- Home

- »

- Reports

- »

-

Blockchain Procurement & Sourcing Intelligence Report, 2030

![Blockchain Procurement & Sourcing Intelligence Report, 2030]()

Blockchain Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jun, 2023

- Base Year for Estimate: 2023

- Report ID: GVR-P-10517

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Blockchain - Procurement Trends

“The growth of technological use in the fields of healthcare, banking, real estate, and transportation has augured well for blockchain procurement leaders.”

Blockchain procurement has emerged as a pivotal thread in the fabric of cost reduction, increased transparency, improved security and automation. The global market is expected to grow at a CAGR of 87.7% from 2024 to 2030. Data traceability and transparency, trust and accountability, decentralization, and immutability are driving the market growth. Venture capital investment is heavily increasing in technology. For instance, in 2021, about 4% of the global venture capital investment was in this technology.

The global blockchain market size was valued at USD 17.5 billion in 2023. One of the key trends is the growth of Non-Fungible Tokens (NFTs), cryptocurrencies, and web 3.0 startups. For instance, IBM is supporting the transformation of money into a digital form known as Central Bank Digital Currency (CBDC).

The acceptance of cryptocurrency as a legal form of currency fosters increased investment in this technology by businesses and investors. Additionally, it stimulates technology providers to enhance their services to achieve a competitive edge. The endeavors undertaken by these companies are anticipated to enhance the effectiveness and efficiency of this technology in the coming future.

In essence, blockchain has brought a paradigm shift in procurement, supplier management and supply chain with the innate ability to transform all sorts of digital transactions. In essence, a host of processes is involved in blockchain to provide instant, shared and transparent information stores on an immutable ledger that authorized members can access.

When an authorized participant inputs a transaction, the technology authenticates it. The transaction that occurs is recorded as a block of data. The next step involves sending the block to every computer node in the network. Besides, the authorized nodes corroborate transactions and add the block to the blockchain. The update, distributed across the network, finalizes the transaction.

Amidst a surge in cyberattacks and fraud, blockchain can bolster cybersecurity, trust and efficiencies. Predominantly, no participant can tamper with or alter a transaction after it has been recorded in the shared ledger. Moreover, smart contracts are stored on the blockchain and executed automatically.

Procurement leaders are expected to seek advancements in computer programming, data structure and architecture to underscore blockchain across advanced and emerging economies. In 2023, North America dominated blockchain industry, contributing 40% of the global market share. The growth is attributed to increased technology adoption in the U.S. and Canada by government organizations.

Decentralized Finance (DeFi) is an emerging financial system that is built on top of this technology. By removing the need for intermediaries and engaging with customers virtually, it enables users to access financial services wherever and whenever they want.

Banks and other institutions face significant expenses when conducting cross-border transactions, often taking around three days or more to finalize. However, organizations like Ripple, whose network spans over 40 countries and six continents, have turned to this technology and cryptocurrencies to surmount these challenges. By utilizing this technology, they are able to achieve nearly instantaneous cross-border transactions while significantly reducing costs.

In addition, the rising concerns towards data traceability, and quick transactions are poised to boost blockchain market expansion.

Supplier Intelligence

“How is the nature of the blockchain market? What are the initiatives taken by the suppliers?”

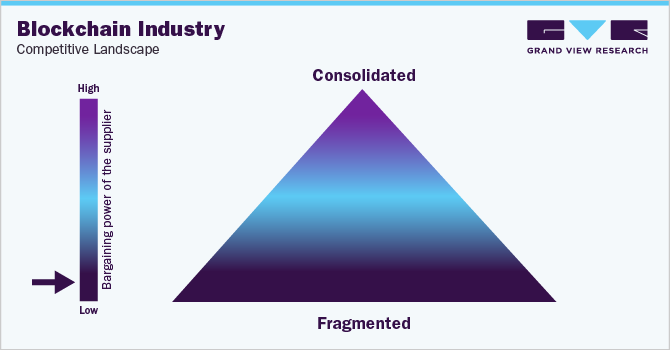

The industry is highly fragmented due to the presence of numerous companies, which are continuously partnering with technology providers to implement this technology in their business. For instance, in January 2022, Walmart and IBM used blockchain technology to improve their supply chain by tracing the storage of goods within seconds. There is no single, dominant blockchain platform that is widely adopted by businesses and consumers. This lack of a standard platform makes it difficult for businesses to develop and deploy these technology applications.

The competition is intense between players as many large and small players offer a range of services. The suppliers of this technology such as developers, and programmers, have increased over time, reducing the supplier’s power to some extent. However, when it comes to specialized blockchain protocols or platforms, the suppliers can have more bargaining power, suggesting the procurement decisions companies may consider.

Key suppliers covered in the industry:

-

IBM Corporation

-

ConsenSys AG

-

LeewayHertz

-

ELEKS Software

-

Blockstream Corporation Inc.

-

Bitfury

-

Springcoin, Inc., d/b/a Spring Labs

-

Chainanalysis

-

Galaxy Digital Holdings Ltd.

-

Markovate

-

Appinventiv

-

Accenture Plc

-

Cubix

Pricing and Cost Intelligence

“What are some of the major cost components in developing or implementing this technology? Which factors impact the cost of blockchain development?”

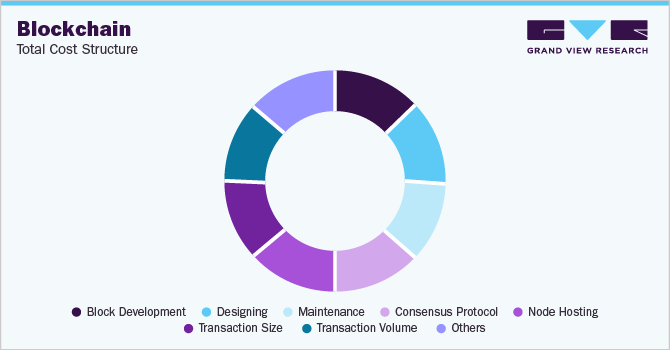

Developing the block, transaction volume, and transaction size form the major cost components when it comes to implementing blockchain technology. There are a number of factors that can affect the pricing of these solutions, including the type of solution, the size and complexity of the project, and the level of expertise required. Businesses should carefully consider all these factors when pricing their solutions to ensure that they are competitive and profitable.

According to an IBM report, the permanent storage cost of blockchain data is about USD 100 per gigabyte (GB). The development of blockchain applications may cost from USD 5,000 to 200,000. The prices of the technology may vary depending on public, private, hybrid, or consortium technology.

The following chart below provides various costs incurred in implementing this technology. The major cost heads are shown below.

Several factors can influence the procurement cost of implementing and operating a blockchain system. First, the complexity of the network and the specific consensus mechanism employed can impact costs. More complex networks may require more powerful hardware, leading to higher upfront expenses. Additionally, the scalability of the solution is crucial, as the cost of scaling the network can vary significantly. Furthermore, the energy consumption associated with mining and transaction verification can contribute to ongoing costs. Moreover, the regulatory environment and legal requirements related to this technology can also influence costs, as compliance measures may involve additional expenses. Last, the level of expertise and technical resources required to develop, deploy, and maintain a blockchain system can impact the overall cost.

Sourcing Intelligence

“Which nations serve as the primary sourcing hubs for blockchain development?”

North America is the major region involved in the development of blockchain technology and is heavily investing in this technology. Over 90% of the North American, and European banks are implementing this technology. In 2022, the share of the U.S. in global mining from Bitcoin rose from 3.5% in 2020 to 38%. In China, the largest cryptocurrency and blockchain players are Bitmain Technologies, with equity funding of USD 450 Million, and Jixin Blockchain, with USD 100 million funding. In terms of blockchain sourcing intelligence, the top six countries preferred for this technology are China, Japan, the U.S., Germany, the U.K., and Singapore.

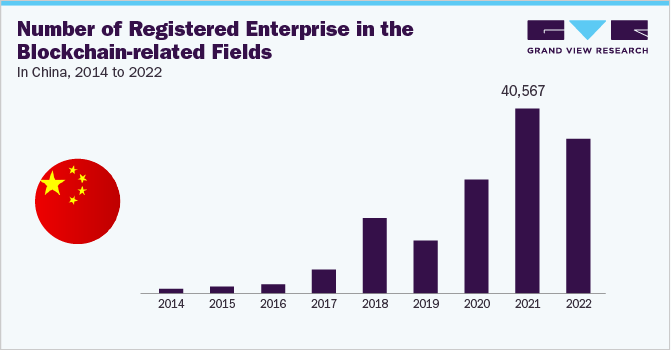

In China, the government strongly supports blockchain technology and is the industry's biggest global promoter. The number of enterprises related to this technology has increased to 40,567 in 2021. With the introduction of a progressed blockchain industrial framework, the Chinese government is increasing the use of distributed networks. To assist blockchain-based businesses, the government intends to develop industrial norms, licenses for property insurance, and tariff incentives.

Western Europe and the Asia Pacific are among the next big spenders on this technology. To meet the rising need for advanced technology in the healthcare sector, top pharma and healthcare companies are actively engaging with blockchain technology providers and procurement leaders. For instance, in March 2021, Moderna, a drug manufacturing company, collaborated with IBM to improve COVID-19 vaccination management. In June 2023, EU’s EBSI Vector project joined forces with Protokol, a blockchain service provider for professional and educational credential verification. This project is expected to simplify the recognition of EU citizens in different countries.

In terms of engagement, large-scale companies opt for either a partial or a full outsourcing model. Many industries are rushing to adopt the power that comes with cutting-edge technologies. Employing an internal team would be beneficial, however, companies are facing significant challenges such as talent shortages, onboarding issues, and infrastructure costs, all of which cause significant budgetary impact. Hence, to achieve increased transparency, reduced risks and frauds, and higher security against outside attacks, major companies in the healthcare, real estate, insurance, and logistics sectors prefer a full outsourcing model. It also helps them gain access to specialized teams that can prove to be beneficial in the long run. It has been observed that employing an offshore strategy can help a company reduce employment costs by more than 50 - 60%.

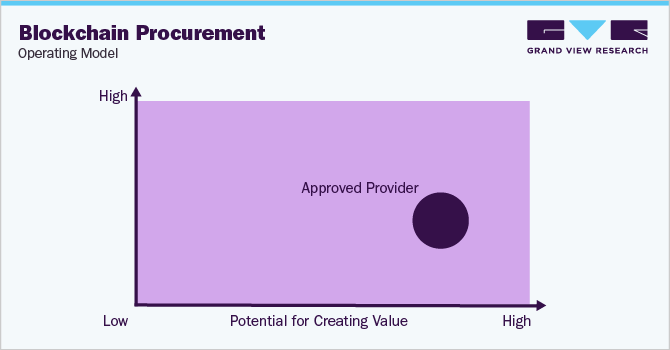

An approved provider model is the most common form of operating model due to its potential for higher value creation. In this model, the blockchain technology provider must meet the predefined set of qualifications, such as prior-proven performance, access to platforms, privacy terms, and various other criteria.

In healthcare, providers are exploring blockchain solutions for securely storing and managing patient medical records and improving the transparency and efficiency of clinical trials. They collaborate with technology and platform/software providers to develop platforms/solutions that can track and verify clinical trial data, ensure the integrity of medical records, provide end-to-end traceability of pharmaceutical products, and build systems that track drug movement and prevent counterfeit drugs from entering the supply chain.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape – the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Blockchain Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 87.7% from 2024 to 2030

Base Year for Estimation

2023

Pricing growth Outlook

8% - 10%

Pricing Models

Cost plus pricing model, fixed price pricing model

Supplier Selection Scope

Cost and pricing, Past engagements, Productivity, Geographical presence

Supplier selection criteria

Type, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key companies profiled

IBM, ConsenSys, LeewayHertz, ELEKS Software, Blockstream, Bitfury, Spring Labs, Chainanalysis, Galaxy Digital Holdings, Markovate, Appinventiv, Accenture Plc, and Cubix

Regional scope

Global

Historical data

2021 - 2022

Revenue Forecast in 2030

USD 1,431.54 billion

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Customization scope

Up to 48 hours of customization free with every report.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global blockchain market size was valued at approximately USD 17.5 billion in 2023 and is estimated to witness a CAGR of 87.7% from 2024 to 2030.

b. The increasing technological advancement and rising demand by various industries are driving the growth of the market.

b. According to the LCC/BCC sourcing analysis, China, and the U.S., are the ideal destinations for sourcing blockchain development.

b. This industry is highly fragmented with the presence of many large players competing for the market share. Some of the key players are IBM, ConsenSys, LeewayHertz, ELEKS Software, and Blockstream.

b. Block development, transaction volume, and transaction size are the major key components of this category. Other key costs include maintenance, node hosting, and designing.

b. Cost-saving measures such as complete service sourcing, verifying the performance of the service providers, and maintaining open communication with suppliers to address any issue are some of the best sourcing practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified