- Home

- »

- Reports

- »

-

Employee Training Services Cost Intelligence Report, 2030

![Employee Training Services Cost Intelligence Report, 2030]()

Employee Training Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Sep, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10541

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Employee Training Services Category Overview

“The employee training services category’s growth is driven by the increasing emphasis on employee development & retention and rising requirements of workplace learning.”

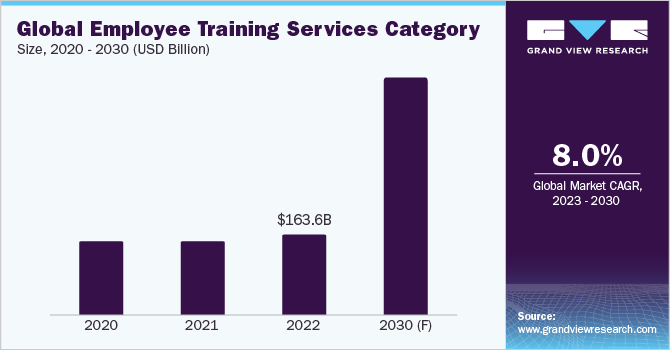

The employee training services category is expected to grow at a CAGR of 8% from 2023 to 2030. This category is growing because of increased learning requirements at workplaces around the world and the popularity of micro learning. The increasing usage of gamification in employee training also contributes to category expansion. It is anticipated that corporate sectors' budgetary concerns may impede category expansion. It is also projected that the advent of affordable e-learning training modules, the Internet of Things (IoT), and wearable technology would present significant chances for the category to grow in terms of sales throughout the projection period.

This category size was valued at USD 163.58 billion in 2022. This category is mostly driven by the growing focus on employee development and retention. Companies are spending on training and development programs to enhance employee skills and job happiness as they fight to entice and keep top personnel. This category for business training will expand due to the availability of inexpensive e-learning training modules. More businesses are implementing creative and economical employee training methods. Organizations can save employee labor hours by switching to e-learning instead of traditional training, and it is easier to maintain, update, and preserve knowledge.

The accessibility of Learning Management Systems (LMS), which enables businesses to provide on-the-job training modules that candidates may finish at their own leisure, is one of the many perks that mobile devices offer. The corporate training method that uses mobile devices eliminates reliance on location and time for attendance.

Supplier Intelligence

“How is the nature of the employee training services category? What are the initiatives taken by the suppliers in this category?”

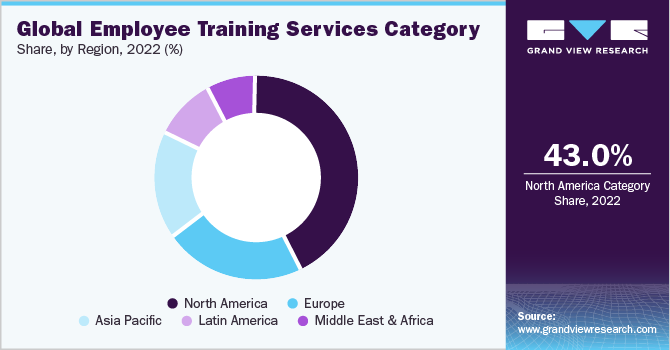

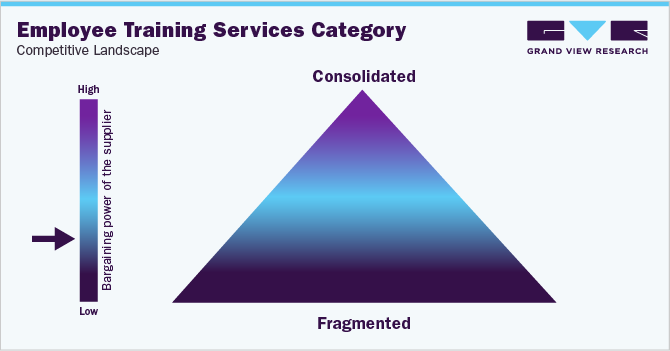

Due to the presence of multiple large companies operating in both domestic and international markets, this category is highly competitive. The leading companies in the sector are embracing joint strategic initiatives to increase market share and profitability.

-

In March 2023, Hemsley Fraser acquired the project management training company, STS, and an online training system maker, MindOnSite (MOS). With enhancements like intelligent learning portals, gamification capabilities, project management simulation tools, and more, the purchases will improve HemsleyFraser's services.

-

In August 2022, a prominent investment firm Francisco Partners made a strategic move by acquiring SAP Litmos, a leading provider of corporate training services. This acquisition enhanced the company's technological capabilities. SAP Litmos benefitted from Francisco Partners' expertise and resources, as it enhanced its technological capabilities, service portfolio, and customer base. This acquisition marked a significant development in the corporate training sector, offering innovative solutions and expanded offerings.

Companies are increasingly investing in training and development initiatives as they see the value of employee development. The American Society for Training and Development (ASTD) conducted a poll to determine how much money businesses spend on employee training and development initiatives. The poll found that businesses are expected to spend an average of USD 1,250 per employee on training and development in 2023. This is an increase of 5% from the previous year.

There are several reasons why businesses are increasing their investment in training and development. First, the job market is becoming increasingly competitive, and businesses need to invest in their employees to stay ahead of the competition. Second, technology is changing rapidly, and businesses need to ensure that their employees have the requisite skills to use new technologies. Third, employees are demanding more training and development opportunities, as they are more interested in learning new skills and growing their careers.

Key suppliers covered in the category:

-

Skillsoft

-

LinkedIn Learning

-

Pluralsight

-

Cornerstone On Demand

-

Udemy for Business

-

OpenSesame

-

GP Strategies

-

D2L Brightspace

-

SAP Litmos

-

Coursera for Business

-

EdCast

Pricing and Cost Intelligence

“What are some of the major cost components in employee training services? Which factors impact the cost of employee training services?”

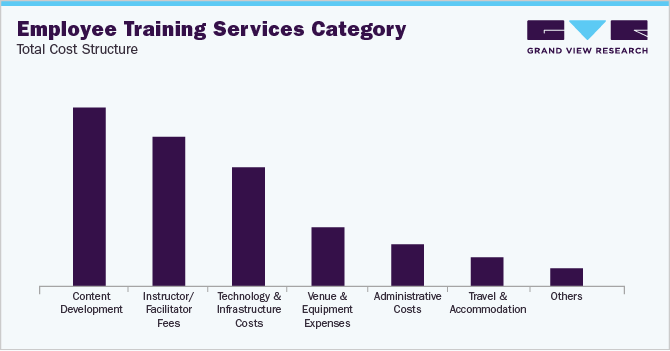

This category has various cost components, including content development, instructor/facilitator fees, technology and infrastructure costs, venue and equipment expenses, travel and accommodation costs, and administrative costs. Content development involves designing, creating, and updating training materials, courses, and modules, while instructor/facilitator fees cover compensation for skilled trainers. Technology and infrastructure costs include training software, learning management systems, and other essential tools. Venue and equipment expenses include renting suitable venues, equipment, and supplies. Administrative costs reflect staff time spent on scheduling, registration, coordination, and communication. Evaluation and assessment tools are crucial for measuring training effectiveness and providing participant materials. By considering these factors, organizations can allocate resources strategically and optimize their training investment for maximum impact.

The following chart provides various costs incurred in this category. The major cost heads are shown below.

The price of employee training services varies depending on various factors, including the type of training, delivery format, number of participants, duration, expertise of trainers, customization, technology requirements, location, materials and resources, and evaluation and feedback. The nature and complexity of the training program, such as basic onboarding or specialized skills training, can significantly affect the prices and can range between USD 500 and USD 2,000 per employee. The delivery format, such as in-person, virtual, or e-learning, can also impact the price. The number of participants in the training program can also affect the price, with larger programs requiring more resources and space.

The duration of the training program, including more content and sessions, can also impact the price, as longer programs require more resources and time to develop and deliver. Experienced trainers with specialized knowledge and skills may charge higher fees than less experienced ones. Customization, the level of customization, and technology requirements also affect the price. Location, such as high-cost areas or international locations, can also impact the price. Materials and resources, such as textbooks, workbooks, and other materials, can also impact the cost of the training program. Finally, evaluation and feedback mechanisms, which involve thorough assessment and feedback, can increase the cost of the training program, as they require resources such as time and money.

Sourcing Intelligence

“Which countries are the leading sourcing destinations for employee training services?”

China, India, the Philippines, and the U.S. are the preferred regions in this category. India stands out due to its robust information technology sector and a vast pool of skilled professionals who offer cost-effective training solutions. The Philippines is also a preferred choice, excelling in customer service training owing to its English-speaking workforce. China's expertise in manufacturing and technology has made it an attractive option for technical and industrial training. Eastern European countries like Romania and Poland provide high-quality software development training. Additionally, countries such as Mexico and Brazil are becoming increasingly popular for language-specific training needs. These leading sourcing destinations offer a combination of skilled talent, cost-effectiveness, and diverse training capabilities to meet the global demand for employee development services.

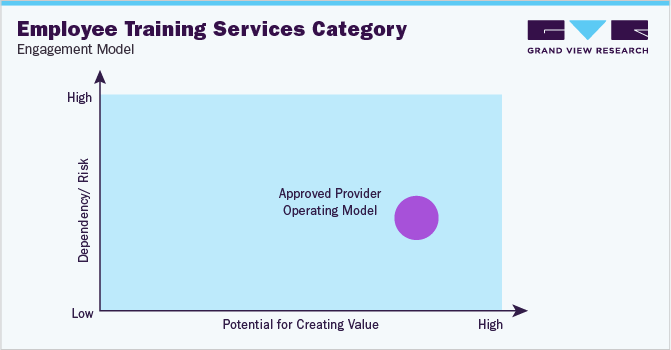

“An approved provider is a supplier meeting a predefined set of qualification criteria, quality standards, prior proven performance, and other selection criteria.”

In terms of employee training services sourcing intelligence, vendors of this category typically use an approved provider-operating model. The approved provider-operating model is widely used where organizations establish a list of pre-vetted external training providers who meet specific quality and content criteria. These providers offer a range of training courses or programs to employees, streamlining the selection process and providing a diverse range of valuable options. The model promotes consistency in training quality and content, with providers regularly evaluated and updated based on performance and relevance. This model fosters a strong partnership between the organization and external providers, fostering collaboration to meet training needs. Overall, the approved provider model optimizes the training process by combining internal expertise with specialized knowledge from external providers, empowering employees with well-vetted options for skill development and growth while maintaining control over the training ecosystem.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Employee Training Services Procurement Intelligence Report Scope

Report Attribute

Details

Employee Training Services Category Growth Rate

CAGR of 8% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 4% (Annually)

Pricing Models

Cost plus pricing, subscription-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Technical expertise, experience, cost and quality of service, capabilities and reliability, customer service,

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Skillsoft, LinkedIn Learning, Pluralsight, Cornerstone On Demand, Udemy for Business, OpenSesame, GP Strategies, D2L Brightspace, SAP Litmos, Coursera for Business, and EdCast.

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 302.78 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. According to the LCC/BCC sourcing analysis China, India, Philippines and U.S are the ideal destinations for sourcing employee training services.

b. The global Employee training services category is highly fragmented with the presence of several players in the market. Some of the major suppliers are Skillsoft, LinkedIn Learning, Pluralsight, Cornerstone On Demand, Udemy for Business, OpenSesame, GP Strategies, D2L Brightspace, SAP Litmos, Coursera for Business and EdCast.

b. Content development, instructor/facilitator fees, technology and infrastructure costs, venue and equipment expenses, travel and accommodation costs, and administrative costs are some of the cost components associated with this category

b. Strategic supplier selection, establishing long-term partnerships, negotiating favorable contract terms, leveraging technology to monitor results are the best sourcing practices considered in the employee training services category.

b. The global employee training services category size was valued at approximately USD 163.58 billion in 2022 and is estimated to witness a CAGR of 8% from 2023 to 2030.

b. Increasing emphasis on employee development and retention and rise in learning requirement at the workplace are driving the growth of the category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified