- Home

- »

- Reports

- »

-

3PL Services Sourcing & Supplier Intelligence Report, 2030

![3PL Services Sourcing & Supplier Intelligence Report, 2030]()

3PL Services Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10501

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

3PL Services Procurement Trends

“The 3PL service is mainly driven by the increasing need to reduce last mile deliveries and the demand for better traceability across supply chain processes.”

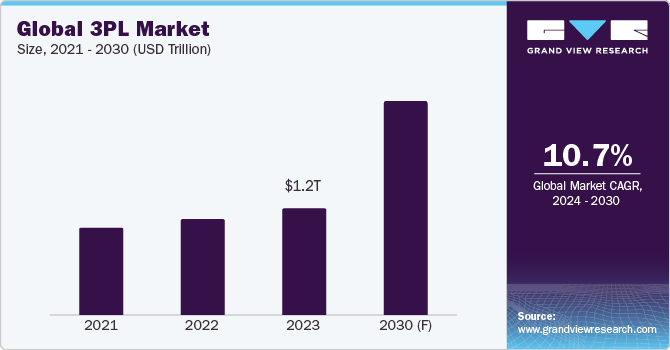

Procurement of third-party logistics (3PL) services has gained prominence from heightened demand for better traceability and end-to-end visibility across the supply chain processes, especially in the e-commerce business. The global market is expected to grow at a CAGR of 10.7% from 2024 to 2030. More and more companies are focusing on reducing the distance of last-mile deliveries by placing fulfillment hubs at more convenient locations. 3PL companies are utilizing advanced technology to expedite deliveries and improve operational efficiencies by reducing handling points. All such factors are fueling the growth. The different segments considered for this report include - value-added logistics services, warehousing and distribution, international transportation, domestic transportation management, and dedicated contract carriage/ freight forwarding.

The global 3PL market size was valued at USD 1,145.11 billion in 2023. Due to an increase in direct-to-consumer orders, many 3PLs are partnering with 4PLs to expand their inventory and transportation capabilities. Seamless system integration has become one of the top trends - as there is an increased need for enhanced connectivity between warehouse management systems, shopping carts, and other platforms to meet the increasing consumer demand. Currently, the North American region accounts for almost 35% of the overall share, followed by APAC and Europe. The APAC 3PL segment is expected to witness the fastest growth.

Continuous technological innovations and advancements, such as seamless e-commerce integrations, warehouse management systems, automated order fulfillment, inventory management systems, an easy post-purchase experience, automated payment reconciliation, order management systems, and returns management, are expected to aid market expansion. Many large warehouses are increasingly using robotic picking arms and vision systems to minimize errors and increase productivity.

For instance, in February 2023, Brightpick developed an advanced fulfillment robot named Autopicker. It can pick and consolidate orders in warehouse aisles. The robot combines a mobile base and a picking arm for order fulfillment. Autonomous mobile robots can move anywhere around the facility, obtain storage totes from shelves, and pick individual items from the totes. By using such automated robots, the company has been able to reduce picking labor by 95% and cut costs for order fulfillment by 50%. The Autopicker works with standard 10-ft shelves and totes and can be easily integrated with any WMS and other existing platforms/systems. As a result, companies can increase storage density by 250%. A typical Autopicker fleet consists of 15 to 100 robots and can optimize the entire fulfillment process.

On the other hand, with the advent of 5G, AR is being increasingly used by companies in the entire supply chain process. It is used in different stages - from sourcing, production, storage, and delivery to even delivery return. More than 30% of 3PL companies are using AR technology (such as smart glasses and other wearable devices) in manufacturing and transportation to gain critical insights about package content, weight, handling, and destination. Together with the Internet of Things (IoT), companies achieve higher time and cost savings, gain better visibility across the supply chain, and improve the handling of goods. For instance, with AR technology in warehousing, managers and staff can visualize the warehouse layout and check if any experiments (such as changing the entire layout structure, product placements, terminal displays, shelf adjustments, and others) are possible. In the case of inventory management, managers and staff can manage all the stocks hands-free using AR. The technology provides higher accuracy during inventory handling.

Similarly, IoT-enabled real-time tracking helps 3PL companies improve intermodal modes of transportation as they can plan efficient shipment routes and reduce delivery times. As a result, this allows for greater visibility across the process. The generated data can be analyzed to gain critical insights and create time-saving or customized routes, change last-mile LTL delivery options, or create separate shipments over a greater number of trucks. RFID Sensors in smart containers help 3PL companies understand dramatic variations in atmospheric pressure by providing detailed information about the surrounding environment by type of units.

Supplier Intelligence

“What are the characteristics of 3PL services? How are the players expanding their capabilities?”

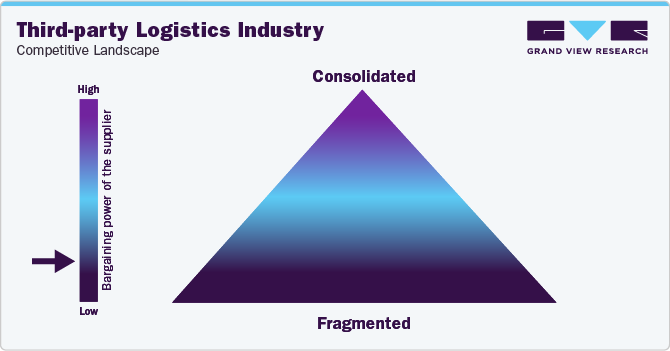

The global 3PL industry is fragmented with many top players competing for the major share. Many large corporations are strategically partnering with mid-sized or small-sized companies to leverage their regional logistics capabilities, expand their local market knowledge, reduce overhead costs, and achieve better profit margins. Many regional players are expanding into new places and helping their clients in expanding their geographic serviceability. New competitors are foraying into the 3PL ecosystem with customized and industry-specific services, redefining the procurement landscape. In-house logistics is the only substitute for 3PL services. However, in-house logistics involves a high level of complexity and hence poses a minimal threat to 3PL services. Buyers can easily switch between providers without incurring any significant switching costs as there are several 3PL providers.

Key suppliers covered in the industry:

-

United Parcel Service

-

DHL

-

Kuehne + Nagel

-

FedEx Corporation

-

Nippon Express

-

DB Schenker

-

C.H. Robinson

-

CEVA Logistics

-

Burris Logistics

-

XPO Logistics

-

J.B Hunt Transport Services

Pricing and Cost Intelligence

“Which variables influence the prices of 3PL services? What are the largest cost components?”

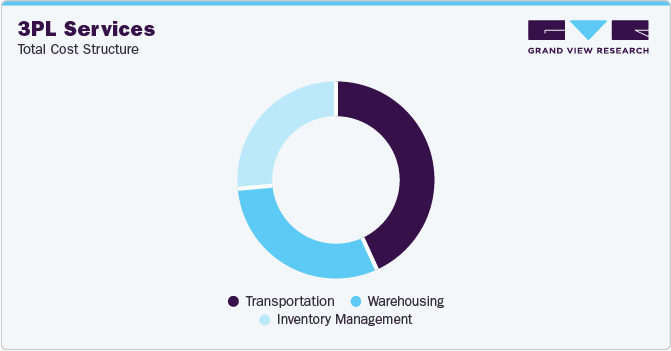

The two biggest cost components of a 3PL service are transportation and warehousing. Together, they account for almost 70% of the total costs. The overall transportation cost can depend on the mode of service - such as air, rail, sea, or road. The warehousing costs can be further broken into order picking storage, shipping, receiving, and others. Inventory carrying and administration costs also influence the cost of the logistics services.

Fluctuations in freight costs significantly impact the 3PL services procurement cost. For instance, in the third week of February 2023, the composite index had reduced by 2% and dropped by 79% compared to February 2022. Drewry’s WCI composite index of USD 1,955 per 40-foot container was 81% below the peak of USD 10,377 compared to September 2021. The index on average, however, remained 38% higher than average compared to 2019 (pre-pandemic) rates of USD 1,420. Freight rates on Rotterdam to New York had decreased by USD 335 to reach USD 5,675 per FEU in February 2023. As of April 2023, the freight rates to ship a 40 feet container to the U.S. from Asia have dropped by 80% since April 2022. The major reasons are the reduction in consumer spending, the trade war between the U.S. and China, and excess inventory.

The following chart below provides a breakdown of the cost structure associated with 3PL services. The fixed costs include warehousing, transportation, and inventory management. The cost of warehousing can depend on multiple cost components, which have been illustrated below.

Sourcing Intelligence

“Which nation is the preferred destination for sourcing?

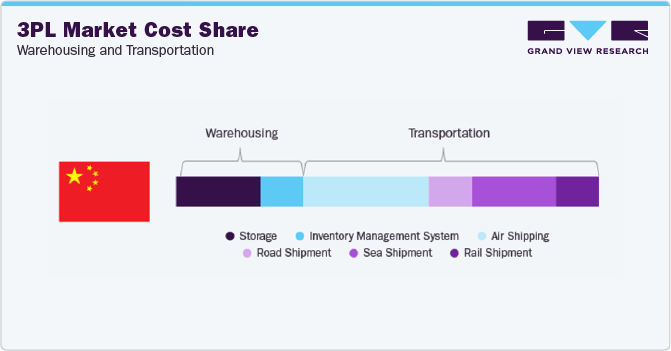

China is one of the most preferred destinations for 3PL services procurement in terms of sourcing intelligence. The cost of warehousing and transportation is low compared to other leading countries such as the U.K., Germany, and the U.S. Since 2019, the freight volumes in China have increased steadily and risen by almost 14% in major trade lanes between China and North America. Labor costs are low in China due to lower operational costs and lower warehousing costs.

The Chinese government is providing huge incentives to companies building warehouses in special zones. The government has also decreased the import and export taxes. Most of the warehouses have started utilizing integrated WMS, and IMS software which provides better traceability and visibility across the supply chain processes. Additionally, most of them are located near ports or airports, which enables companies to meet consumer demands faster.

In China, since 2021, large-scale freight forwarders have merged with many contract logistics providers to generate higher shares of revenue. For instance, the China Logistics Group merged with five state-owned companies in 2021. They are CTS International Logistics, China Logistics, China National Packaging, China Railway Materials Group, and China National Materials Storage and Transportation. Together, the Group manages 42 warehouses, 120 railway lines, and 4.95 million square meters of other storage facilities. The Group, through this merger, had a line of three million vehicles globally.

Major 3PL providers also increased their freight capacity in China. For instance, in 2021, Cainiao purchased a 15% equity in Air China Cargo and entered long-term agreements with Atlas Air and LATAM Airlines Group. Global players, such as Maersk, and Kuehne and Nagel, have also been expanding in this region.

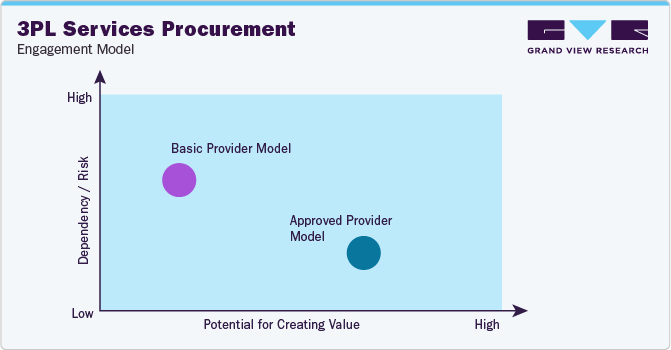

From a sourcing perspective, most suppliers opt for a basic provider model or an approved provider model to achieve higher cost savings, reduce security-related risks, and ensure better flexibility in customization.

The logistics providers are increasing their investments in new technology to develop new products that aid the automation process and reduce transportation time and handling costs. Service providers are also engaging with third-party suppliers, acquiring and partnering with regional suppliers that have adopted a global delivery model to reduce risks to buyers. Clients should make sure that their supply chains are free from inactive suppliers and start focusing on strategic partnerships for value-added sourcing.

The 3PL Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

3PL Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 10.7% from 2024 - 2030

Base Year for Estimation

2023

Pricing growth Outlook

8% - 10%

Pricing Models

Fixed price model, cost plus, and volume-based pricing model

Supplier Selection Scope

Cost and pricing, Past engagements, Productivity, Geographical presence

Supplier selection criteria

Service offerings, transportation methods, 3PL services, software, logistics, compliance

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

United Parcel Service, DHL, Kuehne + Nagel, FedEx Corporation, Nippon Express, DB Schenker, C.H. Robinson, CEVA Logistics, Burris Logistics, XPO Logistics, and J.B Hunt Transport Services

Regional scope

Global

Historical data

2021 - 2022

Revenue Forecast in 2030

USD 2332.82 billion

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Customization scope

Up to 48 hours of customization free with every report.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global 3PL market size was estimated at USD 1,145.11 billion in 2023.

b. The global 3PL market is expected to record a CAGR of 10.7% from 2024 to 2030.

b. The increasing demand to generate analytical insights for client and internal use with better traceability and end-to-end visibility across the supply chain processes, rising preference for better-integrated software management and the need for reducing the distance of last-mile deliveries are driving the growth of the 3PL Services market.

b. According to the LCC/BCC sourcing analysis, China and U.K. are the ideal destinations for sourcing 3PL services.

b. Some of the key 3PL Services providers are DHL, UPS, Kuehne and Nagel, FedEx, Nippon Express, and DB Schenker.

b. The global 3PL services market features a fragmented landscape with the leading ten to fifteen companies accounting for 45% of the market share.

b. Transportation, warehousing, and inventory form the largest cost components. Transportation and warehousing together account for more than 60 − 70% of the total fixed costs of 3PL services.

b. Dispatch timeliness, inventory management accuracy, and cost per unit shipped are some of the KPIs of 3PL services.

b. Adopting an integrated 3PL management software that provides better visibility across the supply chain processes, adopting a greener supply chain, and opting for an approved provider vendor strategy to achieve higher cost and time savings.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified