- Home

- »

- Reports

- »

-

Big Data Procurement Intelligence Report, 2023-2030

![Big Data Procurement Intelligence Report, 2023-2030]()

Big Data Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10535

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Big Data Category Overview

“The big data category’s growth is driven by the increase in adoption of the technology in healthcare, banking, real estate, transportation, manufacturing industry, and fraud detection”

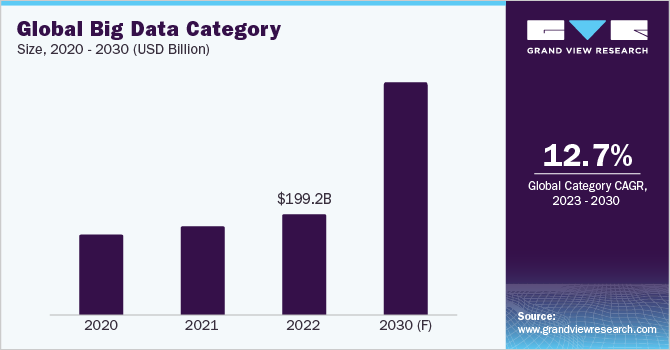

The big data category is expected to grow at a CAGR of 12.7% from 2023 to 2030. Factors such as advancement in technology, increasing data generation, implementation of IOT, social media, and user-generated content, and decreasing cloud storage costs are fueling the category growth. Venture capital investments in various technologies are rapidly rising, with this technology receiving 10% of all venture capital investments worldwide in 2022.

This category size was valued at USD 199.2 billion in 2022. One of the key trends is the growth of cloud migration and cyber security. For instance, Splunk is a big data analytics platform that is used by businesses and organizations to monitor and analyze their IT infrastructure for security threats. It collects data from a variety of sources, including network traffic, system logs, and security appliances. This data is then analyzed using big data analytics tools to identify potential security threats.

This category is a valuable tool for cloud migration. It can be used to assess the current IT infrastructure, identify challenges, and uncover opportunities. This can also help to select the most appropriate migration strategy and facilitate real-time monitoring and management of the migration process. By leveraging this category, organizations can streamline their cloud migration journey and ensure a smooth and efficient transition to the cloud environment.

The growth of the Internet of Things (IoT) is generating a massive amount of data that can be used to improve decision-making. Governments are increasingly using this category to improve public services, such as tracking crime, improving transportation, and managing natural disasters. AI and machine learning are becoming increasingly important for this category, as they can automate the process of data analysis and identify patterns and trends that would be difficult to identify manually.

In addition, the rising interest in predictive analysis, machine learning, and Hadoop is expected to aid big data category expansion.

Supplier Intelligence

“How is the nature of the big data category? What are the initiatives taken by the suppliers in this category?”

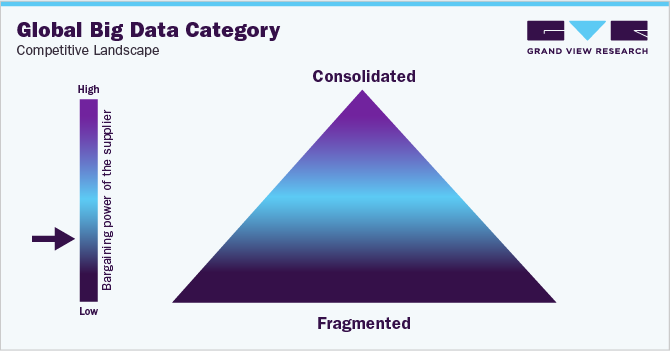

The global big data category is highly fragmented with the presence of several players in the market. This category faces fierce competition from players competing to expand their consumer base. Strategic collaborations and the startup culture are gaining popularity, with new players like Gigasheet boosting revenue and consumer base. Research and development activities are crucial for overall market growth, with players investing in analysis enhancements to add value.

Accenture acquired Ergo, a data-centered business in Argentina, in April 2022, to expand its Cloud First capabilities in the Hispanic South American market. Ergo's 200 data specialists will join Accenture's Data & AI team, providing expertise and resources for data-led transformations. The acquisition will enhance Accenture's services in the South American market.

Key suppliers covered in the category:

-

Accenture

-

Cloudera

-

Google

-

Hewlett-Packard Company (HP)

-

IBM

-

Mu Sigma Inc.

-

Amazon

-

Oracle Corporation

-

Splunk Inc

-

Teradata Corporation.

Pricing and Cost Intelligence

“What are some of the major cost components in developing or implementing this technology? Which factors impact the cost of big data development?”

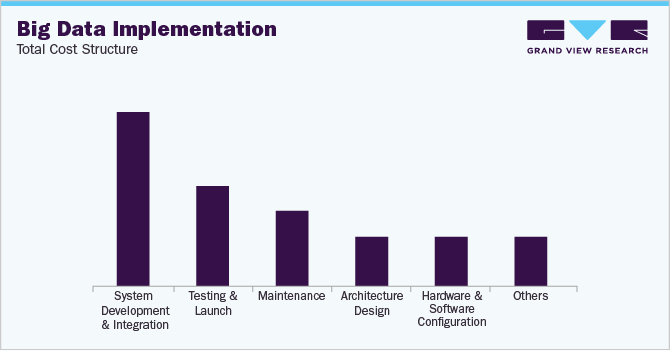

The cost of this category development can vary significantly depending on the project scope, data volume, technology stack, and other factors. Organizations should carefully analyze their specific requirements and evaluate the potential return on investment before embarking on a big data initiative. The major cost components of big data development include system development and integration, testing and launch, maintenance, architecture design, hardware and software configuration, and others.

The implementation of solutions in this category can be costly, with prices ranging from USD 200,000 to 3 million for a mid-sized organization. However, the benefits of big data can also be significant, including the ability to make better decisions, improve operational efficiency, and gain a competitive advantage.

The following chart provides various costs incurred in implementing this technology. The major cost heads are shown below:

Here are some of the factors that can impact the cost of big data implementation:

Project scope: The scope of the project will determine the amount of data that needs to be processed and analyzed, as well as the complexity of the solution. In recent years, the amount of data available to procurement professionals has exploded. This is due to the increasing use of electronic procurement (e-procurement) systems, which collect data on every purchase made by an organization. This data can be used to identify trends, improve decision-making, and reduce costs.

Size and complexity of the data: The size and complexity of the data will also affect the cost of implementation. For example, processing and analyzing petabytes of data will be more expensive than processing and analyzing terabytes of data.

Technology stack: The technology stack used will also affect the cost of implementation. For example, using open-source big data technologies can be more cost-effective than using proprietary big data technologies.

Sourcing Intelligence

“Which countries are the leading sourcing destination for big data development?”

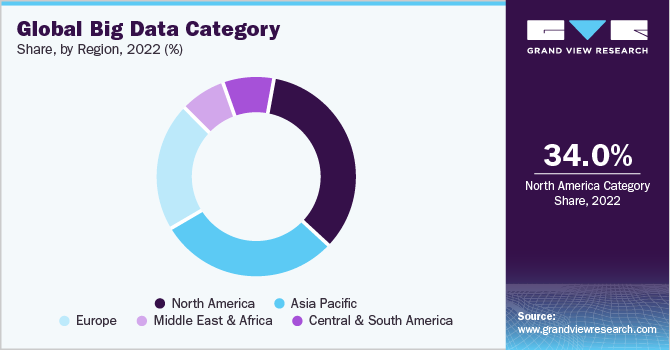

In terms of big data sourcing intelligence, North America and Asia Pacific are the two largest regions in the global big data market. North America is expected to grow at a CAGR of 13.1% during the forecast period, while Asia Pacific is expected to grow at a CAGR of 14.4%.

The growth of this category in North America is being driven by the increasing adoption of big data solutions by businesses in the region. This is being driven by the increasing volume and complexity of data that businesses are generating, as well as the growing demand for analytics tools that can help businesses make better decisions.

The growth of this category in Asia Pacific is being driven by the rapid growth of the internet and mobile devices in the region. This is leading to the generation of large amounts of data, which can be analyzed to gain insights into customer behavior and trends.

The U.S. Department of Education has started a nationwide dashboard that gathers data on public schools across the nation in an effort to streamline big data in education. The dashboard tracks the prospects for the nation's educational sector and its research output. States and public schools are also taking action to incorporate big data into their standard operating procedures.

For instance, Michigan State: Through the assignment of a dashboard that rates performance as improving, remaining the same, or deteriorating in many areas, the state of Michigan has contributed to big data in education. The dashboard focuses on fourteen metrics for postsecondary education, school accountability, learning culture, and value for money.

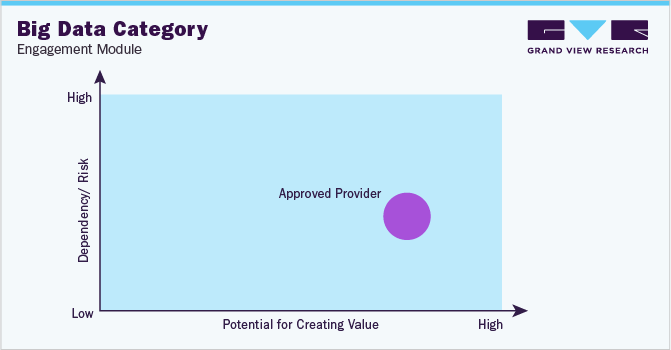

Large-scale companies in the healthcare, real estate, insurance, and logistics sectors often opt for either a partial or full outsourcing model for big data engagement. While employing an internal team would be beneficial, companies face significant challenges such as talent shortages, onboarding issues, and infrastructure costs. These challenges can cause significant budgetary impacts. Major companies are increasingly adopting a full outsourcing model to achieve increased transparency, reduced risks and frauds, and higher security against outside attacks. This model also provides access to specialized teams that can be beneficial in the long run. Additionally, employing an offshore strategy can help companies reduce employment costs by more than 35%-45%.

An approved provider model is the most common form of operating model due to its potential for higher value creation. In this model, the big data technology vendor must fulfill a predetermined set of requirements, including previously demonstrated performance, platform access, privacy conditions, and several other requirements.

Healthcare companies are looking into this category solution for clinical trial efficiency and transparency as well as for safely storing and managing patient medical records. To create platforms/solutions that can track and verify clinical trial data, guarantee the accuracy of medical records, provide end-to-end traceability of pharmaceutical products, and construct systems that track drug movement and stop counterfeit drugs from entering the supply chain, they work with technology and platform/software providers.

The Big Data Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Big Data Procurement Intelligence Report Scope

Report Attribute

Details

Big Data Category Growth Rate

CAGR of 12.7% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 4%

Pricing Models

Subscription-based

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Type, technical expertise, security measures, support and maintenance, cost-effectiveness, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Accenture, Cloudera, Google, Hewlett-Packard Company (HP), IBM, Mu Sigma Inc., Amazon, Oracle Corporation, Splunk Inc, Teradata Corporation.

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 518.42 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global big data category size was valued at approximately USD 199.2 billion in 2022 and is estimated to witness a CAGR of 12.7% from 2023 to 2030.

b. Factors such as advancement in technology, increasing data generation, implementation of IOT, social media and user-generated content and decreasing cloud storage cost are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, China, India and U.S are the ideal destinations for sourcing big data development.

b. This category is highly fragmented with the presence of many large players competing for the market share. Some of the key players are Accenture, Cloudera, Google, Hewlett-Packard Company (HP), IBM, Mu Sigma Inc., Amazon, Oracle Corporation, Splunk Inc, Teradata Corporation.

b. System development and integration, testing and launch, maintenance, architecture design, hardware and software configuration and others are the key cost components for big data category.

b. Cost-saving measures such as complete service sourcing, verifying the performance of the service providers, and maintaining open communication with suppliers to address any issue are some of the best sourcing practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

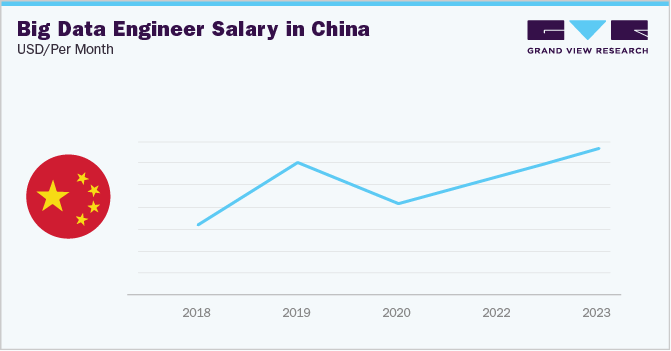

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified