- Home

- »

- Reports

- »

-

Business Intelligence Procurement Intelligence Report, 2030

![Business Intelligence Procurement Intelligence Report, 2030]()

Business Intelligence Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10526

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Business Intelligence Category Overview

“The business intelligence category growth is propelled by the increase in usage of the technology across sectors, industries, healthcare, banking, supply chain for precise and quick decision making.”

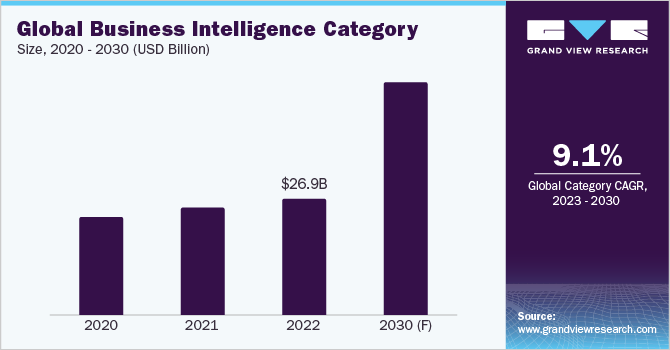

The business intelligence category is expected to grow at a CAGR of 9.1% from 2023 to 2030. The organizations’ desire to modernize and to have a solid strategy for effective go-to-market planning is the primary pillar of category growth. Its services cover a comprehensive understanding that aids in better business decisions that are quick, precise, and tailored providing a competitive edge over others, making it irresistible for a company to implement it in their business. Organizations are starting to recognize and value the importance of data in their operations as the world generates more data from various sources.

The global business intelligence market size was estimated at USD 26.92 billion in 2022. Every industry is seeing an increase in the adoption of BI solutions among small and midsized organizations, fueling the category market. The advantages that BI software offers have led to a spike in the demand for cloud-based business solutions in the SME sector. Data scalability is a prominent feature of BI software and application. The rising need for industry-specific BI solutions in banking, manufacturing, healthcare, security services, and many other areas is one of the emerging category trends.

-

Self-service BI has become an industry buzzword that is fueling the movement for data literacy across industries.

-

One of the most popular BI developments right now is Natural Language Processing (NLP), which has enormous potential for business intelligence in the future. The release of ChatGPT in particular has encouraged broad NLP improvement in analytics.

Decision intelligence is another one that gained recognition in 2022 and is anticipated to keep growing in 2023 as well. It is the application of augmented analytics and machine learning to support business decision-making by humans. Vendors focusing on decision intelligence such as Pyramid Analytics, Sisu Data, and Tellius have attracted venture capital funding with, Pyramid raising USD120 million in May 2022, Tellius raising USD16 million in October 2022, and Sisu USD62 million in late 2021.

In June 2023, Microsoft invested USD13 Billion in Open AI and is launching a new brand called Fabric, which will bring several data products under one umbrella.

Supplier Intelligence

“What kind of category does business intelligence fall under? What actions are taken by the suppliers in this category?”

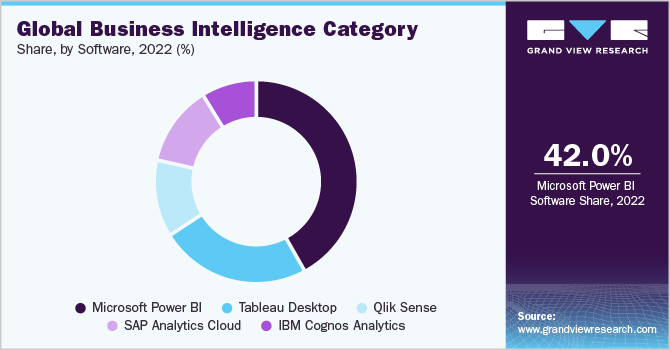

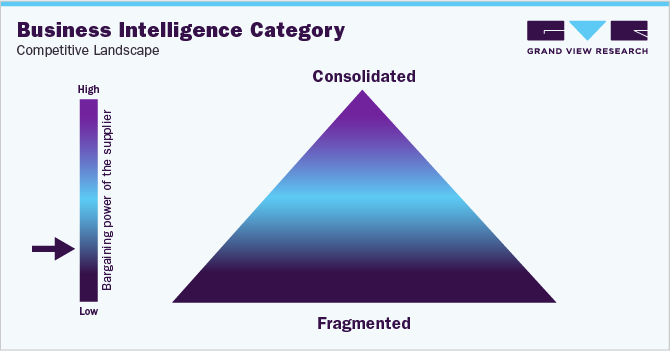

With a wide range of vendors providing a variety of solutions to cater to the diverse demands of business, the market is considered highly competitive. Type, deployment, organization size, and geography are used to segment the market. Leading industry giants Amazon Web Services, Microsoft, Oracle, and SAP offer customized automation by industry verticals that are ready to use. In June 2023, the collaboration of Moody's and Microsoft produces cutting-edge services that offer better insights into corporate intelligence and risk assessment as it combines Moody's strong data and analytical capabilities with the power and scalability of Microsoft Azure OpenAI Service.

The BI market is anticipated to maintain its growth trajectory in the upcoming years as businesses strive to use BI solutions to achieve a competitive advantage and increasingly recognize the value of data-driven decision-making. Additionally, vendors are emphasizing the option of customization of pre-packaged industry verticals.

Key suppliers covered in the category:

-

IBM Corporation

-

Information Builders

-

SAP SE

-

SAS Institute

-

Microsoft Corporation Inc.

-

Qlik

-

Tableau Software

-

Oracle Corporation

-

Informatica

-

Cloud9 Analytics

-

Teradata

-

TIBCO Software

-

Cisco Systems

Pricing and Cost Intelligence

“What are some of the major expenditures involved in developing or implementing this technology? What variables affect business intelligence development costs?”

The industry is constituted by costs of implementation, salaries of software developers/technology professionals, storage, hardware, and security, type of deployment, training, repairs, updates, and maintenances, facilities, and other costs as the key cost components. Costs of implementation includes costs such as licensing, asset purchases/development, design, installation, and testing. Types of deployment include cloud and on-premise. The number of users, the volume of data being analyzed, and the number of connections are a few of the variables that affect the monthly subscription rate for business intelligence software. Cloud-based applications are frequently charged on a subscription basis. Additionally, pricing may differ according to the user type, with power user licenses costing more than licenses that only allow users to view the results. Implementation, training, and support are extra costs.

Business intelligence software has an annual minimum average cost of USD 3,000. Even if it has less functionality, there is a free version available, and there are numerous alternatives in between. Perpetual licensing (on-premises) and subscription hosting plans (cloud) are two common price structures used by BI suppliers.

The following chart provides various costs incurred in implementing this technology. The major cost heads are shown below:

For IBM Cognos, there are three deployment options: On Demand (for up to 200 users), On Cloud Hosted (up to 10,000 users), and Client Hosted (on-premise solution). Professional and enterprise are the two pricing tiers available for the Oracle Analytics Cloud. While the enterprise plan is priced at USD 80 per user, per month, the professional plan is only USD 16 per user. Qlik Sense, a cloud business plan, costs USD 30 per user, per month, providing a 30-day free trial. Tableau has three key strategies. The cost of Tableau Creator is USD 70 per user, each month (paid annually). If deployed on-premises, Tableau Explorer costs USD 35 per user, per month, or USD 42 per user, per month, if hosted in the cloud. The monthly cost of a Self-Service package is USD 220. The price of the platform is USD 185.00 for a single Standard Plan.On the other hand, the Microsoft Power BI Pro package costs USD 9.99 per user per month. Providing prominent attributes such as all Power BI features, on-premise data access, Microsoft 365 collaboration, shared data queries, and others.

The report provides a detailed analysis of the cost structure of business intelligence and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries serve as the primary sourcing hubs for business intelligence development?”

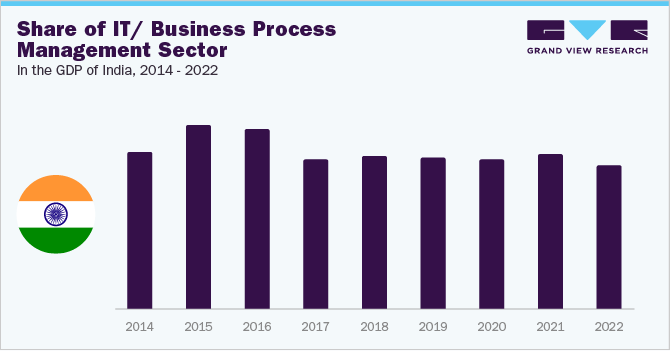

Companies all around the world need highly qualified professionals that can develop cutting-edge technologies. The demand for professionals with substantial training, experience, and a working knowledge of software development, and local rules and regulations is growing. The country's well-established businesses are attempting to increase the use of cloud computing systems to boost the growth of the business intelligence sector. Globally, Central and Eastern Europe, India, China, and South America are the most well-liked regions for offshore software development.

North American nations offer top-notch services, with a focus on creativity and innovation. The increased need for big data and analytics in Canada can be linked to the expansion of the business intelligence sector in the country. The country leads the world in the use of mobile and cloud technology, which has created a favorable environment for the establishment of a highly competitive global economy of the category. These changes suggest that the category will experience positive expansion in the years to come.

Asia is the preferred location for outsourcing software projects, with up to 200 software firms and about one million workers available in this region. The most affordable market prices and a sizable pool of software engineers make it a more reliable option.

India is one of the top locations in the world to outsource software development. Recent estimates indicate that India's software business is growing by 60% yearly. India's market for software development has witnessed an expansion of 30%, over the last three decades. The nation already exports software services to up to 100 different nations. According to the Software Sector Analysis Report, Indian developers are highly educated technical graduates. The country's software market is five times more affordable than, say, those in North America. Software development companies in India normally charge between USD 25 and USD 50 per hour, whereas in the U.S. they charge between USD 30 to USD 70 per hour.

China is one of the leading destinations for offshore businesses, along with India. It offers the most qualified software developers with excellent English skills at the most reasonable costs. Software engineers in China typically charge up to USD 50 per hour.

The Philippines is another country for outsourcing due to its low pricing, competitive market, and strong software foundation. Software development in the Philippines has developed into one of the more well-established sub-sectors of the nation's information technologies industry, according to the Philippines IT market Report. Prices on an hourly basis often range from USD 25 to USD 49.

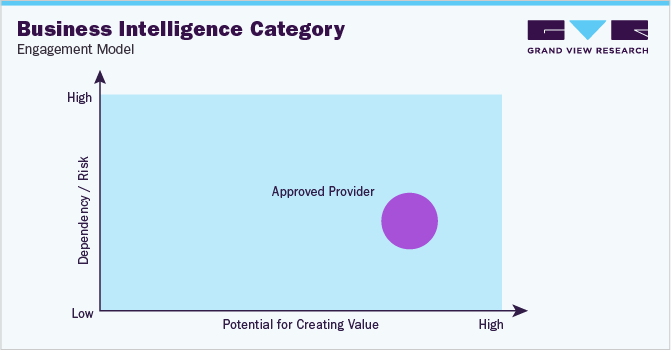

“In the approved provider model, the supplier meets the predefined set of qualifications, quality standards, and other criteria.”

The most prevalent operating model is an approved provider model because of the increased value creation. In this paradigm, the provider of business intelligence must fulfill a predetermined set of requirements, including previously demonstrated performance, platform access, agreed-upon privacy restrictions, and several other standards.

East European software development is also known for its high standards, affordable costs, excellent communication practices, fluency in spoken English, and easy time zones. Eastern European offers hourly prices ranging from USD 25 to USD 50. Poland, Belarus, and Serbia are some of the important source nations. One of the best and most attractive outsourcing locations in the world in 2023 was the Czech Republic. Multinational firms can confidently invest in the information technology sector thanks to taxes of only about 19%. The popular anti-virus software program Avast and the Google clone Seznam.cz were both developed in this European nation, which works closely with other important technology companies.

Business Intelligence sourcing intelligence also requires choosing a country for outsourcing, taking into account factors including cost-effectiveness, quality and expertise, time zones, language and cultural barriers, political stability, and legal and regulatory frameworks. Additionally, consideration should be given to factors like data security and intellectual property protection.

The Business Intelligence Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Business Intelligence Procurement Intelligence Report Scope

Report Attribute

Details

Business Intelligence Category Growth Rate

CAGR of 9.1% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

6% - 8% (Annually)

Pricing Models

Value-based pricing model, dynamic pricing model, subscription-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Type, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

IBM Corporation, Information Builders, SAP SE, SAS Institute, Microsoft Corporation Inc., Qlik, Tableau Software, Oracle Corporation, Informatica, Cloud9 Analytics, Teradata, TIBCO Software, Cisco Systems

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 54.03 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global business intelligence category size was valued at approximately USD 26.92 billion in 2022 and is estimated to witness a CAGR of 9.1% from 2023 to 2030.

b. The increasing technological advancement and rising demand by various industries for efficient functioning, simple data processing, forecasting, transparency, and many other reasons are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India, China and Philippines are the ideal destinations for sourcing business intelligence development.

b. This category is highly fragmented with the presence of many large players competing for the market share. Some of the key players are IBM, SAP SE, SAS Institute, Microsoft Corporation Inc., Oracle Corporation.

b. The industry is constituted by costs of implementation, salaries of software developers/technology professionals, storage, hardware, and security, type of deployment, training, repairs, updates, and maintenances, facilities, and other costs as the key cost components.

b. Cost-cutting techniques including full service sourcing and performance monitoring of the service providers, data protection are some of the best sourcing practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified