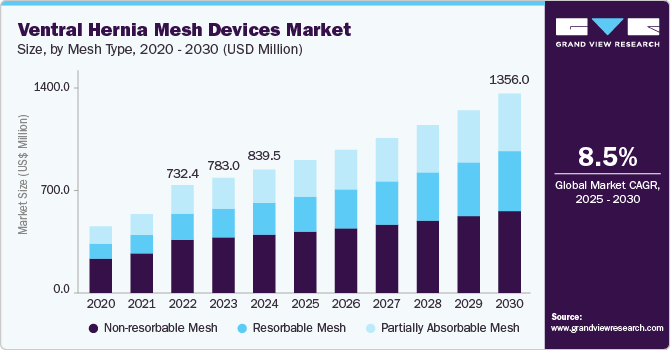

The ventral hernia mesh devices market size was estimated at USD 839.5 million in 2024 and is projected to grow at a CAGR of 8.48% from 2025 to 2030. The increasing cases of hernias, technological advancements in mesh repair, a shift towards preventive healthcare, and a growing preference for minimally invasive procedures are the factors affecting the market's growth.

Key Market Highlights:

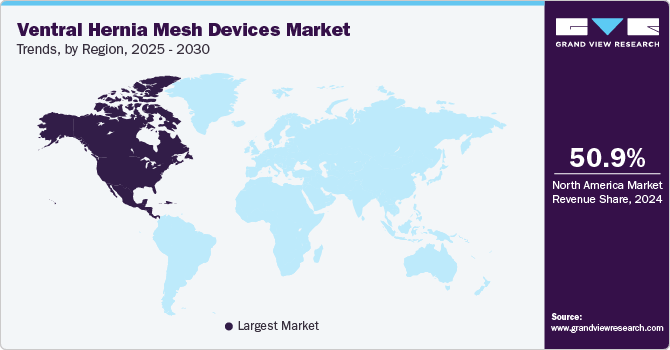

- The North American ventral hernia mesh devices market dominated the global market and accounted for a 50.9% revenue share in 2024.

- The U.S. ventral hernia mesh devices market held a significant share of North America's ventral hernia mesh devices market in 2024.

- By Mesh Type, the non-resorbable mesh devices segment accounted for the largest market share of 47.20% in 2024.

- By Indication, in 2024, the incisional hernia segment accounted for the largest share, 43.40%, of the ventral hernia mesh devices market.

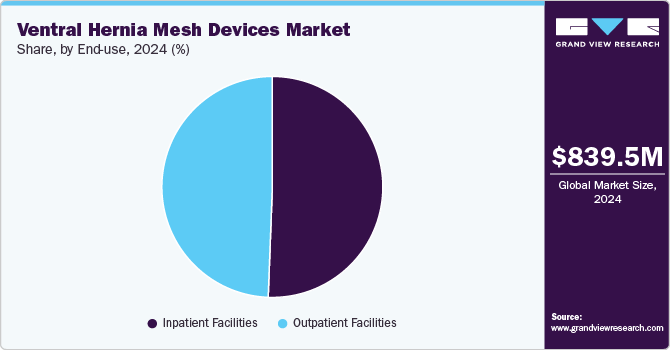

- By End-use, the inpatient facilities segment accounted for 50.6% of the ventral hernia mesh devices market.

There is a significant rise in the number of skin cancer cases globally, which drives the need for advanced solutions to facilitate better cancer care. According to the U.S. FDA, over a million hernia repair procedures are performed annually in the U.S.

Hernia repair is one of the most common surgical procedures performed worldwide. The incidence of hernia is higher in men than in women. According to Verywell Health, approximately 20% of adults will develop a primary ventral hernia, which is expected to rise to about 30% following surgery. This disorder is associated with risk factors such as obesity, smoking, unhealthy lifestyle, and age. About 75% of all hernias occur in the groin in adults each year, leading to an increase in the adoption of hernia repair devices. The high incidence of hernia is boosting the demand for efficient hernia repair, which is expected to fuel the market growth.

The International Surgery Journal also reports that incisional and para-umbilical hernias represent 85% of all ventral hernias. Moreover, umbilical hernias are more prevalent in males (65%) than females (35%), primarily because congenital umbilical hernias are less common in females.

Number of Hernia Types Found in a Study, By Age & Gender

Hernia Type

Total Cases Studied

0-20 Years

21-40 Years

41-60 Years

>60 Years

Male

Female

Male

Female

Male

Female

Male

Female

Incisional Hernia

22

1

-

-

3

5

11

-

2

Umbilical Hernia

20

1

-

3

3

9

3

-

1

Epigastric Hernia

17

-

-

1

4

-

5

3

4

Source: International Surgery Journal, GVR Analysis

As the global population ages, a larger pool of people at higher risk for hernias exists. This led to a rise in reported cases, even if the actual incidence per capita remains stable. Advancements in medical imaging, like ultrasounds and CT scans, make it easier and more common to detect hernias, even those without symptoms. This leads to an impression of increased prevalence as previously undetected cases are now being identified. Certain lifestyle choices can also increase the risk of developing a hernia. These include obesity, chronic cough, and heavy lifting. In addition, public health campaigns and readily available medical information make people more aware of hernias and their symptoms. This led to more people seeking medical attention and getting diagnosed, contributing to a perceived rise in cases.

High incidence of hernia globally and improved patient outcomes by using meshes, which reduce operative and recovery time, are some factors expected to propel market growth. Some advantages of using meshes in hernia repair are alleviating pain and reducing the chances of recurrence. For instance, according to data published by Northeast Georgia Health System, using mesh in hernia repairs can reduce the chances of recurrence by up to 50%. In the U.S., the standard practice is employing mesh for ventral, incisional, and inguinal hernia repairs.

In addition, mesh repair devices are elastic and have an adaptable shape that matches the changing dynamics of the abdominal walls. The large pores in the mesh allow lower foreign body reaction and better & faster soft tissue ingrowth, resulting in flexible scar formation. Thus, these benefits of using mesh in hernia surgeries are anticipated to promote market growth.

Mesh can be used in both open and laparoscopic surgery. Laparoscopic procedures with mesh offer faster recovery times, less pain, and smaller incisions than traditional open repairs without mesh, thereby surging market demand for hernia mesh devices.

Technological advancements in hernia mesh devices have significantly improved patient outcomes and reduced complications. One notable innovation is the development of lightweight and composite meshes. These meshes, such as Parietex Composite Mesh, combine absorbable and non-absorbable materials, providing strength while reducing postoperative discomfort and the risk of chronic pain. For instance, in March 2024, Deep Blue Medical Advances, Inc. introduced the T-Line Hernia Mesh, which helps prevent the recurrence of hernias after abdominal hernia repair surgery.

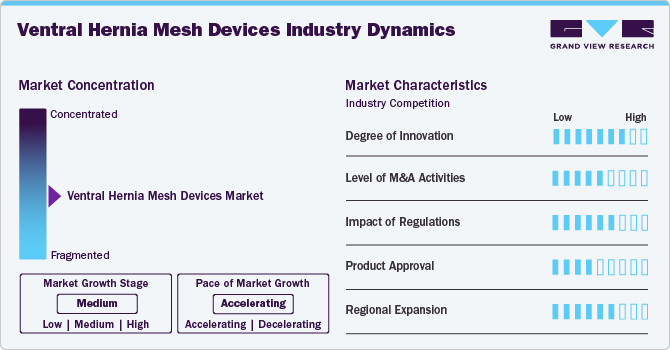

Market Concentration & Characteristics

The ventral hernia mesh devices market exhibits moderate industry concentration, with several key players dominating the market. Initiatives to raise awareness and knowledge about ventral hernia conditions and early diagnosis further stimulate market growth. The ventral hernia mesh devices industry is characterized by high innovation. Notable innovations have included advancements in materials, design, and surgical techniques. Significant developments include creating biocompatible materials, such as absorbable meshes, which reduce long-term foreign body reactions while providing essential support during the healing process; studies have shown these can lead to lower chronic pain and recurrence rates. In addition, self-fixating meshes utilizing micro-grip technology, such as the Symbotex mesh, enhance surgical efficiency by eliminating the need for sutures or adhesives, reducing operative times and complications.

Regulatory frameworks significantly influence the ventral hernia mesh devices industry, as these products are classified under medical devices in most regions. Compliance with regulatory requirements, such as US FDA guidelines or EU CE marking, is imperative for market entry and consumer trust. These regulations govern various aspects, including product design, manufacturing processes, and post-market surveillance, influencing product development timelines and market access. Evolving regulatory landscapes necessitate continuous monitoring and adaptation by industry players to ensure compliance and navigate market dynamics effectively.

Mergers and acquisitions in the ventral hernia mesh devices industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies engage in mergers and acquisitions to expand their product portfolio, enter new markets, acquire cutting-edge technologies, and achieve economies of scale. Such acquisitions aim to expand portfolios, gain AI capabilities, or access new markets.

The ventral hernia mesh device industry faces competition from traditional and emerging imaging methods. Conventional mesh devices for hernia repair remain prevalent due to their cost-effectiveness and simplicity. In addition, laparoscopic techniques that utilize sutures instead of mesh for specific types of hernias also present a competitive alternative. Advances in tissue engineering and regenerative medicine are leading to the development of injectable biomaterials that can promote healing and tissue regeneration without needing permanent implants.

The ventral hernia mesh devices industry is expanding globally, with North America and Europe leading in adoption due to advanced healthcare infrastructure, higher awareness, and regulatory clarity. Asia-Pacific is emerging rapidly, especially in urban centers of China, Japan, South Korea, and India, driven by rising hernia rates, improving healthcare access, and the growing presence of laparoscopic and robotic platforms for hernia repair. For instance, in April 2024, TELA Bio, Inc. launched its OviTex IHR surgical mesh for inguinal hernia repair in the U.S. This new product integrates biologic and synthetic materials, aiming to enhance patient outcomes by providing a durable & flexible repair solution, potentially reducing complications and improving recovery times for hernia surgery patients.

Mesh Type Insights

The non-resorbable mesh devices segment accounted for the largest market share of 47.20% in 2024. The substantial market share can be attributed to its demonstrated clinical efficacy, cost-effectiveness, and strong acceptance among surgeons. These meshes, crafted from materials such as polypropylene or expanded polytetrafluoroethylene (ePTFE), provide enduring mechanical support, significantly lowering recurrence rates when compared to resorbable alternatives. For example, a retrospective study featured in Surgical Endoscopy indicated that the use of synthetic mesh in ventral hernia repair was linked to a recurrence rate of only 13%, in contrast to 20% for biologic mesh. Furthermore, non-resorbable mesh is more cost-effective and widely reimbursed by healthcare systems, making it a practical option for both public and private sectors.

The resorbable mesh segment is expected to grow at the fastest CAGR of 11.4% over the forecast period. Resorbable meshes are surgical implants used in ventral hernia repair that are entirely broken down and absorbed by the body over time. The market growth is driven by rising preference in high-risk and contaminated surgeries, advancements in biomaterials and their performance, reduction in long-term capabilities, and increasing use in outpatient settings and minimally invasive surgeries.

Indication Insights

In 2024, the incisional hernia segment accounted for the largest share, 43.40%, of the ventral hernia mesh devices market. Incisional hernia is the second most common type of hernia after inguinal hernia. Incisional hernia accounts for 10% of all abdominal wall incisions. It is more common in women, as most women undergo midline abdominal surgery during childbirth. Risk factors for incisional hernias include obesity, smoking, surgical site infections, impaired wound healing, malnutrition, and connective tissue disorders. The recurrence rate after the first surgical procedure for incisional hernia ranges from 25% to 52%. According to the American College of Surgeons, the recurrence rate in open surgeries involving mesh is lower than in surgeries with sutures. Laparoscopy performed using a mesh can have a recurrence rate as low as 3.4%. Thus, mesh procedures are preferred for the treatment of incisional hernias.

The umbilical hernia segment is expected to grow significantly over the forecast period. This growth is fueled by the increasing prevalence of umbilical hernia, particularly among aging populations. Umbilical hernias occur due to a defect in the abdominal wall between the stomach and the chest. These hernias are not common, resulting in a lesser number of repairs performed for the treatment of umbilical hernias.

Procedure Insights

The open surgery segment accounted for the largest ventral hernia mesh devices market share in 2024. Market growth is driven by the prevalence of complex and relatively large hernias, widespread surgical training and infrastructure, high preference of surgeons for open surgeries, fewer equipment and setup requirements, and cost-effectiveness in low- and middle-income countries. Open procedures also allow for larger or more intricate mesh placements, including advanced techniques like component separation, which are less feasible with minimally invasive methods. While minimally invasive techniques are growing rapidly, open surgery continues to lead in volume due to its practicality and effectiveness in various clinical scenarios.

The robotic surgery segment is expected to grow significantly over the forecast period. This growth is fueled by its ability to enhance surgical precision, reduce complications, and improve recovery times. The robotic platform offers superior visualization, dexterity, and control, allowing surgeons to perform complex hernia repairs, such as transversus abdominis release (TAR) or component separation, with greater accuracy and minimal invasiveness. For example, studies published in Surgical Endoscopy and Annals of Surgery have demonstrated that robotic ventral hernia repair is associated with lower conversion rates, reduced hospital stays, and decreased postoperative pain compared to open or conventional laparoscopic methods. Additionally, the increasing availability of robotic systems and ongoing surgeon training programs are accelerating adoption globally, particularly in high-volume and tertiary care centers.

End Use Insights

The inpatient facilities segment accounted for 50.6% of the ventral hernia mesh devices market. Inpatient facilities such as hospitals play a pivotal role in the hernia mesh devices market, serving as primary settings for hernia repair surgeries. They drive demand for hernia mesh products and influence market trends by adopting advanced surgical techniques and technologies. Hospitals and clinics also contribute to market growth by participating in clinical trials and research studies, fostering innovation in hernia mesh technology. For instance, according to Springer Nature data published in April 2024, the FDA collaborates with hospitals through programs such as MedSun and the Medical Device Innovation Consortium (MDIC) to enhance postmarket surveillance of hernia mesh devices. MedSun, involving 350 hospitals, facilitates bi-directional communication between the FDA and hospitals, enabling proactive detection and resolution of potential device issues.

The outpatient facilities market is expected to grow significantly during the forecast period. Outpatient facilities such as ambulatory surgical centers provide same-day surgical care, including diagnostic and preventive procedures. They have become popular for their cost-effectiveness, convenience, and reduced infection risk compared to traditional hospitals. The growing preference for laparoscopic techniques, which offer faster recovery and less postoperative pain, aligns well with the capabilities of ASCs. This shift is driven by advancements in surgical technology and improved hernia mesh designs, facilitating safer and more efficient procedures.

Regional Insights

The North American ventral hernia mesh devices market dominated the global market and accounted for a 50.9% revenue share in 2024. Some key factors contributing to the growth include the increasing incidence of hernia and its recurrence, heightened awareness of early disease detection and treatment, and the availability of advanced technologies and imaging modalities that facilitate a physician’s ability to diagnose and treat these conditions. Additionally, there is a growing patient preference for non-invasive diagnostic procedures, which offer detailed assessments without the discomfort associated with traditional hernia repairs.

U.S. Ventral Hernia Mesh Devices Market Trends

The U.S. ventral hernia mesh devices market held a significant share of North America's ventral hernia mesh devices market in 2024, driven by factors such as the rising incidence of ventral hernia cases and technological advancements. Hernia repairs are common in the country, and around 1 million hernia repairs are performed annually in the U.S., as per the American Society of Anesthesiologists. Hernias have a high recurrence rate, and surgeons use surgical mesh to support hernia repair and reduce the recurrence rate. The highest prevalence is of inguinal hernia, with almost 800,000 surgeries performed per year. The presence of favorable reimbursement scenarios for hernia mesh is encouraging patients to opt for surgery. Patients have easy access to detailed reimbursement codes & ratios by the government and industry players.

Europe Ventral Hernia Mesh Devices Market Trends

The European ventral hernia mesh devices industry is witnessing growth fueled by the increasing prevalence of chronic diseases, technological advancements, and regulatory support for innovative imaging systems. In June 2024, the EU is looking to standardize how adverse effects from surgical mesh implants are reported across member countries. Reports of serious complications from surgical mesh for pelvic issues in the past decade have encouraged the EU to take action. Countries such as Germany, France, and the UK are at the forefront of this expansion, with strong healthcare infrastructure and favorable reimbursement policies accelerating the adoption of ventral hernia mesh devices and reducing dependency on healthcare facilities.

The UK ventral hernia mesh devices market is one of the key markets in the region. The rising incidence of hernia has increased the demand for hernia mesh repair. Furthermore, technological advancements and the shift in healthcare dynamics drive the market. Technological advancements are key in driving the growth of the UK's ventral hernia mesh devices market, particularly through innovations in mesh materials, surgical techniques, and minimally invasive platforms. For example, products like the Phasix Mesh and Ventralight ST have gained traction in UK surgical centers due to their superior biocompatibility and ease of integration during laparoscopic and robotic procedures.

The France ventral hernia mesh devices market is expected to grow over the forecast period. The rapidly aging population makes it one of the EU’s fastest-aging countries. According to an article by Béatrice Madeline from March 2023, France's demographic makeup is swiftly changing, with 26% of its people over 60, representing one in every four residents. France's robust healthcare infrastructure and emphasis on early detection have fostered an environment conducive to adopting advanced imaging technologies.

France has seen a steady rise in robotic-assisted hernia repairs, with institutions like Hôpital Européen Georges-Pompidou in Paris integrating da Vinci robotic systems for complex abdominal wall reconstructions. These technologies enable surgeons to perform intricate procedures with higher precision and lower conversion rates than traditional methods. France is also at the forefront of utilizing digital preoperative planning and 3D modeling tools to tailor mesh size and placement, which enhances surgical accuracy and reduces recurrence.

The Germany ventral hernia mesh devices market will expand significantly in the forecast period. Germany’s ventral hernia mesh devices market is witnessing significant growth due to technological advancements and a high prevalence of ventral hernias. Hernia societies in the country are focused on assuring quality care for hernia patients due to the complex nature of surgeries. The German Hernia Society and the German Society for General & Visceral Surgery certified various hernia centers in Germany. Germany has over 1,200 hospitals with a general surgery department and 82 certified hernia centers. Each center has two to three certified hernia surgeons.

The Italy ventral hernia mesh devices market is projected to expand in the forecast period due to increasing demand for advanced surgical techniques for all types of hernias, such as resorbable and partially absorbable meshes. Furthermore, the rising number of minimally invasive surgeries is one of the major factors propelling market growth, as it increases the demand for specialized hernia mesh devices suitable for laparoscopic procedures. Moreover, the Italian Society of Hernia and Abdominal Wall Surgery (ISHAWS) has defined characteristics for certified hernia centers to ensure focus on improved quality for patients.

Asia Pacific Ventral Hernia Mesh Devices Market Trends

The ventral hernia mesh devices market in the Asia Pacific region is projected to experience the fastest growth during the forecast period. China and Japan are expected to dominate this market, and India is also expected to grow. Additionally, the availability of trained professionals and the development of healthcare facilities are anticipated to contribute significantly to market growth. Furthermore, the increasing disposable income of people in Asia is expected to increase the demand for ventral hernia mesh devices.

The Japan ventral hernia mesh devices market will expand in the forecast period. Japan's well-developed healthcare infrastructure and advanced surgical tool availability have expanded the market. Furthermore, a rising incidence of hernias, increasing healthcare expenditures, and advancements in surgical techniques have expanded the market. The region is witnessing a significant surge in surgical procedures, with the World Health Organization estimating that over 2.5 million hernia repairs are performed annually across Asia-Pacific countries. In addition, the Japanese government is taking measures to promote the healthcare industry, which is expected to contribute to market growth. The low prevalence of obesity in Japan minimizes the risk of hernia. However, Westernization has contributed to changing food habits, which is leading to an increase in the prevalence of hernia in the younger population.

The China ventral hernia mesh devices market is expected to grow over the forecast period. A growing aging population, increasing surgical volumes, and rising healthcare infrastructure drive the market in China. China has a substantial number of elderly individuals, with projections indicating that by 2030, over 300 million people are expected to be aged 60 and older, significantly raising the incidence of hernias. For instance, according to the Chinese Medical Association, the country sees approximately 1.5 million hernia repair surgeries annually, which is expected to rise as awareness of treatment options increases.

Latin America Ventral Hernia Mesh Devices Trends

The hernia mesh devices market in Latin America is driven by several key factors, including a rising prevalence of hernias, advancements in surgical technology, and increased healthcare investments across the region. With a population exceeding 650 million, Latin America is experiencing significant demographic changes, including an aging population more susceptible to hernias. The Pan American Health Organization estimates that hernia repairs account for a substantial portion of surgical procedures in the region, with hundreds of thousands of cases reported annually.

Middle East & Africa Ventral Hernia Mesh Devices Trends

An aging population and increasing lifestyle risk factors, such as obesity, contribute to a growing number of hernia cases in the MEA region. Advancements in diagnostic tools and techniques have led to earlier detection of hernias, prompting more patients to seek treatment. Public health initiatives and rising disposable income are increasing awareness of hernia repair procedures using mesh, making them a more considered option.

The ventral hernia mesh devices industry in Saudi Arabia is anticipated to expand in the forecast period. The factors affecting market growth include advancements in medical technology and the rising prevalence of hernia types, such as umbilical and epigastric hernias. Saudi Arabia has the region's largest number of hospitals and primary healthcare centers. Moreover, increased disposable income due to economic growth and urbanization is anticipated to create lucrative growth opportunities. The Saudi Arabian government is diverting funds toward developing a robust healthcare infrastructure by establishing new hospitals. For instance, the Ministry of Health was expected to spend approximately USD 71 billion over 5 years ending in 2020, which aligns with the government’s Vision 2030 and the National Transformation Program.

Key Ventral Hernia Mesh Devices Company Insights

The ventral hernia mesh devices market is highly competitive. Key players such as Medtronic plc, Ethicon Inc., Becton, Dickinson and Company, Novus Scientific AB, and B. Braun SE hold significant positions. Leading companies are pursuing a mix of organic and inorganic strategies, including new product development, partnerships, acquisitions, mergers, and regional growth, to address the unmet demands of their customers.

Key Ventral Hernia Mesh Devices Companies:

The following are the leading companies in the ventral hernia mesh devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- Becton, Dickinson and Company (BD)

- Ethicon Inc. (Johnson & Johnson MedTech)

- Meril Life Sciences Pvt. Ltd.

- Novus Scientific AB

- B. Braun SE

- TELA Bio, Inc.

- BG Medical LLC

- Integra LifeSciences Corporation

- W. L. Gore & Associates, Inc.

- Atrium Medical

Recent Developments

-

In April 2025, BD (Becton, Dickinson and Company) secured FDA 510(k) clearance and introduced the Phasix ST Umbilical Hernia Patch, a fully absorbable mesh tailored for umbilical hernia repair.

-

In February 2024, RTI Surgical, Inc. acquired Cook Group Incorporated, supporting its strength in surgical and regenerative medicine. This acquisition enabled RTI to broaden its assortment of biologic and synthetic offerings, especially in hernia repair and wound management, ultimately improving its capacity to deliver innovative surgical solutions.

-

In June 2023, Advanced Medical Solutions Limited received FDA approval for its LiquiFix FIX8 and Precision Hernia Mesh Fixation Devices. These devices utilize a liquid adhesive to secure mesh during laparoscopic and open hernia surgeries, offering broader fixation points and potentially reducing pain compared to traditional tacks.

Ventral Hernia Mesh Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 902.7 million

Revenue forecast in 2030

USD 1,356 million

Growth rate

CAGR of 8.48% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mesh type, indication, procedure, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada, Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic plc; Ethicon Inc. (Johnson & Johnson MedTech); Meril Life Sciences Pvt. Ltd.; Becton, Dickinson and Company; Novus Scientific AB; B. Braun SE; TELA Bio, Inc.; BG Medical LLC; Integra LifeSciences Corporation; W. L. Gore & Associates, Inc.; Atrium Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ventral Hernia Mesh Devices Market Report Segmentation

This report forecasts country-level revenue growth and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the ventral hernia mesh devices market report on the basis of mesh type, indication, procedure, end use, and region:

-

Mesh Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Resorbable Mesh

-

Partially Absorbable Mesh

-

Non-resorbable Mesh

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Umbilical Hernia

-

Epigastric Hernia

-

Incisional Hernia

-

Others

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Surgery

-

Laparoscopic Surgery

-

Robotic Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ventral hernia mesh devices market size was estimated at USD 839.5 million in 2024 and is expected to reach USD 902.7 million in 2025.

b. The global ventral hernia mesh devices market is expected to grow at a compound annual growth rate of 8.48% from 2025 to 2030, reaching USD 1,356.0 million by 2030.

b. North America dominated the ventral hernia mesh devices market, with a share of 50.92% in 2024. This is attributable to the increasing incidence of hernia and its recurrence, heightened awareness of early disease detection and treatment, and the availability of advanced technologies and imaging modalities that facilitate a physician’s ability to diagnose and treat these conditions.

b. Some key players operating in the ventral hernia mesh devices market include Medtronic plc, Ethicon Inc. (Johnson & Johnson MedTech), Meril Life Sciences Pvt. Ltd., Becton, Dickinson and Company, Novus Scientific AB, B. Braun SE, TELA Bio, Inc., BG Medical LLC, Integra LifeSciences Corporation, W. L. Gore & Associates, Inc., Atrium Medical

b. Key factors driving the growth of the ventral hernia mesh devices include the increasing cases of hernias, technological advancements in mesh repair, a shift towards preventive healthcare, and a growing preference for minimally invasive procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.