- Home

- »

- Reports

- »

-

Direct Mail Services Procurement Intelligence Report, 2030

![Direct Mail Services Procurement Intelligence Report, 2030]()

Direct Mail Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Oct, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10553

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Direct Mail Services Category Overview

“The direct mail services category’s growth is driven by increasing personalization marketing, tangible engagement, and targeted outreach.”

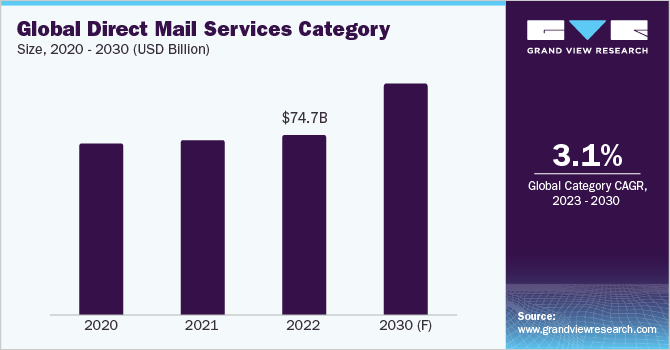

The direct mail services category is expected to grow at a CAGR of 3.1% from 2023 to 2030. While social media's popularity keeps rising, direct mail marketing persists as a dependable and adaptable method for aiding small businesses in generating profits. According to a mailing.com report, marketing mail volume jumped 1.4% to reach 67.1 billion pieces for the fiscal year ending September 2022. Trends such as personalization, sophisticated targeting, and omnichannel experience are expected to drive the category growth. Companies are increasing their budget allocation towards direct mail. For instance, according to the Streetfight 2023 report, around 58% of marketers have increased their budget allocation to direct mail in 2023 as compared to 2022.

An ever-growing significance lies in delivering a relevant and personalized brand experience, given that purchasers now anticipate brands to address them as distinct individuals rather than mere statistics. Through the utilization of diverse variable printing data and pixel-to-postal technologies, marketers who employ direct mail can effectively send out individualized mail items in response to consumer actions in real-time-be it scanning QR codes, viewing products, abandoning carts, and more. This adaptable and efficacious approach ensures continuous engagement with appropriate communications, effectively sustaining audience interest throughout the buyer journey.

The global direct mail services category size was estimated at USD 74.7 billion in 2022. Precise audience segmentation stands as the most robust foundation supporting the effectiveness of the email channel. Leveraging the depth and adaptability of offline data empowers marketers to pinpoint specialized audience groups or expand their campaigns, aligning with growth objectives and strategies. As previously noted, merging online and offline data allows for the creation of comprehensive consumer profiles, effectively closing the targeting gap brought about by digital privacy regulations. Delivering the appropriate message, precisely timed, and directed to the correct individual, constitutes a genuinely invaluable link in an environment where increasing numbers of device manufacturers, platforms, and consumers are actively seeking protection against digital advertisements.

While digital advertising platforms are becoming more difficult to navigate, DTC marketers are not on the verge of abandoning them. Instead of selecting either online or offline strategies, the most successful brands will enhance their campaign effectiveness by amalgamating physical and digital approaches, a concept often referred to as "phygital marketing".

The advanced visibility functionality empowers marketers to oversee their direct mail campaigns by providing automatic notifications when a customer receives a mail piece. Through the utilization of direct mail automation, marketers gain the flexibility to modify their approach and execution of these campaigns.

Supplier Intelligence

“What are the characteristics of the direct mail services category?”

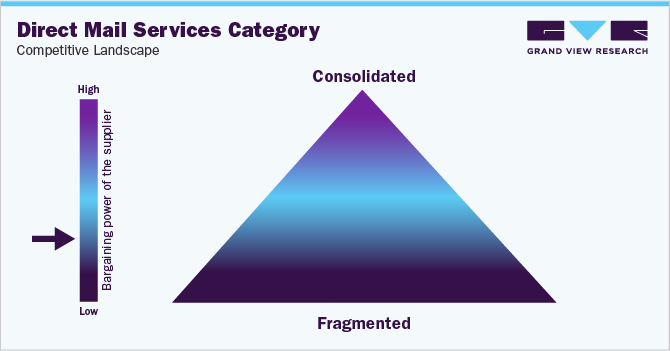

The global direct mail services category is fragmented. The category includes a range of companies offering services related to designing, printing, and distributing direct mail campaigns. These services can include everything from creating marketing materials and graphics to managing mailing lists and coordinating postage and delivery.

The substitutes for direct mail services have increased with the growth of digital marketing channels. Email campaigns, social media advertising, and other online methods can serve as substitutes for traditional direct mail. The ease, speed, and potential cost-effectiveness of digital marketing have led to a higher threat of substitutes in recent years.

Buyers of this category, such as businesses looking to send out marketing materials, might have moderate to high bargaining power. This is because there are multiple providers in the industry, and buyers could easily switch between them based on factors like price, quality, and service. Moreover, the increasing popularity of digital marketing might reduce the reliance on the category, further enhancing buyer power.

Key suppliers covered in the category:

-

Vistaprint

-

PsPrint

-

PostcardMania

-

Gunderson Direct

-

Next Day Flyers

-

Cactus Mailing Company

-

SaasMQL

-

Modern Postcard

-

Mail Shark

-

48HourPrint

Pricing and Cost Intelligence

“What are some of the major cost components in direct mail services? How are these components impacting the category?”

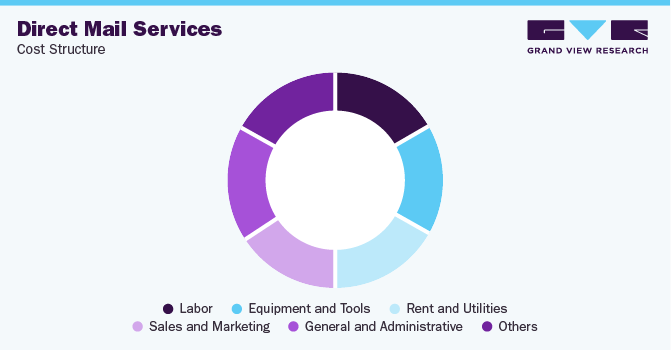

Labor, equipment and tools, rent and utilities, sales and marketing, general and administrative, and others are some of the cost components involved in direct mail services. Labor, and equipment and tools costs are the major cost components of the category. Other costs may include duties and taxes of mailing, which depend on the destination of sending the package. Sending the package outside the country can attract more duties and taxes as compared to mailing within the country.

Direct mail campaigns can also be integrated with other marketing channels that may help in increasing customer awareness. However, this may also attract additional integration fees. Additionally, volume is also an important factor in determining the price of the campaign. The more order units would result in a lower price per piece.

The prices are majorly dependent on personalization, graphics, number of mailings, and type of materials. Additionally, the price is also determined by how much a company is willing to spend on designing, printing, and distribution. On average, direct mail pieces can cost from USD 0.30 to more than USD 10 per person. Copywriting can cost between USD 100 to USD 2000 mainly depending on the number of words and experience of the copywriter. However, new or inexperienced copywriters can charge from USD 20 to USD 50 per copy.

The expenses associated with obtaining mailing lists are primarily contingent on the company’s specific objectives within direct mail marketing. The company can use an internal mailing list or generate new leads to introduce fresh products or services.

The following table indicates the price breakdown of various direct mail service parameters:

Direct Mail Advertising Price Breakdown

Direct Mail Type

Average Price (USD)

Price Per 1000 (USD)

Copywriting

100

100

Printing Mail

1 - 2 per mail or fiyer

1000

Designing

100

100

Delivery

0.17 per direct mail sent

160 - 170

The expenses associated with direct mail marketing surge notably owing to the inclusion of printing costs. A larger quantity of printed materials corresponds to a higher payment. These printing expenses can lead to a conspicuous rise in the price per individual mail piece. Generally, printing prices tend to vary between USD 0.05 and USD 2.00 for each piece. Heavier mail items incur greater costs, while lighter ones are more economical to print. Numerous printing services extend discounts for bulk printing.

The report provides a detailed analysis of the cost structure of direct mail services and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What are some of the best sourcing practices considered for direct mail services?”

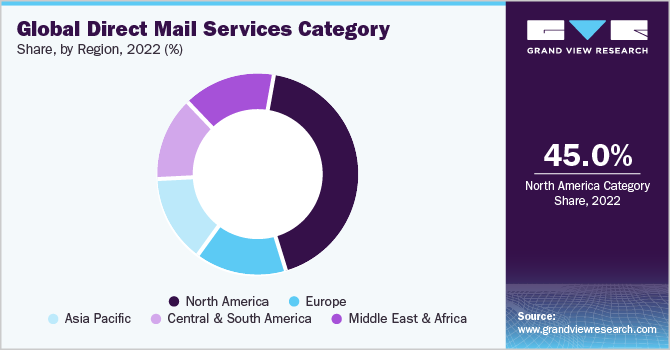

North America dominated the category in 2022. In 2022, the U.S. postal service offered Every Door Direct Mail (EDDM) mailing service that allows one to mail the package in every household area in the carrier route. According to SmallBizGenius 2023 report, 73% of Americans prefer being contacted by brands through direct mail as it can be read whenever they want.

After implementing the "Delivering for America" transformation strategy the previous year, USPS carried out further adjustments in 2022 to attain economic stability.

To reduce expenses and adopt a forward-thinking approach, the postal service:

-

Allocated resources into modern electric postal delivery vehicles.

-

Transitioned to greater utilization of trucks as opposed to air transportation for national mail movement.

-

Integrated new sorting machines for packaging to manage the rising requirements of e-commerce.

-

Optimized retail services by shutting down certain post office branches.

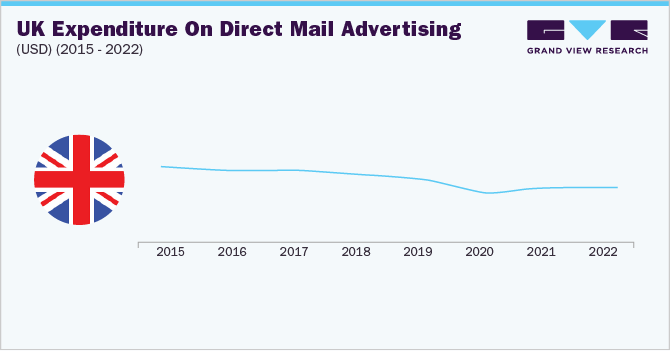

Europe is also an emerging region in direct mail services. As of 2023, 73% of the addressed mail is opened by consumers, as compared to emails with an open rate of 21.5%. In 2022, the spending on direct mail advertising in the UK experienced a growth of 1.2%.

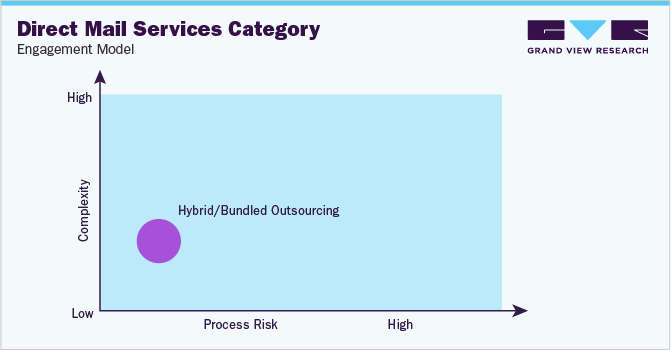

"In the hybrid outsourcing model, suppliers outsource some parts of the overall operation to third parties. Generally, critical operations are carried out in-house by the client."

In terms of direct mail sourcing intelligence, a hybrid model is a popular engagement model that combines in-house and full-service outsourcing. Some companies opt for a partial outsourcing model where companies design direct mail in-house and outsource distribution services. However, having an in-house team or a graphic designer is the cheapest way, as it will cost less. It represents the most cost-effective strategy and potentially the optimal choice for any company. Additionally, if there is a need to create something basic, such as invoices, it can be effortlessly accomplished internally. Several companies already employ at least one graphic designer on their staff, enabling such businesses to prepare the required artwork internally. With these considerations in play, the expense associated with in-house design can effectively be reduced to zero.

An approved provider model is the most common form of the operating model due to its potential for higher value creation. In this model, direct mail service providers must comply with acts such as the Federal Trade Commission Act (FTC Act). The act allows the FTC to protect citizens of the U.S., against misleading, or unfair advertising trade. The act required direct mail marketers to only include true information.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Direct Mail Services Procurement Intelligence Report Scope

Report Attribute

Details

Direct Mail Services Category Growth Rate

CAGR of 3.1% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 4% (Annually)

Pricing Models

Full-service pricing, customization-based pricing, competition-based pricing

Supplier Selection Scope

End-to-end service, customization offered, cost and pricing, compliance, service reliability, and scalability

Supplier Selection Criteria

Customization option, quality of printing, services offered, mailing list services, technology and tools used, track record and reputation, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Vistaprint, PsPrint, PostcardMania, Gunderson Direct Inc., Next Day Flyers, Cactus Mailing Company, SaasMQL, LLC, Modern Postcard, Mail Shark, 48HourPrint

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 95.4 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global Direct Mail Services category size was valued at approximately USD 74.7 billion in 2022 and is estimated to witness a CAGR of 3.1% from 2023 to 2030.

b. The increasing response rate, greater visibility, personalization, and targeting of the correct audience are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis U.S., China, and the UK are the ideal destinations for sourcing direct mail services.

b. This category is fragmented with the presence of numerous players competing for market share. Some of the key players are Vistaprint, PsPrint, PostcardMania, Gunderson Direct, Next Day Flyers, Cactus Mailing Company, SaasMQL, Modern Postcard, Mail Shark, 48HourPrint

b. Labor, equipment and tools, rent and utilities, sales and marketing, general and administrative, and others are some of the key cost components of this category.

b. Conduct thorough research to identify reputable direct mail service providers, consider their expertise in designing, printing, addressing, and mailing, quality control measures in place to ensure accurate printing, addressing, and mailing, considering the level of customization offered are some of the best practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified