- Home

- »

- Reports

- »

-

Electric Coolant Pumps Procurement Intelligence Report, 2030

![Electric Coolant Pumps Procurement Intelligence Report, 2030]()

Electric Coolant Pumps Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Nov, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10556

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Electric Coolant Pumps Category Overview

“The electric coolant pumps category’s growth is driven by the increasing sales of EVs, high demand for compact and efficient design, and the rising need to reduce carbon emissions.”

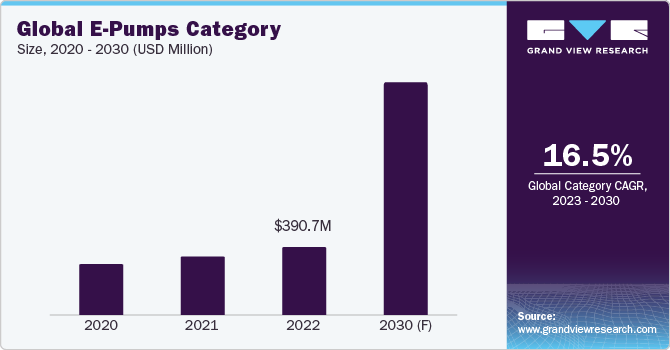

The electric coolant pumps category is expected to grow at a CAGR of 16.5% from 2023 to 2030. The surge in the sale of electric vehicles (EVs) globally, stringent government norms, and benefits associated with e-pumps are encouraging automotive OEMs to opt for e-pumps over mechanical pumps. Electric coolant pumps (e-pumps) are widely used in Internal Combustion Engines (ICE), hybrid and electric vehicles, and models with fuel cell drivelines. The strong emphasis on fuel efficiency and fuel savings and the increasing demand for EVs are prompting automotive OEMs to use high-voltage components (28V, 36V, 48V) in a vehicle's thermal management, which is driving the e-pumps growth.

Continuous circulation of coolant in the radiator engine block to avoid overheating of the engine is one of the primary factors for the adoption of e-pumps in electric and hybrid vehicles. Some of the other factors aiding the expansion of the e-pumps category are robust and compact design, brushless drive for long operating times, and low weight. In ICE vehicles, an e-pump enables optimum thermal management that is operated by conventional direct drive pumps to cool auxiliary circuits, IC engines, batteries, and e-motors.

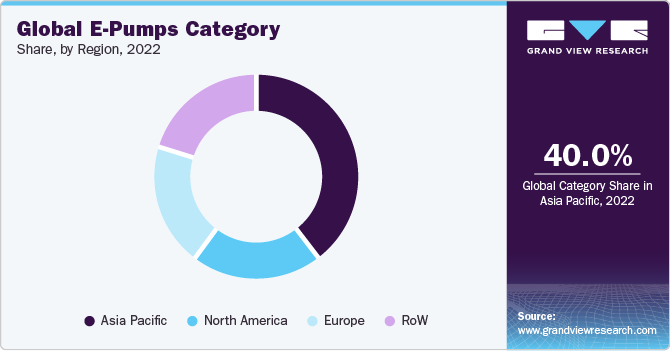

The global electric coolant pumps category was estimated at USD 390.73 million in 2022. In 2022, the Asia Pacific region dominated the category, accounting for the largest share of more than 40% followed by North America and Europe. In terms of technology, e-pump manufacturers focus on product development and offer detailed diagnostic information about the pump with advanced communication features. For instance, companies such as Robert Bosch and Industrie Saleri Italo S.p.A. offer PWM, Local Interconnect Network LIN, or Controller Area Network (CAN) interface to support the coolant flow. Reducing component damage is one strategy for increasing vehicle output, and as a result, the need for electric coolant pumps is rising.

Due to the strict pollution standards being developed by various governments across the world, fleet management, and logistics industries are also embracing EVs actively. For instance, in January 2023, DSV A/S ordered 10 units of the Hyliion Hypertruck ERX electrified trucks for its North American long-haul lanes as part of its efforts to reduce carbon emissions. This in turn helped in increasing the demand for e-pumps steadily.

Supplier Intelligence

“What is the nature of the electric coolant pumps category? Who are some of the leading players?”

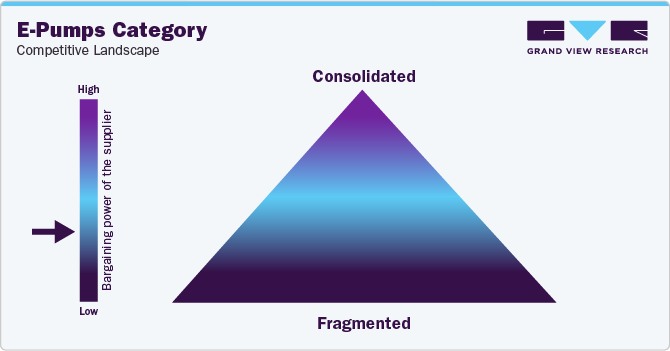

The global electric coolant pumps category is highly fragmented. OEMs and automotive parts manufacturers are focused on enhancing their business and increasing the customer base through new product launches and business partnerships. As such, many new announcements are being made in this e-pumps category combined with the EV market by manufacturers. Leading OEMs such as BMW, Tesla, and Ford are focusing their efforts on producing electric vehicles and manufacturing automotive parts/components.

For instance, in July 2023, a major North American electric school bus OEM extended a contract worth USD 1.3 million yearly with Swedish hydraulics technology company, Concentric AB. The latter would supply EMP-branded electric water pumps. This agreement highlights the rising demand for effective electric water pump solutions, especially in a sector that is quickly shifting to greener, electric transportation. Similarly, in 2022, Robert Bosch added 10 new variants to its e-pump segment. In 2022, Continental AG received two new development contracts from global OEMs (bus, truck, and construction) to provide e-pumps for cooling applications. Similarly, logistics companies are expanding their use of electric vehicles (trucks) in their daily operations, increasing the demand for electric coolant pumps.

In 2022, we found in our research that more than 65% - 70% of the automotive parts/component suppliers provide electric coolant pumps with brushless DC motors (considering the top 40 - 50 companies operating in this category). The high inclination of automotive OEMs toward brushless DC motors can be attributed to the technical factors of these motors, which are well-suited for EV and ICE vehicles. For instance, companies such as Hanon Systems, Rheinmetall AG, Robert Bosch GmbH, Gorman-Rupp Industries, and Mahle GmbH offer brushless DC motors. More than 30% - 40% of companies provide e-pumps for heavy-duty vehicles. However, the bargaining power of the suppliers is reduced due to high fragmentation and high pressure on manufacturers to offer better products at a low cost. Additionally, suppliers find it difficult to earn profit with the rising consumer demand for customized products with new technology at lower costs.

Key suppliers covered in the category:

-

Hanon Systems Co. Ltd

-

Robert Bosch

-

Rheinmetall AG.

-

MAHLE GmbH

-

Sanhua Automotive

-

Hitachi Astemo, Ltd.

-

AISIN CORPORATION

-

Continental AG

-

Johnson Electric Holdings Limited

-

Dayco, LLC

-

SHW AG

-

Concentric AB

-

Valeo

Pricing and Cost Intelligence

“What are some of the major cost components in this category? Which variables impact the total cost?”

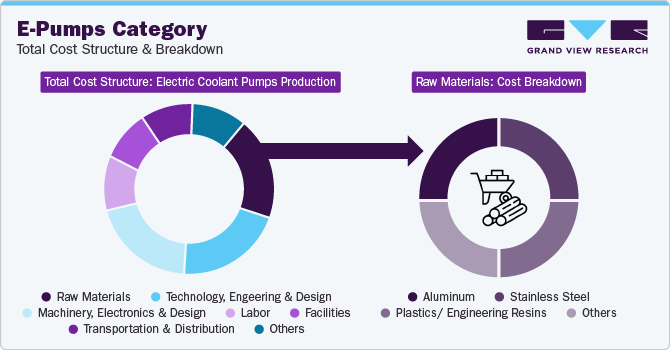

The major cost components associated with e-pump production are raw materials, technology - engineering - design, machinery - electronics - motor, labor, facilities, transportation and distribution, and others. Other costs can include components such as SG&A, R&D, depreciation, tax and profit, maintenance, and insurance, among others. Various raw materials, including aluminum, plastics, stainless steel, and other metals, are used to manufacture electric coolant pumps. These raw materials are sourced from different countries, which means the supply of these raw materials is highly vulnerable to fluctuations in commodity markets and currency exchange rates. The operational costs for pump manufacturing can increase for the component manufacturers owing to their reliance on a limited number of suppliers. Raw materials, technology - engineering - design, machinery - electronics - motor, and labor form the largest cost components in this category, accounting for more than 50% - 60% of the total costs.

The Russian-Ukraine war in 2022 amplified supply chain disruptions in many areas of the automotive segment particularly in Europe. This in turn had an impact on the overall electric pump category price dynamics. The crisis worsened Germany’s economy and forced the nation to downscale or in some cases, suspend its automotive operations significantly in 2022. For instance, BMW reduced its profit margin to 7% - 9% due to the war crisis. Energy costs in Germany increased by 12% since the war in 2022. In the case of electric vehicles, sales were reduced significantly as raw material prices (such as nickel, lithium, and cobalt - used in electric car batteries) skyrocketed. As a result, the demand for electric coolant pumps also reduced.

The following chart below illustrates the major cost components associated with the category.

Some of the factors that can further influence the total cost may include customizations and upgrades, types of rotors, impeller and motor material used, vehicle type/application (EV or commercial vehicles, for instance), material thickness, etc. The material used for the manufacturing of an electric coolant pump is an important cost factor that influences the lifespan of the e-pump. For instance, inferior-grade materials can make the product vulnerable to oxidation, resulting in a higher vibration, lower efficiency, and subsequent wear and tear of the pump, which will increase the cost for companies in the long term. Hence many OEMs are shifting their preference towards carbon fiber composites, fiberglass-reinforced plastics, or carbon fiber reinforced polyphenylene sulfide (PPS), etc. as their impeller or rotor material that not only enhances durability but also provides better mechanical stability and thermal management. All such factors further influence the total cost of production.

In H1 2023, the North American region's carbon fiber-reinforced plastics market displayed sluggish growth. With a low number of offtakes during the first quarter of 2023, demand from downstream industries remained stagnant, resulting in a negative price trend for carbon fiber-reinforced plastics. The shutdown of a few manufacturing facilities in the second quarter of 2023 had an impact on output rates. Along with the increased rate of inflation in the U.S., bank interests also showed indications of a recession, which furthered the downward trend in price trends for carbon fiber-reinforced plastics.

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What kind of strategies are considered in this category? What kinds of models are adopted by different companies?”

The largest end-use industry of electric coolant pumps is the automotive sector. Most of the OEMs manufacture and test their products in-house. For some specialized parts or to meet the surging demand of the customers, many a time OEMs engage with multiple Tier 1 or Tier 2 suppliers. Most of the OEM companies have a separate aftermarket division that produces coolant pumps or may have a long-term supply contract with a Tier 1 supplier. For instance, Rheinmetall AG is a Tier 1 supplier for multiple OEMs such as BMW Group, Volkswagen, Daimler, Honda, Jaguar, Range Rover, etc. Hence, in this category, two types of models are frequently used-the in-house engagement model and the hybrid outsourcing engagement model.

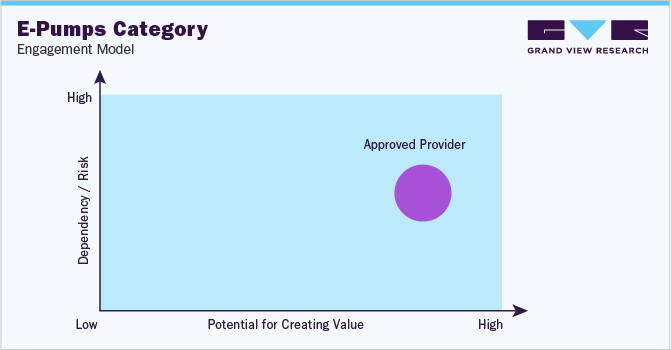

It is anticipated that the numerous initiatives and rules being created by different nations would put pressure on automakers to shift their emphasis to marketing EVs or ICE vehicles with higher fuel efficiency. As a result, the need for electric coolant pumps is anticipated to increase with any move toward zero-emission vehicles. Hence, due to the involvement of demanding technical specifications, most of the manufacturers prefer to engage with approved providers.

"An approved provider is a supplier that meets a predefined set of qualifications, quality standards, prior-proven performances, or other selection criteria."

In terms of electric coolant pumps sourcing intelligence, the most preferred countries for sourcing e-pumps are China, Mexico, Germany, the U.S., and the UK.

In 2022, Mainland China, Germany, the U.S., Italy, and France were the top 5 exporters of plastic items. Almost 60% of global export items made from plastic were produced by that cohort of major plastics exporters. OEMs and component manufacturers are focusing on improving the materials used in impellers. As a result, many automotive OEMs are choosing fiberglass-reinforced plastic (PPS) or carbon fiber composite materials in their impellers and rotors for better thermal management in e-pumps. As of July 2023, The Netherlands is the leading importer of composite plastics with 133,544 shipments, followed by Germany with 127,783 and Mexico with 122,988 shipments.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Electric Coolant Pumps Procurement Intelligence Report Scope

Report Attribute

Details

Electric Coolant Pumps Category Growth Rate

CAGR of 16.5% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

10% - 15% (Annually)

Pricing Models

Volume-based and contract-based model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Voltage type, application, technology, material type, technical specifications, production capacity, operational capabilities, quality measures, certifications, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Hanon Systems Co. Ltd, Robert Bosch, Rheinmetall AG, MAHLE GmbH, Sanhua Automotive, Hitachi Astemo, Ltd., AISIN CORPORATION, Continental AG, Johnson Electric Holdings Limited, Dayco, LLC, SHW AG, Concentric AB, and Valeo.

Regional Scope

Global

Revenue Forecast in 2030

USD 1,325.82 million

Historical Data

2020 - 2021

Quantitative Units

Revenue in USD million and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global electric coolant pumps category size was valued at USD 390.73 million in 2022 and is estimated to witness a CAGR of 16.5% from 2023 to 2030.

b. The increasing demand for energy-efficient vehicles to curb component damage, the rising need to reduce vehicular emissions, and the growing demand for EVs are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, China, Mexico, and Germany are the preferred countries for sourcing electric coolant pumps.

b. The global electric coolant pumps category features a highly fragmented landscape with the presence of many international and regional players. Some of the key players are Hanon Systems Co. Ltd, Robert Bosch, Rheinmetall AG, MAHLE GmbH, Sanhua Automotive, Hitachi Astemo, Ltd., AISIN CORPORATION, Continental AG, Johnson Electric Holdings Limited, Dayco, LLC, SHW AG, Concentric AB, and Valeo

b. Raw materials, technology, engineering and design, machinery, electronics and motors, and labor form the largest cost components in this category. Other costs can include facilities, transportation, and distribution, assembly, rent and utilities, R&D, SG&A, tax, profit and insurance, etc.

b. Sourcing raw materials from low-cost countries, evaluating vendors on component specializations and technical specifications, negotiating with more than two vendors to gain better cost savings, and opting for superior-grade polymers/composite materials are some of the strategies considered in this category

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified