- Home

- »

- Reports

- »

-

Blister Packaging Cost & Supplier Intelligence Report, 2030

![Blister Packaging Cost & Supplier Intelligence Report, 2030]()

Blister Packaging Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10506

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Blister Packaging - Procurement Trends

“The blister packaging market growth is driven by the rise in environmentally friendly packing solutions and increasing demand from pharmaceutical companies.”

Blister packaging procurement has emerged as an innovative solution for smart wrapping, child-resistant, sustainable wrapping, and anti-counterfeiting measures. The global market is expected to grow at a CAGR of 7.4% from 2024 to 2030. Companies are emphasizing environmentally friendly plastics to boost their supply chain management. For example, in February 2023, Astellas Pharma Inc., CKD Corporation, and The Mitsubishi Chemical Group won the Minister of Environment Award of the fifth Japan Open Innovation Prize for using eco-friendly biomass-based plastic for blister packages.

The global blister packaging market size was valued at USD 28.7 billion in 2023. Maintaining safety is the foremost concern in pharmaceutical packaging design. Advances are being made in the development of child-resistant packaging through the implementation of inventive closures and mechanisms. These measures are designed to safeguard young children from unintentional ingestion while ensuring convenience for adults. Additionally, senior-friendly packaging strives to cater to the requirements of elderly patients by incorporating elements such as easily readable labels, larger fonts, and user-friendly opening mechanisms. These endeavors guarantee the secure accessibility of medications to individuals of all ages and physical capabilities.

Additionally, pharmaceutical companies have depicted a heightened demand for nanotechnology due to its ability to provide blister packs with improved barrier protection and reduced package weight. This technology is sought after for enhanced protection against moisture, oxygen, and other gases for their products. In March 2023, Amcor announced a joint research agreement with Nfinite Nanotechnology Inc., to leverage nanotechnology in recyclable packaging.

Wrapping materials have the potential to harm the environment. In response, there is a push for packing and manufacturing companies to create more sustainable products and solutions, owing to the growing pressure on them to follow environmental regulations while producing blister packs. As a result, they are working on designing biodegradable blister packs, which will be expensive to produce and require additional research to offset those expenses. In 2021, Huhtamaki launched its Push Tab blister lid, a sustainable wrapping solution for the global pharmaceutical market. The packaging was made of mono-material PET and contained no aluminum. It was an alternative to the traditional push-through blister packaging and adhered to the strict safety requirements of pharmaceutical packing.

Supplier Intelligence

“What are the characteristics of the blister packaging market? What are the different initiatives taken by the suppliers?”

The industry is highly fragmented, with the presence of several players in the market. Blister wrapping is used in various industries, such as pharmaceuticals, food and beverages, and consumer goods. Each industry has specific requirements and regulations, leading to the presence of multiple players specializing in different sectors.

The bargaining power of buyers is relatively high, alluding to the procurement decisions companies might take in the industry. Buyers, such as consumer goods manufacturers or pharmaceutical companies, have many packing options available and can choose among various blister packaging providers. This gives them leverage to negotiate prices, quality, and other terms to their advantage.

Key suppliers covered in the industry:

-

Amcor plc

-

Westrock Company

-

Blisterpak Inc.

-

Sonoco Products Company

-

Honeywell International Inc.

-

Klockner Pentaplast

-

Dow

-

Constantia Flexibles

-

UFlex Limited

-

ACG

Pricing and Cost Intelligence

“What are some of the major cost components and how are these components impacting the blister packaging market?”

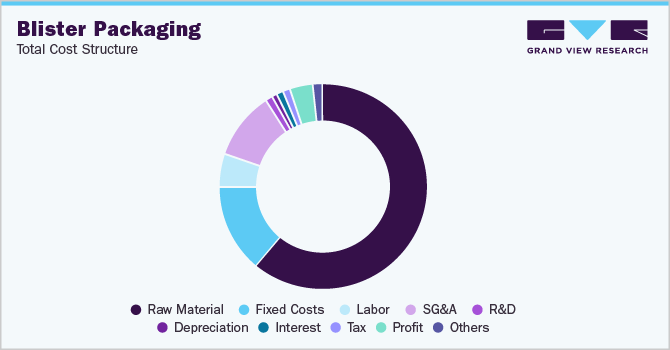

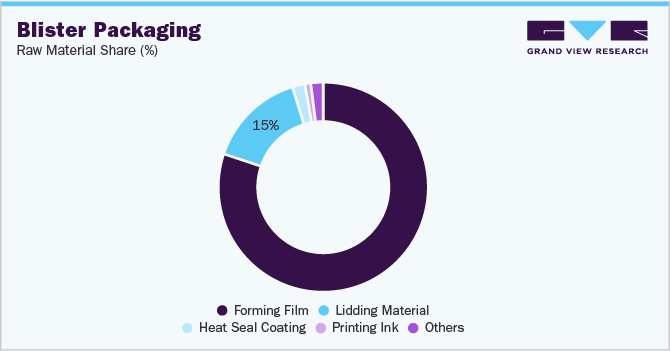

Raw material cost, R&D, labor, and SG&A are some of the cost components for the category. Raw materials (forming film, lidding material, heat seal coating, printing inks, and various others) account for around 60% of the overall cost. Prices of raw materials, such as PVC, increased by more than 25% in 2022 vis-à-vis 2020, owing to COVID-19-induced supply shortages. Product safety and hygiene became the priority for the manufacturers to consider improved packing solutions.

CAPEX cost mainly includes the cost of acquiring the packaging equipment, such as form filling and sealing or coating equipment/machines, that help make the blister packaging using raw materials, including lidding material, heat seal coating, printing inks, and others. Rugged polymers, such as PET, PVC, and PVDC, also account for a major share of the raw material costs. Apart from these, heat seal coating is a critical component used to ensure an adhesive bond between plastic blister and lidding material. These dynamics influence procurement management and cost-decision making.

The total cost structure and raw-material shares illustrated below provide a bird's eye view of the cost intelligence.

Utilization of blister wrapping instead of other packaging options can lead to cost savings once the mold is created for the product. Replicating the blister wrapping using the mold is a simple and straightforward process, which reduces expenses. Additionally, blister packing requires fewer materials compared to alternative methods, making it more cost-efficient.

In 2022, the average global price of polyvinyl chloride (PVC), which is used for forming film, stood at USD 1,115 per metric ton. The average price of PVC in 2021 was USD 1,449 per metric ton, while it was USD 889 per metric ton in 2020.

Sourcing Intelligence

“Which countries are the leading sourcing destination for blister packaging?”

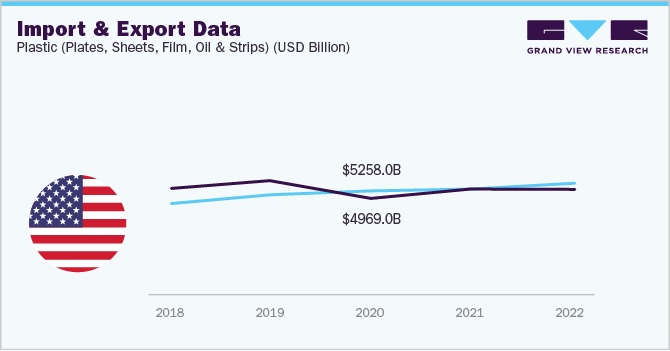

North America dominates with the highest market share. In terms of blister packaging sourcing intelligence, China, Germany, and India are the preferred destination for sourcing blister packs. The U.S. is heavily focusing on sustainable wrapping. Companies such as Amcor plc. are among the top players producing sustainable packaging solutions.

In 2022, blister packages accounted for a 20% market share of medication packing in the U.S. American consumers are highly concerned about the environmental impact of packaging. They look for recyclable plastic films or rigid wrapping, enabling companies to move towards sustainable wrapping.

Additionally, in North America, there is a transition occurring from plastic containers to blisters to improve patient adherence among the expanding elderly population. Meanwhile, the Europe, Middle East, and Africa (EMEA) region is anticipated to achieve the highest CAGR of over 8%. This growth can be attributed to rising concerns regarding physical protection, barrier protection, containment, security, convenience, and portion control.

The U.S. imports most of the blister packaging from Germany, Hong Kong, and China and is among the second largest importer of blister packaging globally. Innovations in blister packaging were driven by the COVID-19 pandemic, resulting in the creation of improved materials and designs aimed at enhancing product protection and minimizing the risk of contamination.

Europe region is heavily focusing on reducing packing waste and recycling the waste. According to the European Parliament’s March 2023 report, The Packaging and Packaging Waste Directive (PPWD) establishes measures aimed at preventing the generation of packing waste & encouraging the reuse and recycling of packing waste. It also outlines the necessities that all packaging sold within the EU must follow. These regulations are intended to minimize the disposal of packing waste and foster a more circular economy. In line with the new circular economy action plan and European Green Deal, in November 2022, the Commission proposed a revision of the PPWD. The objective of this initiative is to guarantee that all packaging can be economically reused or recycled by 2030.

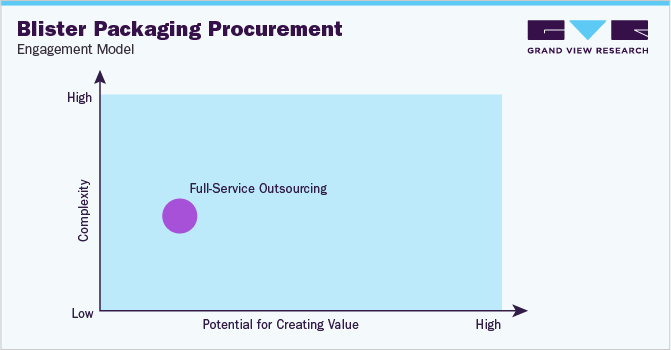

In terms of engagement, companies opt for outsourcing packing solutions rather than in-house packing. Pharmaceutical companies can achieve cost-effective wrapping without compromising quality by leveraging contract packaging organizations (CPOs) to outsource their pharmaceutical packing needs. Pharmaceutical contract wrapping offers the advantage of enabling pharmaceutical companies to leverage packing advancements without exposing themselves to risks. The development of new wrapping formats can incur high costs, and not every design will prove to be enduring.

An approved provider model is the most common form of the operating model due to its potential for higher value creation. In this model, manufacturers must meet a predefined set of qualifications, such as prior-proven performance, government certification, privacy terms, and various other criteria. It is imperative that companies comply with the regulations of the government. For example, the U.S. Food and Drug Administration (FDA) requires manufacturers or packers who pack OTC drug products for retail sales to pack them in a tamper-evident package.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape – the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Blister Packaging Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 7.4% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10%

Pricing Models

Contract-based pricing model, Fixed price pricing model

Supplier Selection Scope

Cost and pricing, past engagements, bulk purchasing, geographical presence

Supplier Selection Criteria

Types of packaging, quality, production capacity, source of manufacturing, regulatory compliance, category innovation, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Amcor plc, Westrock Company, Blisterpak Inc., Sonoco Products Company, Honeywell International Inc., Klockner Pentaplast, Dow, Constantia Flexibles, UFlex Limited, and ACG

Regional Scope

Global

Historical Data

2021 - 2022

Revenue Forecast in 2030

USD 43.8 billion

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global blister packaging market size was valued at approximately USD 28.7 billion in 2023 and is estimated to witness a CAGR of 7.4% from 2024 to 2030.

b. The increasing demand from the pharmaceutical industry and concerns relating to product safety are driving the growth of the market.

b. According to the LCC/BCC sourcing analysis, Germany, China, and India are the ideal destinations for sourcing blister packaging.

How can the nature of the blister packaging industry be described and who are the leading suppliers?b. This industry is highly fragmented with the presence of many large players competing for the market share. Some of the key players are Amcor plc, Westrock Company, Blisterpak Inc., Sonoco Products Company, Honeywell International Inc., Klockner Pentaplast, Dow, Constantia Flexibles, UFlex Limited, and ACG.

b. Raw material, labor, R&D, and SG&A are the major key components of this market. Other key costs include fixed costs which include equipment acquisition cost, quality assurance, and logistics.

b. Cost-saving on bulk purchases, verifying the performance of the service providers, types of blister packaging provided along packaging customization are some of the best sourcing practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified